Assalamu Alaikum Dosto!

Double Bottom Chart Pattern

Double Bottom chart pattern, bearish trend reversal ke baad bullish trend ko represent karta hai. Yeh ek popular price action chart pattern hai, jo traders dwaara Forex aur stock market mein use kiya jaata hai. Double Bottom chart pattern ki formation ko identify karne ke baad, traders is pattern ke hisaab se apni trading strategies set karte hain.

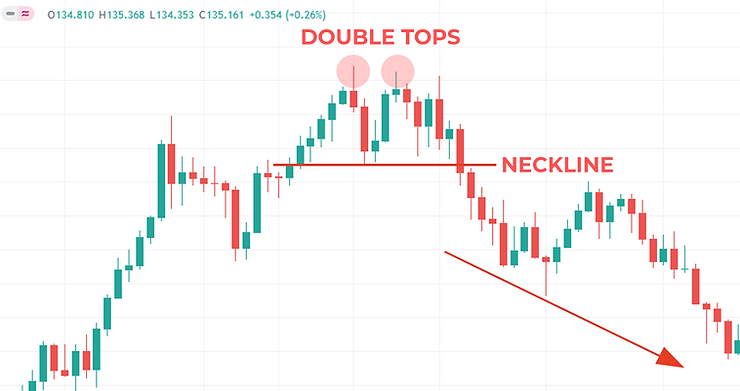

Double Bottom chart pattern ki formation 2 consecutive bottoms se hoti hai. Jab price pehli baar bottom par aata hai, toh ek support level ban jaata hai. Jab price us support level se rebound karta hai, toh traders ko iski movement closely observe karna chahiye. Agar price fir se ek bottom banaata hai, jo pehle ke bottom ke near hi hota hai, toh yeh ek Double Bottom chart pattern ki formation hai.

Double Bottom chart pattern ki formation complete hone ke baad, price bullish trend mein move karta hai. Double Bottom chart pattern ke 2 bottoms ke beech, resistance level hota hai. Agar price level resistance level ko break kar deta hai, toh traders long positions enter karte hain. Is pattern ko trade karne ke liye, traders ko entry, stop loss aur take profit positions ko carefully set karna chahiye.

Pattern Formation

Double Bottom chart pattern ki formation ko identify karne ke baad, traders is pattern ke hisaab se apni trading strategies set karte hain. Yeh ek reliable pattern hai, jise traders zarye Forex aur stock market mein use kiya jaata hai. Yeh pattern complete hone ke baad, price bullish trend mein move karta hai. Double Bottom chart pattern ki formation ke points niche diye jaate hain:

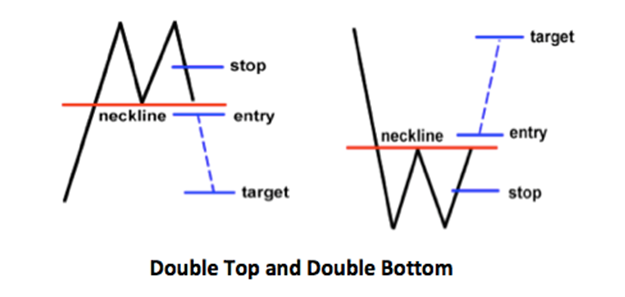

- Pehla Bottom:

Double Bottom chart pattern ki formation ke pehle step mein, price down trend mein hota hai aur ek bottom banata hai. Ye bottom support level ki tarah work karta hai aur price ke further down hone se rokta hai. - Rebound:

Jab price pehle bottom par aata hai, toh ek support level ban jaata hai. Jab price us support level se rebound karta hai, toh traders ko iski movement closely observe karna chahiye. Agar price upper movement karta hai, toh traders ko iski movement ko follow karna chahiye, kyunki yeh ek Double Bottom chart pattern ki formation ka pehla sign hai. - Dusra Bottom:

Jab price rebound karta hai, toh ek resistance level ban jaata hai. Agar price fir se down hone lagta hai aur support level ke near ek aur bottom banata hai, jo pehle ke bottom ke near hi hota hai, toh yeh ek Double Bottom chart pattern ki formation ka second sign hai. - Resistance Level:

