Bear Flag In Forex Trading

"Bear Flag" ka istemaal aam tor par forex market mein takneeki tajzia mein qeemat ke patteren ko bayan karne ke liye kya jata hai jo neechay ki janib mumkina tasalsul ki nishandahi karta hai .

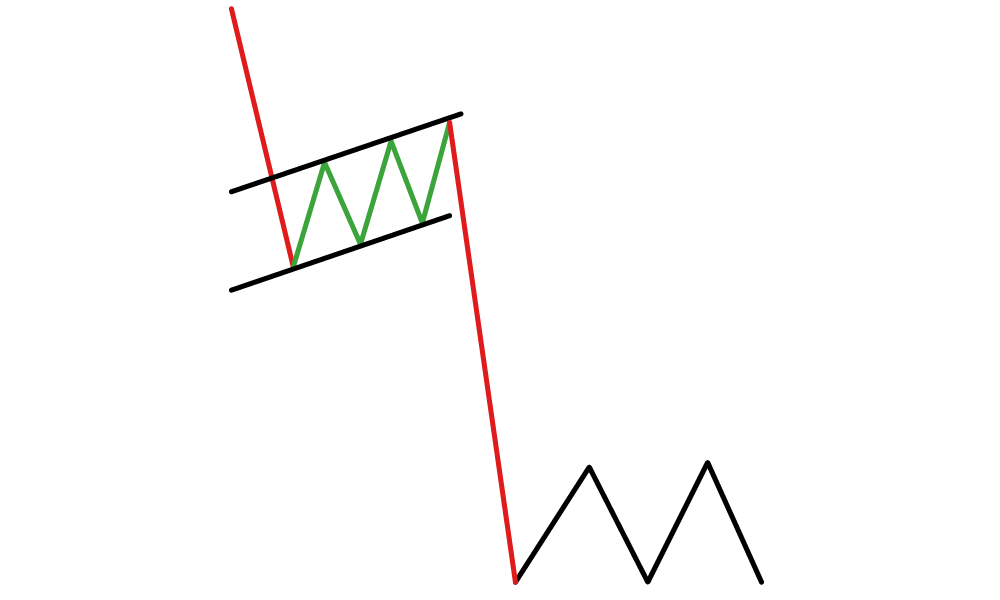

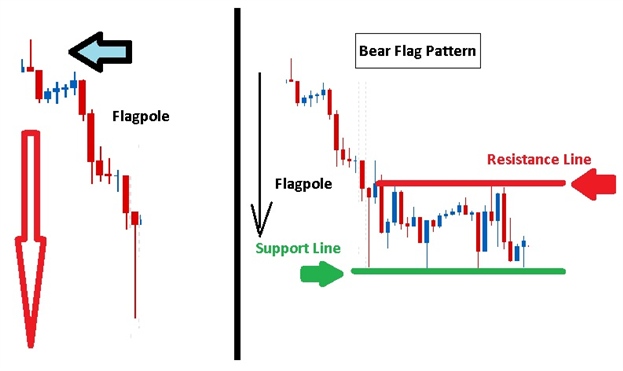

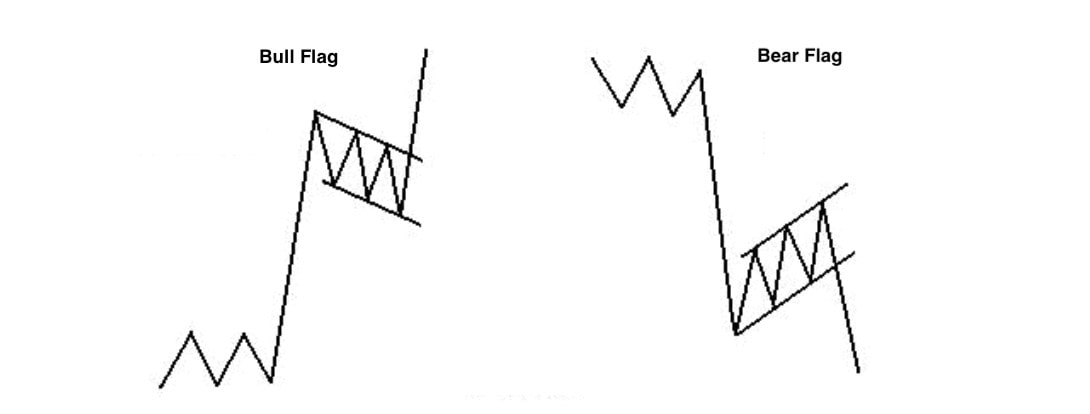

Aik Bear Flag is waqt bantaa hai jab forex jore mein qeemat neechay ki taraf aik mazboot harkat hoti hai, is ke baad yakjahti ki aik mukhtasir muddat hoti hai, jahan qeemat aik taraf ya qadray oopar ki simt mein harkat karti hai. yeh istehkaam ka dorania aik jhanday ki terhan ka namona banata hai, jis mein qeematon mein kami ki harkat parcham ke qutub ki numaindagi karti hai aur istehkaam ki muddat khud parcham ki numaindagi karti hai .

Bear flag patteren ko aik tasalsul ka namona samjha jata hai, jis ka matlab hai ke agar yeh neechay ke rujhan mein zahir hota hai, to yeh tajweez karta hai ke istehkaam ki muddat khatam honay ke baad qeemat mein kami jari rehne ka imkaan hai. tajir is patteren ko aik mukhtasir position mein daakhil honay ke liye signal ke tor par istemaal kar satke hain, yeh tawaqqa karte hue ke qeemat is ke neechay ki taraf jari rahay gi .

