What Is a Trendline?

Trendlines are really undeniable lines that dealers draw in on charts to communicate a movement of expenses together or show a couple of data's best fit. The ensuing line is then used to give the vendor a shrewd idea of the bearing where an endeavor's worth could move.

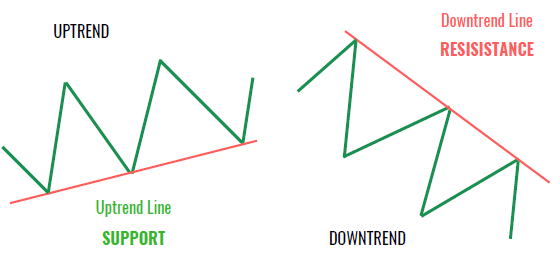

A trendline is a line drawn over turn highs or under go lows to show the prevalent direction of cost. Trendlines are a visual depiction of help and impediment in any time span. They show bearing and speed of cost, and besides portray plans during seasons of cost choking.

What Do Trendlines Tell You?

The trendline is among the primary instruments used by particular specialists. As opposed to looking at past business execution or various fundamentals, particular analysts look for designs in cost movement. A trendline helps specific analysts with concluding the continuous heading in market costs. Particular specialists acknowledge the example is your sidekick, and recognizing this example is the most indispensable stage during the time spent making a respectable trade

To make a trendline, an inspector ought to have something like two spotlights on an expense graph. A couple of inspectors like to use different stretches of time like one second or five minutes. Others see everyday charts or many weeks frames. A couple of specialists set to the side time completely, choosing to see designs considering tick extends instead of periods of time. What makes trendlines so broad in use and charm is they can be used to help with recognizing designs regardless of what the period of time, time frame or stretch used.

If association An is trading at $35 and moves to $40 in two days and $45 in three days, the analyst has three spotlights to plot on an outline, starting at $35, then, moving to $40, and a while later moving to $45. If the examiner characterizes a limit between every one of the three sticker costs, they have an upward design. The trendline drawn has a positive inclination and is subsequently encouraging the master to buy toward the example. If association An's expense goes from $35 to $25, regardless, the trendline has a negative inclination and the master should sell toward the example.

Example Using a Trendline

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Trendline_Nov_2020-01-53566150cb3345a997d9c2d2ef32b5bd.jpg)

Trendlines are to some degree easy to use. A dealer basically has to outline the expense data consistently, using open, close, high and low. Coming up next is data for the Russell 2000 in a flame graph with the trendline applied to three gathering lows more than a multi month stretch of time.

The trendline shows the rise in the Russell 2000 and can be viewed as help while entering a position. For this present circumstance, vendor could pick enter what is happening close the trendline and subsequently widen it into what the future holds. Expecting that the expense movement breaks the trendline on the inconvenience, the vendor can include that as a sign to close the position. This allows the vendor to leave when the example they are following starts to cripple.

Trendlines are, clearly, a consequence of the stretch of time. In the model more than, a seller doesn't need to redraw the trendline constantly. On a period size of minutes, regardless, trendlines and trades could ought to be revised routinely.

تبصرہ

Расширенный режим Обычный режим