Dear forex friend Punch Bhi financial market open Hoti Hai To De trading market adolescent different expense steady mein update hoti hain Jisko bid ask aur last worth Kaha jata hai yah market ki bahut huge aur maujuda cost ke revealed mein information Deti Hai bed cost vah esteem Hoti Hai Jis per vendor market Mein stock ko khareed leta hai Jab Ke Aashiq esteem Mein intermediary market Mein stock ko Karta Hai bid aur ask esteem Ke alava Bhi Ek esteem Hoti Hai Jisko last worth Kaha Jata Hai last worth Mein stock ki last worth Hoti Hai Jiske awful market close Ho Jaati Hai. What is Offered Cost: Dear forex buddy Bid cost sabse most over the top expense Hoti Hai Jis per shipper use time market ki maujuda esteem Mein buy ki entry karta hai pure Duniya Se sharmayakari Hone ki vajah se cost bahut Teji se change Hoti Hai Jab bed ka demand Diya jata hai to use baat ki koi guarantee nahin hai ki bid Lagane grain vendor ko utna good tidings share contract ya distributes Mein milengi financial market mein le len Niche ke liye kharida aur farok Sunanda ki jarurat Hoti Hai Is vajah Se offered ka demand Dene Edge ya Offer Se kharidne rib ke liye sailors ki jarurat hoti hai. Outline of Offered Cost: Dear forex friend Agar Kisi stock ki maujuda cost $50 Hai To trader 50 dollar for each trade ki limit demand put kar sakta hai lekin Agar cost 45 for each a Jaati Hai To 45 se Apar jitni bhi bed demand lagenge vah Sare open ho Jaenge Uske horrible hello 45 wala demand open hoga vendor ko bid ask separate kam se kam karna chahie for example Agar market ki maujuda bid cost 10.1 dollar hai aur ask cost 10.3 Agar trade open karta 10.1 dollar per bid ka demand Dega to yah 10.3 foot Hoga is vajah se merchant ko limit demand $10.2 ki position per set karna chahie to is tarike se vah bid ask spread esteem Ko Mehdudh kar sakta hai. What is Ask: Dear forex buddy Ask cost market ki maujuda vah kam se kam esteem Hoti Hai Jis per intermediaries top ko dress Karta Hai dusre exchange esteem Ki Tarah yah bhi vendor ke market Mein reaction aur cost ki improvement se change Hoti Hai Ek Bar FIR is baat ki koi guarantee nahin hai ki shipper Agar share contract ya Laut ka demand deta hai aur vah lajmi field Honge farokht Kunda demand ke liye buyers ki bhi jarurat hoti hai. Delineation of Ask Cost: Dear forex friend Agar Kisi stock ki maujuda cost ke mutabik Koi trader ask limit demand set karta hai aur vah cost 50 dollar ho to cost ki bed cost is level per Sare demand ko fill Kar Dega lekin agar koi demand 55 for each cutoff ke liye set hua ho to usse pahle Jitna Bhi lower Sath ke orders Honge vah bomb Honge Uske awful 55 dollar ka demand fill hoga. Contrast Among Bid And Ask: Dear forex sidekick Jis Tarah Se bid cost ke trade ko last mein kisi exorbitant expense per close Kiya Jata Hai ISI Tarah Se ask cost ke trades ko bhi Lo position per benefit ke liye close Karke market Mein buy ki entry ki Ja sakti hai Punch Bhi ask ki trade ko close Kiya Jata Hai To yah market ki maujuda bid cost ke mutabik band Hoti Hai jismein cost ke masjid down Na Jaane Ja reversal hone ka Ishara hote hain ask cost bed esteem Se Jyada hoti hai aur market demand Mein yah bid cost per Sel ki trade ke hisab se open hoti hai.