Taham, yeh note karna zaroori hai ke tamam bear flag patteren ke nateejay mein kami ka rujhan jari nahi rehta. patteren bhi nakaam ho sakta hai, aur qeemat mazbooti ki muddat se oopar ki simt mein toot sakti hai, jis ke nateejay mein rujhan badal sakta hai. lehaza, taajiron ko –apne tijarti faislon ki tasdeeq ke liye bear flag patteren ke sath mil kar deegar isharay aur tajzia ki taknik istemaal karni chahiye .

Trading with Bear Flag

Agar koi tajir forex market mein Bear Flag ke patteren ki shanakht karta hai, to woh usay mukhtasir position mein daakhil honay ke liye signal ke tor par istemaal kar sakta hai. reechh ke jhanday ke patteren ke sath tijarat karte waqt yahan kuch aisay iqdamaat hain jin par aik tajir amal kar sakta hai :

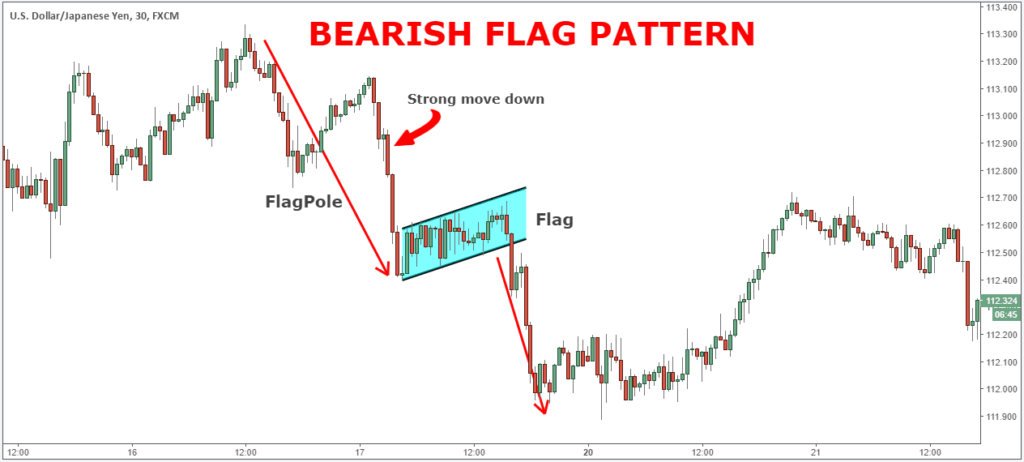

Bear Flag ke patteren ki shanakht karen : tajir ko qeemat mein kami ki aik mazboot harkat ki talaash karni chahiye, jis ke baad aik mazbooti ki muddat, jo jhanday jaisa patteren banati hai .

Patteren ki tasdeeq karen : tajir ko dosray isharay ya tajzia ki taknik, jaisay ke support aur muzahmat ki satah, rujhan ki lakerain, ya harkat pazeeri ost ka istemaal karte hue patteren ki tasdeeq karni chahiye .

