Bearish Correction

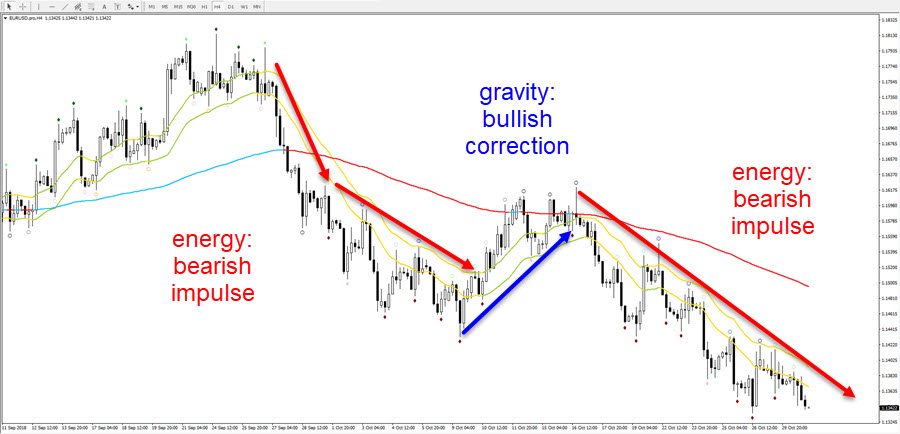

Bearish correction aik istilaah hai jo maliyati mandiyon mein kisi asasa ya market mein qeematon mein earzi kami ko majmoi tor par taizi ke rujhan mein bayan karne ke liye istemaal hoti hai. dosray lafzon mein, yeh farokht ke dabao ki muddat hai jo qeematon mein izafay ke rujhan ko rokta hai lekin zaroori nahi ke is rujhan ke khatmay ka ishara kere .

Mandi ki islaah mukhtalif awamil ki wajah se ho sakti hai, jaisay munafe lainay, manfi khabrain ya muashi data, ya sarmaya karon ke jazbaat mein tabdeeli. is ka nateeja aam tor par kam qeematon mein hota hai aur yeh chand dinon se le kar kayi hafton ya mahino tak kahin bhi chal sakta hai .

Tajir aur sarmaya car qeematon ke chart ko dekh kar aur pattern aur asharion ka tajzia karkay mandi ki islaah ki nishandahi karne ke liye takneeki tajzia ka istemaal karte hain. woh is maloomat ko tijarti faislay karne ke liye istemaal kar satke hain, jaisay ke tasheeh ke douran kisi asasay ko bechna ya mukhtasir karna, ya jab qeematein dobarah barhna shuru ho jayen to wapas khareedna .

Yeh note karna zaroori hai ke mandi ki islaah bear market se mukhtalif hoti hai, jo qeematon mein kami ki musalsal muddat ka hawala deti hai. taajiron aur sarmaya karon ko bearish correction aur bear markets dono ki taraf se paish kiye jane walay khatraat aur mumkina mawaqay se aagah hona chahiye aur is ke mutabiq apni hikmat amlyon ko adjust karna chahiye

Bullish Correction

Bullish Correction aik istilaah hai jo maliyati mandiyon mein kisi asasa ya market mein majmoi tor par mandi ke rujhan ke andar qeemat mein izafay ki earzi harkat ko bayan karne ke liye istemaal hoti hai. dosray lafzon mein, yeh kharidari ke dabao ki muddat hai jo qeematon mein kami ke rujhan ko rokta hai lekin zaroori nahi ke is rujhan ke khatmay ka ishara kere .

Bullish Correction mukhtalif awamil ki wajah se ho sakti hai, jaisay ke misbet khabrain ya muashi data, sarmaya karon ke jazbaat mein tabdeeli, ya short cowering. is ka nateeja aam tor par ziyada qeematon mein hota hai aur yeh chand dinon se le kar kayi hafton ya mahino tak kahin bhi chal sakta hai .

