Introduction.

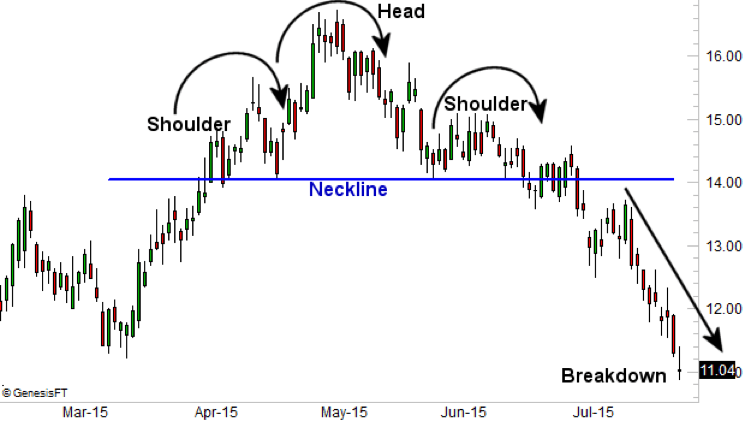

Head and shoulders candlestick patterns* takneeki tajzia mein aik maqbool candlestick pattern hea aur yeh aik bearish reversal patteren hai jis ka istemaal aik oopri trend* se neechay ke trend ki taraf trend ke ulat jane ki paish goi karne ke liye kya ja sakta hai head and shoulders candlestick patterns patteren teen chotyon par mushtamil hai, jis mein darmiyani chouti sab se onche hai.

Head and shoulders candlestick patterns main darj zail ajzaa se bantaa hai.

Left shoulder.

Oopri trend ke douran qeemat ki chouti banti hai .

Head.

Aik high price ki chouti left kandhay ki chouti ke baad banti hai, aam tor par ziyada hajam ke sath banti hea.

Right shoulder.

Head ke muqablay mein kam qeemat ki chouti jo sir se pal back ke baad banti hai, jis ka hajam sir se kam hota hai .

patteren ki tasdeeq is waqt hoti hai jab gardan ki lakeer, jo baen kandhay aur dayen kandhay ke nichale hissay ko jor kar banti hai, neechay ki taraf toot jati hai. yeh asasa baichnay ya mukhtasir karne ke signal ke tor par dekha jata hai.

Second condition of Head and shoulders candlestick pattern.

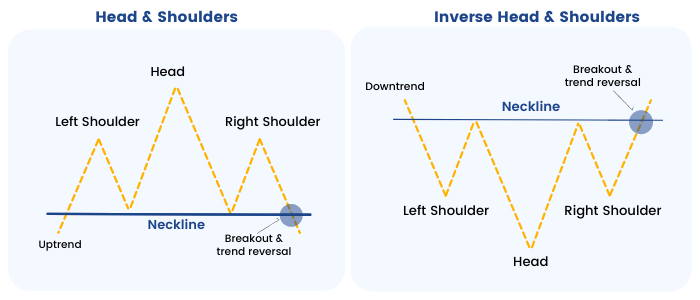

Head and shoulders candlestick pattern ki aik second condition bhi hea jaisay inverted head and shoulders candlestick patterns kehty hean , jo ke taizi se ulatnay ka patteren hai yeh note karna zaroori hai ke tamam sir aur kaandhon ke patteren rujhan ko tabdeel nahi karte hain, aur taajiron ko tijarti faisla karne se pehlay deegar takneeki isharay ke sath patteren ki tasdeeq karni chahiye aur head and shoulders candlestick patterns* aik maqbool takneeki tajzia ka pattern* hai jo candlestick charts mein paaya ja sakta hai. yeh aik ulat patteren samjha jata hai, jis ka matlab hai ke yeh mojooda rujhan ki simt mein tabdeeli ki taraf ishara karta hai. sir aur kaandhon ka patteren teen chotyon par mushtamil hota hai, jis mein darmiyani chouti sab se onche hoti hai, jo aik" sir" banati hai aur baqi do chotiyan sir ke dono taraf" kaandhon" ki tashkeel karti hain.

Trading at Head and shoulders candlestick patterns.

