Dear friends MACD indicator market ki movement ko zahir karta hay aur is indicator ko powerful samja jata hay aur traders market ki right direction ki movement ko judge karny me kamyab ho sakty hey, RSI aur MACD indicators ko same time me es tarha se chart me use key ja sakty hey key dono hi indicators ko active kar lena chaye aur other indicators ko delete kar dena chaye ta key chart clean ho jaye aur yahi 2 indicators active ho kar signals den, zeyada indicators charts me zaror active key ja sakty hey magar esa karny se chart me market ki movement ko watch karna mushkil ho jata hay es ley 2 hi indicators ka use karna zeyada behtar result de sakta hay aur me samjta hon sab se best yahi hay key RSI key sath MACD indicator use kia jaye dono ka combination best result de sakta hay aur traders fake trend aur movement se bach sakty hey.

How to get better results From MACD.

Dear friends MACD aur RSI indicators ko agar use kia jaye to dono ka combination best result de sakta hay aur traders fake trend aur movement se bach sakty hey, dono hi indicators terminal me already majood hoty hey es key ley traders ko indicators list me jana ho ga aur dono indicators ko active kar lena chaye agar es ka experience demo account me hasil ho jaye to zeyada behtar hay.

MACD indicator.

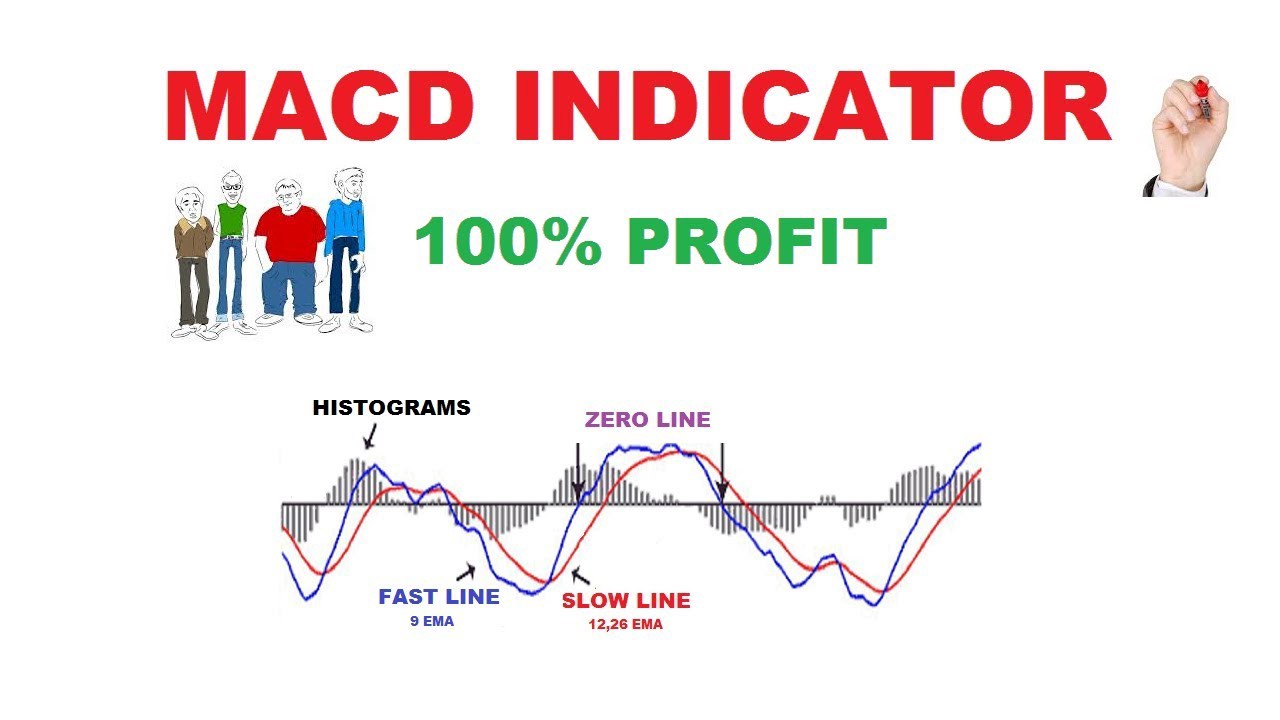

