Uses of neck line in trading

Introduction

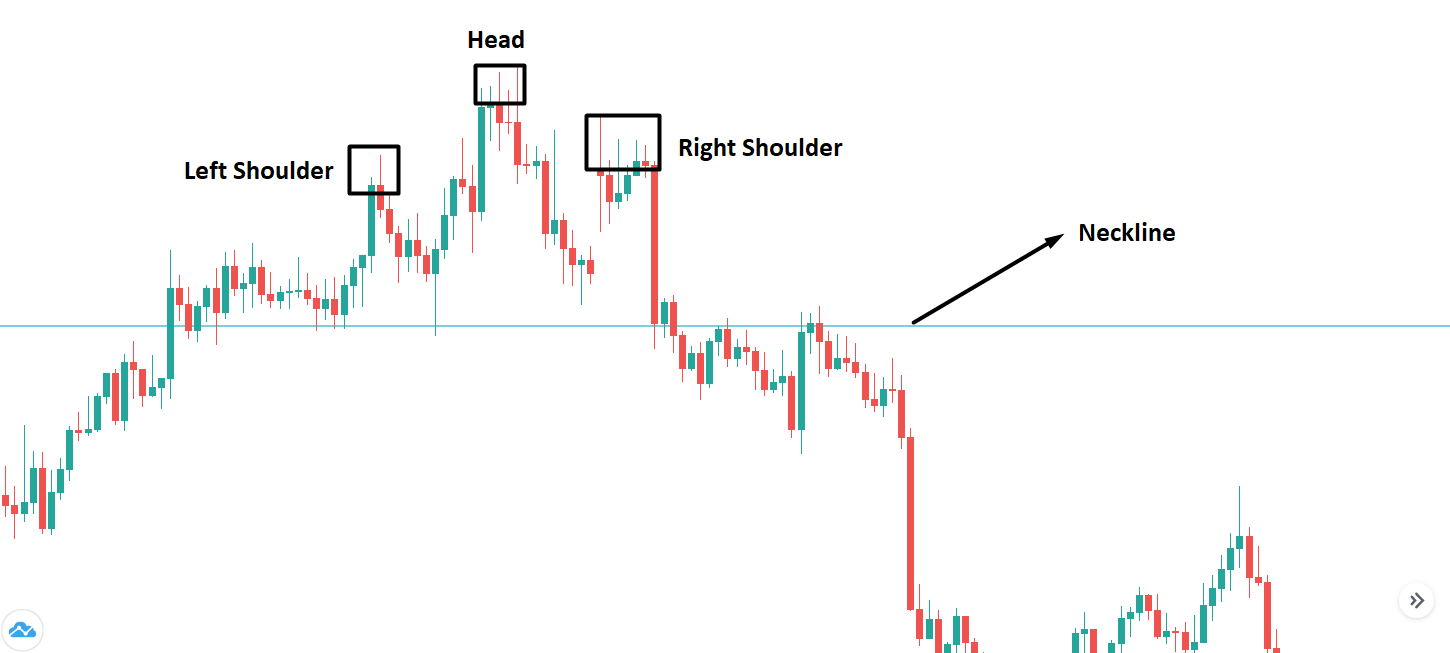

Trading mein, istilaah" neckline" ka istemaal aik trend line ke liye kya jata hai jo chart patteren ke sab se kam nichale points ko jorta hai, jaisay ke head & Shoulder Pattern aik takneeki chart patteren hai jo is waqt bantaa hai jab stock ki qeemat chouti head tak pahonch jati hai, phir wapas girty hai, phir is se bhi onche chouti ( head ) par charh jati hai, aur phir dobarah girty hai. teesri chouti (right shoulders) jo aam tor par head se neechay hoti hai neck line head & Shoulders kay 2 falls ke nichale points ko jor kar khenchi jati hai jo sir aur kaandhon ke nichale hissay ko tashkeel dete hain.

Neck line in trading definition

Neck k line support ya muzahmat ki aik satah hai jo sir aur kaandhon ke patteren par payi jati hai jisay traders order dainay ke liye astritjk ilaqon ka taayun karne ke liye istemaal karte hain. gardan ki lakeer sir aur kaandhon ke ٹاپنگ patteren ke jhoolon ( jo pehli do chotyon ke baad hoti hai ) ko judte hai. naik line ke neechay ki harkat patteren ke break out ka ishara deti hai aur is baat ki nishandahi karti hai ke pichlle up trained ke neechay ki taraf ulat jana jari hai .

sir aur kaandhon ke neechay walay patteren ki soorat mein, jisay ulta sir aur kandhay kaha jata hai, naik line patteren ki do jhoolon ki oonchaiyon ko judte hai aur dayen janib phail jati hai. jab qeemat naik line se oopar uthti hai to yeh patteren ke break out aur Sabiqa neechay ke rujhan ke ulat jane ka ishara deti hai .

Head and shoulder pattern

Sir aur kaandhon ka patteren oopar ke rujhan ke baad bantaa hai aur yeh chouti, aik ریٹیسمنٹ, aik onche doosri chouti, aik retestment aik nichli teesri chouti, aur gardan ki lakeer ke neechay aik qatra par mushtamil hota hai .

kuch traders short position mein daakhil hotay hain ya lambi pozishnon se bahar nikaltay hain jab qeemat naik line se neechay gir jati hai. mukhtasir mein daakhil honay walon ke liye, aik stap nuqsaan aksar haliya jhulay ke oopar ya teesri chouti ke ounchay oopar rakha jata hai .

sir aur kaandhon ke liye mutawaqqa manfi harkat patteren ki oonchai hai — jo ke doosri chouti ki qeematon ke darmiyan do retestment mein se sab se kam qeemat tak ka farq hai. usay qeemat ka hadaf kaha jata hai. is baat ki koi zamanat nahi hai ke qeemat is satah tak pahonch jaye gi, ya is satah par girna band ho jaye gi. yeh sirf aik takhmeenah hai .

