Aslam u alaikum,

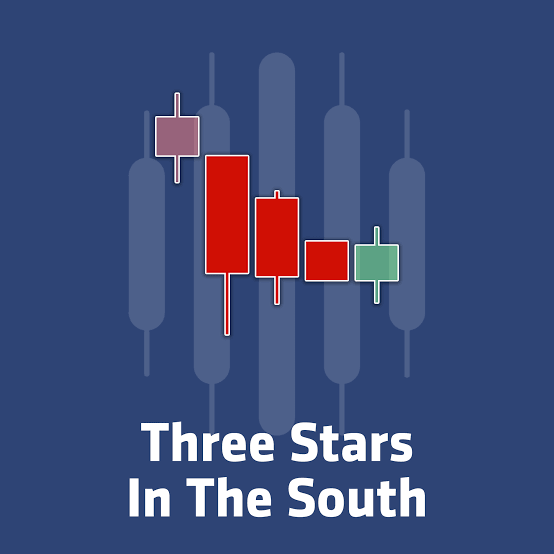

Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Three stars in the south candlestick pattern price chart k bottom par banne k bad market inverse movement shoro karta hai, aur ye pattern teen bearish candles par mushtamil hota hai. Pattern ki pehli candle candle aik long real body wali bearish candle hoti hai, jab k middle wali candlestick pehli candle se size main choti lekin shadow wali hoti hai. Pattern ki last candle aik small marubozu ya Spinning top (with small up and down shadow) candle se melti julti candle hoti hai. Price chart par aapko hirani hogi k jab aap descent block pattern ko bhi same issi pattern se melta julta dekhengay, lekin descent block pattern ki last candle aik small hanging man candle hoti hai.

Three stars in the south candlestick pattern prices k bottom main assets k support level par banta hai, jahan se prices ne bullish trend reversal main tabdeel hona hota hai. Ye pattern teen lagatar bearish candles ka aik majmoa hai, jiss main teeno candles lower low par close hoti hai, jin ki tafseel darjazel hai;

1. First Candle: Three stars in the south candlestick patteren ki pehli candle aik bearish candles hoti hai, jo k real body main strong candle banti hai, aur ye candle prices k downtrend ki tasalsul ki alamat hoti hai. Pattern ki pehli candle aik bagher upper aur lower shadow ki hoti hai, jiss ka open price close price se ooper hota hai.

2. Second Candle: Three stars in the south candlestick patteren ki dosri candle bhi same pehli candle ki tarah aik bearish candle hoti hai. Ye candle pehli candle k real body ya uss k close price k baad open hoti hai, jo k lower par close hoti hai. Iss ka candle ki real body pehli candle k muqabele main kam hoti hai, jab k ye candle shadow ki sath hoti hai.

3. Third Candle: Three stars in the south candlestick patteren ki teesri candle bhi same pechli do candles ki tarah aik bearish candle hoti hai, jo k dosri candle k real body ya uss k close price par open ho kar lower par close hoti hai. Ye candle ziada tar pechli dono candles se size main kam hoti hai, jab k ye candle aik marubozu candle hoti hai.

Three stars in the south candlestick pattern price chart par banne wale un pattern main shamil hen, k jiss main shamil tamam candles same pattern k hone k bawajood bhi ye trend reversal ka kaam karti hai. Pattern price chart par bearish trend ya low price area main banta hai, jo k matloba timeframe main ye position prices k leye support zone sabi hota hai. Pattern teen bearish candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k prices k lower side par strongness show karti hai. Pattern ki dosri candle pehli candle se real body main kam hoti hai, lekin up and down shadow k sath pehli candle k lower par close hoti hai. Pattern ki last candle aik small real body wali bearish candle hoti hai, jiss k upper aur lower side par koi shadow nahi hota yanni ye aik marubozu candle hoti hai.

