Definition:-

Aslam u alaikum,

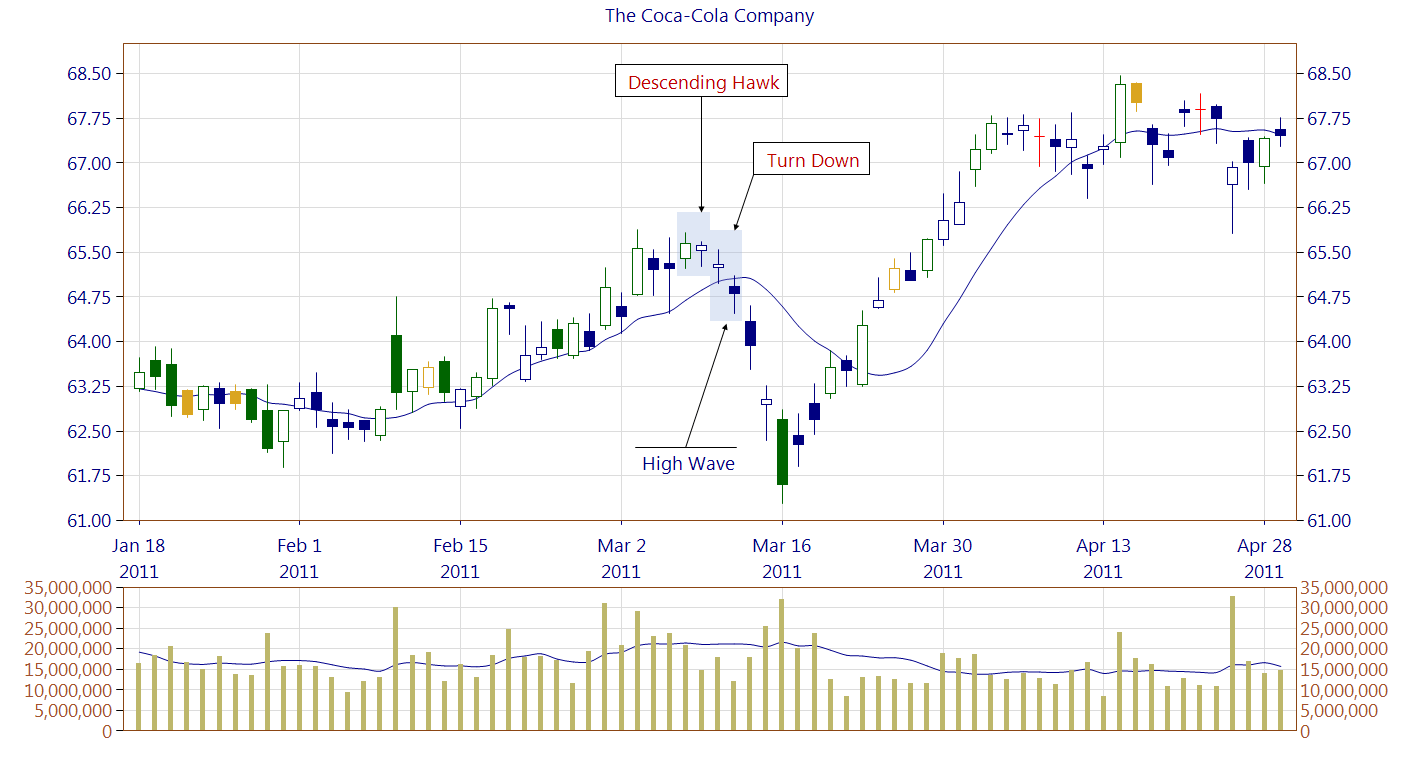

Dear Forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Forex chart ma descending hawk pattern 2 candlestick pattern par mabni hota hai. Es pattern ki pehle candlestick long or bullish hoti hai or second candlestick relatively small hoti hai but ye market ma gap down sy open hoti hai or market ko up move kara deti hai. Second candlestick pehle candlestick ki body k andar confined hoti hai. Ye pattern harami pattern sy resemble karta hai but es pattern ma both candlestick bullish hoti hain.

Criteria of the pattern.

Descending hawk pattern ka ik criteria hai jis ko ham cover kar lety hain. Firstly market ma up trend prevailing karna chahe. Secondly firsr day ma long or white candlestick form hoti hai. Thirdly second candlestick b bullish hoti hai but ye pehle candlestick ki body k andar confined hoti hai.

Descending hawk pattern flexibility.

Descending hawk pattern 2 bullish candlestick par mustamil hota hai or second candlestick pehle candlestick ki body ma confined hoti hai. Pehle din ki candlestick normal ya long hoti hai. Es pattern ki both candlesticks ki body ka top ya bottom same point par hota hai. But second candlestick ki body first candlestick sy small honi chahe.

Traders behaviour.

Descending pattern trader ko disparity ka signal deta hai. Pehle din trader ko heavy buying nazar ati hai. Jb k second day trader ko pata chalta hai k buyer weak ho chuky hain or trader ko confirmation k bad sell ki trade ma enter hony k lae try karna chahe.

Setting of stop loss.

Trader kio b trade ko open karta hai to stop loss bhot zaruri hai ye trader k account ko safe rakhta hai or trader ko mazeed trades k open karny ma helpout karta hai. Es case ma trader ko market k higher point ko as a stop loss use karna chahe. So agr market ma mazeed bullish move hota hai to stop loss sy trader market sy out ho jata hai.

Aslam u alaikum,

Dear Forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Forex chart ma descending hawk pattern 2 candlestick pattern par mabni hota hai. Es pattern ki pehle candlestick long or bullish hoti hai or second candlestick relatively small hoti hai but ye market ma gap down sy open hoti hai or market ko up move kara deti hai. Second candlestick pehle candlestick ki body k andar confined hoti hai. Ye pattern harami pattern sy resemble karta hai but es pattern ma both candlestick bullish hoti hain.

Criteria of the pattern.

Descending hawk pattern ka ik criteria hai jis ko ham cover kar lety hain. Firstly market ma up trend prevailing karna chahe. Secondly firsr day ma long or white candlestick form hoti hai. Thirdly second candlestick b bullish hoti hai but ye pehle candlestick ki body k andar confined hoti hai.

Descending hawk pattern flexibility.

Descending hawk pattern 2 bullish candlestick par mustamil hota hai or second candlestick pehle candlestick ki body ma confined hoti hai. Pehle din ki candlestick normal ya long hoti hai. Es pattern ki both candlesticks ki body ka top ya bottom same point par hota hai. But second candlestick ki body first candlestick sy small honi chahe.

Traders behaviour.

Descending pattern trader ko disparity ka signal deta hai. Pehle din trader ko heavy buying nazar ati hai. Jb k second day trader ko pata chalta hai k buyer weak ho chuky hain or trader ko confirmation k bad sell ki trade ma enter hony k lae try karna chahe.

Setting of stop loss.

Trader kio b trade ko open karta hai to stop loss bhot zaruri hai ye trader k account ko safe rakhta hai or trader ko mazeed trades k open karny ma helpout karta hai. Es case ma trader ko market k higher point ko as a stop loss use karna chahe. So agr market ma mazeed bullish move hota hai to stop loss sy trader market sy out ho jata hai.