Ik profitable trade krne k liye different important candlestick pattern ko study karna zarori hota ha. Aaj main aap sa Piercing Candlestick Pattern ki kuch information share krna chati hoon.

What is the Piercing Candlestick Pattern ??

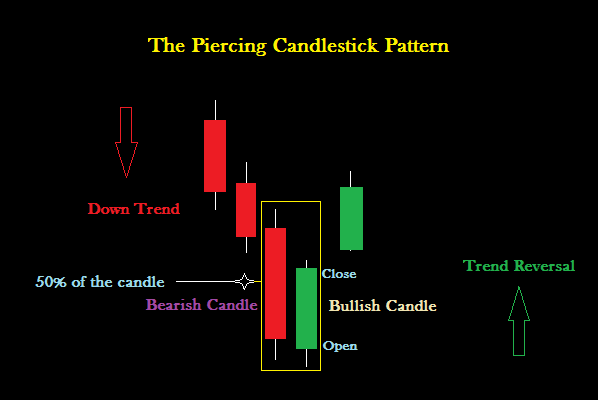

Dear members, piercing Candlestick Pattern support level per banany Wala pattern 2 candlestick per mushtamil hota hai. Jo aapko uptrend ki information or indications deta hai. Is candlestick pattern main aapko downtrend k bad buyer's pressure milta hai. Agar aap chart ko dekhen to aap is pattern ko easily identify kar sakte hain.

Identification of Piercing candlestick pattern:

Agr ap chart ko dikhn to ap ye notice krn ge, k Piercing Candlestick Pattern ko downtrend k bad support level per banta hai. Agr market mein yah pattern support level per nai banta, tu is pattern ki effectiveness zyda nahin hoti. Ye hamesha 2 different types ki candlestick say mil kr banta hai. Jis main first candle long bearish candlestick honi cheye aur 2nd candlestick bullish honi cheye, jo first candle k mid point say oper close hoti hai. Esi situation main market main buying ki trade kr sakhty hain.

Importance of Candlestick Pattern:

Agr market ko technically analyse karna chahte hain, tu aapko hamesha market mein available candlestick pattern ko study karna hota hai. Forex trading mein different candlestick pattern ki bahut zyda importance hoti hai. In candlestick ko study kr k ap ik achi trade kr sakte hain.

Interpretation of candlestick pattern

Dear members, yah pattern ap ko future bullish trend ki information daita hai. Forex trading mai trade open krne se pale pori planning krni hoti ha. Is se phlay stop-loss or take profit ki values ko acchi tarah calculate kar ka koi b decision lena cheye. Is candlestick pattern main stop-loss ki value last bearish candlestick ka closing values hota hai, or jab aap iska take profit set karna chahte hain, tu bearish trend Kay start his point sa hota hai, us point Tak aap ka take profit ki limit ho sakhti hai. Agr ap in rules ko follow karen to ap apne account ko save rakh kr Bohat achi trade kr sakte hain.

What is the Piercing Candlestick Pattern ??

Dear members, piercing Candlestick Pattern support level per banany Wala pattern 2 candlestick per mushtamil hota hai. Jo aapko uptrend ki information or indications deta hai. Is candlestick pattern main aapko downtrend k bad buyer's pressure milta hai. Agar aap chart ko dekhen to aap is pattern ko easily identify kar sakte hain.

Identification of Piercing candlestick pattern:

Agr ap chart ko dikhn to ap ye notice krn ge, k Piercing Candlestick Pattern ko downtrend k bad support level per banta hai. Agr market mein yah pattern support level per nai banta, tu is pattern ki effectiveness zyda nahin hoti. Ye hamesha 2 different types ki candlestick say mil kr banta hai. Jis main first candle long bearish candlestick honi cheye aur 2nd candlestick bullish honi cheye, jo first candle k mid point say oper close hoti hai. Esi situation main market main buying ki trade kr sakhty hain.

Importance of Candlestick Pattern:

Agr market ko technically analyse karna chahte hain, tu aapko hamesha market mein available candlestick pattern ko study karna hota hai. Forex trading mein different candlestick pattern ki bahut zyda importance hoti hai. In candlestick ko study kr k ap ik achi trade kr sakte hain.

Interpretation of candlestick pattern

Dear members, yah pattern ap ko future bullish trend ki information daita hai. Forex trading mai trade open krne se pale pori planning krni hoti ha. Is se phlay stop-loss or take profit ki values ko acchi tarah calculate kar ka koi b decision lena cheye. Is candlestick pattern main stop-loss ki value last bearish candlestick ka closing values hota hai, or jab aap iska take profit set karna chahte hain, tu bearish trend Kay start his point sa hota hai, us point Tak aap ka take profit ki limit ho sakhti hai. Agr ap in rules ko follow karen to ap apne account ko save rakh kr Bohat achi trade kr sakte hain.

تبصرہ

Расширенный режим Обычный режим