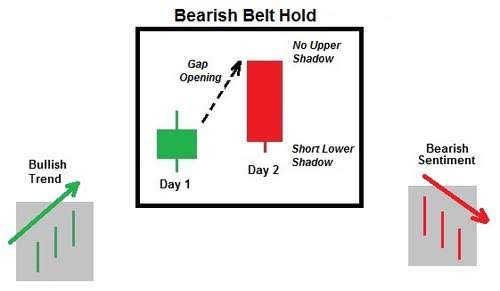

Yeh bearish dark cloud cowl, aur three un side down jaisay namonon ki doosri line ho sakti hai. Is soorat mein, ziyada ahem aik se ziyada linon par mushtamil patteren hai. Jab bearish belt preserve patteren aik bohat lambi candle se bantaa hai ( midday aakhri mother btyon ki ost lambai se teen gina ziyada ) to yeh aik bohat mazboot muzahmati sector bana sakta ha candle stick ko lambay asli jism ke sath bearish hona chahiye. Oopri saya kam se kam hona chahiye. Patteren up trained ke douran hona chahiye. Mazeed bar-aan, patteren mein aksar nichala saya hota hai jisay rujhan ke khilaaf" hain" rakha ja sakta hai ya khincha ja sakta hai, bilkul isi terhan jaisay belt patlon ke aik jore ko pakdae hue hai. Hum dekhte hain ke 27 July 2021 ko Apple ke yomiya buying and selling consultation ke douran bearish belt mein unmarried candle caught patteren mojood hai. Pachaas din ki saada moving common se oopar qeematon ke sath, murawaja rujhan taizi ka hai. Is ke baad hamein aik barri bearish candle nazar aati hai jis mein koi oopri vِokay aur thora sa neechay ka saya hota hai. Ab jab ke hum jantay hain ke is beari candle stuck patteren ko kaisay pehchana jaye, aayiyae behtareen tijarti hikmat amlyon par baat karte hain. Bearish belt hold candle stuck patteren ki tijarat kaisay karen. Adaad o shumaar se pata chalta hai ke taajiron ko riwayati hikmat ke bar aks karna chahiye aur 1 : five ke behtareen rissk praise ke sath mojooda rujhan ke tasalsul ki tawaqqa karte hue taizi ke tasalsul ki hikmat e amli ka istemaal karte hue patteren ki tijarat karni chahiye. Lekin is se pehlay ke hum aisa karen, aayiyae sekhen ke kis terhan ziyada tar tajir riwayati tor par mumkina taap patteren ki tijarat karte hain aur jantay hain ke belt preserve sign milnay par hamein waqai kya karna chahiye . Bearish Belt Hold Candlesticks Pattern

Bearish Belt Hold Candlesticks Pattern

Dear Bearish Belt Hold Candlesticks ma market aksar aspect trend ma hoti hai or kahe bar help or resistance ko hit karti hai but marketplace ik jis aspect par damage karti hahahe. Wo break chahe assist ko kary ya resistance ko dealer ko eski pehle affirmation karni chahe. Confirmation es sorat ma ho sakti hai ok market break karny wali route ma he ik candle ko entire kar ley. Asi circumstance ma dealer ko identical path ma trade ko 23.False Break in Bearish Belt Hold Candlesticks PatteTrader ko hamesa es bat ka khawal rakhna chahe okay marketplace aksar false get away b karti hai or trader agr asy fake escape ma pans jae to usko eska bhot nuksan ho sakta hai or uska account wash ho sakta hai. Jo dealer forex ma get away method ko use karty hain unko chahe k wo es pattern par focus karyn. Traders ko high-quality consequences k lae patterns k sath sath apna revel in b zarur make use of karna chahe tb he unko acha earnings hasil ho sakta hai or wo loss ay bach sakty hain. Serf patterns ko blindly follow karna kafi ni hota or trader es tarha bhot loss ma pans sakta hai kiu ok market ki motion friend buddy exchange hoti rehti hai. Tep by way of step commands to distinguish the terrible belt preserve candles design

