Inverted Hammer candlestick pattern ka Introduction

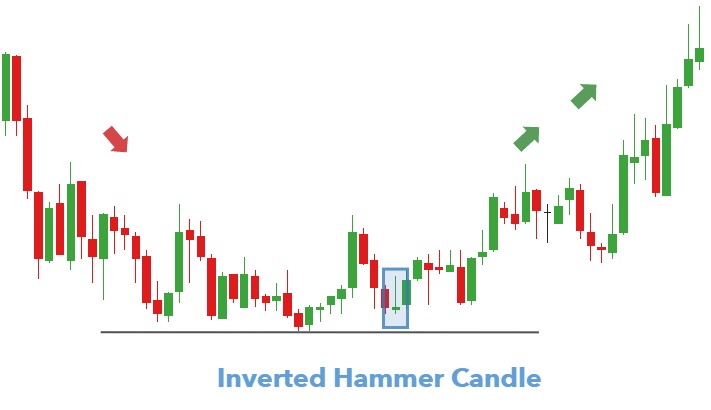

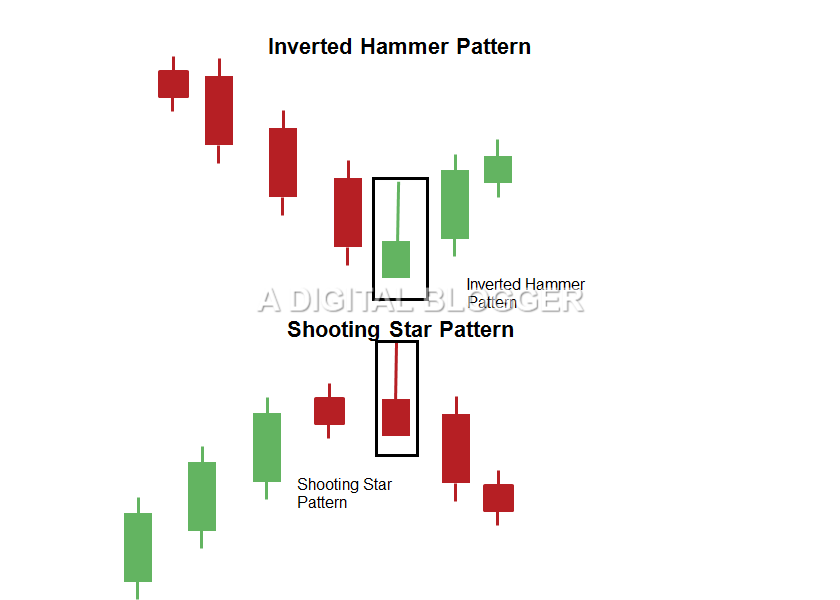

Forex trading main ulta hathora candle stuck patteren aik takneeki tajzia ka tool hai jo maliyati mandiyon mein taajiron aur sarmaya karon ko mumkina rujhan ki tabdeelion ki nishandahi karne mein madad karta hai. yeh aik taizi ka namona hai jis ki khasusiyat aik lambi vِk aur aik chhota sa jism hai jo candle stuck ke neechay waqay hai .ulta hathora patteren is waqt bantaa hai jab iftitahi qeemat ikhtitami qeemat se kam hoti hai, aur mom batii ki onche qeemat iftitahi aur ikhtitami qeematon se numaya tor par oopar hoti hai. candle stuck ki kam qeemat aam tor par iftitahi qeemat ke qareeb ya isi satah par hoti hai .

Inverted Hammer Candlestick Pattern ki Explaination

Forex market main tajir aur sarmaya car aam tor par ultay hathoray ke patteren ka istemaal neechay ke rujhan mein mumkina rujhan ke ulat jane ki nishandahi karne ke liye karte hain. lambi vِk kam qeematon ko mustard karne ki numaindagi karti hai, aur candle stuck ke nichale hissay mein chhota sa jism zahir karta hai ke khredar farokht ke dabao ke bawajood qeemat ko ouncha karne ke qabil thay .ultay hathoray ke patteren ke baray mein aik ahem baat yeh hai ke usay taizi ke signal ki mazbooti ki tasdeeq ke liye aala tijarti hajam ke sath hona chahiye. ziyada tijarti hajam is baat ki nishandahi karta hai ke market mein kharidari ki mazboot dilchaspi hai, jo taizi ke ریورسل signal ki durustagi ki tasdeeq mein madad kar sakti hai .

