AOA

Introduction

Friends kya hal hain aapke ummid karta hun aap khairiyat se Honge Aaj is topic ko Ham discuss Karenge vah slippage yah Forex trading mein kitne important Hai Jab trading hoti hai aur isko Ham dusre Alfaaz mein sepping rate trading bhi kah sakte hain isko ham Kis Tarah use karte hain isko understand karne ki koshish karte hain Hamari train Behtar ho sake aur ham market Se Achcha profit Haseen kar sake

Details of slippage

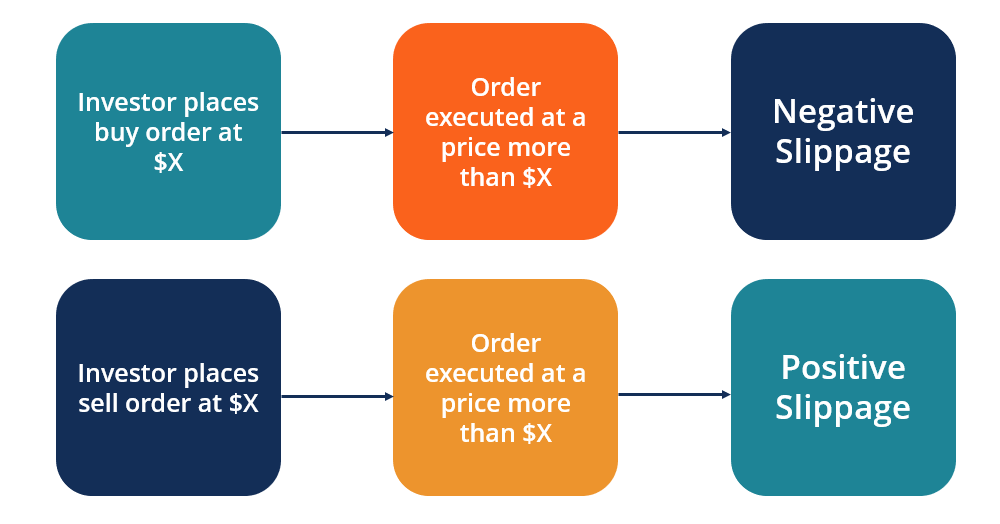

Slippage Forex trading Mein Ek common phenomenon Hai jismein trader ki order ke execution price mein kya hota hai yah gap usually market volatitly low liquidity ya market order ki position se creates Hota Hai iska matlab hai ki trader ko order use price per excuse Nahin Hua Jis price per vah use order ko place kar raha tha slippage ka level usually trader ki order size market condition aur broker ke execution Technology per depend Karta Hai slippage ka traders ky profit aur loss per Hota Hai jisse Hamari language mein price improvement Kahate Hain Ek situation Hoti Hai Jahan trader ka order execution price Uske expected price se behtar hota hai iska result Hota Hai ke trader ko Behtar Entry Aur exit point Milte Hain aur vah Jyada profit Hasil kar sakta hai isko opposite negative Se Jaise Hamare language mein price deterioration Kahate Hain Ek situation Hoti Hai Jahan trader ko order execution price Uske expected price se worse hoti hai iska result Hota Hai ke trader ko expected se kam profit Milta hai aur vah Jyada loss face karta hai

Slippage is ka level trader ke order type per bhi depend Karta Hai market order Mein slippage Ka risk sabse Jyada hota hai Kyunki yah order instant execution ke liyev hota hai aur execution price ke liye Koi guarantee Nahin Hoti Hai Kyunki yah order market Mein stop price take excuse hone ke liye hota hai aur Agar market price stock price se Gujar Jaati Hai To yah order ho sakta hai jo expected se bahut kam ho sakta hai slippage ka level broker ke execution speed or technology per depend karta hai agar broker Ek execution speed aur Technology speed aur Technology Jyada acchi hai to slippage iska level kam hota hai isliye trader ko broker selection Mein broker ki execution speed aur Technology ka bhi Dhyan Rakhna chahie Slippage se bachne ke liye trader ko Kuchh tips follow karna chahie sabse pahle traders ko high volatitly aur Low liquidity time mein trading se avoid karna chahie Kyunki is time mein slippage ka risk sabse Jyada Hota Hai dusri Baat trader ko limit orderuse karna chahie Jahan possible Ho Kyunki limit order se excution price per control rahata hai aur slippage ka risk kam hota hai third Baat trader Ko broker selection Mein execution speed aur Technology ko bhi mind Mein Rakhna chahie Jiske slippage Ka risk kam ho sake aur forth sabse important Baat trader ko trading strategy ko strictly karna chahie Agar trader strictly trading trade follow Karega to vah trading Mein consistancy La sakte hain aur slippage Ka risk kam ho sakta hai