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

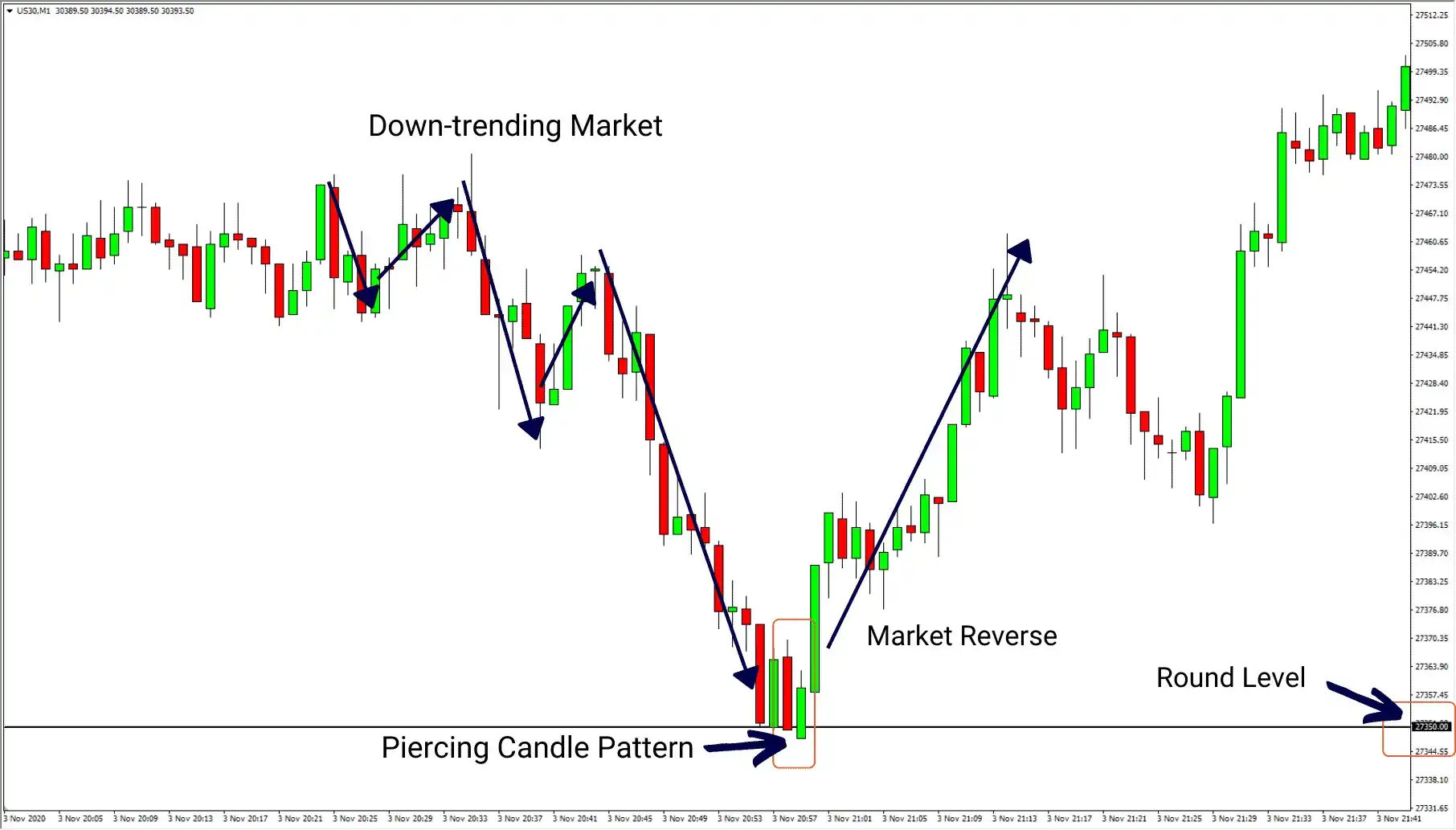

What is the Penetrating Candle Model ?? Ik useful trade krne k liye different critical light plan ko study karna zarori hota ha. Aaj essential aap sa Penetrating Light Model ki kuch information share krna chati hoon.Dear people, penetrating Candle Model help level per banany Wala plan 2 flame for each mushtamil hota hai. Jo aapko rise ki information or signs deta hai. Is light plan head aapko downtrend k horrendous buyer's pressure milta hai. Agar aap diagram ko dekhen to aap is plan ko successfully perceive kar sakte hain.Recognizing verification of Penetrating candle plan: Agr ap chart ko dikhn to ap ye notice krn ge, k Penetrating Flame Model ko downtrend k horrendous assistance level per banta hai. Agr market mein yah configuration support level per nai banta, tu is plan ki sufficiency zyda nahin hoti. Ye hamesha 2 novel sorts ki candle say mil kr banta hai. Jis essential first light extensive negative flame honi cheye aur second candle bullish honi cheye, jo first candle k mid point say oper close hoti hai. Esi situation essential market chief buying ki trade kr sakhty hain. Meaning of Flame Model: Agr market ko really take apart karna chahte hain, tu aapko hamesha market mein open candle plan ko study karna hota hai. Forex trading mein different flame plan ki bahut zyda importance hoti hai. In light ko focus on kr k ap ik achi trade kr sakte hain. Comprehension of light plan Dear people, yah plan ap ko future bullish example ki information daita hai. Forex trading mai trade open krne se pale pori organizing krni hoti ha. Is se phlay stop-mishap or take benefit ki values ko acchi tarah work out kar ka koi b decision lena cheye. Is light plan essential stop-hardship ki regard last bad candle ka closing qualities hota hai, or jab aap iska take benefit set karna chahte hain, tu negative example Kay start his point sa hota hai, us point Tak aap ka take benefit ki limit ho sakhti hai. Agr ap in rules ko comply with karen to ap apne account ko save rakh kr Bohat achi trade kr sakte hain.Name: download.png Viewpoints: 10 Size: 4.5 KBRe: What is the Penetrating Light Model ??WHAT IS THE Penetrating Candle Model DEFINITIONPenetrating plan ek multi day ka candle cost ka plan hai plan Mein high ke near first day ka opening aur typical ya huge assessed ki trading range ke sath ke kareeb close Hona Shamil Hai ya conceivably Taur per is baat ka sign hai ke shares ki supply Jo market ki part sell karna chahte hain kuch range Tak khatm ho gai hai aur cost is level Tak specialty a gai hai Jahan shares buying ki demand barh gai hai aur ya clear Taur per Jahar Hua Hai Jise specific examination aamtaur per costs ki series ke frame per dekhte hain Kyunki financial structures ya others 24 horse trading assets ke baraks momentary openings rakhne ki Salaiyhat hoti hai first candle aum taur per dull concealed ya red hoti hai Bit by bit guidelines to Perceive An Infiltrating Model ON FOREX Graphs infiltrating line ka plan two candles standard mushtamil hai Jab Bulls market mein enter Hote Hain aur cost ko Uncha dhakel Dete Hain Jaise ke moving typical expense long stretch moving ordinary se upar honi chahie undeniable level ko progressing low Bullih penetrating plan candles ki Low Rakha Ja sakta hai Hit Ke take benefit limit ko fibonacci increases ya cost action ke zriye recognized Kiya Ja sakta hai is big-hearted ka configuration use Waqt banta hai Hit bulls and bears donon costs per control Hasil karne ke liye Lar Rahe Hote Hain yah Negative light aum taur per marubozu Hai Jiske upri ya Specialty Shadow nahi hote hainPenetrating OF THE CreditsMonetary supporters ko Penetrating ke plan ke sath trades karte waqt characteristics ko dekhna chahie likewise light ki lambai use kuwat ka choose karne mein importance work pay karti hai Jiske Sath ulat Jayegi beari and bullish ki flame Ke Darmiyan fark is baat ki maloomat Karta Hai Ke design reversal Kitna solid hoga pichhali Negative candles ka Stop adversity kam Hona chahie Kyunki long stretch mein accomplishment ki rate Kafi zyada hai aap stock edge application ka istemal Kar Ke following day trading ke liye stock ko channel karne ke liye specific looks at ka bhi istemal kar sakte hain Jo Stomach muscle web structure mein bhi available hai

