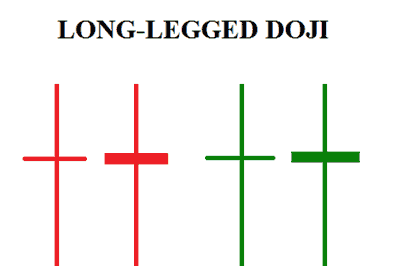

What is the long legged dogi?

lambi tangon wala doji aik mom batii hai jo oopri aur neechay ke lambay saaye par mushtamil hoti hai aur is ki khilnay aur band honay ki qeemat taqreeban aik jaisi hoti hai, jis ke nateejay mein aik chhota sa asli jism hota hai. aik lambi tangon wala doji bunyadi security ki qeemat ki mustaqbil ki simt ke baray mein ghair yakeeni ki nishandahi karta hai. lambi tangon walay dojies aik mazbooti ki muddat ke aaghaz ko bhi nishaan zad kar satke hain, jahan qeemat aik ya ziyada lambi tangon wali doji ko sakht patteren mein jane ya naya rujhan bananay ke liye totnay se pehlay tashkeel deti hai.

lambi tangon wali doji mom batian is waqt sab se ziyada ahem samjhi jati hain jab woh mazboot up trained ya down trained ke douran hoti hain. lambi tangon wala doji is baat ki nishandahi karta hai ke talabb aur rasad ki quwaten tawazun ke qareeb hain aur rujhan ulat sakta hai. is ki wajah yeh hai ke tawazun ya ghair faisla kin pan ka matlab hai ke qeemat ab is simt nahi barh rahi hai jo pehlay thi. jazbaat badal satke hain. misaal ke tor par, aik up trained ke douran, qeemat ziyada barh rahi hai aur ziyada tar muddat khulay ke oopar band ho jati hai.

lambi tangon wala doji zahir karta hai ke kharidaron aur baichnay walon ke darmiyan larai hui thi lekin aakhir-kaar woh taqreeban barabar ho gaye. yeh pehlay ke adwaar se mukhtalif hai jahan khredar control mein thay. patteren kisi bhi time frame par paaya ja sakta hai lekin taweel mudti charts par ziyada ahmiyat rakhta hai kyunkay ziyada shurka is ki tashkeel mein hissa daaltay hain. yeh wasee tar doji family ka hissa hai jis mein mayaari doji shaamil hai ,

Long legged dogi trading considerations:

lambi tangon walay doji ko tijarat karne ke mutadid tareeqay hain, halaank patteren ki bunyaad par tijarat ki zaroorat nahi hai. patteren sirf aik mom batii hai, jo kuch taajiron ke khayaal mein kaafi ahem nahi hai, khaas tor par chunkay tijarti faislay ki zamanat dainay ke liye qeemat ikhtitami bunyaad par ziyada nahi barhi. kuch traders amal karne se pehlay mazeed tasdeeq dekhna chahain ge — qeemat ki harkat jo lambi tangon walay doji ke baad hoti hai. is ki wajah yeh hai ke lambi tangon walay doji kabhi kabhi klstrz mein, ya barray istehkaam ke hissay ke tor par ho satke hain. un consolidations ka nateeja Sabiqa rujhan ke ulat phair, ya is ka tasalsul ho sakta hai, is baat par munhasir hai ke qeemat kis terhan se consolidation se nikalti hai. agar patteren ki tijarat karna chahtay hain, to yahan kuch umomi tijarti khayalat hain :

Entry:

chunkay patteren ko ghair faisla kin muddat ke tor par dekha jata hai, aik tajir lambi tangon walay doji ki qeemat ke ounchay ya kam se oopar jane ka intzaar kar sakta hai. agar qeemat oopar jati hai to lambi position darj karen. agar qeemat patteren se neechay jati hai to aik mukhtasir position darj karen. mutabadil tor par, intzaar karen aur dekhen ke aaya lambi tangon walay doji ke ird gird aik consolidation bantaa hai, aur phir jab qeemat bal tarteeb consolidation se oopar ya neechay jati hai to lamba ya chhota darj karen.

rissk managment :

agar qeemat lambi taang walay doji ya consolidation se oopar jane tak daakhil ho rahi hai to patteren ya console ke neechay stap nuqsaan rakhen. is ke bar aks, agar qeemat lambi taang walay doji ya consolidation se neechay anay par mukhtasir darj kar rahay hain, to patteren ya consolidation ke oopar stap nuqsaan rakhen.

market structure :

lambi tangon wala doji aik durust signal dainay ka ziyada imkaan rakhta hai agar yeh kisi barray support ya muzahmati satah ke qareeb zahir hota hai. misaal ke tor par, agar qeemat barh rahi hai aur phir aik barri muzahmati satah ke qareeb lambi tangon wala doji banata hai, to is se qeemat mein kami ka saamna karne ke imkanaat barh satke hain agar qeemat lambi tangon walay doji se neechay girty hai.

Taking profit:

lambi tangon walay dojies ke sath munafe ke ahdaaf munsalik nahi hotay hain, is liye taajiron ko munafe lainay ka koi tareeqa talaash karne ki zaroorat hogi agar koi taraqqi kere. tajir takneeki isharay istemaal kar satke hain, ya misaal ke tor par jab qeemat mutharrak ost se tajawaz kar jaye to bahar nikal satke hain. kuch tajir aik muqarara khatrah / inaam ka tanasub istemaal kar satke hain. misaal ke tor par, agar $ 200 ki tijarat ko khatrah la-haq ho, to woh tijarat se is waqt bahar nikal jatay hain jab woh $ 400 ya $ 600 oopar hotay hain .

تبصرہ

Расширенный режим Обычный режим