Forex buying and selling me candle sticks chart sample us waqat banta hai jab bhi marketplace me koi charge kisi nuqta aghaz okay muqable me kam ho jaye lekin apne establishing factor se kuch fasle pe band ho jaye, hammer candle stick sample me candle ki choti si bady ban jati hai jo ok doji candle stick pattern se mukhtalif hoti hai. Hammer candle stick sample me candle ka jo saya banta hai aik to wo downward hota hai aur dosra ye saya candle ki frame ka taqreeban dugna hota hai. Is wahja se is candle stick sample ko hammer candle stick sample kaha jata hai. Hammer candle stick pattern me candle ki frame marketplace ki commencing aur final factor ko represent karti hai, jab okay candle stick ka saya marketplace ki fee high aur low ko show karti hai jo okay us length me howe hoti hai. Hammer candle stick aksar bearish motion pe banti hai jis me market me koi rate aik khas waqat ok leye bohut hi ziada right down to chali jati hai lekin shoppers ki pressure ki waja se wo charge wapis uper role pe a jati hai. Lekin pher bhi candle ki aik small frame nechahy aspect pe ban jati hai. Hammer candle stick pattern me marketplace rate ki down side pe rejection ko zahir karti hai jis se market us role se wapis a jati hai.

Benefits of this sample:

the Forex market buying and selling me hammer candle stick us waqat banta hai jab marketplace me promoting pressure waqti tawar pe a jata aur us okay bad market ki reversal ho jati hai aur candle ki close hone pe market ki candle stick hammer patterns ka van jata hai. Hammer candle stick sample banne se marketplace me customer zyada active ho jate fowl, aur traders ko marketplace ki reversal ka ishara mel jata hai. Jis se traders marketplace me stocks ko sbuy karte chook. Forex trading me hamamer candle pattern ka ye faida hai k is se hamen aik strong qisam ki market ki reversal ka ishara mel jata hai aur yahan se marketplace pher uptrend chalna shoro karta hai. Hamen lazmi tawar par hammer candle stick banne ok horrific marketplace me buy ka change open karna chaheye.

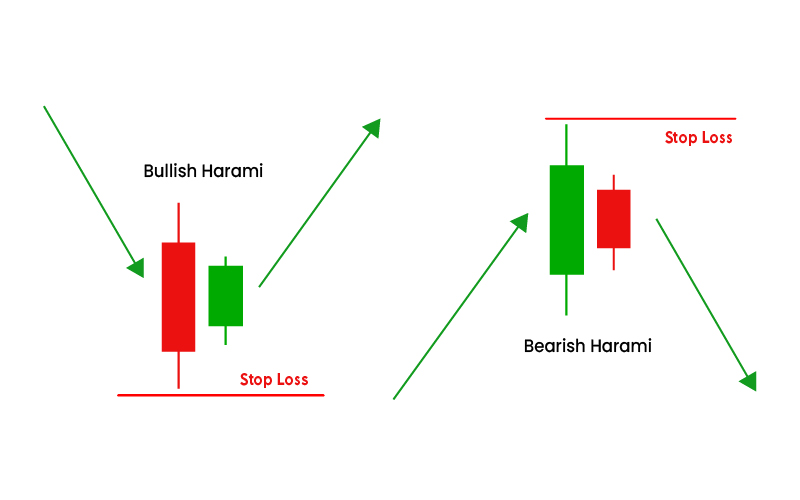

Feature of Harami Candlestick Pattern:

\

Market Mein is Candle ke bahut jyada benefit hote hain ya Hamara candle Ek bahut hi more potent formation candle hoti hai marketplace me yah candle price formation ko idea karti hai aur charge formation ko is composed karne ke sath sath yah market Mein ine charge ke indicators ko bhi display karti hai commonly ya marketplace Mein takes form Mein Najar Aati Hai aur yah candle backside downtrend aur signalling attentional uptrend key reversal rate ko acche tarike se display Karte Hain inke jariye se market Mein ine Tamam strategies ko acche tarike se verify kiya Ja sakta hai marketplace Mein yah candle bahut hi simple candle hoti hai aur yah Ek dependable candle hoti hai yah candle gadget required foremost extra game nahin karti aur yah marketplace Mein Tamam members ko with ease available hoti hai is liye Tamam contributors market Mein is candal ka istemal karke bahuot zyada advantage se Hasil kar sakte hain aur Market Mein Is key jariye se apni change ko profitable aur informative trade banaa sakte hain.

Benefits of this sample:

the Forex market buying and selling me hammer candle stick us waqat banta hai jab marketplace me promoting pressure waqti tawar pe a jata aur us okay bad market ki reversal ho jati hai aur candle ki close hone pe market ki candle stick hammer patterns ka van jata hai. Hammer candle stick sample banne se marketplace me customer zyada active ho jate fowl, aur traders ko marketplace ki reversal ka ishara mel jata hai. Jis se traders marketplace me stocks ko sbuy karte chook. Forex trading me hamamer candle pattern ka ye faida hai k is se hamen aik strong qisam ki market ki reversal ka ishara mel jata hai aur yahan se marketplace pher uptrend chalna shoro karta hai. Hamen lazmi tawar par hammer candle stick banne ok horrific marketplace me buy ka change open karna chaheye.

Feature of Harami Candlestick Pattern:

\

Market Mein is Candle ke bahut jyada benefit hote hain ya Hamara candle Ek bahut hi more potent formation candle hoti hai marketplace me yah candle price formation ko idea karti hai aur charge formation ko is composed karne ke sath sath yah market Mein ine charge ke indicators ko bhi display karti hai commonly ya marketplace Mein takes form Mein Najar Aati Hai aur yah candle backside downtrend aur signalling attentional uptrend key reversal rate ko acche tarike se display Karte Hain inke jariye se market Mein ine Tamam strategies ko acche tarike se verify kiya Ja sakta hai marketplace Mein yah candle bahut hi simple candle hoti hai aur yah Ek dependable candle hoti hai yah candle gadget required foremost extra game nahin karti aur yah marketplace Mein Tamam members ko with ease available hoti hai is liye Tamam contributors market Mein is candal ka istemal karke bahuot zyada advantage se Hasil kar sakte hain aur Market Mein Is key jariye se apni change ko profitable aur informative trade banaa sakte hain.

تبصرہ

Расширенный режим Обычный режим