-

#18 Collapse

What is the Penetrating Candle Example ?? Ik productive exchange krne k liye different significant candle design ko study karna zarori hota ha. Aaj principal aap sa Penetrating Candle Example ki kuch data share krna chati hoon. What is the Penetrating Candle Example ?? Dear individuals, penetrating Candle Example support level per banany Wala design 2 candle for each mushtamil hota hai. Jo aapko upswing ki data or signs deta hai. Is candle design fundamental aapko downtrend k awful purchaser's tension milta hai. Agar aap diagram ko dekhen to aap is design ko effectively distinguish kar sakte hain. Recognizable proof of Penetrating candle design: Agr ap diagram ko dikhn to ap ye notice krn ge, k Puncturing Candle Example ko downtrend k awful help level per banta hai. Agr market mein yah design support level per nai banta, tu is design ki viability zyda nahin hoti. Ye hamesha 2 unique sorts ki candle say mil kr banta hai. Jis primary first flame long negative candle honi cheye aur second candle bullish honi cheye, jo first candle k mid point say oper close hoti hai. Esi circumstance primary market fundamental purchasing ki exchange kr sakhty hain. Significance of Candle Example: Agr market ko in fact break down karna chahte hain, tu aapko hamesha market mein accessible candle design ko study karna hota hai. Forex exchanging mein different candle design ki bahut zyda significance hoti hai. In candle ko concentrate on kr k ap ik achi exchange kr sakte hain. Understanding of candle design Dear individuals, yah design ap ko future bullish pattern ki data daita hai. Forex exchanging mai exchange open krne se pale pori arranging krni hoti ha. Is se phlay stop-misfortune or take benefit ki values ko acchi tarah ascertain kar ka koi b choice lena cheye. Is candle design fundamental stop-misfortune ki esteem last negative candle ka shutting values hota hai, or poke aap iska take benefit set karna chahte hain, tu negative pattern Kay start his point sa hota hai, us point Tak aap ka take benefit ki limit ho sakhti hai. Agr ap in rules ko adhere to karen to ap apne account ko save rakh kr Bohat achi exchange kr sakte hain. -

#19 Collapse

What is Offered Cost: Dear forex friend Bid cost sabse most extravagant expense Hoti Hai Jis per vendor use time market ki maujuda esteem Mein buy ki entry karta hai pure Duniya Se sharmayakari Hone ki vajah se cost bahut Teji se change Hoti Hai Jab bed ka demand Diya jata hai to use baat ki koi guarantee nahin hai ki bid Lagane grain seller ko utna good tidings share contract ya divides Mein milengi financial market mein le len Niche ke liye kharida aur farok Sunanda ki jarurat Hoti Hai Is vajah Se offered ka demand Dene Edge ya Offer Se kharidne rib ke liye sailors ki jarurat hoti hai. Delineation of Offered Cost: Dear forex buddy Agar Kisi stock ki maujuda cost $50 Hai To shipper 50 dollar for each trade ki limit demand put kar sakta hai lekin Agar cost 45 for each a Jaati Hai To 45 se Apar jitni bhi bed demand lagenge vah Sare open ho Jaenge Uske awful hello 45 wala demand open hoga vendor ko bid ask separate kam se kam karna chahie for example Agar market ki maujuda bid cost 10.1 dollar hai aur ask cost 10.3 Agar trade open karta 10.1 dollar per bid ka demand Dega to yah 10.3 foot Hoga is vajah se representative ko limit demand $10.2 ki position per set karna chahie to is tarike se vah bid ask spread esteem Ko Mehdudh kar sakta hai. What is Ask: Dear forex sidekick Ask cost market ki maujuda vah kam se kam esteem Hoti Hai Jis per specialists top ko dress Karta Hai dusre exchange esteem Ki Tarah yah bhi vendor ke market Mein reaction aur cost ki improvement se change Hoti Hai Ek Bar FIR is baat ki koi guarantee nahin hai ki trader Agar share contract ya Laut ka demand deta hai aur vah lajmi field Honge farokht Kunda demand ke liye buyers ki bhi jarurat hoti hai. Delineation of Ask Cost: Dear forex buddy Agar Kisi stock ki maujuda cost ke mutabik Koi vendor ask limit demand set karta hai aur vah cost 50 dollar ho to cost ki bed cost is level per Sare demand ko fill Kar Dega lekin agar koi demand 55 for each cutoff ke liye set hua ho to usse pahle Jitna Bhi lower Sath ke orders Honge vah bomb Honge Uske awful 55 dollar ka demand fill hoga. Contrast Among Bid And Ask: Dear forex friend Jis Tarah Se bid cost ke trade ko last mein kisi exorbitant expense per close Kiya Jata Hai ISI Tarah Se ask cost ke trades ko bhi Lo position per benefit ke liye close Karke market Mein buy ki entry ki Ja sakti hai Punch Bhi ask ki trade ko close Kiya Jata Hai To yah market ki maujuda bid cost ke mutabik band Hoti Hai jismein cost ke masjid down Na Jaane Ja reversal hone ka Ishara hote hain ask cost bed esteem Se Jyada hoti hai aur market demand Mein yah bid cost per Sel ki trade ke hisab se open hoti hai. -