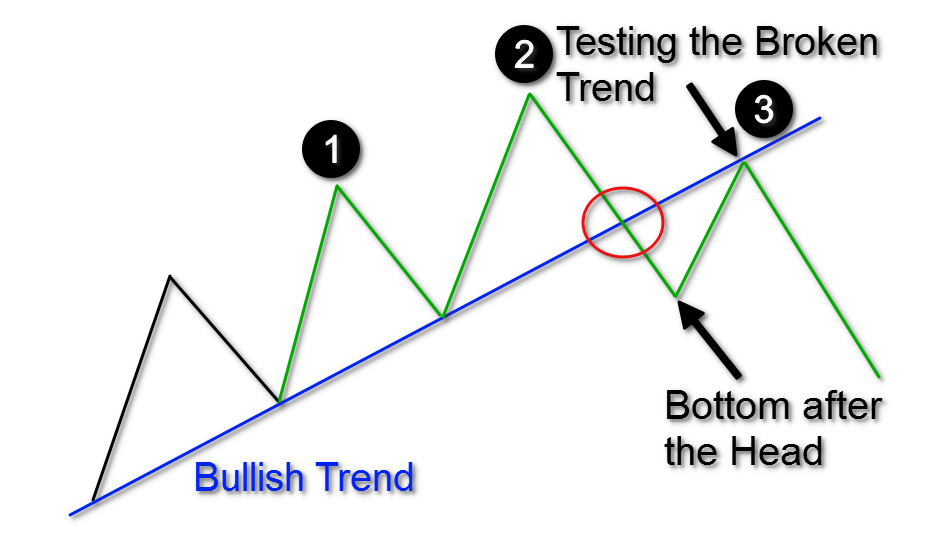

Head and shoulders candlestick patterns candlestick pattern ke sath tijarat mein candlestick chart mein patteren ki shanakht karna aur phir tijarti faislay karne ke liye is ka istemaal shaamil hai. traders aksar up trained ke baad ban'nay ke liye patteren ki talaash karte hain, kyunkay yeh mumkina rujhan ke ulat jane aur neechay ke rujhan mein tabdeeli ka ishara deta hai. is ke bar aks, agar neechay ke rujhan ke baad patteren bantaa hai, to yeh mumkina rujhan ko oopri rujhan mein tabdeel karne ka ishara day sakta hai.

Role of Neck Line.

Head and shoulders candlestick patterns ke sath tijarat karte waqt, tajir aksar neck line ke neechay band honay ka intzaar karte hue patteren ki tasdeeq talaash karte hain (" kaandhon" ke neechay ko jornay wali line ). aik baar naik line toot jane ke baad, tajir mukhtasir position mein daakhil ho satke hain ya kisi bhi mojooda lambi position ko band kar satke hain.

Additional Information.

Dear traders yeh note karna zaroori hai ke kisi bhi dosray takneeki tajzia ke patteren ki terhan, sir aur kaandhon ka patteren faul proof nahi hai aur ho sakta hai ke hamesha rujhan ko tabdeel nah kere. lehaza, patteren ki tasdeeq karne aur bakhabar tijarti faislay karne ke liye dosray isharay aur tools ka istemaal karna zaroori hai. sir aur kaandhon ke patteren ke sath tijarat karte waqt khatray ka intizam karna aur position ka munasib size istemaal karna bhi zaroori hai.

Head and shoulders candlestick patterns* takneeki tajzia mein aik maqbool candlestick pattern hea aur yeh aik bearish reversal patteren hai jis ka istemaal aik oopri trend* se neechay ke trend ki taraf trend ke ulat jane ki paish goi karne ke liye kya ja sakta hai head and shoulders candlestick patterns patteren teen chotyon par mushtamil hai, jis mein darmiyani chouti sab se onche hai.

Head and shoulders candlestick patterns main darj zail ajzaa se bantaa hai.

Left shoulder.

Oopri trend ke douran qeemat ki chouti banti hai .

Head.

Aik high price ki chouti left kandhay ki chouti ke baad banti hai, aam tor par ziyada hajam ke sath banti hea.

Right shoulder.