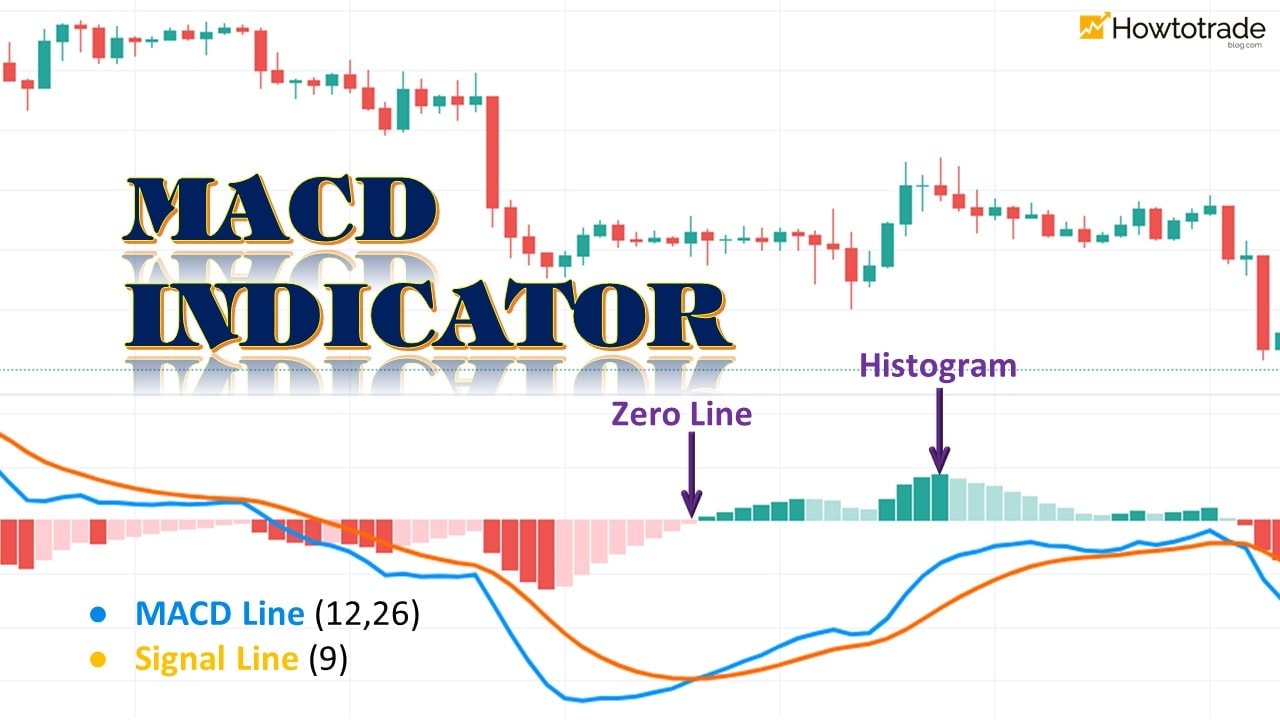

Friends MACD indicator aik moving average convergence and divergence indicator bhi aik leading technical indicator hay jo price action per kam karta hay ye past period ki moving average per calculations karta hay aur in kay zariye aik aisa signal provide karta hay jiski base per ham trend ka tayun kar kay trade main enter ho sakty hain. MACD indicator kai tariqon say work karta hay laikin ziada tar crossover, divergence aur rapid rise/fall hain.

How to Use MACD indicator.

Friends MACD indicator ko use karte hain to hum ko is market mein kafi jyada profit Mil jata hai kyunki is market mein Ham acchi tarike se kam karte Hain to Ham is market mein fayda ho jata hai forex market mein mscd indicator indicator ka use karte hain to humko is market mein kafi jyada fayda ho jata hai forex market mein humko acche tarike se kam karne per fayda tha bahut hi jafar miss market mein is indicator ko use karke achcha design lete hain forex market mein Ham agar indicator ko use karte hain to humko is market mein fayda tab hota hai jab Ham is market mein acche tarike se fayda hasrat hai jab Ham is market mein fayda hota hai Japanese market mein acchi tarike se kam karte hain fayda tab hota hai jab hamesha market mein acche tarike se kam kar sakte hain.