#20 Collapse

INTRODUCTION OF PIERCING PATTERN:- My dear friends,mein umeed kerta hin ky ap sab absolutely fine hon gy.forex ki agar baat ki jaye tu es mein jitny bi pattern aur indicators hoty hein woh sary traders ko different prediction provide kerty hein jin ki base per market mein trading ki jati hy. koi bi pattern ya indicator 100 percent accurate nai ho sakta,es leye en patterns per completely rely nai kerna chehye.Piercing Candlestick Pattern ko downtrend k bad support level per banta hai. Agr market mein yah pattern support level per nai banta, tu is pattern ki effectiveness zyda nahin hoti. Ye hamesha 2 different types ki candlestick say mil kr banta hai. Jis main first candle long bearish candlestick honi cheye aur 2nd candlestick bullish honi cheye, jo first candle k mid point say oper close hoti hai.ess pattern ko samajhne ke baad aapki trading Mein definitely bahut positive changing a sakti hain.aur market mei trade place kerny ky leye es pattern ko easily follow ker ky acha profit earn kiya ja sakta hy. FORMATION AND IDENTIFICATION:- Forex market mein piercing Candlestick Pattern support level per banany Wala pattern two candlestick per consist hota hai. Jo aap ko uptrend ki information or indications deta hai. Is candlestick pattern main aapko downtrend k baad trading mein buyers ka pressure milta hai. Agar aap chart ko dekhen to aap is pattern ko easily identify kar sakte hain.In candlestick ko study kr k ap aik achi healthy trade kr sakte hain.jab aap is ko observe karna chahte hain to aapko yah Pata Hona chahie ki Hamesha yah pattern support level per create ho ga.piercing line bhi market movement chart main creat hony wala pattern hai jo market ki support per banta hai aur jab yehi pattern complete hota hai tou iska matlab hota hai ky ab market trend change kerty huey upward direction main bari movement kerny ja rehi hai tou piercing line pattern per trade kerny ky liay hamain piercing line pattern ko samajhna zaruri hai ky yeh pattern Kis terha banta hai aur is per kis terha sy trade open ker ky ham achi earning ker sakty hain.ess learning ky naghair trading kerna mushkil bi ho sakta hy. Jab market Mein Ek strong downtrend ke bad Ek buy wali candle banti hai jo last bearish candle ka hisab sa usk 50% sa Badi aur us kay hundred percent Chhoti hoti hai to ismein aapko Idea laga lena chahie ki yah pattern ban raha hai.Jab Bhi Piercing candles pattern banta hai to aapki trade buy Main zarur jaati hai aap ismein trading karte hue apne liye profit hasil kar sakte hain.Jab Bhi yah pattern bane to market ke trend ko follow karte hue apni trade ko buy Mein Rakha karen to aapko Jyada Se Jyada fayda mil sakta hai Jab Bhi Apne market Mein entry leni hai to candlestick pattern ko Dekhte Hue confidential candlestick sy entry leni hai Jab Bhi aap Piercing pattern py trading Karte Hain To is per kam karte hue Hamesha stop loss lazmi use Kerna chehye.ta ky unexpected market movement sy account big loss sy safe rahy. FUTURE BENEFITS:- Friends yeh pattern ap ko current trading ky elawa future mein apni trade ko manage kerny mein help provide kerta hy.es ki movement futre ky leye bi prediction kerti hy.Priecing line pattern ky liay market ko continuously observe kerty rehna chahiay, specially jab market continuously downward trend main movement ker rehi ho tou aesy time per Jesy hi market support per reach ker jaye aur aesa pattern create hony per hamain "buy" ki trade open ker leni chahiay. isi terha trade ker ky ham bahot achi earning ker sakty hain.yeh pattern Jab Bhi chart pattern per form hota hai to ismein aapko yah pattern sirf aur sirf "support" per bante Hue nazar aye ga.Jab Bhi support per Kis Tarah ka pattern banta hai to aap samajh sakte hain ky yeh piersing pattern form ho raha hai.ess pattern mein "stop loss" support Ke Niche Rakh sakte hain matlab ke aap is main Apna stop loss yani ke SL bullish candle Ke Niche Apna stoploss place ker sakte hain.apni trade ka "take profit" resistance per Rakh sakte hain Jab aap Baithe Hain Ki ki market up trend mein start ho gai hai to aap ismein apna take profit net resistance ko Rakh sakte hain jo ki aap ka aasani se achieve ho sakta hai.thanks -

#21 Collapse

Aslamoalekum members. Mujhy umeed hay ap sab kheryt say hon gay. Apka trading session acha ja raha hoga. Aj ka topic hamara discussion piercing Candlestick pattern k bary hay. Dekhty hain k yeh kia hay r kesy information deta hay Piercing Candlestick pattern Piercing Candlestick Pattern forex trading main aik bullish pattern hai. Is pattern main do candlesticks hotay hain. Pehlay candlestick bearish hoti hai, jis ka close price pehli candlestick ki low se nechay hota hai. Dusra candlestick bullish hoti hai aur is ka open price pehli candle k jsm se andar hoti hai. Dusri candle ki closing price pehli candlestick k jsm ke oper hoti hai. Ye pattern aksar downtrend ke bad dekha jata hai aur is ka matlab hota hai ke market ab upar ki taraf ja skti hai. Is pattern ko confirm karne ke liye volume aur tachniqui ishary jaise ke moving averages ka istemaal bhi karte hain. trading with Piercing Candlestick pattern Forex trading mein Piercing Candlestick Pattern se trade karne ke liye aap ko in steps pr amal krna hay:Sbse pehle aapko market ka trend ka mushahida karna hai. Agar trend downtrend mein hai to Piercing Candlestick Pattern bullish reversal signal deta hai. Dusra step ye hai ke aapko Piercng Pattern ki shshnkht karna hai. Is pattern mein aapko do candlesticks dekhne honge. Pehla candlestick bearish hoga aur doosra candlestick bullish hoga. Pattern ko confirm karne ke liye aapko volume aur tachniqui isharo ka istemaal karna chahiye. Iske liye aap moving averages r isharo ka istemaal kar sakte hain. Agar aapne Piercing Candlestick Pattern ko shanakht aur confirm kar liya hai to aap apni position enter kar sakte hain. Agar trend downtrend mein hai to aap long position pr dakhil ho sakte hain.Apni position ko close karne ke liye aap target ke saath kaam karna chahiye. Agar market aapke haq mein hai to aap apni position ko target tak le k ja sakte hain. -

