Aslam o Alaikum!

Dear members ais market mai kaam karny k liay humry pass trading Strategy honi chaye agar hum ais market mai Bollinger Band Indicator use krty hai to hum ko ais market mai Bollinger Band Indicator ki setting ka pata hona chaye aor ye pata hona chaye k ais market mai Bollinger Band Indicator ko kaisy use kr k hum trading kar sakty hain.

Introduction Of Bollinger Band Indicator:

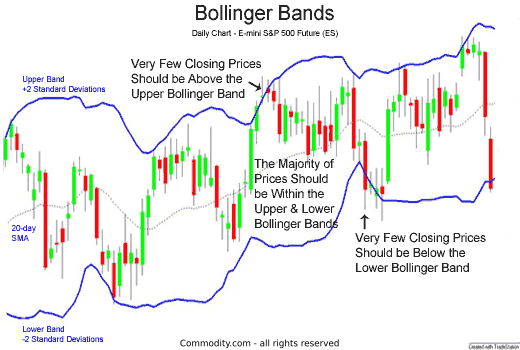

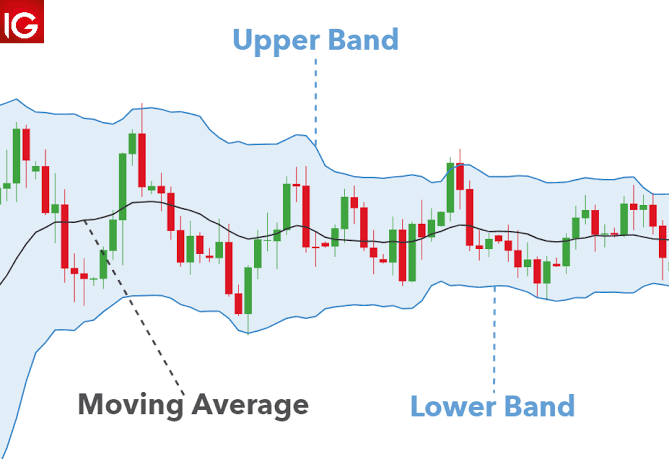

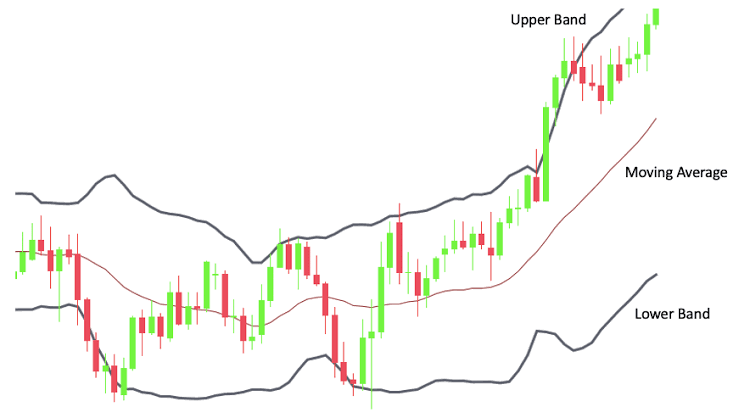

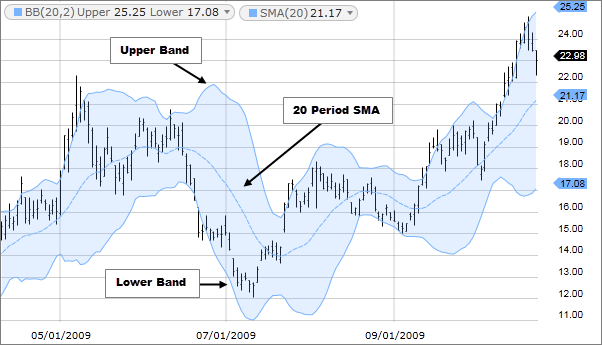

Dear members Forex trading mein bollinger band 3 layers ko use karta hai or enki base par signal deta hai. Jo trader en three layers ko observe karty hain wo acha profit hasil karny ma hamesa kamyab ho jaty hain. Jb market middle layer par exist kar rahi hu to eska matlab ye hai k trader ko es time apny orders ko hold karna chahe kiu k ye side way market ka signal dey rahi hoti hai. Jb market upper layyer ki tarha jana start hoti hai to eska matlab ye hota hai k market up trend ma ja rahi hai or trader ko es time par buy ki trade open karni chahe. Jb market bottom layer ki taraf ah rahi ho to eska matlab ye hota hai k trader ko es time par sell ki trade open karni chahe kiu k ye market ki down movement ko show kar rahi hoti hai.

Upper Band Of Bollinger Band Indicator:

Dear members Jab bhi aap market mein proper market information hasil karte Hain to aapko is indicator ke bare mein ek upper band milta hai ki is specific period of time main market kitna ab per Raha aur usko aap ek line ke jarie recognise karte hain draw karte Hain ki is specific period of time main market mein yah hi banae usko Ham upper band mein show karenge.

