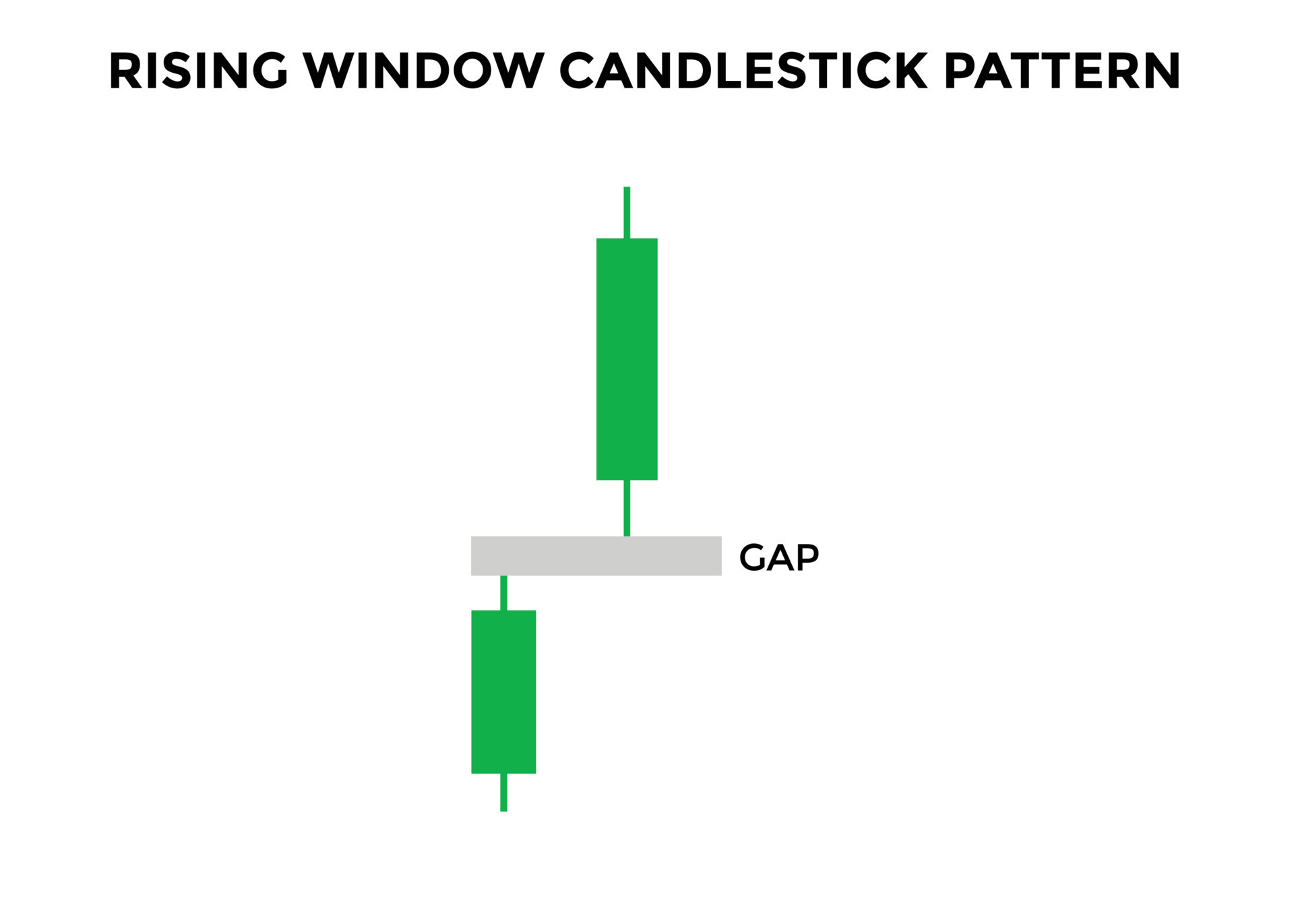

Candlestick Patterns: Rising Window (Barq Pattern)

1. Tareef: Rising Window, jo Barq Pattern ke naam se bhi jana jata hai, ek bullish continuation candlestick pattern hai jo market mein uptrend ke doran aata hai. Ye pattern gap up opening ke saath shuru hota hai, jismein current session ki opening price pehle session ki closing price se oonchi hoti hai. Is pattern mein price ka rapid increase hota hai jo market ke bullish momentum ko darust karta hai.

2. Ahmiyat:

- Continuation Signal: Rising Window pattern bullish trend ke continuation ka signal deta hai. Ye pattern uptrend ke doran aksar dekha jata hai aur indicate karta hai ke market mein bullish momentum ab bhi jari hai.

- Volume ka Darust Karna: Is pattern ke saath high volume ka saath hone par, iski reliability aur bhi zyada hoti hai. High volume ke saath Rising Window dekhna, market mein strong buying interest ko darust karta hai.

- Entry aur Exit Points: Traders Rising Window pattern ko entry aur exit points ke taur par istemal karte hain. Agar kisi trend ke doran Rising Window dekha jata hai, toh traders existing positions ko hold kar sakte hain ya phir naye long positions enter kar sakte hain.

3. Istemal:

- Trend Confirmation: Rising Window pattern uptrend ki confirmation ke liye istemal kiya jata hai. Agar market mein uptrend hai aur Rising Window dekha jata hai, toh yeh bullish trend ka continuation darust karta hai.

- Swing Trading: Swing traders Rising Window pattern ko trend ka continuation signal ke roop mein istemal karte hain. Jab market mein bullish momentum hai aur Rising Window dekha jata hai, toh swing traders long positions enter kar sakte hain.

تبصرہ

Расширенный режим Обычный режим