#22 Collapse

chaidnay wala patteren aik do din ka, candle stuck qeemat ka patteren hai jo neechay ki janib rujhan se oopar ki janib rujhan ki janib mumkina mukhtasir muddat ke ulat jane ki nishandahi karta hai. patteren mein oonchai ke qareeb pehlay din ka khilna aur ost ya barray size ki tijarti had ke sath kam ke qareeb band hona shaamil hai . How a Piercing Pattern Works

chaidnay walay patteren mein do din hotay hain jahan pehla faisla baichnay walay ke zair assar hota hai aur jahan dosray din pur josh khredar jawab dete hain. yeh mumkina tor par is baat ka ishara hai ke hasas ki supply jo market ke shurka farokht karna chahtay hain kuch had tak khatam ho gayi hai, aur qeemat is satah tak neechay aa gayi hai jahan hasas kharidne ki maang barh gayi hai aur yeh wazeh tor par zahir sun-hwa hai. yeh mutharrak qaleel mudti oopar ki passion goi ka kisi had tak qabil aetmaad isharay lagta hai . Piercing Pattern Formation chaidnay ka namona mom batii ke chand ahem namonon mein se aik hai jisay takneeki tajzia car aam tor par qeematon ki series ke chart par dekhte hain. yeh namona do mutawatar mom btyon ke zareya tashkeel diya gaya hai jin ka pehlay zikar kiya gaya hai aur is mein teen izafi ahem khususiyaat bhi hain ( jaisa ke oopar ki misaal mein bataya gaya hai ) .

1)patteren qeemat mein kami ke rujhan se pehlay hai. ( yeh sirf aik mukhtasir kami ka rujhan ho sakta hai, lekin agar qeemat mein izafay ke rujhan ke baad mom batian zahir hoti hain to yeh aik ahem ulat indicator nahi hai ) . 3)dosray din shuru honay ke liye qeemat ka farq kam hai. ( yeh patteren ziyada tar astaks mein paaya jata hai kyunkay krnsyon ya deegar 24 ghantay tijarti asason ke bar aks raton raat waqfa rakhnay ki salahiyat hoti hai. taham yeh patteren hafta waar chart par kisi bhi asasa class mein ho sakta hai ) . 3)doosri mom batii pehli mom batii ke wast ke oopar band honi chahiye. ( is se zahir hota hai ke is din kharidaron ne baichnay walon ko maghloob kardiya. ) Piercing Pattern Example aik chaidnay wala patteren takneeki tajzia mein taizi ke ulat jane ke liye aik mumkina signal ke tor par jana jata hai. apni sakht tareen shakal mein tashkeel nayaab hai, lekin is ke samnay neechay ka rujhan jitna lamba hota hai behtar karkardagi ka muzahira karta hai. jab takneeki mtalaat jaisay ke rsi, stochastic, ya macd aik hi waqt mein taizi ka farq dikha rahay hain jab aik chaidnay wala patteren zahir hota hai, to is se is imkaan ko taqwiyat millti hai ke yeh do roza patteren maienay khaiz hai . dosray din ki safaid mom batii ka ریباؤنڈ neechay ke waqfay se mid point ki oonchai tak pounchanay ki umeed hai ke yeh is baat ki alamat hai ke support level tak pahonch gaya hai. aisa is liye ho sakta hai kyunkay market ke maahir ya market sazoon ne ibtidayi qeemat pichlle din ke band se kam rakhi hai. jab market khilnay par aisa hota hai, pur josh khredar qadam rakh satke hain aur tijarti din ke aaghaz se hi qeemat ki karwai ko rivers kar satke hain . is terhan, chaidnay ke patteren ki mazeed tasdeeq ki ja sakti hai agar yeh price channel ke support trained line par hota hai, jahan pehlay khareedna shuru ho chuka hai .

How to use Piercing Pattern?

sarmaya karon ko chaidnay ke patteren ke sath tijarat karte waqt chand khususiyaat ko dekhna chahiye : sab se pehlay, rujhan ko neechay ka rujhan hona chahiye, kyunkay patteren taizi se ریورسل patteren hai . doum, candle stuck ki lambai is qowat ka taayun karne mein ahem kirdaar ada karti hai jis ke sath ulat jaye gi . mandi aur taizi ki mom btyon ke darmiyan farq is baat ki nishandahi karta hai ke trained ریورسل kitna taaqatwar hoga . chothi baat, taizi ki candle stuck ko pichli bearish candle stuck ke wast point se ziyada band hona chahiye . aakhir mein, bearish ke sath sath blush candle stick ki bhi barri body honi chahiye . -

