Harami Cross Pattern In Forex Trading

Harami cross aik candle stuck patteren hai jisay forex trading mein istemaal kya ja sakta hai. yeh do mom batii ka namona hai jo rujhan ki simt mein mumkina ulat jane ki nishandahi karta hai. harami cross is waqt bantaa hai jab aik choti mom batii ( cross ) aik barri mom batii ( maa ) ke jism mein hoti hai .

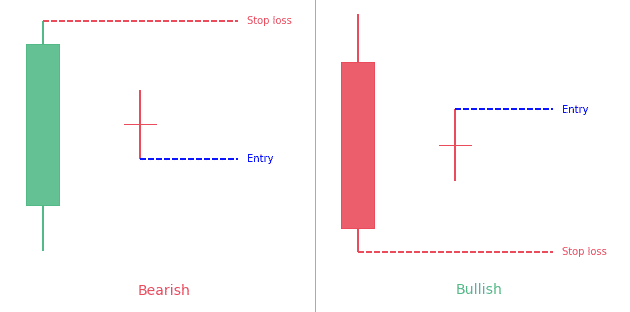

Bullish harami cross mein, pehli mom batii aik lambi bearish candle hoti hai, is ke baad aik choti blush cross hoti hai jo pichli candle ke body mein hoti hai. yeh patteren batata hai ke farokht ka dabao kam ho gaya hai, aur yeh ke mumkina tor par ulat palat ho sakta hai .

Bearish harami cross mein, pehli candle aik lambi blush candle hoti hai, is ke baad aik choti bearish cross hoti hai jo pichli candle ke body mein hoti hai. yeh patteren batata hai ke kharidari ka dabao kam ho gaya hai, aur yeh ke manfi pehlu mein mumkina ulat palat ho sakta hai .

Yeh note karna zaroori hai ke harami cross patteren par tanhai mein inhisaar nahi kya jana chahiye, aur yeh ke mumkina ulat phair ki tasdeeq ke liye deegar takneeki tajzia ke ozaar bhi istemaal kiye jayen. mazeed bar-aan, taajiron ko hamesha khatray ka intizam karne ke liye stap las orders ka istemaal karna chahiye agar patteren tawaqqa ke mutabiq nahi chalta hai .

Trading with Harami Cross Pattern

Agar aap forex trading mein harami cross patteren ka istemaal karte hue tijarat karne ka iradah rakhtay hain, to yahan ghhor karne ke liye kuch iqdamaat hain :

Rujhan ki shanakht karen : harami cross patteren aik ulat patteren hai, is liye murawaja rujhan ki nishandahi karna zaroori hai. agar rujhan taizi ka hai, to aap ko bearish harami cross patteren talaash karna chahiye. agar rujhan mandi ka hai, to aap ko taizi se harami cross patteren talaash karna chahiye .

Patteren talaash karen : aik baar jab aap rujhan ki shanakht karlen, chart par harami cross patteren ko talaash karen. patteren do mom btyon par mushtamil hona chahiye - aik barri maa ki mom batii aur aik choti cross mom batii .

Tasdeeq ka intzaar karen : agarchay harami cross patteren aik mazboot reversal signal hai, lekin yeh hamesha mahswara diya jata hai ke tijarat mein daakhil honay se pehlay tasdeeq ka intzaar karen. ulat jane ki tasdeeq ke liye aap dosray takneeki isharay jaisay moving average, trained lines, ya oscilator istemaal kar satke hain .

Apni tijarat karen : agar aap ko yaqeen hai ke rujhan tabdeel ho raha hai, to aap naye rujhan ki simt tijarat mein daakhil ho satke hain. misaal ke tor par, agar aap ko taizi se harami cross patteren nazar aata hai, to aap currency pear par taweel safar kar satke hain .

Apne stap las aur take profit ki sthin set karen : tijarat aap ke khilaaf honay ki soorat mein –apne nuqsaan ko mehdood karne ke liye stap las ke orders set karna zaroori hai. take profit orders ko tijarat ko band karne ke liye bhi istemaal kya ja sakta hai jab pehlay se tay shuda munafe ka hadaf poora ho jata hai .

