Introduction

I hope all friend fine main umeed krta hn k ap sab dost thik hn gy aur apna Kam samajhdari ke sath complete kar rahe honge or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain.

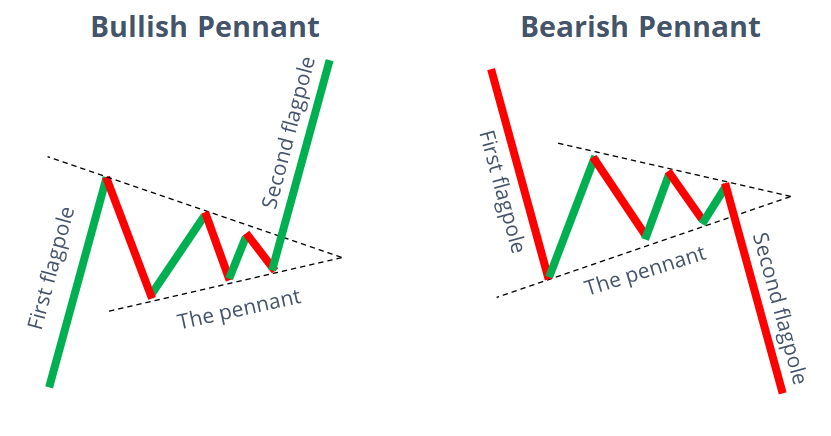

What Is Pennant Pattern .

Pennant aik neutral formation hoti ha jo triangle patterns sa kafi similar hota ha, ye aik steep trend k baad small wedge ki surat ma appear hotay hain aur opposite direction ma develop kartay hain uptrend k baad is pattern ma downward slope hoti ha aur downtrend k baad is ma upward slope hoti ha, pennant aik trading pattern hai jis ko trader apny faiday k lae estamal kar sakty hain

Working Pennant Pattern

Market kbi ik he direction ma hamesa move ni karti wo main trend ko follow karny k bad kuch dair consolidate karti hai or es state ma pennat pattern creatr hota hai ham ye keh sakty hain k pennant pattern market ki continuation ko show karta hai consoliidation k waqat market k volume ko observe karna chahe market ka volume kam ho ga to consolidation state continue karti rahy gi or jb volume increase ho jae ga to market break out karny wali hai, jb market break out kar jae to tb trader ko apni trade open karni chahe, aksar asa dakhny ma ay hai k market us side he pennant pattern k bad move karti hai jis side ye es pattern sy pehle move kar rahi hoti hai

Trade With Pennant Pattern

Trader ko pennat pattern ko deeply observe karna chahe or es pattern k bad market k break out ka wait karna chahe. normally asa hota hai k market us side par he move karti hai jis side par es pattern sy pehle move kar rahi hoti hai es he lae ham pennant pattern ko continuation pattern kaha jata hai. Yani market agr up trend ma hai to pennant pattern k bad ye mazeed up jany k chances hoty hain. So trader ko buy ki trade ko he open karna chahe. Jo trader es time par achi trade open ni karty wo kbi acha profit hasil karny ma kamyab ni ho sakty yani pennant pattern k anadar market jb move karna start ho jati hai to market ik channel ma move karna start ho jati hai or ye channel break out par he end hota hai

Trade Precautionary

Ye pattern trader ki madad k lae hoty hain but enko ankhyn band kar k ehtamad ni karna chahe pattern market ko explain karty hain or trader es explanation ko use kar k achi trade ko open karty hain agr market ki explanation ko use na kiya jae to trader kbi achi or profit delany wali trades ko open ni kar sakta jis sy esko ye nuksan hota hai k loss ka shikar ho kar apna he account wash kara bethta hai so small lot sy or pattern ki base par trade ko open kiya jae to kamyabi ma dair ni lgti or profit hasil zarur hota hai esi sorat ma he loss sy bacha ja sakta hai

Ye market ki volatility ki study kay ly use ky jata hy Jb certian point sy above or below move karta hy or es ka ye matlab hota kay market ka trend change hony wala hy . Bhot sary technical tool ki tarha ye daily chart kay laye banaya giya hai. Lkn trader esko kisi bhe time frame mein use kar sakty hain Aaj aaj ki post ke Ek technical post hai aur aapko bahut pasand I Hogi aur bhi improve mint kar rahi ho gai isliye aap koshish karen* knowledge experience information saath saath Hasil Karte. forex ma bhot sari techniques or methods k zaryae trade open ki jati hai jis ka main maqsad ye hota hai k trader ko benefit hasil ho jae. Jis trader k pass acha capital or acha knowledge ho ga wo acha profit hasil karny mian kamyab ho jae ga. Jis trader k pass kio technique or acha capital ni hota wo profit hasil karny ma hamesa nakam ho jata hai. So es topic ma ham yaha par discuss karyn gy.