Dakhlay aur kharji raastoon ka taayun karen : tajir ko apni mukhtasir position ke liye dakhlay aur kharji raastoon ka taayun karna chahiye. woh market mein daakhil ho satke hain jab qeemat reechh ke jhanday ke patteren ki nichli trained line se neechay ajati hai, aur jab qeemat support level tak pahonch jati hai ya ulat jane ke assaar dukhati hai to is position se bahar nikal satke hain .

Khatray ka intizam karen : tajir ko apne khatray ka intizam karna chahiye aik stap las order tarteeb day kar mumkina nuqsanaat ko mehdood karne ke liye agar qeemat mukhalif simt mein chali jati hai, aur munasib position ke size aur rissk managment ki hikmat amlyon ko istemaal kar ke .

Tijarat ki nigrani karen : tajir ko yeh dekhnay ke liye tijarat ki nigrani karni chahiye ke aaya qeemat neechay ki taraf jari hai, aur agar zaroori ho to apni kharji hikmat e amli ko adjust karen .

Yeh note karna zaroori hai ke reechh ke jhanday ke patteren ke sath tijarat karna koi zamanat Yafta hikmat e amli nahi hai, aur taajiron ko bakhabar tijarti faislay karne ke liye tajzia ki deegar techniques aur rissk managment ki hikmat amlyon ke sath mil kar istemaal karna chahiye .

"Bear Flag" ka istemaal aam tor par forex market mein takneeki tajzia mein qeemat ke patteren ko bayan karne ke liye kya jata hai jo neechay ki janib mumkina tasalsul ki nishandahi karta hai .

Aik Bear Flag is waqt bantaa hai jab forex jore mein qeemat neechay ki taraf aik mazboot harkat hoti hai, is ke baad yakjahti ki aik mukhtasir muddat hoti hai, jahan qeemat aik taraf ya qadray oopar ki simt mein harkat karti hai. yeh istehkaam ka dorania aik jhanday ki terhan ka namona banata hai, jis mein qeematon mein kami ki harkat parcham ke qutub ki numaindagi karti hai aur istehkaam ki muddat khud parcham ki numaindagi karti hai .

Bear flag patteren ko aik tasalsul ka namona samjha jata hai, jis ka matlab hai ke agar yeh neechay ke rujhan mein zahir hota hai, to yeh tajweez karta hai ke istehkaam ki muddat khatam honay ke baad qeemat mein kami jari rehne ka imkaan hai. tajir is patteren ko aik mukhtasir position mein daakhil honay ke liye signal ke tor par istemaal kar satke hain, yeh tawaqqa karte hue ke qeemat is ke neechay ki taraf jari rahay gi .

Taham, yeh note karna zaroori hai ke tamam bear flag patteren ke nateejay mein kami ka rujhan jari nahi rehta. patteren bhi nakaam ho sakta hai, aur qeemat mazbooti ki muddat se oopar ki simt mein toot sakti hai, jis ke nateejay mein rujhan badal sakta hai. lehaza, taajiron ko –apne tijarti faislon ki tasdeeq ke liye bear flag patteren ke sath mil kar deegar isharay aur tajzia ki taknik istemaal karni chahiye .

Trading with Bear Flag

Agar koi tajir forex market mein Bear Flag ke patteren ki shanakht karta hai, to woh usay mukhtasir position mein daakhil honay ke liye signal ke tor par istemaal kar sakta hai. reechh ke jhanday ke patteren ke sath tijarat karte waqt yahan kuch aisay iqdamaat hain jin par aik tajir amal kar sakta hai :

Bear Flag ke patteren ki shanakht karen : tajir ko qeemat mein kami ki aik mazboot harkat ki talaash karni chahiye, jis ke baad aik mazbooti ki muddat, jo jhanday jaisa patteren banati hai .

Patteren ki tasdeeq karen : tajir ko dosray isharay ya tajzia ki taknik, jaisay ke support aur muzahmat ki satah, rujhan ki lakerain, ya harkat pazeeri ost ka istemaal karte hue patteren ki tasdeeq karni chahiye .

Dakhlay aur kharji raastoon ka taayun karen : tajir ko apni mukhtasir position ke liye dakhlay aur kharji raastoon ka taayun karna chahiye. woh market mein daakhil ho satke hain jab qeemat reechh ke jhanday ke patteren ki nichli trained line se neechay ajati hai, aur jab qeemat support level tak pahonch jati hai ya ulat jane ke assaar dukhati hai to is position se bahar nikal satke hain .