Tijarat ki nigrani karen : aik baar jab aap apni tijarat kar len, to is ki bareek beeni se nigrani karen ke aaya patteren tawaqqa ke mutabiq chalta hai. khatray ka intizam karne aur munafe ko ziyada se ziyada karne ke liye zaroorat ke mutabiq –apne stap las aur take praft ki satah ko adjust karen .

Yeh note karna zaroori hai ke harami cross patteren hamesha qabil bharosa nahi hota, is liye usay deegar takneeki tajzia ke alaat aur rissk managment ki hikmat amlyon ke sath mil kar istemaal kya jana chahiye. mazeed bar-aan, haqeeqi raqam ke sath tijarat karne se pehlay demo account par mashq karne ka mahswara diya jata hai .

Harami cross aik candle stuck patteren hai jisay forex trading mein istemaal kya ja sakta hai. yeh do mom batii ka namona hai jo rujhan ki simt mein mumkina ulat jane ki nishandahi karta hai. harami cross is waqt bantaa hai jab aik choti mom batii ( cross ) aik barri mom batii ( maa ) ke jism mein hoti hai .

Bullish harami cross mein, pehli mom batii aik lambi bearish candle hoti hai, is ke baad aik choti blush cross hoti hai jo pichli candle ke body mein hoti hai. yeh patteren batata hai ke farokht ka dabao kam ho gaya hai, aur yeh ke mumkina tor par ulat palat ho sakta hai .

Bearish harami cross mein, pehli candle aik lambi blush candle hoti hai, is ke baad aik choti bearish cross hoti hai jo pichli candle ke body mein hoti hai. yeh patteren batata hai ke kharidari ka dabao kam ho gaya hai, aur yeh ke manfi pehlu mein mumkina ulat palat ho sakta hai .

Yeh note karna zaroori hai ke harami cross patteren par tanhai mein inhisaar nahi kya jana chahiye, aur yeh ke mumkina ulat phair ki tasdeeq ke liye deegar takneeki tajzia ke ozaar bhi istemaal kiye jayen. mazeed bar-aan, taajiron ko hamesha khatray ka intizam karne ke liye stap las orders ka istemaal karna chahiye agar patteren tawaqqa ke mutabiq nahi chalta hai .

Trading with Harami Cross Pattern

Agar aap forex trading mein harami cross patteren ka istemaal karte hue tijarat karne ka iradah rakhtay hain, to yahan ghhor karne ke liye kuch iqdamaat hain :

Rujhan ki shanakht karen : harami cross patteren aik ulat patteren hai, is liye murawaja rujhan ki nishandahi karna zaroori hai. agar rujhan taizi ka hai, to aap ko bearish harami cross patteren talaash karna chahiye. agar rujhan mandi ka hai, to aap ko taizi se harami cross patteren talaash karna chahiye .

Patteren talaash karen : aik baar jab aap rujhan ki shanakht karlen, chart par harami cross patteren ko talaash karen. patteren do mom btyon par mushtamil hona chahiye - aik barri maa ki mom batii aur aik choti cross mom batii .

Tasdeeq ka intzaar karen : agarchay harami cross patteren aik mazboot reversal signal hai, lekin yeh hamesha mahswara diya jata hai ke tijarat mein daakhil honay se pehlay tasdeeq ka intzaar karen. ulat jane ki tasdeeq ke liye aap dosray takneeki isharay jaisay moving average, trained lines, ya oscilator istemaal kar satke hain .

Apni tijarat karen : agar aap ko yaqeen hai ke rujhan tabdeel ho raha hai, to aap naye rujhan ki simt tijarat mein daakhil ho satke hain. misaal ke tor par, agar aap ko taizi se harami cross patteren nazar aata hai, to aap currency pear par taweel safar kar satke hain .

Apne stap las aur take profit ki sthin set karen : tijarat aap ke khilaaf honay ki soorat mein –apne nuqsaan ko mehdood karne ke liye stap las ke orders set karna zaroori hai. take profit orders ko tijarat ko band karne ke liye bhi istemaal kya ja sakta hai jab pehlay se tay shuda munafe ka hadaf poora ho jata hai .

