Definition

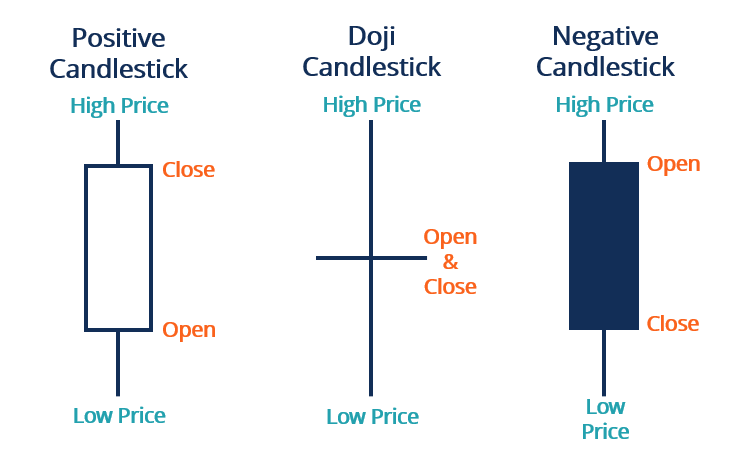

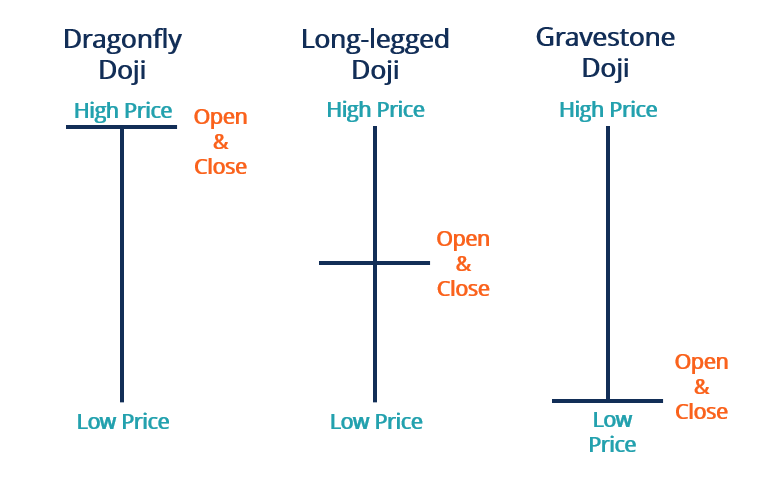

Drign flayi aik qisam ka candle stuck patteren hai jo qeemat ki karwai ki tareekh par munhasir hai, ya to qeemat mein kami ya oopar ki taraf mumkina ulat phair ki nishandahi kar sakta hai. yeh is waqt shakal ikhtiyar karta hai jab asasa ki onche, khuli aur ikhtitami qeematein aik dosray ke sath millti hain. kyunkay qeemat jahan khuli thi is ke bohat qareeb thi

is se zahir hota hai ke khredar mom batii ki lambai mein honay wali farokht ko jazb karne aur qeemat ko wapas oopar le jane ke qabil thay. mom batii ka lamba neechay ka saya zahir karta hai ke mom batii ki muddat ke douran jarehana farokht hui thi

Qeemat mein kami ke baad, drign flayi candle stick ka zahir hona is baat ki nishandahi kar sakta hai ke qeemat mein izafah ufaq par hai. is se zahir hota hai ke izafi farokht knndgan market mein daakhil ho rahay hain, jis ki wajah se oopar ka rujhan qaim honay ke baad qeemat mein kami waqay ho sakti hai. dono sooraton mein, drign flayi ke baad anay wali mom batii ko waqfiyat ki tasdeeq faraham karne ki zaroorat hai

Trading with What Is a Dragonfly Doji?

