Introduction to Relative Vigor Index Indicator

Relative Vigor Index (RVI) ik technical indicator ha go technical analysis krny mn use kia jata ha. Ye indicator traders ko trend ke strength calculate krny k moqay deta ha. Traders current closing price ko trading range say compare kr k iski calculations krty hain aur isko trend ke strength measure krny k liye use krty hain aur achi trading k liye use krty hain. Relative Vigor index market mn kam karty howe aap ko ik indicator dia jata hai. Aap kisi bhi broker mein is ko istemal kar skty hain aur aap is ky zariye market mein trends ky bry mn useful information lety howe isko analysis ka hisab bna skty hain aur apni trades is ko use kar k lgaty hain. Market mn dusry indicator ke trha RVI b bhut important indicator hai.

Relative Vigor Index Indicator ki Tafseeli Wazahat

Relative vigor index ko use karaty rehna chahiay additionally Kam k contest can also additionally postingkartay hay to appko apni gettingto know talents kogrowth kartay hoye posting karniparti hay.jab haum contest canalso additionally am nai hotay hay haumay postings kinice pay zayada cognizance kartay hoyecontest can also additionally postskarni chahiye aur apnayinformation ko enhance kartay rehna chahiyeThe RVI Indicator is calculated by comparing the current closing price with the previous closing price, and then calculating the difference between the two. This difference is then divided by the range of the price over the same period, which is typically a 10-day period. The result is a ratio that is then smoothed using an exponential moving average (EMA) to provide a more reliable trend indicator

RVI Oscillator ka Trading main Istamal

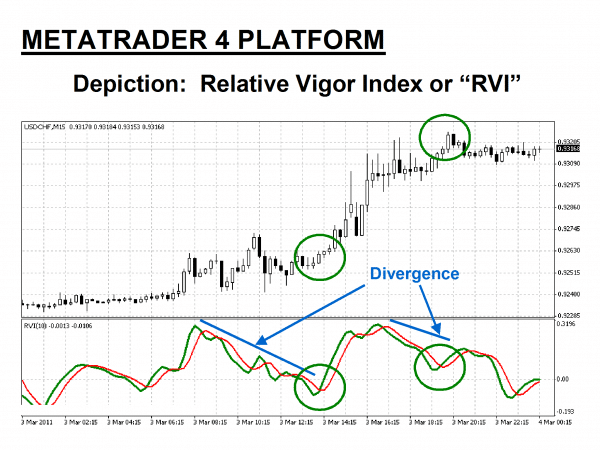

The Relative Vigor Index (RVI) is a technical indicator used in financial analysis to measure the strength of a trend in a particular security or asset. The RVI is calculated by comparing the closing price of a security to its opening price, with the difference being divided by the range of the security for that period.The RVI integrator is a method of smoothing out the RVI indicator over a period of time to better identify trends and minimize false signals. This is typically achieved by taking a moving average of the RVI over a specified time period, which can help to reduce the impact of short-term fluctuations and noise in the data.

RVI Oscillator ka Working Principle

Relative vigor index indicator asset ki close price ka recent price range Se mavaj Na karta hai aur price ki nakalo Harkat Ke Piche takat ki value Paida Karta Hai yah jitni Jyada value Paida Karega friend itna hi strong Hona chahie dusri Taraf Lo aur relative vigor index value Ek Purush sukun aur sideways market ko jahir Karti Hai relative vigor index indicator value Paida Karta Hai Jo Kabhi Kabhi Upar aur down levels ke kareeb trading Karti Hai relative vigor index indicator relative strength index indicator Ki Tarah trend ki Simat Mein change ka immun hai jo darasal iski Sabse Badi takat Hai dusri Taraf relative figure index indicator se Lekh important weakness yah hai ki yah range market Mein Amali Taur per bekar Hai Jab price action figure index indicator Se mashvara Karte Hain Jab price action Upar ya down ki taraf friend Mein Lambe arse Tak trading Karta Hai Kyunki vah karne ki koshish Karte Hain ke maujuda trend kab khatm hoga.

Relative Vigor Index (RVI) ik technical indicator ha go technical analysis krny mn use kia jata ha. Ye indicator traders ko trend ke strength calculate krny k moqay deta ha. Traders current closing price ko trading range say compare kr k iski calculations krty hain aur isko trend ke strength measure krny k liye use krty hain aur achi trading k liye use krty hain. Relative Vigor index market mn kam karty howe aap ko ik indicator dia jata hai. Aap kisi bhi broker mein is ko istemal kar skty hain aur aap is ky zariye market mein trends ky bry mn useful information lety howe isko analysis ka hisab bna skty hain aur apni trades is ko use kar k lgaty hain. Market mn dusry indicator ke trha RVI b bhut important indicator hai.

Relative Vigor Index Indicator ki Tafseeli Wazahat

Relative vigor index ko use karaty rehna chahiay additionally Kam k contest can also additionally postingkartay hay to appko apni gettingto know talents kogrowth kartay hoye posting karniparti hay.jab haum contest canalso additionally am nai hotay hay haumay postings kinice pay zayada cognizance kartay hoyecontest can also additionally postskarni chahiye aur apnayinformation ko enhance kartay rehna chahiyeThe RVI Indicator is calculated by comparing the current closing price with the previous closing price, and then calculating the difference between the two. This difference is then divided by the range of the price over the same period, which is typically a 10-day period. The result is a ratio that is then smoothed using an exponential moving average (EMA) to provide a more reliable trend indicator

RVI Oscillator ka Trading main Istamal

The Relative Vigor Index (RVI) is a technical indicator used in financial analysis to measure the strength of a trend in a particular security or asset. The RVI is calculated by comparing the closing price of a security to its opening price, with the difference being divided by the range of the security for that period.The RVI integrator is a method of smoothing out the RVI indicator over a period of time to better identify trends and minimize false signals. This is typically achieved by taking a moving average of the RVI over a specified time period, which can help to reduce the impact of short-term fluctuations and noise in the data.

RVI Oscillator ka Working Principle

Relative vigor index indicator asset ki close price ka recent price range Se mavaj Na karta hai aur price ki nakalo Harkat Ke Piche takat ki value Paida Karta Hai yah jitni Jyada value Paida Karega friend itna hi strong Hona chahie dusri Taraf Lo aur relative vigor index value Ek Purush sukun aur sideways market ko jahir Karti Hai relative vigor index indicator value Paida Karta Hai Jo Kabhi Kabhi Upar aur down levels ke kareeb trading Karti Hai relative vigor index indicator relative strength index indicator Ki Tarah trend ki Simat Mein change ka immun hai jo darasal iski Sabse Badi takat Hai dusri Taraf relative figure index indicator se Lekh important weakness yah hai ki yah range market Mein Amali Taur per bekar Hai Jab price action figure index indicator Se mashvara Karte Hain Jab price action Upar ya down ki taraf friend Mein Lambe arse Tak trading Karta Hai Kyunki vah karne ki koshish Karte Hain ke maujuda trend kab khatm hoga.

تبصرہ

Расширенный режим Обычный режим