Stop Loss Order:

Stop loss order aik qisam ka order hota hai jo aik brokr ke paas security farokht karne ke liye diya jata hai jab yeh aik khaas qeemat tak pahonch jata hai, taakay tajir ke nuqsaan ko mehdood kya ja sakay agar market un ke khilaaf harkat karti hai. yeh tool un taajiron ke liye mufeed hai jo –apne manfi khatray ko mehdood karna chahtay hain aur –apne tijarti sarmaye ki hifazat karna chahtay hain. stop loss set kar ke, tajir –apne nuqsanaat ko kam kar satke hain aur barray dara down se bach satke hain .

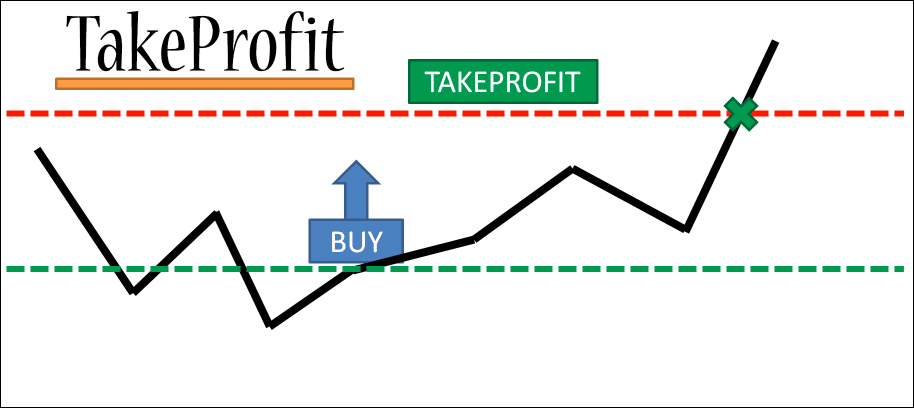

Take Profit:

take profit aik aisa order hai jo aik brokr ke sath diya jata hai jab woh kisi khaas qeemat tak pahonch jata hai to is ko farokht karne ke liye, munafe ko band karne ke liye. yeh tool un taajiron ke liye mufeed hai jo munafe haasil karna chahtay hain aur mumkina munafe se mahroom honay se bachna chahtay hain. take profit set kar ke, tajir is baat ko yakeeni bana satke hain ke woh pehlay se tay shuda munafe ke sath tijarat se bahar nikleen, bajaye is ke ke un fawaid ko barqarar rakhen aur mumkina tor par kho den .

stop loss aur take profit use karne ke fawaid mein shaamil hain.

Risk Management :

stop loss ko mehdood karne aur tijarti sarmaye ki hifazat mein madad karta hai, jabkay take profit munafe ko band karne aur munafe wapas dainay se bachney mein madad karta hai . nuqsaan ko rokain aur munafe len tijarat mein aam tor par use honay walay do tools hain jo taajiron ko –apne khatray ko sambhalay aur munafe bakhash tijarat karne ke imkanaat ko badhaane mein madad kar satke hain.

Discipline:

stop loss aur take profit ke liye pehlay se tay shuda sthin tay kar ke, tajir jazbati faisla karne se bach satke hain aur –apne tijarti mansoobay par qaim reh satke hain .

Efficiency:

nuqsaan ko roknay aur munafe lainay ke orders pehlay se jari kiye ja satke hain, jis se tajir apni pozishnon ki musalsal nigrani kiye baghair apni tijarti hikmat e amli ke deegar pehluo par tawajah markooz kar satke hain .majmoi tor par, stop lossaur take profit ka use taajiron ke liye –apne khatray ko sambhalay aur marketon mein kamyabi ke imkanaat ko badhaane ka aik muaser tareeqa ho sakta hai .

تبصرہ

Расширенный режим Обычный режим