Khatray ka intizam karen : tajir ko apne khatray ka intizam karna chahiye aik stap las order tarteeb day kar mumkina nuqsanaat ko mehdood karne ke liye agar qeemat mukhalif simt mein chali jati hai, aur munasib position ke size aur rissk managment ki hikmat amlyon ko istemaal kar ke .

Tijarat ki nigrani karen : tajir ko yeh dekhnay ke liye tijarat ki nigrani karni chahiye ke aaya qeemat neechay ki taraf jari hai, aur agar zaroori ho to apni kharji hikmat e amli ko adjust karen .

Yeh note karna zaroori hai ke reechh ke jhanday ke patteren ke sath tijarat karna koi zamanat Yafta hikmat e amli nahi hai, aur taajiron ko bakhabar tijarti faislay karne ke liye tajzia ki deegar techniques aur rissk managment ki hikmat amlyon ke sath mil kar istemaal karna chahiye .

Is phase ke dauran market mein ek flag jaise pattern ban jata hai jise traders bear flag kehte hain. Flag pattern downward sloping hota hai aur ismein prices mein ek gradual decline dekha jata hai. Is phase ke baad market mein ek sharp price drop dekhne ko milta hai jise flagpole kehte hain. Flagpole ki length bear flag ke width se kuch had tak ziada hoti hai. Flagpole ke baad phir se ek consolidation phase shuru hota hai jismein prices kuch had tak stable rehte hain aur bear flag ka formation complete ho jata hai. Jab bear flag ka formation complete ho jata hai to traders sell signal ke liye wait karte hain. Jab market mein bear flag ka formation complete ho jata hai to iske baad market mein phir se downward price movement ka possibility hota hai. Traders sell signal ke liye wait karte hain aur phir jab price downward movement mein hota hai to unhe apni positions close karne ke liye signal mil jata hai. Bear flag ke baad traders ko ek aur tool ki madad se apne trading decisions optimize karne ki madad milti hai, jise Fibonacci retracement kehte hain. Fibonacci retracement ki madad se traders market mein price movements ko analyze kar sakte hain aur support aur resistance levels ka pata laga sakte hain.

Is phase ke dauran market mein ek flag jaise pattern ban jata hai jise traders bear flag kehte hain. Flag pattern downward sloping hota hai aur ismein prices mein ek gradual decline dekha jata hai. Is phase ke baad market mein ek sharp price drop dekhne ko milta hai jise flagpole kehte hain. Flagpole ki length bear flag ke width se kuch had tak ziada hoti hai. Flagpole ke baad phir se ek consolidation phase shuru hota hai jismein prices kuch had tak stable rehte hain aur bear flag ka formation complete ho jata hai. Jab bear flag ka formation complete ho jata hai to traders sell signal ke liye wait karte hain. Jab market mein bear flag ka formation complete ho jata hai to iske baad market mein phir se downward price movement ka possibility hota hai. Traders sell signal ke liye wait karte hain aur phir jab price downward movement mein hota hai to unhe apni positions close karne ke liye signal mil jata hai. Bear flag ke baad traders ko ek aur tool ki madad se apne trading decisions optimize karne ki madad milti hai, jise Fibonacci retracement kehte hain. Fibonacci retracement ki madad se traders market mein price movements ko analyze kar sakte hain aur support aur resistance levels ka pata laga sakte hain.  Bear Flag ko chart per find karna traders ke liye important hota hai, kyunki iski madad se wo market mein bearish trend ki continuation ko predict kar sakte hain aur apni trading decisions ko optimize kar sakte hain. Bear Flag ko chart per find karne ke liye traders ko kuch steps follow karne hote hain. Sabse pehle, traders ko market ka chart analyze karna hota hai. Iske liye traders market ka price action chart use karte hain jismein price ke movements ko dekha ja sakta hai.

Bear Flag ko chart per find karna traders ke liye important hota hai, kyunki iski madad se wo market mein bearish trend ki continuation ko predict kar sakte hain aur apni trading decisions ko optimize kar sakte hain. Bear Flag ko chart per find karne ke liye traders ko kuch steps follow karne hote hain. Sabse pehle, traders ko market ka chart analyze karna hota hai. Iske liye traders market ka price action chart use karte hain jismein price ke movements ko dekha ja sakta hai.

تبصرہ

Расширенный режим Обычный режим