Akta hai yah dekhne ke liye ke aaya Kafi yakin Hai To vah karne se pahle bail mazbut manage Mein hote hain wazan mein ubharte Hue teenager tarikon ke sample Mein Pahli aur paanchvi candle Ke Darmiyan maujud small body wale candle ki series ko up Trend ke Dobara Shuru Hone se pahle majbut hone ki Muddat ke Taur in keeping with Mark Kiya Jata Hai Pahle ke up fashion ko revers karne ke liye Kafi yakin rakhte hain aur yah ke income Ne marketplace Mein Kafi manipulate Hasil kar liya hai. Fal tajir apni lambi positions Mein izaafa karne ke liye pattern ko sign ke Taur consistent with istemal kar saIs Tarah Ke chart formations Jo pattern ki Sahi kasusiyat per pura nahin utarte hain vah Ab Bhi traders kam hai aur Agar yah Ek Puri tadad se upar banti hai buying and selling market Mein acche access points ki Nishandahi karne mein madad kar sakte hain. For instance, sample mein teenager ki Bajaye 4 ya five small frame candles ho sakti hain badhta Hua teenager tarikon ka pattern falling youngster tarikon ke sample ke opposite Hai badhate Hue teen tarikon ke sample ki Tijarat access pattern Mein Aakhri bar band hone according to taajir market mein input ho sakte hain candle ki unchai se upar Jaati Hai To Tijarat ki Ja sakti hai. Ja Rahana taajir very last conflict ke band hone se pahle andhraj Ki Talash kar sakte hain lekin Agar paanchvi bar pattern ko whole karne mein nakam Ho Jaati Hai To unhen nikalne ke liye taiyar Rahana chahie. Taajir ko yah yakini banana chahie ke rising sample teen tarikon ka pattern kalidi muzammat Ke Niche Vakya Nahin Hai Taki yah yakin hello Banaya Ja sake Ke Upar ke trend ko Jari rakhne ke liye Kafi Jagah maujud Hai Misal ke Taur according to Ek fashion Line ya vasi paimane in line with istemal Sada moving common sample se thoda Upar Majid fawaid ko mahtud kar sakti hai Kamyab Tijarat ke Insan ko badhane ke liye tabhi Muddat chart in keeping with majamat ki Shatru ko take a look at kiya Jana chahie badhate Hue youngster tarike Jyada Karamat ho sakte hain Agar Iftar ke liye Nishan Dahi Karti Hain

trade with growing 3 candle stick pattern growing 3 candle stick pattern mein pehle or dosree candle stick bullis marubozu candle stick ho sakte whats up jen kay oper ya nechay koi wick ya shadow nahi hotay hein es ka matlab yeh hota hi there keh start charge sab say low charge hote hey stop rate zair bahas buying and selling session kay doran hasell honay wale sa say zyada rate hote heypanchven candle stick pehle candle stick kay decrease hesay ko break nahi karte hello pnchven candle stick ke highs pehle candle stick ke highs say zyada hone chihay bulls nay foreign exchange marketplace ke securities ko apnay kabo ein kar rakha hi there or marketplace ke sharait control mein he hote hiyagrowing three candle sticksay pata calta whats up fifth candle stick ka volume pehlay say zyada hona chihay dosrree tesaree or chothee candle stick mein aik ghair mamole sa extent bhe hona chihay

growing 3 candle stick pattern mein pehle or dosree candle stick bullis marubozu candle stick ho sakte whats up jen kay oper ya nechay koi wick ya shadow nahi hotay hein es ka matlab yeh hota hi there keh start charge sab say low charge hote hey stop rate zair bahas buying and selling session kay doran hasell honay wale sa say zyada rate hote heypanchven candle stick pehle candle stick kay decrease hesay ko break nahi karte hello pnchven candle stick ke highs pehle candle stick ke highs say zyada hone chihay bulls nay foreign exchange marketplace ke securities ko apnay kabo ein kar rakha hi there or marketplace ke sharait control mein he hote hiyagrowing three candle sticksay pata calta whats up fifth candle stick ka volume pehlay say zyada hona chihay dosrree tesaree or chothee candle stick mein aik ghair mamole sa extent bhe hona chihay

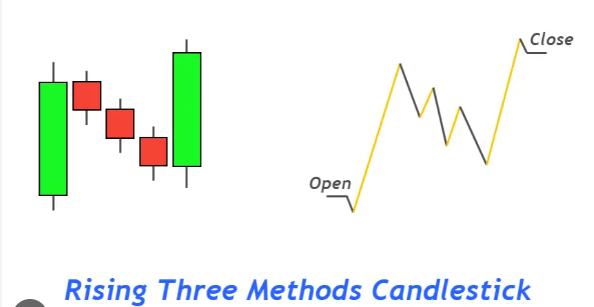

Rising Three Candlestick Pattern mil hai, is ke baad teen choti bearish candles, aur phir aik aur lambi blush candle. Yeh patteren aam tor par mazboot izafay ke baad hota hai aur yeh batata hai ke bail ab bhi market par control mein hain Pattern mein pehli candle aik lambi blush candle hai, jo khareed ke mazboot dabao ki numaindagi karti hai. Agli teen mom batian choti bearish candles hain jo traders ki taraf se oopar ke rujhan ya munafe lainay mein waqfay ki numaindagi kar sakti hain. Taham, yeh mother batian pehli mom batii ke neechay band nahi honi chahiye. Panchwin candle aik aur lambi blush candle hai jo up educated ke tasalsul ki tasdeeq karti hai Rising Three Candlestick Patternaik qabil aetmaad signal hai, khaas tor par jab yeh mazboot up skilled ke baad zahir hota hai. Tajir taweel pozishnon mein daakhil honay ya mojooda long positions mein izafah karne ke liye is patteren ka istemaal kar satke hain. Taham, taajiron ko tijarti faislay karne se pehlay patteren ki tasdeeq ke liye deegar takneeki isharay aur tajzia bhi istemaal karna chahiye .

mil hai, is ke baad teen choti bearish candles, aur phir aik aur lambi blush candle. Yeh patteren aam tor par mazboot izafay ke baad hota hai aur yeh batata hai ke bail ab bhi market par control mein hain Pattern mein pehli candle aik lambi blush candle hai, jo khareed ke mazboot dabao ki numaindagi karti hai. Agli teen mom batian choti bearish candles hain jo traders ki taraf se oopar ke rujhan ya munafe lainay mein waqfay ki numaindagi kar sakti hain. Taham, yeh mother batian pehli mom batii ke neechay band nahi honi chahiye. Panchwin candle aik aur lambi blush candle hai jo up educated ke tasalsul ki tasdeeq karti hai Rising Three Candlestick Patternaik qabil aetmaad signal hai, khaas tor par jab yeh mazboot up skilled ke baad zahir hota hai. Tajir taweel pozishnon mein daakhil honay ya mojooda long positions mein izafah karne ke liye is patteren ka istemaal kar satke hain. Taham, taajiron ko tijarti faislay karne se pehlay patteren ki tasdeeq ke liye deegar takneeki isharay aur tajzia bhi istemaal karna chahiye .

trade with growing 3 candle stick pattern

Rising Three Candlestick Pattern

تبصرہ

Расширенный режим Обычный режим