I hope all friend fine main umeed krta hn k ap sab dost thik hn gy aur apna Kam samajhdari ke sath complete kar rahe honge or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain.

What Is Pennant Pattern .

Pennant aik neutral formation hoti ha jo triangle patterns sa kafi similar hota ha, ye aik steep trend k baad small wedge ki surat ma appear hotay hain aur opposite direction ma develop kartay hain uptrend k baad is pattern ma downward slope hoti ha aur downtrend k baad is ma upward slope hoti ha, pennant aik trading pattern hai jis ko trader apny faiday k lae estamal kar sakty hain

Working Pennant Pattern

Market kbi ik he direction ma hamesa move ni karti wo main trend ko follow karny k bad kuch dair consolidate karti hai or es state ma pennat pattern creatr hota hai ham ye keh sakty hain k pennant pattern market ki continuation ko show karta hai consoliidation k waqat market k volume ko observe karna chahe market ka volume kam ho ga to consolidation state continue karti rahy gi or jb volume increase ho jae ga to market break out karny wali hai, jb market break out kar jae to tb trader ko apni trade open karni chahe, aksar asa dakhny ma ay hai k market us side he pennant pattern k bad move karti hai jis side ye es pattern sy pehle move kar rahi hoti hai

Trade With Pennant Pattern

Trader ko pennat pattern ko deeply observe karna chahe or es pattern k bad market k break out ka wait karna chahe. normally asa hota hai k market us side par he move karti hai jis side par es pattern sy pehle move kar rahi hoti hai es he lae ham pennant pattern ko continuation pattern kaha jata hai. Yani market agr up trend ma hai to pennant pattern k bad ye mazeed up jany k chances hoty hain. So trader ko buy ki trade ko he open karna chahe. Jo trader es time par achi trade open ni karty wo kbi acha profit hasil karny ma kamyab ni ho sakty yani pennant pattern k anadar market jb move karna start ho jati hai to market ik channel ma move karna start ho jati hai or ye channel break out par he end hota hai

Trade Precautionary

Ye pattern trader ki madad k lae hoty hain but enko ankhyn band kar k ehtamad ni karna chahe pattern market ko explain karty hain or trader es explanation ko use kar k achi trade ko open karty hain agr market ki explanation ko use na kiya jae to trader kbi achi or profit delany wali trades ko open ni kar sakta jis sy esko ye nuksan hota hai k loss ka shikar ho kar apna he account wash kara bethta hai so small lot sy or pattern ki base par trade ko open kiya jae to kamyabi ma dair ni lgti or profit hasil zarur hota hai esi sorat ma he loss sy bacha ja sakta hai

Ye market ki volatility ki study kay ly use ky jata hy Jb certian point sy above or below move karta hy or es ka ye matlab hota kay market ka trend change hony wala hy . Bhot sary technical tool ki tarha ye daily chart kay laye banaya giya hai. Lkn trader esko kisi bhe time frame mein use kar sakty hain Aaj aaj ki post ke Ek technical post hai aur aapko bahut pasand I Hogi aur bhi improve mint kar rahi ho gai isliye aap koshish karen* knowledge experience information saath saath Hasil Karte. forex ma bhot sari techniques or methods k zaryae trade open ki jati hai jis ka main maqsad ye hota hai k trader ko benefit hasil ho jae. Jis trader k pass acha capital or acha knowledge ho ga wo acha profit hasil karny mian kamyab ho jae ga. Jis trader k pass kio technique or acha capital ni hota wo profit hasil karny ma hamesa nakam ho jata hai. So es topic ma ham yaha par discuss karyn gy.

تبصرہ

Расширенный режим Обычный режим