Hook Reversal Candlestick Pattern:

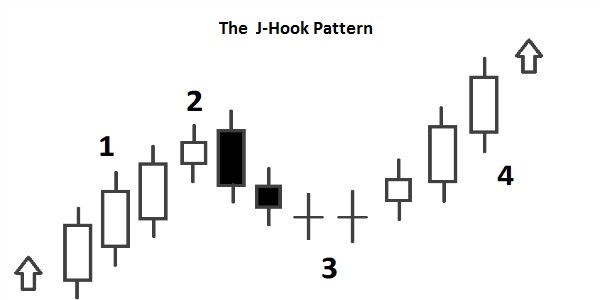

" Hook Reversal" aik istilaah hai jo takneeki tajzia mein istemaal ki jati hai taakay candle stuck pattern ki aik qisam ko bayan kya ja sakay jo security ke mojooda rujhan mein mumkina ulat jane ki nishandahi kar sakta hai. patteren do mom btyon par mushtamil hai jo aik" hook" shakal banatay hain .

pehli candle stuck aik lambi aur bearish ( surkh ya siyah ) candle stuck hai jo farokht ke mazboot dabao ki nishandahi karti hai. doosri candle stick aik choti aur taiz ( sabz ya safaid ) candle stick hai jo pehli candle stick ke neechay khulti hai lekin –apne wast point ke oopar band hojati hai .

Pattern ko taizi ka signal samjha jata hai agar yeh neechay ke rujhan ke baad zahir hota hai, jis se yeh zahir hota hai ke khredar qadam barha rahay hain aur rujhan ko tabdeel kar rahay hain. is ke bar aks, agar patteren up trained ke baad zahir hota hai, to yeh bearish signal ho sakta hai jo is baat ki nishandahi karta hai ke baichnay walay control haasil kar rahay hain .

yeh note karna zaroori hai ke candle stuck pattern, Bashmole hook reversal, ko tijarti faislay karne ke liye tanhai mein istemaal nahi kya jana chahiye. signal ki tasdeeq aur khatray ko kam karne ke liye deegar takneeki isharay aur tajzia bhi istemaal kya jana chahiye .

Trading in Hook reversal candlestick patterns:

Hook reversal candlestick patterns can be used in trading by following these steps:

1. Learn about the different types of hook reversal candlestick patterns such as the hammer, hanging man, shooting star, and inverted hammer. These patterns are characterized by a long wick and a small body.

2. Look for these patterns on your price chart. They can occur at the top or bottom of a trend and are often used as a signal of a potential trend reversal.

3. Confirm the pattern with other technical indicators such as moving averages, trend lines, or support and resistance levels.

4. Enter a trade based on the pattern and your analysis. For example, if you see a hammer pattern at the bottom of a downtrend, you may enter a long position with a stop loss below the low of the candlestick.

5. Manage your risk by setting a stop loss and taking profit targets. You may also want to use trailing stops to lock in profits as the trade moves in your favor.

It is important to note that no trading strategy is foolproof, and it is essential to practice good risk management and have a solid understanding of technical analysis before using hook reversal candlestick patterns or any other trading strategy.

" Hook Reversal" aik istilaah hai jo takneeki tajzia mein istemaal ki jati hai taakay candle stuck pattern ki aik qisam ko bayan kya ja sakay jo security ke mojooda rujhan mein mumkina ulat jane ki nishandahi kar sakta hai. patteren do mom btyon par mushtamil hai jo aik" hook" shakal banatay hain .

pehli candle stuck aik lambi aur bearish ( surkh ya siyah ) candle stuck hai jo farokht ke mazboot dabao ki nishandahi karti hai. doosri candle stick aik choti aur taiz ( sabz ya safaid ) candle stick hai jo pehli candle stick ke neechay khulti hai lekin –apne wast point ke oopar band hojati hai .

Pattern ko taizi ka signal samjha jata hai agar yeh neechay ke rujhan ke baad zahir hota hai, jis se yeh zahir hota hai ke khredar qadam barha rahay hain aur rujhan ko tabdeel kar rahay hain. is ke bar aks, agar patteren up trained ke baad zahir hota hai, to yeh bearish signal ho sakta hai jo is baat ki nishandahi karta hai ke baichnay walay control haasil kar rahay hain .

yeh note karna zaroori hai ke candle stuck pattern, Bashmole hook reversal, ko tijarti faislay karne ke liye tanhai mein istemaal nahi kya jana chahiye. signal ki tasdeeq aur khatray ko kam karne ke liye deegar takneeki isharay aur tajzia bhi istemaal kya jana chahiye .

Trading in Hook reversal candlestick patterns:

Hook reversal candlestick patterns can be used in trading by following these steps:

1. Learn about the different types of hook reversal candlestick patterns such as the hammer, hanging man, shooting star, and inverted hammer. These patterns are characterized by a long wick and a small body.

2. Look for these patterns on your price chart. They can occur at the top or bottom of a trend and are often used as a signal of a potential trend reversal.

3. Confirm the pattern with other technical indicators such as moving averages, trend lines, or support and resistance levels.

4. Enter a trade based on the pattern and your analysis. For example, if you see a hammer pattern at the bottom of a downtrend, you may enter a long position with a stop loss below the low of the candlestick.

5. Manage your risk by setting a stop loss and taking profit targets. You may also want to use trailing stops to lock in profits as the trade moves in your favor.

It is important to note that no trading strategy is foolproof, and it is essential to practice good risk management and have a solid understanding of technical analysis before using hook reversal candlestick patterns or any other trading strategy.

تبصرہ

Расширенный режим Обычный режим