Double Bottom chart pattern mein, 2 bottoms ke beech resistance level hota hai. Jab price level resistance level ko break kar deta hai, toh traders long positions enter karte hain. Is pattern ko trade karne ke liye, traders ko entry, stop loss aur take profit positions ko carefully set karna chahiye. - Volume:

Double Bottom chart pattern ki formation ke dauran volume ko bhi closely observe karna chahiye. Jab price rebound karta hai, toh volume bhi increase hone lagta hai. Agar doosre bottom ki formation ke dauran volume first bottom se kam rehta hai, toh yeh Double Bottom chart pattern ki validity ko khatre mein daal sakta hai. - Time Frame:

Double Bottom chart pattern ki formation, long time frame mein hone ke chances zyada hote hain. Is pattern ko identify karne ke liye, traders ko chart ko carefully analyze karna chahiye aur multiple time frames par iski validity ko confirm karna chahiye.

Double Bottom Strategies

Double Bottom chart pattern mein price ek support level create karta hai, phir us level ko break karne ki koshish karta hai aur phir wapas neechay jaata hai lekin dobara support level ko touch karta hai, jisse pattern ko complete kiya jaata hai. Is pattern ko identify karna traders ke liye profitable ho sakta hai kyunki isse price ki bullish movement ki expectation hoti hai.

Yahaan kuch Double Bottom chart pattern ki trading strategies batayi gayi hain:

- Confirm the pattern:

Double Bottom pattern identify karne ke liye, pehle price ke upar wale support level ko dekha jaata hai. Agar price ek baar neechay jaata hai aur fir dubaara support level ko touch kar ke upar jaata hai, to ye ek Double Bottom pattern ka indication hai. Iske baad traders ko confirm karna hota hai ki pattern sahi hai ya nahi. Agar pattern sahi hai, to traders buy positions open kar sakte hain. - Entry and stop loss:

Double Bottom pattern mein entry point support level ko break karne ke baad hota hai. Entry point ke baad stop loss ka level bhi set kiya jaana chahiye, jisse trader ko losses se bachne ki possibility hoti hai. - Take profit:

Take profit level ko set karna bahut important hai. Iske liye traders ko support level ka distance calculate karke target level set karna hota hai. Traders ko target level set karte waqt, risk aur reward ke ratio ko dhyaan mein rakhna chahiye. - Use other indicators:

Double Bottom pattern ko confirm karne ke liye, traders ko other indicators ka use karna chahiye, jaise ki volume aur momentum indicators. In indicators ki help se traders ko ye pata chalta hai ki bullish movement strong hai ya nahi. - Risk management:

Double Bottom pattern ki trading strategies ke saath sahi risk management ka use karna bahut important hai. Traders ko apne risk ko manage karna chahiye aur unhe apne trade ke liye ek plan bana lena chahiye, jisse wo losses se bach sakte hain.

Trading

Double Bottom chart pattern ke saath sahi knowledge aur experience ka use karna bahut important hai. Traders ko market ke movements aur news par bhi dhyaan dena chahiye, jisse wo apne trading strategies ko sahi tareeke se modify kar sakte hain. Iske alawa, traders ko apne trading plan ko regularly review karna chahiye, taki wo sahi aur profitable trading decisions le sake.

- Entry point:

Double Bottom chart pattern mein entry point support level ko break karne ke baad hota hai. Traders ko confirm karna chahiye ki pattern sahi hai ya nahi, phir unhe buy positions open karni chahiye. - Stop loss:

Stop loss level ko set karna bahut important hai. Double Bottom chart pattern mein stop loss level neeche wale support level ke thoda neeche set kiya jaata hai, jisse trader ko losses se bachne ki possibility hoti hai. - Take profit:

Take profit level ko set karna bahut important hai. Iske liye traders ko support level ka distance calculate karke target level set karna hota hai. Traders ko target level set karte waqt, risk aur reward ke ratio ko dhyaan mein rakhna chahiye. - Exit point:

Traders ko exit point set karna bahut important hai. Agar price target level ko touch karne ke baad wapas neechay jaata hai, to traders ko exit kar dena chahiye. Agar price target level ko cross karke upar jaata hai, to traders ko take profit level ke paas apni positions ko close kar dena chahiye.

تبصرہ

Расширенный режим Обычный режим