Head ke muqablay mein kam qeemat ki chouti jo sir se pal back ke baad banti hai, jis ka hajam sir se kam hota hai .

patteren ki tasdeeq is waqt hoti hai jab gardan ki lakeer, jo baen kandhay aur dayen kandhay ke nichale hissay ko jor kar banti hai, neechay ki taraf toot jati hai. yeh asasa baichnay ya mukhtasir karne ke signal ke tor par dekha jata hai.

Second condition of Head and shoulders candlestick pattern.

Head and shoulders candlestick pattern ki aik second condition bhi hea jaisay inverted head and shoulders candlestick patterns kehty hean , jo ke taizi se ulatnay ka patteren hai yeh note karna zaroori hai ke tamam sir aur kaandhon ke patteren rujhan ko tabdeel nahi karte hain, aur taajiron ko tijarti faisla karne se pehlay deegar takneeki isharay ke sath patteren ki tasdeeq karni chahiye aur head and shoulders candlestick patterns* aik maqbool takneeki tajzia ka pattern* hai jo candlestick charts mein paaya ja sakta hai. yeh aik ulat patteren samjha jata hai, jis ka matlab hai ke yeh mojooda rujhan ki simt mein tabdeeli ki taraf ishara karta hai. sir aur kaandhon ka patteren teen chotyon par mushtamil hota hai, jis mein darmiyani chouti sab se onche hoti hai, jo aik" sir" banati hai aur baqi do chotiyan sir ke dono taraf" kaandhon" ki tashkeel karti hain.

Trading at Head and shoulders candlestick patterns.

Head and shoulders candlestick patterns candlestick pattern ke sath tijarat mein candlestick chart mein patteren ki shanakht karna aur phir tijarti faislay karne ke liye is ka istemaal shaamil hai. traders aksar up trained ke baad ban'nay ke liye patteren ki talaash karte hain, kyunkay yeh mumkina rujhan ke ulat jane aur neechay ke rujhan mein tabdeeli ka ishara deta hai. is ke bar aks, agar neechay ke rujhan ke baad patteren bantaa hai, to yeh mumkina rujhan ko oopri rujhan mein tabdeel karne ka ishara day sakta hai.

Role of Neck Line.

Head and shoulders candlestick patterns ke sath tijarat karte waqt, tajir aksar neck line ke neechay band honay ka intzaar karte hue patteren ki tasdeeq talaash karte hain (" kaandhon" ke neechay ko jornay wali line ). aik baar naik line toot jane ke baad, tajir mukhtasir position mein daakhil ho satke hain ya kisi bhi mojooda lambi position ko band kar satke hain.

Additional Information.

Dear traders yeh note karna zaroori hai ke kisi bhi dosray takneeki tajzia ke patteren ki terhan, sir aur kaandhon ka patteren faul proof nahi hai aur ho sakta hai ke hamesha rujhan ko tabdeel nah kere. lehaza, patteren ki tasdeeq karne aur bakhabar tijarti faislay karne ke liye dosray isharay aur tools ka istemaal karna zaroori hai. sir aur kaandhon ke patteren ke sath tijarat karte waqt khatray ka intizam karna aur position ka munasib size istemaal karna bhi zaroori hai.

Head and Shoulders pattern ki identification ke liye, humein kuch indicators ki madad leni hoti hain. Sabse pehle humein uptrend ko dekhna hota hai. Agar price continuously up trend mein hai to yeh ek indication hai ke Head and Shoulders pattern ban sakta hai. Jab price left shoulder banata hai, to uske baad price down trend mein jata hai aur ek level tak kam ho jata hai. Phir price phir se high point tak pahunchta hai aur isse Head banata hai. Iske baad phir se price down trend mein jata hai aur right shoulder banata hai. Right shoulder ke time par, price pehle ke trend line ko break karta hai, jo ek bearish signal hai. Jab price right shoulder ke baad down trend mein jaata hai, to yeh ek clear indication hai ke Head and Shoulders pattern complete ho gaya hai. Head and Shoulders pattern ki trading strategy mein, humein sell karne ke liye wait karna hota hai. Jab right shoulder complete ho jata hai, to sell karne ke liye ek good opportunity banti hai. Sell ke liye stop loss ek high point par set kiya jaata hai, jahan price right shoulder banata hai. Profit target ko set karne ke liye, hum ek bearish trend line ko draw karte hain. Yeh trend line, left shoulder aur head ko join karke banayi jaati hai aur right shoulder ko touch karti hai. Jab price trend line ko break karta hai, to yeh sell signal hai aur hum profit target ko hit kar sakte hain.