Drign flayi patteren aisa nahi hai jo aksar zahir hota hai, lekin jab aisa hota hai, to yeh aik ahteyati pegham ke tor par kaam karta hai ke ho sakta hai mojooda rujhan ulatnay wala ho. qeemat mein izafay ke baad drign flayi ki taraf se dala jane wala lamba nichala saya is baat ki nishandahi karta hai ke baichnay walay kam az kam zirbhs muddat ke aik hissay ke liye dobarah control haasil karne ke qabil thay. yahan tak ke agar din khatam honay par qeemat isi terhan rehti hai, haqeeqat yeh hai ke is muddat ke douran farokht ke dabao ki miqdaar mein izafah sun-hwa hai, yeh aik intibahi ishara hai .

Ulat jane ki tasdeeq mom batii se honi chahiye jo mumkina tor par bearish drign flayi patteren ki pairwi karti hai. line mein agli mom batii ko neechay ki taraf jana chahiye aur neechay khatam karna chahiye jahan drign flayi candle ne kya tha. is soorat mein ke tasdeeqi mom batii par qeemat ziyada barh jati hai, signal be maienay ho jaye ga kyunkay qeemat mazeed barh sakti hai

Qeemat mein kami ke baad, drign flayi ishara karta hai ke market mein ibtidayi tor par farokht knndgan mojood thay, lekin yeh ke tijarti session ke ekhtataam tak, kharidaron ne qeemat ko wapas dhakel diya tha jahan yeh kami se pehlay thi. is se zahir hota hai ke market mein gravt ke bawajood kharidari ka ziyada dabao hai, jo qeemat mein izafay ki paish goi kar sakta hai .

Traders ke liye tijarat mein daakhil honay ka riwayati waqt ya to tasdeeqi candle ki takmeel ke douran ya is ke foran baad hota hai. aik stap nuqsaan ka order drign flayi patteren ke nichale darjay se neechay rakha jana chahiye agar koi taizi se ulat jane par long daakhil honay wala hai. agar aap bearish ke baad aik mukhtasir position kholtey hain, to aap –apne stap loss order ko position day satke hain taakay yeh drign flayi ki oonchai se oopar ho

Important points

Drign flayi ka khula, ouncha aur qareeb taqreeban aik jaisa nahi hota. yeh aik wajah hai ke drign flayi is terhan ki nayaab talaash hai. un tenu qeematon mein se har aik ke darmiyan aam tor par chand dollar ka farq hota hai. agli misaal aik drign flayi ki tasweer kashi karti hai jo aik taweel mudti really ke douran honay wali side way islaah ke douran namodaar hui. drign flayi haliya range ki kam tareen satah se neechay girta hai, lekin khredar taizi se qeemat ko un sthon se oopar le jatay hain

Dragonfly Doji Candlestick ko market me Ksi bhi pair K chart me find out krny ke liye ap ko is ko smjhna bhut zarori hoti hai, ager ap candlesticks ko dekh kar trade krty hain to ap ko loss hony k chances bht kam chances hoty hain. Jb market open hoti hy to seller ki force strong hoti hy isliye nechy ki trf shadow bnti hy lekin bulls comeback kerty hain aur market price ko opening level per wapus ley jaty hain aor candle ki body nhi bnany dety.

Basically ye Candlestick aap ko market mn upward ya buying pressure ko show krti hai jis K mtlb hota Hy K market trend K chances hen Kay change Hoga aur billing trend shuru hony wala basically ye apko aik strong signal deti Hy Candlestick jis ki madad sy ap asani sy trend ko smjh Kay apni trade open KR skty hen.

Drign flayi aik qisam ka candle stuck patteren hai jo qeemat ki karwai ki tareekh par munhasir hai, ya to qeemat mein kami ya oopar ki taraf mumkina ulat phair ki nishandahi kar sakta hai. yeh is waqt shakal ikhtiyar karta hai jab asasa ki onche, khuli aur ikhtitami qeematein aik dosray ke sath millti hain. kyunkay qeemat jahan khuli thi is ke bohat qareeb thi

is se zahir hota hai ke khredar mom batii ki lambai mein honay wali farokht ko jazb karne aur qeemat ko wapas oopar le jane ke qabil thay. mom batii ka lamba neechay ka saya zahir karta hai ke mom batii ki muddat ke douran jarehana farokht hui thi

Qeemat mein kami ke baad, drign flayi candle stick ka zahir hona is baat ki nishandahi kar sakta hai ke qeemat mein izafah ufaq par hai. is se zahir hota hai ke izafi farokht knndgan market mein daakhil ho rahay hain, jis ki wajah se oopar ka rujhan qaim honay ke baad qeemat mein kami waqay ho sakti hai. dono sooraton mein, drign flayi ke baad anay wali mom batii ko waqfiyat ki tasdeeq faraham karne ki zaroorat hai

Trading with What Is a Dragonfly Doji?