Importance for tradersSlippage is a common phenomenon Hai jismein trader ke order ke excution price Mein gap hota hai slippage ka level trader ke order size market condition aur broker ke excution Technology per depend karta

Positive slippage traders ke profit ko improve kar sakta hai Jab Ke negative slippage trader ko expected se kam profit ya Jyada loss De sakta hai market order aur stop order Mein slippage is Ka risk sabse Jyada hota hai broker ki excution speed aur Technology bhi slippage is ka level per impact dalta hai isliye brokers selection mein bhi factor ko consider karna important hy Traders high volatitly or low liquidity Mein trading se avoid karna chahie Jahan slippage ka risk sabse Jyada Hota Hai limit orders ka use karna bhi trader ko sleepes ke bachne mein help kar sakta hai traders ko Citric trading follow karna chahie Jiski vajah se vah trading mein consistancy La sakte hain aur Slippage ka risk kam kar skating kar sakte hain hai

Introduction

Friends kya hal hain aapke ummid karta hun aap khairiyat se Honge Aaj is topic ko Ham discuss Karenge vah slippage yah Forex trading mein kitne important Hai Jab trading hoti hai aur isko Ham dusre Alfaaz mein sepping rate trading bhi kah sakte hain isko ham Kis Tarah use karte hain isko understand karne ki koshish karte hain Hamari train Behtar ho sake aur ham market Se Achcha profit Haseen kar sake

Details of slippage

Slippage Forex trading Mein Ek common phenomenon Hai jismein trader ki order ke execution price mein kya hota hai yah gap usually market volatitly low liquidity ya market order ki position se creates Hota Hai iska matlab hai ki trader ko order use price per excuse Nahin Hua Jis price per vah use order ko place kar raha tha slippage ka level usually trader ki order size market condition aur broker ke execution Technology per depend Karta Hai slippage ka traders ky profit aur loss per Hota Hai jisse Hamari language mein price improvement Kahate Hain Ek situation Hoti Hai Jahan trader ka order execution price Uske expected price se behtar hota hai iska result Hota Hai ke trader ko Behtar Entry Aur exit point Milte Hain aur vah Jyada profit Hasil kar sakta hai isko opposite negative Se Jaise Hamare language mein price deterioration Kahate Hain Ek situation Hoti Hai Jahan trader ko order execution price Uske expected price se worse hoti hai iska result Hota Hai ke trader ko expected se kam profit Milta hai aur vah Jyada loss face karta hai

Slippage is ka level trader ke order type per bhi depend Karta Hai market order Mein slippage Ka risk sabse Jyada hota hai Kyunki yah order instant execution ke liyev hota hai aur execution price ke liye Koi guarantee Nahin Hoti Hai Kyunki yah order market Mein stop price take excuse hone ke liye hota hai aur Agar market price stock price se Gujar Jaati Hai To yah order ho sakta hai jo expected se bahut kam ho sakta hai slippage ka level broker ke execution speed or technology per depend karta hai agar broker Ek execution speed aur Technology speed aur Technology Jyada acchi hai to slippage iska level kam hota hai isliye trader ko broker selection Mein broker ki execution speed aur Technology ka bhi Dhyan Rakhna chahie Slippage se bachne ke liye trader ko Kuchh tips follow karna chahie sabse pahle traders ko high volatitly aur Low liquidity time mein trading se avoid karna chahie Kyunki is time mein slippage ka risk sabse Jyada Hota Hai dusri Baat trader ko limit orderuse karna chahie Jahan possible Ho Kyunki limit order se excution price per control rahata hai aur slippage ka risk kam hota hai third Baat trader Ko broker selection Mein execution speed aur Technology ko bhi mind Mein Rakhna chahie Jiske slippage Ka risk kam ho sake aur forth sabse important Baat trader ko trading strategy ko strictly karna chahie Agar trader strictly trading trade follow Karega to vah trading Mein consistancy La sakte hain aur slippage Ka risk kam ho sakta hai

Importance for tradersSlippage is a common phenomenon Hai jismein trader ke order ke excution price Mein gap hota hai slippage ka level trader ke order size market condition aur broker ke excution Technology per depend karta

Positive slippage traders ke profit ko improve kar sakta hai Jab Ke negative slippage trader ko expected se kam profit ya Jyada loss De sakta hai market order aur stop order Mein slippage is Ka risk sabse Jyada hota hai broker ki excution speed aur Technology bhi slippage is ka level per impact dalta hai isliye brokers selection mein bhi factor ko consider karna important hy Traders high volatitly or low liquidity Mein trading se avoid karna chahie Jahan slippage ka risk sabse Jyada Hota Hai limit orders ka use karna bhi trader ko sleepes ke bachne mein help kar sakta hai traders ko Citric trading follow karna chahie Jiski vajah se vah trading mein consistancy La sakte hain aur Slippage ka risk kam kar skating kar sakte hain hai

تبصرہ

Расширенный режим Обычный режим