Three stars in the south candlestick pattern par trading bhi dosri bullish trend reversal ki tarah ki jati hai, lekin market main entry se pehle confirmation candle ka hona zarori hai, q k pattern ki teeno candles bearish hoti hai. Confirmation candle real body main bullish honi chaheye, jo k teesri bearish candle k above close honi chaheye. Lekin agar pattern k baad bearish candle banti hai, to ye trend continuation pattern ka kaam karegi. Jiss par buy ki entry ki bajaye sell ki entry ki ja sakti hai. Stop Loss pattern k sab se lower side par ya last teesri small candle k lower prices se two pips below set karen.

Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Three stars in the south candlestick pattern price chart k bottom par banne k bad market inverse movement shoro karta hai, aur ye pattern teen bearish candles par mushtamil hota hai. Pattern ki pehli candle candle aik long real body wali bearish candle hoti hai, jab k middle wali candlestick pehli candle se size main choti lekin shadow wali hoti hai. Pattern ki last candle aik small marubozu ya Spinning top (with small up and down shadow) candle se melti julti candle hoti hai. Price chart par aapko hirani hogi k jab aap descent block pattern ko bhi same issi pattern se melta julta dekhengay, lekin descent block pattern ki last candle aik small hanging man candle hoti hai.

Candles Formation

Three stars in the south candlestick pattern prices k bottom main assets k support level par banta hai, jahan se prices ne bullish trend reversal main tabdeel hona hota hai. Ye pattern teen lagatar bearish candles ka aik majmoa hai, jiss main teeno candles lower low par close hoti hai, jin ki tafseel darjazel hai;

1. First Candle: Three stars in the south candlestick patteren ki pehli candle aik bearish candles hoti hai, jo k real body main strong candle banti hai, aur ye candle prices k downtrend ki tasalsul ki alamat hoti hai. Pattern ki pehli candle aik bagher upper aur lower shadow ki hoti hai, jiss ka open price close price se ooper hota hai.

2. Second Candle: Three stars in the south candlestick patteren ki dosri candle bhi same pehli candle ki tarah aik bearish candle hoti hai. Ye candle pehli candle k real body ya uss k close price k baad open hoti hai, jo k lower par close hoti hai. Iss ka candle ki real body pehli candle k muqabele main kam hoti hai, jab k ye candle shadow ki sath hoti hai.

3. Third Candle: Three stars in the south candlestick patteren ki teesri candle bhi same pechli do candles ki tarah aik bearish candle hoti hai, jo k dosri candle k real body ya uss k close price par open ho kar lower par close hoti hai. Ye candle ziada tar pechli dono candles se size main kam hoti hai, jab k ye candle aik marubozu candle hoti hai.

Explanation

Three stars in the south candlestick pattern price chart par banne wale un pattern main shamil hen, k jiss main shamil tamam candles same pattern k hone k bawajood bhi ye trend reversal ka kaam karti hai. Pattern price chart par bearish trend ya low price area main banta hai, jo k matloba timeframe main ye position prices k leye support zone sabi hota hai. Pattern teen bearish candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k prices k lower side par strongness show karti hai. Pattern ki dosri candle pehli candle se real body main kam hoti hai, lekin up and down shadow k sath pehli candle k lower par close hoti hai. Pattern ki last candle aik small real body wali bearish candle hoti hai, jiss k upper aur lower side par koi shadow nahi hota yanni ye aik marubozu candle hoti hai.

Trading

Three stars in the south candlestick pattern par trading bhi dosri bullish trend reversal ki tarah ki jati hai, lekin market main entry se pehle confirmation candle ka hona zarori hai, q k pattern ki teeno candles bearish hoti hai. Confirmation candle real body main bullish honi chaheye, jo k teesri bearish candle k above close honi chaheye. Lekin agar pattern k baad bearish candle banti hai, to ye trend continuation pattern ka kaam karegi. Jiss par buy ki entry ki bajaye sell ki entry ki ja sakti hai. Stop Loss pattern k sab se lower side par ya last teesri small candle k lower prices se two pips below set karen.

تبصرہ

Расширенный режим Обычный режим