Tajir aur sarmaya car qeematon ke chart ko dekh kar aur patteren aur isharay ka tajzia karkay taizi se honay wali islahat ki nishandahi karne ke liye takneeki tajzia ka istemaal karte hain. woh is maloomat ko tijarti faislay karne ke liye istemaal kar satke hain, jaisay ke tasheeh ke douran kisi asasay ko khareedna ya ziyada der tak jana, ya qeematein dobarah girnay par bechna .

Yeh note karna zaroori hai ke taizi ki islaah bail market se mukhtalif hoti hai, jo qeematon mein izafay ki musalsal muddat se morad hai. taajiron aur sarmaya karon ko taizi se islahat aur bail market dono ki taraf se paish kiye jane walay khatraat aur mumkina mawaqay se aagah hona chahiye, aur is ke mutabiq apni hikmat amlyon ko adjust karna chahiye .

Bearish correction aik istilaah hai jo maliyati mandiyon mein kisi asasa ya market mein qeematon mein earzi kami ko majmoi tor par taizi ke rujhan mein bayan karne ke liye istemaal hoti hai. dosray lafzon mein, yeh farokht ke dabao ki muddat hai jo qeematon mein izafay ke rujhan ko rokta hai lekin zaroori nahi ke is rujhan ke khatmay ka ishara kere .

Mandi ki islaah mukhtalif awamil ki wajah se ho sakti hai, jaisay munafe lainay, manfi khabrain ya muashi data, ya sarmaya karon ke jazbaat mein tabdeeli. is ka nateeja aam tor par kam qeematon mein hota hai aur yeh chand dinon se le kar kayi hafton ya mahino tak kahin bhi chal sakta hai .

Tajir aur sarmaya car qeematon ke chart ko dekh kar aur pattern aur asharion ka tajzia karkay mandi ki islaah ki nishandahi karne ke liye takneeki tajzia ka istemaal karte hain. woh is maloomat ko tijarti faislay karne ke liye istemaal kar satke hain, jaisay ke tasheeh ke douran kisi asasay ko bechna ya mukhtasir karna, ya jab qeematein dobarah barhna shuru ho jayen to wapas khareedna .

Yeh note karna zaroori hai ke mandi ki islaah bear market se mukhtalif hoti hai, jo qeematon mein kami ki musalsal muddat ka hawala deti hai. taajiron aur sarmaya karon ko bearish correction aur bear markets dono ki taraf se paish kiye jane walay khatraat aur mumkina mawaqay se aagah hona chahiye aur is ke mutabiq apni hikmat amlyon ko adjust karna chahiye

Bullish Correction

Bullish Correction aik istilaah hai jo maliyati mandiyon mein kisi asasa ya market mein majmoi tor par mandi ke rujhan ke andar qeemat mein izafay ki earzi harkat ko bayan karne ke liye istemaal hoti hai. dosray lafzon mein, yeh kharidari ke dabao ki muddat hai jo qeematon mein kami ke rujhan ko rokta hai lekin zaroori nahi ke is rujhan ke khatmay ka ishara kere .

Bullish Correction mukhtalif awamil ki wajah se ho sakti hai, jaisay ke misbet khabrain ya muashi data, sarmaya karon ke jazbaat mein tabdeeli, ya short cowering. is ka nateeja aam tor par ziyada qeematon mein hota hai aur yeh chand dinon se le kar kayi hafton ya mahino tak kahin bhi chal sakta hai .

Tajir aur sarmaya car qeematon ke chart ko dekh kar aur patteren aur isharay ka tajzia karkay taizi se honay wali islahat ki nishandahi karne ke liye takneeki tajzia ka istemaal karte hain. woh is maloomat ko tijarti faislay karne ke liye istemaal kar satke hain, jaisay ke tasheeh ke douran kisi asasay ko khareedna ya ziyada der tak jana, ya qeematein dobarah girnay par bechna .

Yeh note karna zaroori hai ke taizi ki islaah bail market se mukhtalif hoti hai, jo qeematon mein izafay ki musalsal muddat se morad hai. taajiron aur sarmaya karon ko taizi se islahat aur bail market dono ki taraf se paish kiye jane walay khatraat aur mumkina mawaqay se aagah hona chahiye, aur is ke mutabiq apni hikmat amlyon ko adjust karna chahiye .

تبصرہ

Расширенный режим Обычный режим