Assalamu Alaikum dear forex member umaid Karti Hoon ke aap sab khairiyat se honge dear members Jab hum Forex trading business Mein kaam karte Hain To hamen apna Kam acche tarike se soch samajhkar aur Market ke mohmed ke mutabik karna Hota Hai Kyunki usi surat Mein hamen market Se achcha profit hasil Hota Hai isiliye hamen apna knowledge aur experience increase karna hota hai aur iske sath sath hamen apni working quality ko de birthday improve karna Hota Hai tabhi Ham is business Mein successful ho sakte hain.

Dear members forex market mein trading ke liye Ham break out aur breakdown trading strategy ka istemal karte Hain to vahan per risk level ko hum minimise karne ke liye grade trading strategy ko istemal karte hain agar market Kisi direction mein moment Kar jaati hai to use time per hamari trade open ho jaaye aur hamen profit hasil ho jaaye grade trading mein hamen break out ya break down ka vate nahin karna padta jab bhi market jis direction mein apni moment Karti hai to hamari trade open hoti hai aur hamen vahan se achcha profit hasil ho jata hai lekin market jab tak usi direction mein chalti rahti hai hamen profit hasil hota rahata hai lekin jab market usi direction mein jyada movement Karti hai to rivers order mein moment start Karti hai tab hamen trade close karne Karke profit ko save krna prh sakta hai.

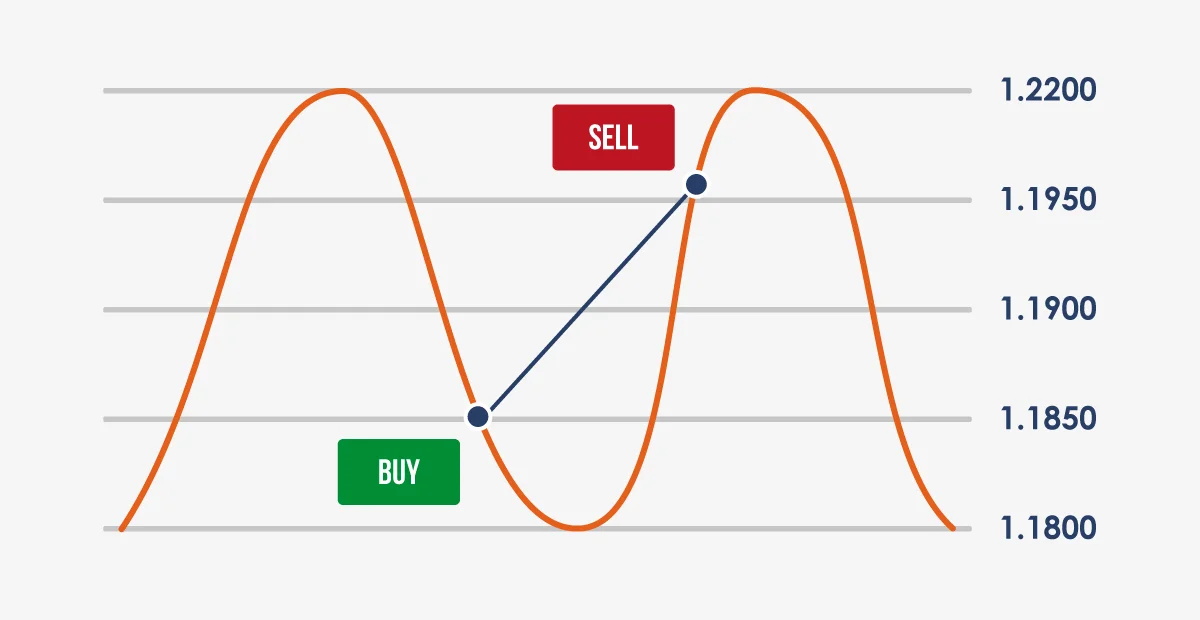

dear forex members forex trading market mein spuport aur resistance ke darmiyan market movement kar rahi hoti hai to use waqt Kisi bhi direction mein sport ya resistance ko break out kar sakti hai to use waqt hamari trade open ho jaaye isiliye hamen sport break aur stop loss registers break per bye stop set kar dena chahie kyunki hamen profit ka sem order mein target bhi set kar dete Hain Is Tarah jab market break out Karti hai to vah jyada movement Karti hai to aisi surat mein hamen aur aap profit target pura ho jata hai aur hamen achcha profit hasil ho jata hai aur trade open aur close bhi nahin Karni padati kyunki Is Tarah hamari trade automatic close ho jaati hai. Aisa Ham isliye karte hain kyunki sometime market Kuch der hamare favor mein rahane ke bad apni moment ko change bhi kar sakti hai jiski vajah se hamara order loss mein ja sakta hai.

Dear Forex member grid trading ayse trading strategy hoti hai jo ki predetermined price ke liye buy ya sell order ke liye istemal hoti hai jo ke pending orders hote hain aur automatically execute ho jaate Hain.

Yeah different crypto market mein trending or sideway environment ke liye bahut suitable hoti hai.

Grid trading forex trading market mein bahut jyada istemal hone wali trading strategy hoti hai.

Yeah dunia ki trading volume ky hisab sy ik largest financial market hoti hai.

What is Grid Trading?

Dear members forex market mein trading ke liye Ham break out aur breakdown trading strategy ka istemal karte Hain to vahan per risk level ko hum minimise karne ke liye grade trading strategy ko istemal karte hain agar market Kisi direction mein moment Kar jaati hai to use time per hamari trade open ho jaaye aur hamen profit hasil ho jaaye grade trading mein hamen break out ya break down ka vate nahin karna padta jab bhi market jis direction mein apni moment Karti hai to hamari trade open hoti hai aur hamen vahan se achcha profit hasil ho jata hai lekin market jab tak usi direction mein chalti rahti hai hamen profit hasil hota rahata hai lekin jab market usi direction mein jyada movement Karti hai to rivers order mein moment start Karti hai tab hamen trade close karne Karke profit ko save krna prh sakta hai.

Usage of Grid Trading:

dear forex members forex trading market mein spuport aur resistance ke darmiyan market movement kar rahi hoti hai to use waqt Kisi bhi direction mein sport ya resistance ko break out kar sakti hai to use waqt hamari trade open ho jaaye isiliye hamen sport break aur stop loss registers break per bye stop set kar dena chahie kyunki hamen profit ka sem order mein target bhi set kar dete Hain Is Tarah jab market break out Karti hai to vah jyada movement Karti hai to aisi surat mein hamen aur aap profit target pura ho jata hai aur hamen achcha profit hasil ho jata hai aur trade open aur close bhi nahin Karni padati kyunki Is Tarah hamari trade automatic close ho jaati hai. Aisa Ham isliye karte hain kyunki sometime market Kuch der hamare favor mein rahane ke bad apni moment ko change bhi kar sakti hai jiski vajah se hamara order loss mein ja sakta hai.

Keys Takeaway:

Dear Forex member grid trading ayse trading strategy hoti hai jo ki predetermined price ke liye buy ya sell order ke liye istemal hoti hai jo ke pending orders hote hain aur automatically execute ho jaate Hain.

Yeah different crypto market mein trending or sideway environment ke liye bahut suitable hoti hai.

Grid trading forex trading market mein bahut jyada istemal hone wali trading strategy hoti hai.

Yeah dunia ki trading volume ky hisab sy ik largest financial market hoti hai.

تبصرہ

Расширенный режим Обычный режим