Explanation of Swing trading

swing trading a speculative strategy hai jis k tehat traders trading markets ka fayda uthate hue nazr aate Hain.. by picking tops and bottoms, aur traders is ke mutabik lambi aur mukhtasir positions me enter ho sakte hain.

swing trading ko medium term samjha jata hai.. kyon k aam taur per positions kuchh ghanton se Chand din ke darmiyaan kahin bhi rah jaati hai, long-term traders ki himayat ki jaati hai q k traders trendss ke sath faida utha kr mukamat per in trends ko better banaa sakte hain

range bound strategy ki tarah oscillators and indicators ko optimal entry/exit positions and times ko select krne k lye use kia jata h... Fark sirf yahi hai k swing trading both trending or range bound markets ko applies krti h

Trading with Explanation of Swing trading

Substantial number of trading opportunities (trading opportunities ki khatir khawa amount).

Coins

Entails strong appreciation of technical analysis( technical analysis ko bht ziada appreciate kia jata h)

• Still requires extensive time investment( investemnet k lye bht ziada time require hta h).

Important points

Forex trading me swing trading strategy se murad wo strategy hai jis me traders market price ki top peak aur down peak pe trade open karte hen, market jab bhi kisi supply ya demand ki pressure ki waja se bohut hi ziada top ya down position pe chali jati hai to zarori nahi hota hai k market us hi position pe continue hi chalta hai bulke maximum market wahan se wapis reverse ho jati hai aur kuch reverse trend pe chalne k bad wapis wo apni position pe chal parti hai.

Swing trading strategy me market me hum day trading aur scalping se mukhtalif kaam karte hen is me short term ki trading bhi ho sakti hai aur long term ki trading bhi ho sakti hai. Is waja se hamen swing trading strategy se bapoor faida hasil karte rehna chaheye.

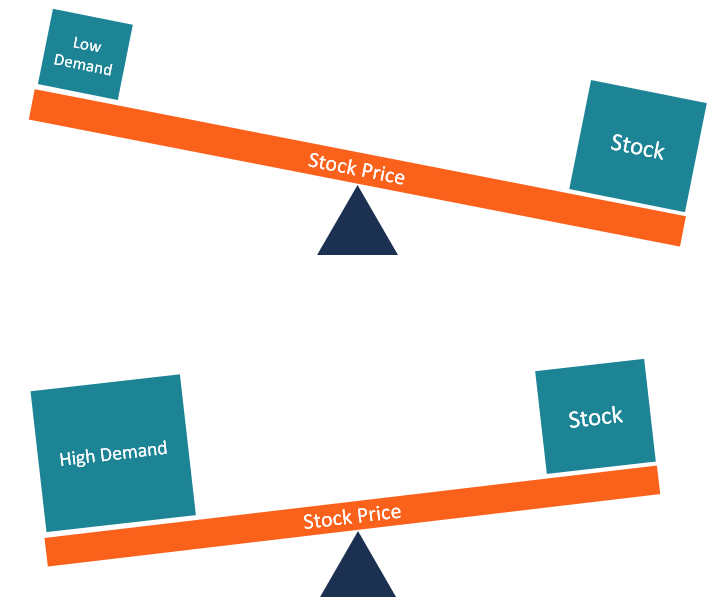

Forex trading me ya financial market me jab price aik khas position k hisab se move kar rahi hoti hai to ye aik trend kehlati hai, trend me ya to ye upward trend hogi ya downward trend aur ya sideways trend ho sakti hai. Trend me candle sticks aik makhsos length k hisab se ja rahi hoti hai. Aur market me ye trend supply aur demand ki waja se banti hai. Lekin agar market me achhank demand ya supply ziada ho jaye to is se market aksar breakout karke aik lambi candle stick banati hai jo k aik khas waqat k leye bohut unchi position pe chali jati hai aur us k bad market ki price wapis down hona shoro hoti hai.

swing trading a speculative strategy hai jis k tehat traders trading markets ka fayda uthate hue nazr aate Hain.. by picking tops and bottoms, aur traders is ke mutabik lambi aur mukhtasir positions me enter ho sakte hain.

swing trading ko medium term samjha jata hai.. kyon k aam taur per positions kuchh ghanton se Chand din ke darmiyaan kahin bhi rah jaati hai, long-term traders ki himayat ki jaati hai q k traders trendss ke sath faida utha kr mukamat per in trends ko better banaa sakte hain

range bound strategy ki tarah oscillators and indicators ko optimal entry/exit positions and times ko select krne k lye use kia jata h... Fark sirf yahi hai k swing trading both trending or range bound markets ko applies krti h

Trading with Explanation of Swing trading

Substantial number of trading opportunities (trading opportunities ki khatir khawa amount).

Coins

Entails strong appreciation of technical analysis( technical analysis ko bht ziada appreciate kia jata h)

• Still requires extensive time investment( investemnet k lye bht ziada time require hta h).

Important points

Forex trading me swing trading strategy se murad wo strategy hai jis me traders market price ki top peak aur down peak pe trade open karte hen, market jab bhi kisi supply ya demand ki pressure ki waja se bohut hi ziada top ya down position pe chali jati hai to zarori nahi hota hai k market us hi position pe continue hi chalta hai bulke maximum market wahan se wapis reverse ho jati hai aur kuch reverse trend pe chalne k bad wapis wo apni position pe chal parti hai.

Swing trading strategy me market me hum day trading aur scalping se mukhtalif kaam karte hen is me short term ki trading bhi ho sakti hai aur long term ki trading bhi ho sakti hai. Is waja se hamen swing trading strategy se bapoor faida hasil karte rehna chaheye.

Forex trading me ya financial market me jab price aik khas position k hisab se move kar rahi hoti hai to ye aik trend kehlati hai, trend me ya to ye upward trend hogi ya downward trend aur ya sideways trend ho sakti hai. Trend me candle sticks aik makhsos length k hisab se ja rahi hoti hai. Aur market me ye trend supply aur demand ki waja se banti hai. Lekin agar market me achhank demand ya supply ziada ho jaye to is se market aksar breakout karke aik lambi candle stick banati hai jo k aik khas waqat k leye bohut unchi position pe chali jati hai aur us k bad market ki price wapis down hona shoro hoti hai.

تبصرہ

Расширенный режим Обычный режим