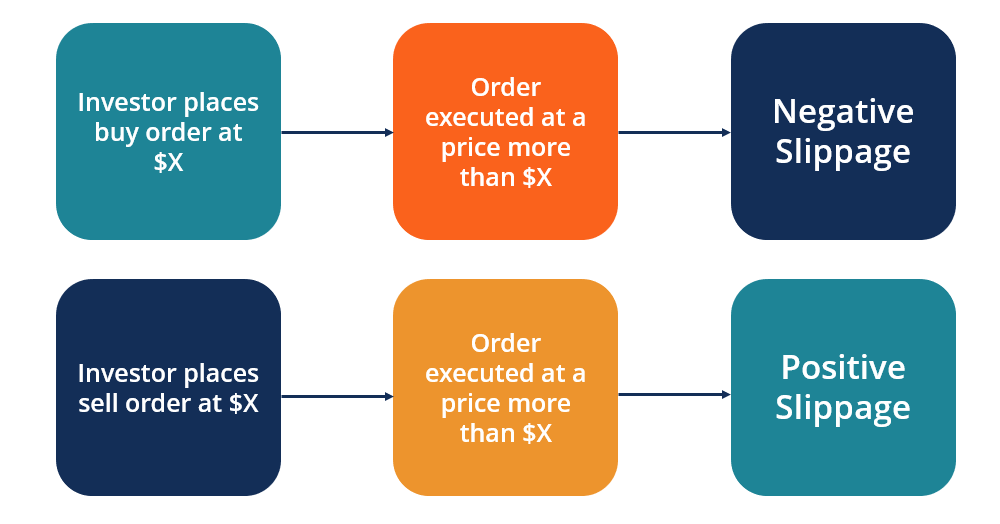

Dear traders Slippage trading ki aspected qeemat aur asal qeemat ke darmiyan farq hai jis par tijarat ki jati hai aur slippage ke halaat mein trading se murad woh soorat e haal hai jahan kisi asasay ki mutawaqqa qeemat aur is qeemat ke darmiyan farq ho jis par asasa ki asal mein tijarat ki jati hai. yeh mutadid awamil ki wajah se ho sakta hai jaisay market mein utaar charhao, likoyditi, aur order buk ki geherai.

Safety while Performing Trading in Slippage Condition.

Slippage ke halaat mein trading karte waqt, aik hikmat e amli ka hona zaroori hai jis mein qeemat ki naqal o harkat ke imkanaat ka hisaab ho. aik nuqta nazar had ke orders ka istemaal karna hai, jo taajiron ko aik makhsoos qeemat muqarrar karne ki ijazat deta hai jis par woh asasa kharidne ya baichnay ke liye tayyar hain. is se tijarat par phislan ke asraat ko mehdood karne mein madad mil sakti hai is baat ko yakeeni bana kar ke lain deen matlooba qeemat par injaam paye aur phir aik aur hikmat e amli yeh hai ke

stop loss orders ka istemaal kya jaye, jo qeemat ki makhsoos satah tak pounchanay par khud bakhud tijarat ko mutharrak karte hain. yeh utaar charhao walay baazaaron mein kaar amad saabit ho sakta hai jahan qeematein taizi se ghair mutawaqqa simtao mein muntaqil ho sakti hain.

mazeed bar-aan, taajiron ko phislan ke halaat se munsalik mumkina khatraat se aagah hona chahiye, jaisay ke lain deen ki laagat mein izafah aur na muwafiq qeematon par tijarat ko injaam dainay ka imkaan. un khatraat ko kam karne ke liye market ke halaat ki ahthyat se nigrani karna aur is ke mutabiq tijarti hikmat amlyon ko adjust karna zaroori hai.