Drign flayi patteren aisa nahi hai jo aksar zahir hota hai, lekin jab aisa hota hai, to yeh aik ahteyati pegham ke tor par kaam karta hai ke ho sakta hai mojooda rujhan ulatnay wala ho. qeemat mein izafay ke baad drign flayi ki taraf se dala jane wala lamba nichala saya is baat ki nishandahi karta hai ke baichnay walay kam az kam zirbhs muddat ke aik hissay ke liye dobarah control haasil karne ke qabil thay. yahan tak ke agar din khatam honay par qeemat isi terhan rehti hai, haqeeqat yeh hai ke is muddat ke douran farokht ke dabao ki miqdaar mein izafah sun-hwa hai, yeh aik intibahi ishara hai .

Ulat jane ki tasdeeq mom batii se honi chahiye jo mumkina tor par bearish drign flayi patteren ki pairwi karti hai. line mein agli mom batii ko neechay ki taraf jana chahiye aur neechay khatam karna chahiye jahan drign flayi candle ne kya tha. is soorat mein ke tasdeeqi mom batii par qeemat ziyada barh jati hai, signal be maienay ho jaye ga kyunkay qeemat mazeed barh sakti hai

Qeemat mein kami ke baad, drign flayi ishara karta hai ke market mein ibtidayi tor par farokht knndgan mojood thay, lekin yeh ke tijarti session ke ekhtataam tak, kharidaron ne qeemat ko wapas dhakel diya tha jahan yeh kami se pehlay thi. is se zahir hota hai ke market mein gravt ke bawajood kharidari ka ziyada dabao hai, jo qeemat mein izafay ki paish goi kar sakta hai .

Traders ke liye tijarat mein daakhil honay ka riwayati waqt ya to tasdeeqi candle ki takmeel ke douran ya is ke foran baad hota hai. aik stap nuqsaan ka order drign flayi patteren ke nichale darjay se neechay rakha jana chahiye agar koi taizi se ulat jane par long daakhil honay wala hai. agar aap bearish ke baad aik mukhtasir position kholtey hain, to aap –apne stap loss order ko position day satke hain taakay yeh drign flayi ki oonchai se oopar ho

Important points

Drign flayi ka khula, ouncha aur qareeb taqreeban aik jaisa nahi hota. yeh aik wajah hai ke drign flayi is terhan ki nayaab talaash hai. un tenu qeematon mein se har aik ke darmiyan aam tor par chand dollar ka farq hota hai. agli misaal aik drign flayi ki tasweer kashi karti hai jo aik taweel mudti really ke douran honay wali side way islaah ke douran namodaar hui. drign flayi haliya range ki kam tareen satah se neechay girta hai, lekin khredar taizi se qeemat ko un sthon se oopar le jatay hain

Dragonfly Doji Candlestick ko market me Ksi bhi pair K chart me find out krny ke liye ap ko is ko smjhna bhut zarori hoti hai, ager ap candlesticks ko dekh kar trade krty hain to ap ko loss hony k chances bht kam chances hoty hain. Jb market open hoti hy to seller ki force strong hoti hy isliye nechy ki trf shadow bnti hy lekin bulls comeback kerty hain aur market price ko opening level per wapus ley jaty hain aor candle ki body nhi bnany dety.

Basically ye Candlestick aap ko market mn upward ya buying pressure ko show krti hai jis K mtlb hota Hy K market trend K chances hen Kay change Hoga aur billing trend shuru hony wala basically ye apko aik strong signal deti Hy Candlestick jis ki madad sy ap asani sy trend ko smjh Kay apni trade open KR skty hen.

تبصرہ

Расширенный режим Обычный режим