Inverted Hammer Candlestick Pattern ka Istemal

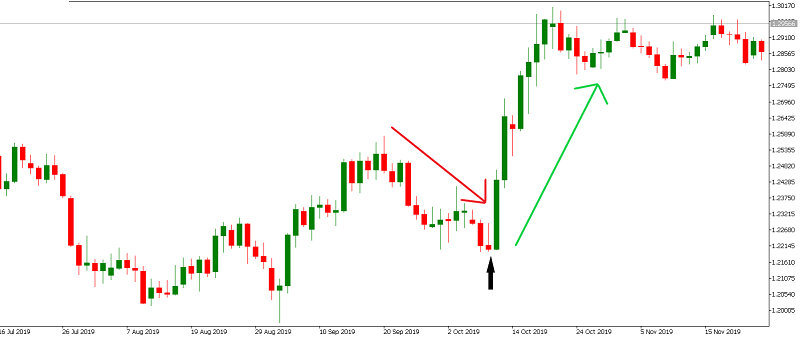

Forex market main ultay hathoray ka patteren istemaal karte waqt aik aur ahem baat woh sayaq o Sabaq hai jis mein yeh zahir hota hai. taajiron aur sarmaya karon ko chahiye ke woh patteren talaash karen jo taweel kami ke rujhan ke baad ya istehkaam ki muddat ke douran zahir ho. is se is imkaan ko badhaane mein madad millti hai ke patteren haqeeqi rujhan ko tabdeel karne ka ishara day raha hai .agar ulta hathora patteren up trained ke tanazur mein zahir hota hai, to yeh ulat signal ki terhan qabil aetmaad nahi ho sakta hai. is soorat mein, yeh haqeeqi ulat palat ke bajaye mehez aik earzi tawaquf ya rujhan mein istehkaam ki nishandahi kar sakta hai .

Trading Strategy with Pattern

ultay hathoray ke patteren ke sath tijarat karte waqt, taajiron aur sarmaya karon ko apni pozishnon ko munazzam karne ke liye rissk managment ki munasib taknik istemaal karni chahiye. is mein mumkina nuqsanaat ko mehdood karne ke liye stop las orders tarteeb dena shaamil ho sakta hai agar tijarat tawaqqa ke mutabiq nahi hoti hai .aakhir mein, ulta hathora patteren aik taizi se ریورسل patteren hai jo mumkina rujhan ki tabdeelion ki nishandahi karne mein taajiron aur sarmaya karon ke liye aik mufeed tool saabit ho sakta hai. taham, is sayaq o Sabaq par ghhor karna zaroori hai jis mein patteren zahir hota hai aur patteren ki bunyaad par tijarat karte waqt rissk managment ki munasib taknik istemaal karna zaroori hai .

Forex trading main ulta hathora candle stuck patteren aik takneeki tajzia ka tool hai jo maliyati mandiyon mein taajiron aur sarmaya karon ko mumkina rujhan ki tabdeelion ki nishandahi karne mein madad karta hai. yeh aik taizi ka namona hai jis ki khasusiyat aik lambi vِk aur aik chhota sa jism hai jo candle stuck ke neechay waqay hai .ulta hathora patteren is waqt bantaa hai jab iftitahi qeemat ikhtitami qeemat se kam hoti hai, aur mom batii ki onche qeemat iftitahi aur ikhtitami qeematon se numaya tor par oopar hoti hai. candle stuck ki kam qeemat aam tor par iftitahi qeemat ke qareeb ya isi satah par hoti hai .

Inverted Hammer Candlestick Pattern ki Explaination

Forex market main tajir aur sarmaya car aam tor par ultay hathoray ke patteren ka istemaal neechay ke rujhan mein mumkina rujhan ke ulat jane ki nishandahi karne ke liye karte hain. lambi vِk kam qeematon ko mustard karne ki numaindagi karti hai, aur candle stuck ke nichale hissay mein chhota sa jism zahir karta hai ke khredar farokht ke dabao ke bawajood qeemat ko ouncha karne ke qabil thay .ultay hathoray ke patteren ke baray mein aik ahem baat yeh hai ke usay taizi ke signal ki mazbooti ki tasdeeq ke liye aala tijarti hajam ke sath hona chahiye. ziyada tijarti hajam is baat ki nishandahi karta hai ke market mein kharidari ki mazboot dilchaspi hai, jo taizi ke ریورسل signal ki durustagi ki tasdeeq mein madad kar sakti hai .

Inverted Hammer Candlestick Pattern ka Istemal

Forex market main ultay hathoray ka patteren istemaal karte waqt aik aur ahem baat woh sayaq o Sabaq hai jis mein yeh zahir hota hai. taajiron aur sarmaya karon ko chahiye ke woh patteren talaash karen jo taweel kami ke rujhan ke baad ya istehkaam ki muddat ke douran zahir ho. is se is imkaan ko badhaane mein madad millti hai ke patteren haqeeqi rujhan ko tabdeel karne ka ishara day raha hai .agar ulta hathora patteren up trained ke tanazur mein zahir hota hai, to yeh ulat signal ki terhan qabil aetmaad nahi ho sakta hai. is soorat mein, yeh haqeeqi ulat palat ke bajaye mehez aik earzi tawaquf ya rujhan mein istehkaam ki nishandahi kar sakta hai .

Trading Strategy with Pattern

ultay hathoray ke patteren ke sath tijarat karte waqt, taajiron aur sarmaya karon ko apni pozishnon ko munazzam karne ke liye rissk managment ki munasib taknik istemaal karni chahiye. is mein mumkina nuqsanaat ko mehdood karne ke liye stop las orders tarteeb dena shaamil ho sakta hai agar tijarat tawaqqa ke mutabiq nahi hoti hai .aakhir mein, ulta hathora patteren aik taizi se ریورسل patteren hai jo mumkina rujhan ki tabdeelion ki nishandahi karne mein taajiron aur sarmaya karon ke liye aik mufeed tool saabit ho sakta hai. taham, is sayaq o Sabaq par ghhor karna zaroori hai jis mein patteren zahir hota hai aur patteren ki bunyaad par tijarat karte waqt rissk managment ki munasib taknik istemaal karna zaroori hai .

تبصرہ

Расширенный режим Обычный режим