How to avoid Slippage.

qeemat ki phislan is qisam ki phislan is waqt hoti hai jab security ki qeemat taizi se barh jati hai, jis ki wajah se amal daraamad ki qeemat mutawaqqa qeemat se mukhtalif hoti hai. misaal ke tor par, agar koi tajir stock kharidne ke liye $ 50 ka market order deta hai, lekin order bharnay se pehlay qeemat barh kar $ 55 ho jati hai, to tajir ko qeemat mein kami ka saamna karna parre ga aur phir slippage is waqt hoti hai jab tijarat ko tawaqqa se mukhtalif waqt ya jagah par amal mein laya jata hai, jis ki wajah se amal daraamad ki qeemat mutawaqqa qeemat se mukhtalif hoti hai. misaal ke tor par, agar koi tajir market ke aaghaz par stock kharidne ka order deta hai, lekin is order par din ke baad tak amal nahi hota hai, to tajir ko

slippage ka saamna karna parre ga jab tridr ka order market mein dastyab likoyditi se ziyada hota hai, jis ki wajah se amal daraamad ki qeemat tawaqqa se ziyada kharab hoti hai. misaal ke tor par, agar koi tajir stock kharidne ke liye bara order deta hai, lekin order ko bharnay ke liye kaafi baichnay walay nahi hain, to tajir ko hajam mein kami ka saamna karna par sakta hai.

Safety while Performing Trading in Slippage Condition.

Slippage ke halaat mein trading karte waqt, aik hikmat e amli ka hona zaroori hai jis mein qeemat ki naqal o harkat ke imkanaat ka hisaab ho. aik nuqta nazar had ke orders ka istemaal karna hai, jo taajiron ko aik makhsoos qeemat muqarrar karne ki ijazat deta hai jis par woh asasa kharidne ya baichnay ke liye tayyar hain. is se tijarat par phislan ke asraat ko mehdood karne mein madad mil sakti hai is baat ko yakeeni bana kar ke lain deen matlooba qeemat par injaam paye aur phir aik aur hikmat e amli yeh hai ke

stop loss orders ka istemaal kya jaye, jo qeemat ki makhsoos satah tak pounchanay par khud bakhud tijarat ko mutharrak karte hain. yeh utaar charhao walay baazaaron mein kaar amad saabit ho sakta hai jahan qeematein taizi se ghair mutawaqqa simtao mein muntaqil ho sakti hain.

mazeed bar-aan, taajiron ko phislan ke halaat se munsalik mumkina khatraat se aagah hona chahiye, jaisay ke lain deen ki laagat mein izafah aur na muwafiq qeematon par tijarat ko injaam dainay ka imkaan. un khatraat ko kam karne ke liye market ke halaat ki ahthyat se nigrani karna aur is ke mutabiq tijarti hikmat amlyon ko adjust karna zaroori hai.

How to avoid Slippage.

qeemat ki phislan is qisam ki phislan is waqt hoti hai jab security ki qeemat taizi se barh jati hai, jis ki wajah se amal daraamad ki qeemat mutawaqqa qeemat se mukhtalif hoti hai. misaal ke tor par, agar koi tajir stock kharidne ke liye $ 50 ka market order deta hai, lekin order bharnay se pehlay qeemat barh kar $ 55 ho jati hai, to tajir ko qeemat mein kami ka saamna karna parre ga aur phir slippage is waqt hoti hai jab tijarat ko tawaqqa se mukhtalif waqt ya jagah par amal mein laya jata hai, jis ki wajah se amal daraamad ki qeemat mutawaqqa qeemat se mukhtalif hoti hai. misaal ke tor par, agar koi tajir market ke aaghaz par stock kharidne ka order deta hai, lekin is order par din ke baad tak amal nahi hota hai, to tajir ko

slippage ka saamna karna parre ga jab tridr ka order market mein dastyab likoyditi se ziyada hota hai, jis ki wajah se amal daraamad ki qeemat tawaqqa se ziyada kharab hoti hai. misaal ke tor par, agar koi tajir stock kharidne ke liye bara order deta hai, lekin order ko bharnay ke liye kaafi baichnay walay nahi hain, to tajir ko hajam mein kami ka saamna karna par sakta hai.

تبصرہ

Расширенный режим Обычный режим