Head and Shoulders pattern ki identification ke liye, humein kuch indicators ki madad leni hoti hain. Sabse pehle humein uptrend ko dekhna hota hai. Agar price continuously up trend mein hai to yeh ek indication hai ke Head and Shoulders pattern ban sakta hai. Jab price left shoulder banata hai, to uske baad price down trend mein jata hai aur ek level tak kam ho jata hai. Phir price phir se high point tak pahunchta hai aur isse Head banata hai. Iske baad phir se price down trend mein jata hai aur right shoulder banata hai. Right shoulder ke time par, price pehle ke trend line ko break karta hai, jo ek bearish signal hai. Jab price right shoulder ke baad down trend mein jaata hai, to yeh ek clear indication hai ke Head and Shoulders pattern complete ho gaya hai. Head and Shoulders pattern ki trading strategy mein, humein sell karne ke liye wait karna hota hai. Jab right shoulder complete ho jata hai, to sell karne ke liye ek good opportunity banti hai. Sell ke liye stop loss ek high point par set kiya jaata hai, jahan price right shoulder banata hai. Profit target ko set karne ke liye, hum ek bearish trend line ko draw karte hain. Yeh trend line, left shoulder aur head ko join karke banayi jaati hai aur right shoulder ko touch karti hai. Jab price trend line ko break karta hai, to yeh sell signal hai aur hum profit target ko hit kar sakte hain.  Head and Shoulders pattern ka use karne ke liye, traders ko thoda patience rakhna padta hai. Yeh pattern time consuming hai aur ismein trading signal hone mein thoda waqt lagta hai. Lekin iske baad, yeh ek effective trading strategy hai aur isse traders ka profitability improve ho sakta hai. Head and Shoulders pattern ko identify karna aur trading strategy mein use karna, traders ko technical analysis mein acchi command aur experience ki zaroorat hoti hai. Is pattern ka ek variation hai inverse Head and Shoulders pattern. Is pattern mein downtrend ke baad price ek low point tak pahunchta hai jo head kehlaya jata hai. Iske baad price phir se up trend mein jaata hai aur ek high point tak pahunchta hai, jo left shoulder hota hai. Iske baad price down trend mein jata hai aur phir se ek high point tak pahunchta hai, jo right shoulder kehlata hai. Jab right shoulder banta hai, to price up trend mein enter karta hai aur is pattern ko complete kar deta hai. Head and Shoulders pattern aur inverse Head and Shoulders pattern, dono hi forex trading mein effective trading strategies hai. Inko samajhna aur use karna, traders ko profitable trades karne mein help karta hai. Iske liye traders ko candlestick chart analysis ki acchi samajh aur experience ki zaroorat hoti hai.

Head and Shoulders pattern ka use karne ke liye, traders ko thoda patience rakhna padta hai. Yeh pattern time consuming hai aur ismein trading signal hone mein thoda waqt lagta hai. Lekin iske baad, yeh ek effective trading strategy hai aur isse traders ka profitability improve ho sakta hai. Head and Shoulders pattern ko identify karna aur trading strategy mein use karna, traders ko technical analysis mein acchi command aur experience ki zaroorat hoti hai. Is pattern ka ek variation hai inverse Head and Shoulders pattern. Is pattern mein downtrend ke baad price ek low point tak pahunchta hai jo head kehlaya jata hai. Iske baad price phir se up trend mein jaata hai aur ek high point tak pahunchta hai, jo left shoulder hota hai. Iske baad price down trend mein jata hai aur phir se ek high point tak pahunchta hai, jo right shoulder kehlata hai. Jab right shoulder banta hai, to price up trend mein enter karta hai aur is pattern ko complete kar deta hai. Head and Shoulders pattern aur inverse Head and Shoulders pattern, dono hi forex trading mein effective trading strategies hai. Inko samajhna aur use karna, traders ko profitable trades karne mein help karta hai. Iske liye traders ko candlestick chart analysis ki acchi samajh aur experience ki zaroorat hoti hai.

تبصرہ

Расширенный режим Обычный режим