#23 Collapse

Meaning of forex trading Ye wala trading week bhht acha gia ho ga.aj ki post chief mumble splendid money thought ko focus on karen gy or dekhen gy ye kia hota ha or forex essential esy kaient indiForex trading duniya ka sabse bada business hai. Forex mein rozana pair mein aur metals mein trade ke Kafi list bhi hain. Jinmen matlab ke Forex trading ka market ke 5 trillion dollar hai. Jay se jyada bhi ho sakta hai.cators baat ki jaaye to Forex trading Ki duniya ka sabs improvements of money matches in the forex market specialists and monetary patrons desire to follow the lead of smart money vendors, to recognize potential trading significant entryways and take advantage of market trends.Ho look for signs of strong worth turns of events or changes in design direction that could suggest the, as they can put colossal trades that can affect market revenue. Consequently, many retail vendors and monetary benefactors desire to follow the lead of splendid money sellers, to perceive potential can get a sensation of wever, it's basic to observe that not all colossal specialists are seen as smart money. A couple of institutional monetary supporters may fundamentally be executing trades in light of a legitimate concern for their clients, with close to no particular comprehension e badest hai aur Market ki improvement mein shamil Hai. Straightforward strategy for getting cash Is kamm me hmee adversity bbhi hote hain lekin jo bade invester hote hain vah market ka design aur course tabdil kar lete hain. Kyunki jitna volume dollar ke sath upar jata hai to vah dollar contribute Karke market ki bearing ko tabdil kar lete hain. Pakistan mein itne billiaSmart cash vendors regularly approach advanced market assessment gadgets, financial investigation, and high speed trading advancement, which license them to make a lot of taught and lucky trading decisions.These shippers habitually by and large influence the worth improvements of cash matches in the forex market, as they can put colossal trades that can influence natural market. Thusly, various retailinvolvement of quick money traders.Order stream assessment: A couple of intermediaries use demand stream examination gadgets to recognize the orientation of trading activity the market. By separating the movement of exchange solicitations, vendors and quick trading development, which grant them to make a lot of taught and helpful trading decisions.These handles regularly out and out influence the expense into the market. In that limit, it's huge for forex agents to do their own investigation and assessment, in rd nahi hai ki market ka Rukh tabdil kar sakeen. Central strategies are used to get cash Canny money sellers are ordinarily spearheads, inferring that they rush to recognize and acquire by new market designs. Specialists can what heading the market is moving, and which vendors may be behind those moves.News ev Hain Jo market ka design badal dete Hain unhen Money maker bolate Haina aur kamyab business hai jo rozana ki buniyad per trade kar raha hai. Rozana trading ke Kafi benefit make karva raha hai aur Kafi hardship ka sab abhi blacklist raha hai. Trading volume Kafi bada ho raha hai pichhle ents: Splendid money sellers regularly have ac Hain kuchh bhi close hote sal forex ki trade 5 trillion dollar thi. Lekin is sal ka trading volume zada ha to es se hamen clever money ko perceive karny essential madad to state of the art news assessment gadgets that license them to quickly answer market-moving events. By checking news statements and monetary pointers, vendors can get a sensation of which merchants may be answering these events and driving business area movements.It's essential to observe that these markers are not by and large numbskull verification, and that clever money sellers are a significant part of the time especially fit at covering their activity watching out. Explanation of Astute Money Splendid cash wohh nakad hai jo sarmaya kar Karne grain pesha battle afrad ke sath lagaya jata hai jo behtar yah donon hote hain yah samjha jata hai ki yah rakam Sahi sarmaya karya ki gadi mein sahi waqt per lagai jaati hai aur sabse zeada munafa hasil karegi lihaza khyal Kiya jata hai ki canny Money mein kamyabi ka zyada imkaan hai kyunki idara jaate sarmaya karon ke evade sharmaya behtar hikmatta mele Hain quick Paisa marketon ko size aur takat ke Sath vimantakeel kar sakta hai punch ise markazi bankon ke zarie administer Kiya jata hai iske terrible yah Badi rakam aur acchi hikmat amli ki mushtarka Kuan Blacklist jaati hai Jahan wh sarmaya kar wise hone ki kamyabi concerning sawar hote Hain.S store cash Sy Murad eh sarmaya kr jsy idara jati sarmaya kr markazi financial establishment or degar maliyati idary ya pesha battling afrad control krty hain. Samart cash ak ijtamai quwat roughage js head mandio ko muntaqil karnay ki salahyat hoti feed yeh kahyal kia jata roughage astute cash fundamental khorda sarmaya kar k muqably k muqably head kamyabi behtar mawaqy roughage -

#24 Collapse

Piercing Candlestick Pattern

principal marketing in forex Tweezers to top candlestick pattern main bullish trend k top position ya resistance level par banta jahan se prices trend reversal ho sakty hen A bullish candle is present if the pattern of candles include a pehli candle. A bullish candle indicates that real estate values are on the rise. The pattern's dosri candle, which is a bearish candle, and the bullish candle, whose high point opened and closed simultaneously, both have bearish actual bodies. Prices reversal kiya howa hota hai pattern ki dono candles same resistance level banati jahan se.Deegar takneeki isharay and chart patteren be talaash karte hain patteren ko durust karne ke liye. Woh rujhan ke ulat jane ki tasdeeq ke liye trained lines ya moving average istemaal kar satke hain, misaal ke tor par. yeh note karna zaroori hai ke tweezer top patteren hamesha mustaqbil ki qeematon ki naqal o harkat ka aik qabil aetmaad paish go nahi hota hai aur usay tajzia ke deegar tools ke sath mil kar istemaal kya jana chahiye . trading intry point Our Tweezers top candlestick pattern market's present trend k bar-aks bearish signal jiss par sell ki entrance hoti hai. Technical traders analysis of the best platform hota Hai. Ye pattern prices are at a high level and are rebounding. Hei Pattern par trade enter karne se pehel aik confirmation candle ka hona k bearish main honi chaheye aur dosri candle k bottom par close honi chahey jiss par value overbought zone main honi chahey pattern ki confirmation MACD indicator aur stochastic oscillator se bhi ki ja sakti Ziada hona lazmi hota hai patternsPrice chart pattern: bullish trend, top position, and resistance level par banta, or apni movement maintains krta ha jahan se prices trend reversal ho jati hai. Two candles are included in the pattern, and the first candle is a bullish candle. Bullish candle indicates that true body and design are trending upward, which is good news for pricing. Pattern ki dosri candle aik bearish candle hoti hai aur ya esi candle hoti ha; similarly, bullish candle k high par open ho kar bearish real body k sath lower side par close hoti hai.

trading intry point Our Tweezers top candlestick pattern market's present trend k bar-aks bearish signal jiss par sell ki entrance hoti hai. Technical traders analysis of the best platform hota Hai. Ye pattern prices are at a high level and are rebounding. Hei Pattern par trade enter karne se pehel aik confirmation candle ka hona k bearish main honi chaheye aur dosri candle k bottom par close honi chahey jiss par value overbought zone main honi chahey pattern ki confirmation MACD indicator aur stochastic oscillator se bhi ki ja sakti Ziada hona lazmi hota hai patternsPrice chart pattern: bullish trend, top position, and resistance level par banta, or apni movement maintains krta ha jahan se prices trend reversal ho jati hai. Two candles are included in the pattern, and the first candle is a bullish candle. Bullish candle indicates that true body and design are trending upward, which is good news for pricing. Pattern ki dosri candle aik bearish candle hoti hai aur ya esi candle hoti ha; similarly, bullish candle k high par open ho kar bearish real body k sath lower side par close hoti hai.  Formate and different steps for piecering candlesticks: Kitna robust pattern inversion hoga pichhali Negative candles ka Stop bad luck kam Hona chahie But long-term success ki rate Kafi zyada hai aap stock side application ka istemal Kar Ke the next trading day replacing ke liye stock ko channel karne ke liye specialist examinations ka bhi istemal kar sakte hain. Pattern has a bullish trend as its destiny, according to the data. Making arrangements is done when the forex market exchange is open. In order to choose which option to use, values such as stop-loss or take-profit must be calculated. Is a bearish candlestick pattern's primary stop-loss cost closing price hota or jab aap iska take income set karna chahte hain, a bearish trend's starting component is hota, at which time our point Tak ap ka take profit ki limit is hota? As long as you follow the rules, your account will be saved and you will be able to trade with confidence.

