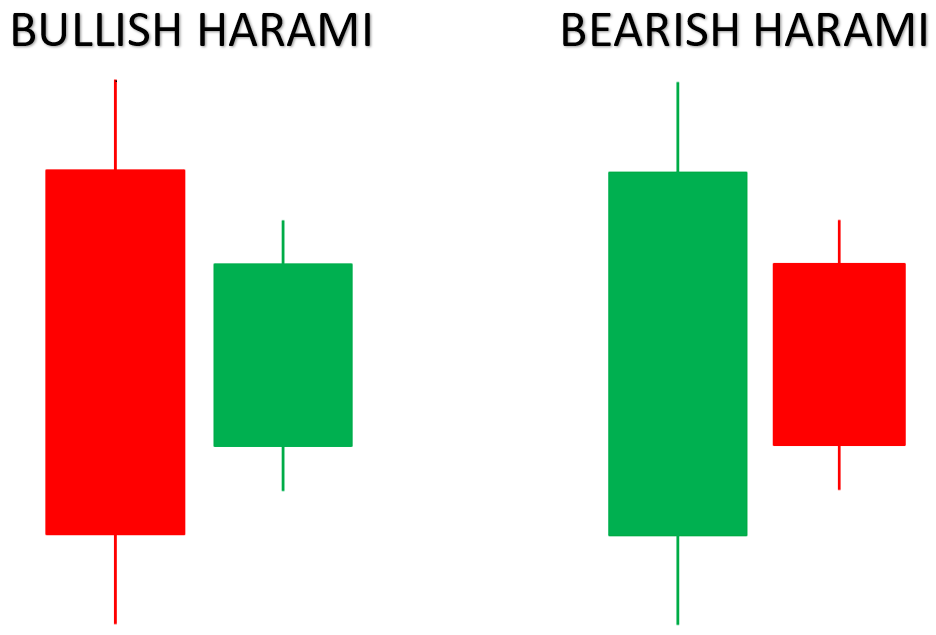

My dear Friend ab hum harami candlestick k bary ma baat karny lagy hai. Harami candlestick chart pattern ka bohot se traders ko knowledge nahi hoga isi ka jaiza lety hey,Dear Harami candle stick esa pattern hai jes ko understand karny ke ley day 1 ka time frame chart use karna important hota hai, day 1 me single candle bullish ya bearish banta hay es par hi focus nahi kia jata 2nd day key candle se ye information hasil ho sakti ha.aur as ki 2types ha.

Berish Hamari Candlestick:

My dear Friend ab hum Bearish hamari candlestick k bary ma baat karny lagy hai bearish reversal pattern ha or ye bullish trend k end main bnta ha es k bad market ka trend reverse ho k bearish ho jata ha or market main qeemten km hona shro ho jati hain.es pattern main hamen achi sell ki trade mil jati ha.as ko hum beraish bi kehty hai.

Bullish hamari candlestick:

My dear Friend ab hum bullish candlestick k bary ma baat karny lagy hai bullish reversal hota ha mtlb k ye bearish trend k end main banta ha or es k bad market ka trend reverse ho k bullish ho jata ha or market main qeemten barhna shro ho jati hain.as patten k bad hum achi buy ki trade le skty hain.Bullish candle ka size bearish sa chota hona zarori ha.

is patron ke banne ki sabse badi nishani ji hai ki pahle ek chhoti si candle banti hai jo ki ek shooting satta hota hai aur iske sath jab Koi badi candle banti hai aur vah is ko break kar ke upar ki taraf chali jaati hai to is tab harami pattern banta ha.as ko hum bullish hamari candlestick kehty ha.

Berish Hamari Candlestick:

My dear Friend ab hum Bearish hamari candlestick k bary ma baat karny lagy hai bearish reversal pattern ha or ye bullish trend k end main bnta ha es k bad market ka trend reverse ho k bearish ho jata ha or market main qeemten km hona shro ho jati hain.es pattern main hamen achi sell ki trade mil jati ha.as ko hum beraish bi kehty hai.

Bullish hamari candlestick:

My dear Friend ab hum bullish candlestick k bary ma baat karny lagy hai bullish reversal hota ha mtlb k ye bearish trend k end main banta ha or es k bad market ka trend reverse ho k bullish ho jata ha or market main qeemten barhna shro ho jati hain.as patten k bad hum achi buy ki trade le skty hain.Bullish candle ka size bearish sa chota hona zarori ha.

is patron ke banne ki sabse badi nishani ji hai ki pahle ek chhoti si candle banti hai jo ki ek shooting satta hota hai aur iske sath jab Koi badi candle banti hai aur vah is ko break kar ke upar ki taraf chali jaati hai to is tab harami pattern banta ha.as ko hum bullish hamari candlestick kehty ha.

تبصرہ

Расширенный режим Обычный режим