Trading stratigy at MACD.

Friends MACD indicator main market centre line ko cross ker chuki ho tou hamain previous trend ky reversal main trade open ker leni Chahiay ky jab market MFI main oversold Ho jaey tou market main reverse trend shuru hota hai tou sath hi MACD indicator main market centre line ko cross ker ky upper side per index increase hona shoru ho jati hai tou hamain aesy time per market main trade buy main open ker leni Chahiay ky hamain market main buy ki trade main profit hasil ho jata hai ky jab market oversold hony ky bahd reverse order main trade open kerty hain tou market bhi her surat buy main chalna shoru ker deti hai tou hamain buy main trade open kerny per acha profit hasil ho jata hai isi ky berux jab market uptrend main movement kerty huey MFI main overbought position main ponch jati hai tou aesy time per MACD main bhi market upper side sy cross ker ky lower side per strength increase hona shoru ho jati hai tou aesy time per hamain market main sell ki trade lgani chahyie.

How to get better results From MACD.

Dear friends MACD aur RSI indicators ko agar use kia jaye to dono ka combination best result de sakta hay aur traders fake trend aur movement se bach sakty hey, dono hi indicators terminal me already majood hoty hey es key ley traders ko indicators list me jana ho ga aur dono indicators ko active kar lena chaye agar es ka experience demo account me hasil ho jaye to zeyada behtar hay.

MACD indicator.

Friends MACD indicator aik moving average convergence and divergence indicator bhi aik leading technical indicator hay jo price action per kam karta hay ye past period ki moving average per calculations karta hay aur in kay zariye aik aisa signal provide karta hay jiski base per ham trend ka tayun kar kay trade main enter ho sakty hain. MACD indicator kai tariqon say work karta hay laikin ziada tar crossover, divergence aur rapid rise/fall hain.

How to Use MACD indicator.

Friends MACD indicator ko use karte hain to hum ko is market mein kafi jyada profit Mil jata hai kyunki is market mein Ham acchi tarike se kam karte Hain to Ham is market mein fayda ho jata hai forex market mein mscd indicator indicator ka use karte hain to humko is market mein kafi jyada fayda ho jata hai forex market mein humko acche tarike se kam karne per fayda tha bahut hi jafar miss market mein is indicator ko use karke achcha design lete hain forex market mein Ham agar indicator ko use karte hain to humko is market mein fayda tab hota hai jab Ham is market mein acche tarike se fayda hasrat hai jab Ham is market mein fayda hota hai Japanese market mein acchi tarike se kam karte hain fayda tab hota hai jab hamesha market mein acche tarike se kam kar sakte hain.

Trading stratigy at MACD.

Friends MACD indicator main market centre line ko cross ker chuki ho tou hamain previous trend ky reversal main trade open ker leni Chahiay ky jab market MFI main oversold Ho jaey tou market main reverse trend shuru hota hai tou sath hi MACD indicator main market centre line ko cross ker ky upper side per index increase hona shoru ho jati hai tou hamain aesy time per market main trade buy main open ker leni Chahiay ky hamain market main buy ki trade main profit hasil ho jata hai ky jab market oversold hony ky bahd reverse order main trade open kerty hain tou market bhi her surat buy main chalna shoru ker deti hai tou hamain buy main trade open kerny per acha profit hasil ho jata hai isi ky berux jab market uptrend main movement kerty huey MFI main overbought position main ponch jati hai tou aesy time per MACD main bhi market upper side sy cross ker ky lower side per strength increase hona shoru ho jati hai tou aesy time per hamain market main sell ki trade lgani chahyie.

:max_bytes(150000):strip_icc()/Untitled-8f2a454694704ce99fc7a63c4e30fe36.jpg)

:max_bytes(150000):strip_icc():format(webp)/MACD-88b76e15562147d5bfe5108b169b74b3.png)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-01-d70065c4e23241e18c117cbbb295dcce.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-02-58bf5e34f0f94730b6e2d56ef9032b6d.jpg)

تبصرہ

Расширенный режим Обычный режим