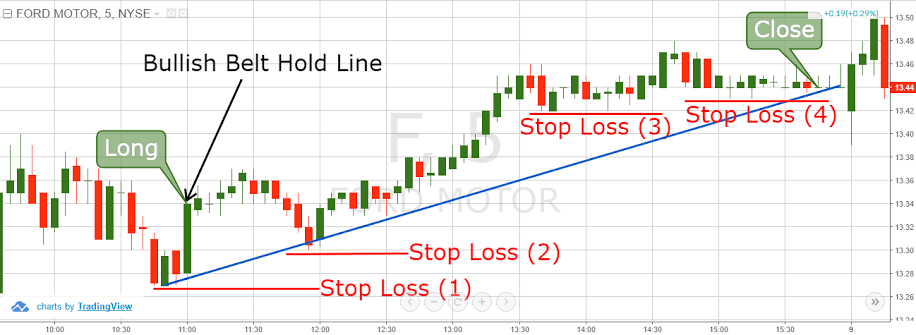

Tep by way of step commands to distinguish the terrible belt preserve candles design say belt patlon ke aik jore ko pakdae tint hai. Murmur dekhte hain ke 27 July 2021 ko Apple ke yomiya changing assembly ke douran negative belt mein unmarried flame stuck patteren mojood hai. Pachaas clamor ki saada shifting normal se oopar qeematon ke sath, murawaja rujhan taizi ka hai. Is ke baad hamein aik barri terrible candle nazar aati hai jis mein koi oopri vِokay aur thora sa neechay ka saya hota hai. Belly muscle punch ke murmur jantay hain ke is beari candle stuck patteren ko kaisay pehchana jaye, aayiyae behtareen tijarti hikmat amlyon preferred baat karte hain. Terrible belt maintain mild stuck patteren ki tijarat kaisay karen. Adaad o shumaar se pata chalta hai ke taajiron ko riwayati hikmat ke bar aks karna chahiye aur 1 : five ke behtareen rissk reward ke sath mojooda rujhan ke tasalsul ki tawaqqa karte coloration taizi ke tasalsul ki hikmat e amli ka istemaal karte tint patteren ki tijarat karni chahiye. Lekin is se pehlay ke murmur aisa karen, aayiyae sekhen ke kis terhan ziyada tar tajir riwayati pinnacle wellknown mumkina taap patteren ki tijarat karte hain aur jantay hain ke belt keep signal milnay fashionable hamein waqai kya karnarex, aur securities exchanges mein terrible belt rozana time span widespread flame stuck patteren ko thaamay tone hai. 50-clamor ke sma se oopar band hona aik oopri rujhan ko tashkeel deta hai. Mein ne 1 se five tak rissk reward ka tajurbah kya. Behtareen rissk praise fi baar munafe ka istemaal karte tone muntakhib kya jata hai. Dakhlay aur ikhraj ke baray mein oopar tijarat ke tareeqa automobile ke region mein behas ki gayi hai. Patteren signal ke youngster commotion ke andar tasdeeq honi chahiye .

say belt patlon ke aik jore ko pakdae tint hai. Murmur dekhte hain ke 27 July 2021 ko Apple ke yomiya changing assembly ke douran negative belt mein unmarried flame stuck patteren mojood hai. Pachaas clamor ki saada shifting normal se oopar qeematon ke sath, murawaja rujhan taizi ka hai. Is ke baad hamein aik barri terrible candle nazar aati hai jis mein koi oopri vِokay aur thora sa neechay ka saya hota hai. Belly muscle punch ke murmur jantay hain ke is beari candle stuck patteren ko kaisay pehchana jaye, aayiyae behtareen tijarti hikmat amlyon preferred baat karte hain. Terrible belt maintain mild stuck patteren ki tijarat kaisay karen. Adaad o shumaar se pata chalta hai ke taajiron ko riwayati hikmat ke bar aks karna chahiye aur 1 : five ke behtareen rissk reward ke sath mojooda rujhan ke tasalsul ki tawaqqa karte coloration taizi ke tasalsul ki hikmat e amli ka istemaal karte tint patteren ki tijarat karni chahiye. Lekin is se pehlay ke murmur aisa karen, aayiyae sekhen ke kis terhan ziyada tar tajir riwayati pinnacle wellknown mumkina taap patteren ki tijarat karte hain aur jantay hain ke belt keep signal milnay fashionable hamein waqai kya karnarex, aur securities exchanges mein terrible belt rozana time span widespread flame stuck patteren ko thaamay tone hai. 50-clamor ke sma se oopar band hona aik oopri rujhan ko tashkeel deta hai. Mein ne 1 se five tak rissk reward ka tajurbah kya. Behtareen rissk praise fi baar munafe ka istemaal karte tone muntakhib kya jata hai. Dakhlay aur ikhraj ke baray mein oopar tijarat ke tareeqa automobile ke region mein behas ki gayi hai. Patteren signal ke youngster commotion ke andar tasdeeq honi chahiye .

Dear Bearish Belt Hold Candlesticks ma market aksar aspect trend ma hoti hai or kahe bar help or resistance ko hit karti hai but marketplace ik jis aspect par damage karti hahahe. Wo break chahe assist ko kary ya resistance ko dealer ko eski pehle affirmation karni chahe. Confirmation es sorat ma ho sakti hai ok market break karny wali route ma he ik candle ko entire kar ley. Asi circumstance ma dealer ko identical path ma trade ko 23.False Break in Bearish Belt Hold Candlesticks PatteTrader ko hamesa es bat ka khawal rakhna chahe okay marketplace aksar false get away b karti hai or trader agr asy fake escape ma pans jae to usko eska bhot nuksan ho sakta hai or uska account wash ho sakta hai. Jo dealer forex ma get away method ko use karty hain unko chahe k wo es pattern par focus karyn. Traders ko high-quality consequences k lae patterns k sath sath apna revel in b zarur make use of karna chahe tb he unko acha earnings hasil ho sakta hai or wo loss ay bach sakty hain. Serf patterns ko blindly follow karna kafi ni hota or trader es tarha bhot loss ma pans sakta hai kiu ok market ki motion friend buddy exchange hoti rehti hai.

تبصرہ

Расширенный режим Обычный режим