On neck trader psychology

security aik bunyadi neechay ke rujhan ya bunyadi up trained ke andar aik barray pal back mein masroof hai. pehli mom batii aik lambi siyah asli body post karti hai. qeemat ki yeh kamzor karwai mandi ki khushnodi mein izafah karti hai jabkay kamzor belon ko mukammal paspaai par majboor karti hai .

doosri mom batii par hifazati farq neechay aa jata hai aur aik nai nichli satah par farokht hota hai, lekin khredar control sambhaal letay hain aur qeemat ko pehlay ke qareeb tak le jane ke qabil hotay hain lekin is se oopar nahi. reechh dekhte hain ke belon ke paas qeemat ko pehlay ke qareeb se oopar dhakelnay ki taaqat nahi hai. nazriya yeh hai ke reechh agli kayi mom btyon par qaabiz ho jayen ge aur qeemat ko kam kar den ge. jaisa ke behas ki gayi hai, haqeeqat mein, yeh sirf adhay waqt mein hota hai. is terhan patteren reechh aur bail dono ko kinare par rakhta hai, jis ke nateejay mein bunyadi tor par aik sikka palat_ta hai ke aaya patteren ke baad qeematein ziyada hon gi ya kam .

Introduction

Trading mein, istilaah" neckline" ka istemaal aik trend line ke liye kya jata hai jo chart patteren ke sab se kam nichale points ko jorta hai, jaisay ke head & Shoulder Pattern aik takneeki chart patteren hai jo is waqt bantaa hai jab stock ki qeemat chouti head tak pahonch jati hai, phir wapas girty hai, phir is se bhi onche chouti ( head ) par charh jati hai, aur phir dobarah girty hai. teesri chouti (right shoulders) jo aam tor par head se neechay hoti hai neck line head & Shoulders kay 2 falls ke nichale points ko jor kar khenchi jati hai jo sir aur kaandhon ke nichale hissay ko tashkeel dete hain.

Neck line in trading definition

Neck k line support ya muzahmat ki aik satah hai jo sir aur kaandhon ke patteren par payi jati hai jisay traders order dainay ke liye astritjk ilaqon ka taayun karne ke liye istemaal karte hain. gardan ki lakeer sir aur kaandhon ke ٹاپنگ patteren ke jhoolon ( jo pehli do chotyon ke baad hoti hai ) ko judte hai. naik line ke neechay ki harkat patteren ke break out ka ishara deti hai aur is baat ki nishandahi karti hai ke pichlle up trained ke neechay ki taraf ulat jana jari hai .

sir aur kaandhon ke neechay walay patteren ki soorat mein, jisay ulta sir aur kandhay kaha jata hai, naik line patteren ki do jhoolon ki oonchaiyon ko judte hai aur dayen janib phail jati hai. jab qeemat naik line se oopar uthti hai to yeh patteren ke break out aur Sabiqa neechay ke rujhan ke ulat jane ka ishara deti hai .

Head and shoulder pattern

Sir aur kaandhon ka patteren oopar ke rujhan ke baad bantaa hai aur yeh chouti, aik ریٹیسمنٹ, aik onche doosri chouti, aik retestment aik nichli teesri chouti, aur gardan ki lakeer ke neechay aik qatra par mushtamil hota hai .

kuch traders short position mein daakhil hotay hain ya lambi pozishnon se bahar nikaltay hain jab qeemat naik line se neechay gir jati hai. mukhtasir mein daakhil honay walon ke liye, aik stap nuqsaan aksar haliya jhulay ke oopar ya teesri chouti ke ounchay oopar rakha jata hai .

sir aur kaandhon ke liye mutawaqqa manfi harkat patteren ki oonchai hai — jo ke doosri chouti ki qeematon ke darmiyan do retestment mein se sab se kam qeemat tak ka farq hai. usay qeemat ka hadaf kaha jata hai. is baat ki koi zamanat nahi hai ke qeemat is satah tak pahonch jaye gi, ya is satah par girna band ho jaye gi. yeh sirf aik takhmeenah hai .

On neck trader psychology

security aik bunyadi neechay ke rujhan ya bunyadi up trained ke andar aik barray pal back mein masroof hai. pehli mom batii aik lambi siyah asli body post karti hai. qeemat ki yeh kamzor karwai mandi ki khushnodi mein izafah karti hai jabkay kamzor belon ko mukammal paspaai par majboor karti hai .

doosri mom batii par hifazati farq neechay aa jata hai aur aik nai nichli satah par farokht hota hai, lekin khredar control sambhaal letay hain aur qeemat ko pehlay ke qareeb tak le jane ke qabil hotay hain lekin is se oopar nahi. reechh dekhte hain ke belon ke paas qeemat ko pehlay ke qareeb se oopar dhakelnay ki taaqat nahi hai. nazriya yeh hai ke reechh agli kayi mom btyon par qaabiz ho jayen ge aur qeemat ko kam kar den ge. jaisa ke behas ki gayi hai, haqeeqat mein, yeh sirf adhay waqt mein hota hai. is terhan patteren reechh aur bail dono ko kinare par rakhta hai, jis ke nateejay mein bunyadi tor par aik sikka palat_ta hai ke aaya patteren ke baad qeematein ziyada hon gi ya kam .

تبصرہ

Расширенный режим Обычный режим