Formate and different steps for piecering candlesticks: Kitna robust pattern inversion hoga pichhali Negative candles ka Stop bad luck kam Hona chahie But long-term success ki rate Kafi zyada hai aap stock side application ka istemal Kar Ke the next trading day replacing ke liye stock ko channel karne ke liye specialist examinations ka bhi istemal kar sakte hain. Pattern has a bullish trend as its destiny, according to the data. Making arrangements is done when the forex market exchange is open. In order to choose which option to use, values such as stop-loss or take-profit must be calculated. Is a bearish candlestick pattern's primary stop-loss cost closing price hota or jab aap iska take income set karna chahte hain, a bearish trend's starting component is hota, at which time our point Tak ap ka take profit ki limit is hota? As long as you follow the rules, your account will be saved and you will be able to trade with confidence.

-

#25 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : What is the Piercing Candlestick Pattern piercing pattern patteren aik do din ka, candle stuck qeemat ka patteren hai jo neechay ki janib rujhan se oopar ki janib rujhan ki janib mumkina mukhtasir muddat ke ulat jane ki nishandahi karta hai. patteren mein oonchai ke qareeb pehlay din ka khilna aur ost ya barray size ki tijarti had ke sath kam ke qareeb band hona shaamil hai. is mein pehlay din ke baad aik waqfa neechay bhi shaamil hai jahan dosray din tijarat shuru hoti hai, kam ke qareeb khilna aur bulandi ke qareeb band hona. close bhi aik candle stuck hona chahiye jo pichlle din ki surkh mom batii ke jism ke oopar ki lambai ke kam az kam nisf hissay par muheet ho . Explanation piercing pattern ka patteren aik do din ka candle patteren hai jo neechay ki janib rujhan se oopar ki janib rujhan ki taraf mumkina ulat jane ka ishara karta hai . yeh mom batii ka namona aam tor par sirf paanch din bahar honay ki paish goi karta hai . is patteren ki teen khususiyaat mein patteren se pehlay neechay ki taraf rujhan, pehlay din ke baad aik waqfa, aur patteren mein doosri mom batii ke tor par aik mazboot ulat jana shaamil hai . piercing pattern ka patteren kaisay kaam karta hai . chaidnay walay patteren mein do din hotay hain jahan pehla faisla baichnay walay ke zair assar hota hai aur jahan dosray din pur josh khredar jawab dete hain. yeh mumkina tor par is baat ka ishara hai ke hasas ki supply jo market ke shurka farokht karna chahtay hain kuch had tak khatam ho gayi hai, aur qeemat is satah tak neechay aa gayi hai jahan hasas kharidne ki maang barh gayi hai aur yeh wazeh tor par zahir sun-hwa hai. yeh mutharrak qaleel mudti oopar ki passion goi ka kisi had tak qabil aetmaad isharay lagta hai . piercing pattern patteren ki tashkeel chaidnay ka namona mom batii ke chand ahem namonon mein se aik hai jisay takneeki tajzia car aam tor par qeematon ki series ke chart par dekhte hain. yeh namona do mutawatar mom btyon ke zareya tashkeel diya gaya hai jin ka pehlay zikar kiya gaya hai aur is mein teen izafi ahem khususiyaat bhi hain ( jaisa ke oopar ki misaal mein bataya gaya hai ) . patteren qeemat mein kami ke rujhan se pehlay hai. ( yeh sirf aik mukhtasir kami ka rujhan ho sakta hai, lekin agar qeemat mein izafay ke rujhan ke baad mom batian zahir hoti hain to yeh aik ahem ulat indicator nahi hai ) . dosray din shuru honay ke liye qeemat ka farq kam hai. ( yeh patteren ziyada tar astaks mein paaya jata hai kyunkay krnsyon ya deegar 24 ghantay tijarti asason ke bar aks raton raat waqfa rakhnay ki salahiyat hoti hai. taham yeh patteren hafta waar chart par kisi bhi asasa class mein ho sakta hai ) . doosri mom batii pehli mom batii ke wast ke oopar band honi chahiye. ( is se zahir hota hai ke is din kharidaron ne baichnay walon ko maghloob kardiya. ) aik piercing pattern wala patteren takneeki tajzia mein taizi ke ulat jane ke liye aik mumkina signal ke tor par jana jata hai. apni sakht tareen shakal mein tashkeel nayaab hai, lekin is ke samnay neechay ka rujhan jitna lamba hota hai behtar karkardagi ka muzahira karta hai. jab takneeki mtalaat jaisay ke rsi, stochastic, ya macd aik hi waqt mein taizi ka farq dikha rahay hain jab aik chaidnay wala patteren zahir hota hai, to is se is imkaan ko taqwiyat millti hai ke yeh do roza patteren maienay khaiz hai . dosray din ki safaid mom batii ka rebound neechay ke waqfay se mid point ki oonchai tak pounchanay ki umeed hai ke yeh is baat ki alamat hai ke support level tak pahonch gaya hai. aisa is liye ho sakta hai kyunkay market ke maahir ya market sazoon ne ibtidayi qeemat pichlle din ke band se kam rakhi hai. jab yeh market khuli jagah par hota hai, pur josh khredar qadam rakh satke hain aur tijarti din ke aaghaz se hi qeemat ki karwai ko rivers kar satke hain . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#26 Collapse

chaidnay wala patteren aik do din ka, candle stuck qeemat ka patteren hai jo neechay ki janib rujhan se oopar ki janib rujhan ki janib mumkina mukhtasir muddat ke ulat jane ki nishandahi karta hai. patteren mein oonchai ke qareeb pehlay din ka khilna aur ost ya barray size ki tijarti had ke sath kam ke qareeb band hona shaamil hai. is mein pehlay din ke baad aik waqfa neechay bhi shaamil hai jahan dosray din tijarat shuru hoti hai, kam ke qareeb khilna aur bulandi ke qareeb band hona. close bhi aik candle stuck hona chahiye jo pichlle din ki surkh mom batii ke jism ke oopar ki lambai ke kam az kam nisf hissay par muheet ho . How a Piercing Pattern Works