Tijarat ki nigrani karen : aik baar jab aap apni tijarat kar len, to is ki bareek beeni se nigrani karen ke aaya patteren tawaqqa ke mutabiq chalta hai. khatray ka intizam karne aur munafe ko ziyada se ziyada karne ke liye zaroorat ke mutabiq –apne stap las aur take praft ki satah ko adjust karen .

Yeh note karna zaroori hai ke harami cross patteren hamesha qabil bharosa nahi hota, is liye usay deegar takneeki tajzia ke alaat aur rissk managment ki hikmat amlyon ke sath mil kar istemaal kya jana chahiye. mazeed bar-aan, haqeeqi raqam ke sath tijarat karne se pehlay demo account par mashq karne ka mahswara diya jata hai .

:max_bytes(150000):strip_icc()/HaramiCross2-ef9838326287403e945931251cc6c05e.png) Pehla Candlestick: Pehla candlestick ek lamba aur bearish (red or black) candle hota hai, jo current trend ko darust karta hai. Dusra Candlestick: Dusra candlestick ek small-sized candle hoti hai, jo pehle candlestick ke andar khulta hai aur opposite direction mein close hoti hai. Yadi pehla candlestick bearish hai, to dusra candlestick bullish hoti hai aur vice versa. Dusra candlestick ki body pehle candlestick ki body ke andar hoti hai, isse harami (pregnant) effect utpann hota hai. Interpretation of Harami Cross Pattern:

Pehla Candlestick: Pehla candlestick ek lamba aur bearish (red or black) candle hota hai, jo current trend ko darust karta hai. Dusra Candlestick: Dusra candlestick ek small-sized candle hoti hai, jo pehle candlestick ke andar khulta hai aur opposite direction mein close hoti hai. Yadi pehla candlestick bearish hai, to dusra candlestick bullish hoti hai aur vice versa. Dusra candlestick ki body pehle candlestick ki body ke andar hoti hai, isse harami (pregnant) effect utpann hota hai. Interpretation of Harami Cross Pattern: Harami Cross pattern bearish ya bullish trend mein ek potential reversal ya trend change ki suchna deta hai. Yadi Harami Cross pattern bearish trend ke baad aata hai, to yeh bullish reversal signal hota hai aur yadi yeh bullish trend ke baad aata hai, to yeh bearish reversal signal hota hai. Is pattern ke hone par traders ko future market movement ko dhyan se dekhkar buy ya sell ke nirnay par vichar karna chahiye. Mahatvapurn Baatein: Harami Cross pattern ki sapatikruti aur prabhavshilata ke liye ise anya technical indicators aur market analysis ke saath istemal karein. Is pattern ko confirm karne ke liye market context aur trend direction ka bhi mahatvapurna hai. Risk prabandhan ke liye stop-loss orders ka istemal karein, taki aap apne trading positions ko surakshit rakhein. Harami Cross Candlestick Pattern forex trading mein ek mahatvapurna pattern hai, lekin yeh hamesha sapatik nahi hota. Is pattern ko samajhne aur istemal karne se pahle, aapko doosre technical aur fundamental analysis tools ka bhi sahara lena chahiye.

Harami Cross pattern bearish ya bullish trend mein ek potential reversal ya trend change ki suchna deta hai. Yadi Harami Cross pattern bearish trend ke baad aata hai, to yeh bullish reversal signal hota hai aur yadi yeh bullish trend ke baad aata hai, to yeh bearish reversal signal hota hai. Is pattern ke hone par traders ko future market movement ko dhyan se dekhkar buy ya sell ke nirnay par vichar karna chahiye. Mahatvapurn Baatein: Harami Cross pattern ki sapatikruti aur prabhavshilata ke liye ise anya technical indicators aur market analysis ke saath istemal karein. Is pattern ko confirm karne ke liye market context aur trend direction ka bhi mahatvapurna hai. Risk prabandhan ke liye stop-loss orders ka istemal karein, taki aap apne trading positions ko surakshit rakhein. Harami Cross Candlestick Pattern forex trading mein ek mahatvapurna pattern hai, lekin yeh hamesha sapatik nahi hota. Is pattern ko samajhne aur istemal karne se pahle, aapko doosre technical aur fundamental analysis tools ka bhi sahara lena chahiye.

تبصرہ

Расширенный режим Обычный режим