Middle Band Of Bollinger Band Indicator:

Dear members agar aap donon indicator sahi tarike se draw kar lete hain upper or lower donon wala to uske bad aapke pass third per Jo chij aati hai vah middle band aata hai ya aap UN donon ke darmiyaan mein ek line draw karte Hain ki yah inse market ka middle hai to agar market ka trend market ke middle se upar nikal jata hai to yah possibility hai ki market ab per band Tak jayegi aur agar market ka trend market ke middle se niche a jata hai to is bar ki possibility bahut jyada hoti hai ki market ab resistance Tak jayegi yah ek nai resistance hot banaegi.

Lower Band Of Bollinger Band Indicator:

Dear members aap ab per band ko recognise karte hain ISI tarah aap per lower bande ko bhi recognise kar sakte hain iske liye aapko market ke sabse resistance ko chhodkar sport ko dekhna hoga Kya hua kaun kaun se point hai jis per market sabse lowest point per thi aur aap vahan per ek draw sketch taiyar karenge to use aap ko pata chal jaega ki is specific period of time main market nahin yah sport banaen.

Introduction Of Bollinger Band Indicator:

Dear members Forex trading mein bollinger band 3 layers ko use karta hai or enki base par signal deta hai. Jo trader en three layers ko observe karty hain wo acha profit hasil karny ma hamesa kamyab ho jaty hain. Jb market middle layer par exist kar rahi hu to eska matlab ye hai k trader ko es time apny orders ko hold karna chahe kiu k ye side way market ka signal dey rahi hoti hai. Jb market upper layyer ki tarha jana start hoti hai to eska matlab ye hota hai k market up trend ma ja rahi hai or trader ko es time par buy ki trade open karni chahe. Jb market bottom layer ki taraf ah rahi ho to eska matlab ye hota hai k trader ko es time par sell ki trade open karni chahe kiu k ye market ki down movement ko show kar rahi hoti hai.

Upper Band Of Bollinger Band Indicator:

Dear members Jab bhi aap market mein proper market information hasil karte Hain to aapko is indicator ke bare mein ek upper band milta hai ki is specific period of time main market kitna ab per Raha aur usko aap ek line ke jarie recognise karte hain draw karte Hain ki is specific period of time main market mein yah hi banae usko Ham upper band mein show karenge.

Middle Band Of Bollinger Band Indicator:

Dear members agar aap donon indicator sahi tarike se draw kar lete hain upper or lower donon wala to uske bad aapke pass third per Jo chij aati hai vah middle band aata hai ya aap UN donon ke darmiyaan mein ek line draw karte Hain ki yah inse market ka middle hai to agar market ka trend market ke middle se upar nikal jata hai to yah possibility hai ki market ab per band Tak jayegi aur agar market ka trend market ke middle se niche a jata hai to is bar ki possibility bahut jyada hoti hai ki market ab resistance Tak jayegi yah ek nai resistance hot banaegi.

Lower Band Of Bollinger Band Indicator:

Dear members aap ab per band ko recognise karte hain ISI tarah aap per lower bande ko bhi recognise kar sakte hain iske liye aapko market ke sabse resistance ko chhodkar sport ko dekhna hoga Kya hua kaun kaun se point hai jis per market sabse lowest point per thi aur aap vahan per ek draw sketch taiyar karenge to use aap ko pata chal jaega ki is specific period of time main market nahin yah sport banaen.

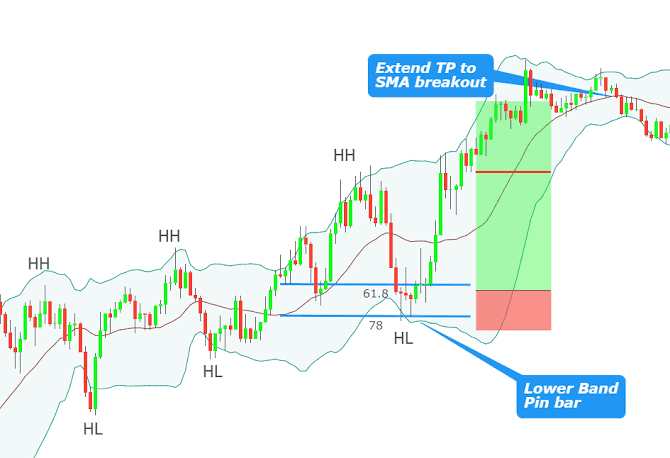

BOLLINGER An Inversion FROM THE External Groups Ya common sense hai ke Zaroorat Se Zyada overbought and over sold ki condition lead ka bais banti hai external bollinger band ke close to cost ke activity ki ek Khas types ki model maujud Hain M top ek W base ke inverse hai Agar value Specialty ridge bar se specialty cap Jaati Hai aur center line ko Upar Jaati Hai to Upper Wali bar upri cost ka target hongi Agar specialty ki taraf patterns areas of strength for itna Hai To Ek divert BB ki value Upar Le Ja sakta hai

BOLLINGER An Inversion FROM THE External Groups Ya common sense hai ke Zaroorat Se Zyada overbought and over sold ki condition lead ka bais banti hai external bollinger band ke close to cost ke activity ki ek Khas types ki model maujud Hain M top ek W base ke inverse hai Agar value Specialty ridge bar se specialty cap Jaati Hai aur center line ko Upar Jaati Hai to Upper Wali bar upri cost ka target hongi Agar specialty ki taraf patterns areas of strength for itna Hai To Ek divert BB ki value Upar Le Ja sakta hai

تبصرہ

Расширенный режим Обычный режим