chaidnay wala patteren aik do din ka, candle stuck qeemat ka patteren hai jo neechay ki janib rujhan se oopar ki janib rujhan ki janib mumkina mukhtasir muddat ke ulat jane ki nishandahi karta hai. patteren mein oonchai ke qareeb pehlay din ka khilna aur ost ya barray size ki tijarti had ke sath kam ke qareeb band hona shaamil hai. is mein pehlay din ke baad aik waqfa neechay bhi shaamil hai jahan dosray din tijarat shuru hoti hai, kam ke qareeb khilna aur bulandi ke qareeb band hona. close bhi aik candle stuck hona chahiye jo pichlle din ki surkh mom batii ke jism ke oopar ki lambai ke kam az kam nisf hissay par muheet ho . Piercing Pattern Formation

chaidnay ka namona mom batii ke chand ahem namonon mein se aik hai jisay takneeki tajzia car aam tor par qeematon ki series ke chart par dekhte hain. yeh namona do mutawatar mom btyon ke zareya tashkeel diya gaya hai jis ka pehlay zikar kiya gaya hai aur is mein teen izafi ahem khususiyaat bhi hain ( jaisa ke oopar ki misaal mein bataya gaya hai ) . patteren qeemat mein kami ke rujhan se pehlay hai. ( yeh sirf aik mukhtasir kami ka rujhan ho sakta hai, lekin agar qeemat mein izafay ke rujhan ke baad mom batian zahir hoti hain to yeh aik ahem ulat nahi hai ) . dosray din shuru honay ke liye qeemat ka farq kam hai. ( yeh patteren ziyada tar astaks mein paaya jata hai kyunkay krnsyon ya deegar 24 ghantay tijarti asason ke bar aks raton raat waqfa rakhnay ki salahiyat hoti hai. taham yeh patteren hafta waar chart par kisi bhi asasa class mein ho sakta hai ) . doosri mom batii pehli mom batii ke wast ke oopar band honi chahiye. ( is se zahir hota hai ke is din kharidaron ne baichnay walon ko maghloob kardiya. ) pehli mom batii aam tor par gehray rang ki ya surkh hoti hai, jo neechay walay din ki nishandahi karti hai, aur doosri sabz ya halkay rang ki hoti hai, jo is din ki nishandahi karti hai jo khilnay se ouncha band hota hai. jab aik tajir taizi ke ulat jane ko dekh raha hota hai, to koi bhi surkh mom batii is ke baad safaid candle stick aik alert ho sakti hai, lekin chaidnay ka namona aik khaas ishara hai kyunkay market ke ziyada tar shurka ke liye ulat jane ka imkaan ghair mutawaqqa hai . Piercing ern Exampl

aik chaidnay wala patteren takneeki tajzia mein taizi ke ulat jane ke liye aik mumkina signal ke tor par jana jata hai. apni sakht tareen shakal mein tashkeel nayaab hai, lekin is ke samnay neechay ka rujhan jitna lamba hota hai behtar karkardagi ka muzahira karta hai. jab takneeki mtalaat jaisay ke rsi, stochastic, ya macd aik hi waqt mein aik chaidnay wala namona zahir honay ke sath hi taizi ka farq dikha rahay hain, to is se is imkaan ko taqwiyat millti hai ke yeh do roza patteren maienay khaiz hai . dosray din ki safaid mom batii ka neechay ke waqfay se mid point ki oonchai tak pounchanay ki umeed hai ke yeh is baat ki alamat hai ke support level tak pahonch gaya hai. aisa is liye ho sakta hai kyunkay market ke maahir ya market sazoon ne ibtidayi qeemat pichlle din ke band se kam rakhi hai. jab market khilnay par aisa hota hai, pur josh khredar qadam rakh satke hain aur tijarti din ke aaghaz se hi qeemat ki karwai ko rivers kar satke hain . is terhan, chaidnay ke patteren ki mazeed tasdeeq ki ja sakti hai agar yeh kisi qeemat channel ke support trained line par hota hai, jahan pehlay khareedna shuru ho chuka hai. chaidnay ka namona aam tor par ulat jane ke liye sirf aik mumkina signal hota hai is liye chaidnay walay patteren ke baad aik tajir tootay hue farq ko dekhna chahay ga . break way gape aik patteren hai jo ulat phair ke pehlay marhalay mein hota hai. is ki shanakht dosray din ki safaid mom batii ke sath lagataar do safaid mom batii se hoti hai jo pehlay din ki ikhtitami qeemat se dosray din ki ibtidayi qeemat tak kaafi ziyada farq zahir karti hai. aik chaidnay ka namona jis ke baad waqfa waqfa hota hai is baat ki mazboot tasdeeq ho sakti hai ke ulat phair ho rahi hai . taizi ke badlay mein, taajiron ke paas aam tor par do maqbool ikhtiyarat hotay hain. woh up trained se faida uthany ke liye stock khareed satke hain. woh mojooda market ki qeemat se kam strike price ke sath un di money cal option kharidne ka bhi intikhab kar satke hain . Access to World-Class Learning From Top Universities kya aap banking, sarmaya kaari ke intizam, ya fnans se mutaliq deegar shobo se mutaliq mharton ko farogh dainay mein dilchaspi rakhtay hain? secron online srtifkit programon ko browse karen jo duniya ki Maroof yonyorstyan aymrits ke sath shiraakat mein paish karte hain. bunyadi bunyadi baton se le kar taaza tareen tehqeeqi mtalaat tak, aap ko sanat ke mahireen ke zareya sikhayiye jane walay korsz ki aik range mil jaye gi. mustaqbil ke liye tayyar mharton ko tayyar karne ke baray mein mazeed jaanen aur shuru karen .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:55 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим