Up side tasuki gap pattern

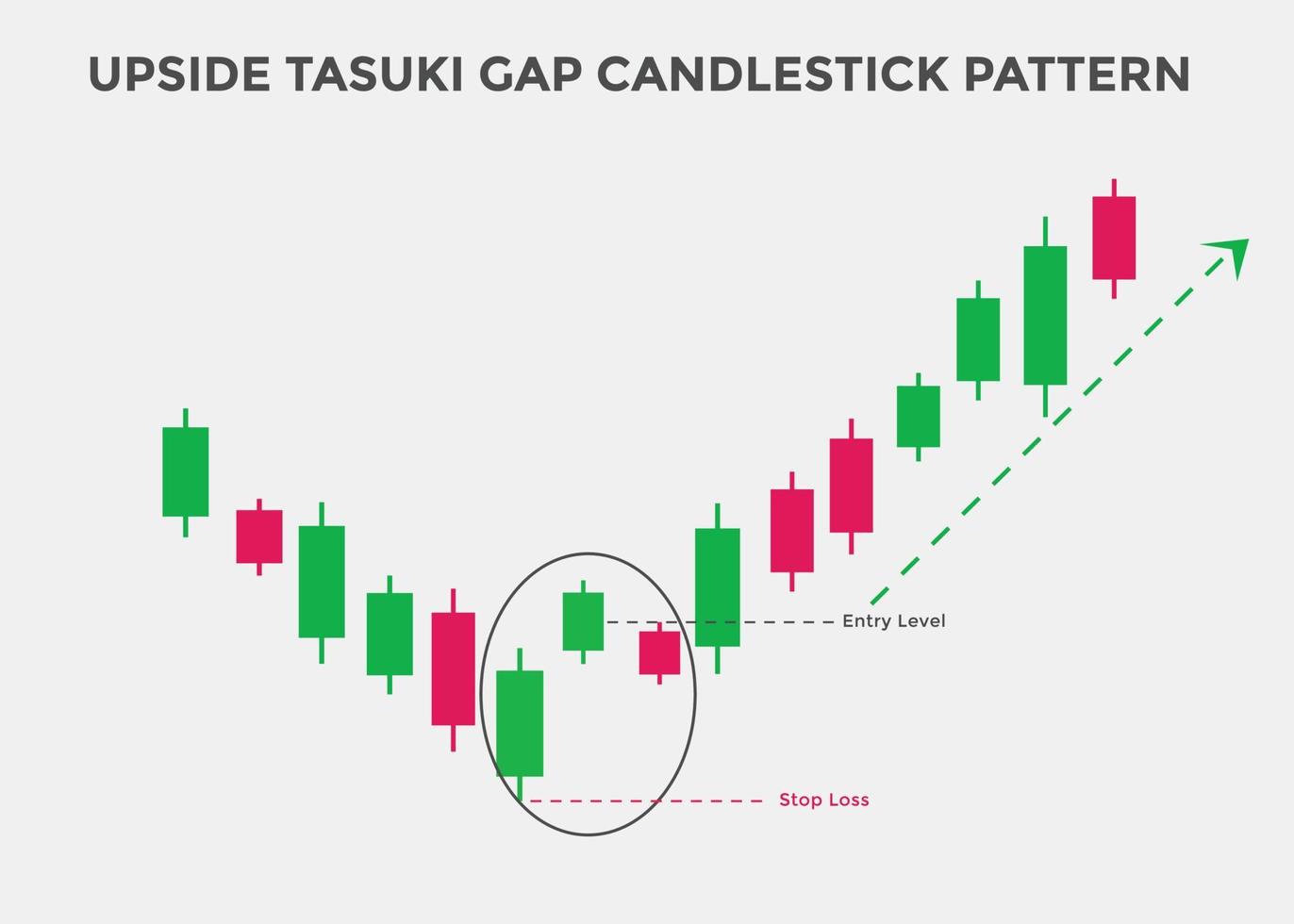

Up side tasuki gape pattern aik takneeki tajzia pattern hai jo stock market trading mein mumkina taizi ke rujhanaat ki nishandahi karne ke liye istemaal hota hai. Yeh teen shama daan par mushtamil hai jo pehli aur teesri shama ke darmiyan faasla banati hai. Pehli candle stuck taizi ki hai aur pichlle din ki bandish ke oopar khulti hai, jabkay doosri candle stick bearish hai aur pehli candle stuck ke khulay ke neechay band hoti hai. Teesri candle stick taizi se hai aur doosri candle stick ke qareeb se oopar khulti hai, jo is baat ki nishandahi karti hai ke taizi ka rujhan jari reh sakta hai . Is pattern ko taizi ki raftaar ka aik qabil aetmaad ishara samjha jata hai, lekin taajiron ko tijarti faisla karne se pehlay deegar awamil jaisay hajam aur market ke majmoi rujhanaat par bhi ghhor karna chahiye . Is mazmoon mein, hum up side tasuki gape pattern par tafseel se baat karen ge, bashmole is ki tashkeel, tashreeh, tijarti hikmat e amli, aur mumkina nuqsanaat .

Up side tasuki gap pattern ki tashkeel

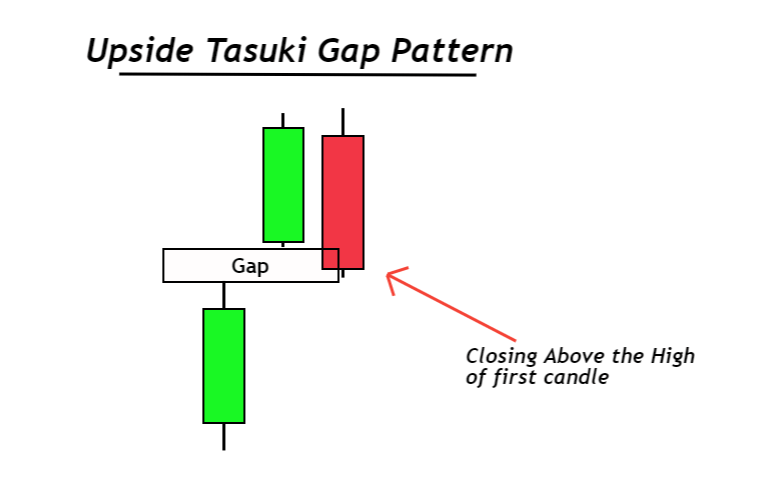

Jaisa ke pehlay zikar kiya gaya hai, up side tasuki gape pattern teen mom btyon par mushtamil hai. Pehli candle stick taizi ki hai aur pichlle din ke band se oopar khulti hai, jo is baat ki nishandahi karti hai ke khredar market par control mein hain. Doosri candle stick bearish hai aur pehli candle stuck ke band ke oopar khulti hai lekin is ke khulay se neechay band hoti hai, is baat ki nishandahi karti hai ke baichnay walon ne market ka control sambhaal liya hai. Pehli aur doosri mom batii ke darmiyan farq ko tasuki gape ke naam se jana jata hai . Teesra candle stuck taiz hai aur doosri candle stuck ke qareeb se oopar khulti hai, jo is baat ki nishandahi karti hai ke kharidaron ne market par dobarah control haasil kar liya hai. Agar teesri candle stuck doosri candle stuck ke khilnay ke oopar band ho jati hai to taizi ke rujhan ki tasdeeq ho jati hai .

Up side tasuki gap pattern ki tashreeh

Up side tasuki gape pattern ko taizi ke ulat pattern ke tor par samjha jata hai, jo is baat ki nishandahi karta hai ke shayad mandi ka rujhan khatam ho raha hai, aur aik naya taizi ka rujhan shuru ho sakta hai. Traders is pattern ko is waqt talaash kar satke hain jab koi stock neechay ke rujhaan mein ho, aur woh samajte hain ke yeh simt ko tabdeel karne ke liye tayyar ho sakta hai . Pattern se pata chalta hai ke doosri aur teesri mom batii ke darmiyan istehkaam ki aik mukhtasir muddat hosakti hai, jis ke douran khredar aur baichnay walay market par control ke liye muqaabla kar rahay hain. Taham, agar teesri candle stuck doosri candle stuck ke qareeb se oopar khulti hai, to yeh batata hai ke kharidaron ne market par dobarah control haasil kar liya hai, aur taizi ka rujhan jari reh sakta hai . Taajiron ko upside tasuki gap pattern ki bunyaad par tijarti faisla karne se pehlay deegar awamil, jaisay hajam aur majmoi market ke rujhanaat par ghhor karna chahiye .

Up side tasuki gape pattern ke liye tijarti hikmat e amli

Tajir up side tasuki gape pattern ko signal ke tor par istemaal kar satke hain taakay woh stock khareed saken jis ke baray mein un ka khayaal hai ke is ki qader kam hai aur woh taizi ke ulat jane ke liye tayyar hai. Taham, inhen tijarti faisla karne se pehlay deegar awamil, jaisay hajam aur market ke majmoi rujhanaat par bhi ghhor karna chahiye . Aik mumkina tijarti hikmat e amli taizi ke rujhan ki tasdeeq karte hue doosri candle stuck ke khulay hue oopar teesri candle stuck ke band honay ka intzaar karna hai. Is ke baad tajir aik lambi position mein daakhil ho satke hain aur agar rujhan jari nahi rehta hai to mumkina nuqsanaat ko mehdood karne ke liye stap las order set kar satke hain . Doosri hikmat e amli yeh hai ke teesri candle stuck doosri candle stuck ke khilnay ke oopar band honay ke baad wapsi ka intzaar karen. Tajir pal back ke baad lambi position mein daakhil ho satke hain aur mumkina nuqsanaat ko mehdood karne ke liye stap las order set kar satke hain . Taajiron ko up side tasuki gape pattern par mabni tijarti faisla karne se pehlay market ke majmoi rujhan par bhi ghhor karna chahiye. Agar majmoi tor par market ka rujhan mandi ka shikaar hai, to taweel position mein daakhil honay se pehlay aik tasdeeq shuda taizi ke rujhan ka intzaar karna behtar hoga .

Up side tasuki gape pattern aik takneeki tajzia pattern hai jo stock market trading mein mumkina taizi ke rujhanaat ki nishandahi karne ke liye istemaal hota hai. Yeh teen shama daan par mushtamil hai jo pehli aur teesri shama ke darmiyan faasla banati hai. Pehli candle stuck taizi ki hai aur pichlle din ki bandish ke oopar khulti hai, jabkay doosri candle stick bearish hai aur pehli candle stuck ke khulay ke neechay band hoti hai. Teesri candle stick taizi se hai aur doosri candle stick ke qareeb se oopar khulti hai, jo is baat ki nishandahi karti hai ke taizi ka rujhan jari reh sakta hai . Is pattern ko taizi ki raftaar ka aik qabil aetmaad ishara samjha jata hai, lekin taajiron ko tijarti faisla karne se pehlay deegar awamil jaisay hajam aur market ke majmoi rujhanaat par bhi ghhor karna chahiye . Is mazmoon mein, hum up side tasuki gape pattern par tafseel se baat karen ge, bashmole is ki tashkeel, tashreeh, tijarti hikmat e amli, aur mumkina nuqsanaat .

Up side tasuki gap pattern ki tashkeel

Jaisa ke pehlay zikar kiya gaya hai, up side tasuki gape pattern teen mom btyon par mushtamil hai. Pehli candle stick taizi ki hai aur pichlle din ke band se oopar khulti hai, jo is baat ki nishandahi karti hai ke khredar market par control mein hain. Doosri candle stick bearish hai aur pehli candle stuck ke band ke oopar khulti hai lekin is ke khulay se neechay band hoti hai, is baat ki nishandahi karti hai ke baichnay walon ne market ka control sambhaal liya hai. Pehli aur doosri mom batii ke darmiyan farq ko tasuki gape ke naam se jana jata hai . Teesra candle stuck taiz hai aur doosri candle stuck ke qareeb se oopar khulti hai, jo is baat ki nishandahi karti hai ke kharidaron ne market par dobarah control haasil kar liya hai. Agar teesri candle stuck doosri candle stuck ke khilnay ke oopar band ho jati hai to taizi ke rujhan ki tasdeeq ho jati hai .

Up side tasuki gap pattern ki tashreeh

Up side tasuki gape pattern ko taizi ke ulat pattern ke tor par samjha jata hai, jo is baat ki nishandahi karta hai ke shayad mandi ka rujhan khatam ho raha hai, aur aik naya taizi ka rujhan shuru ho sakta hai. Traders is pattern ko is waqt talaash kar satke hain jab koi stock neechay ke rujhaan mein ho, aur woh samajte hain ke yeh simt ko tabdeel karne ke liye tayyar ho sakta hai . Pattern se pata chalta hai ke doosri aur teesri mom batii ke darmiyan istehkaam ki aik mukhtasir muddat hosakti hai, jis ke douran khredar aur baichnay walay market par control ke liye muqaabla kar rahay hain. Taham, agar teesri candle stuck doosri candle stuck ke qareeb se oopar khulti hai, to yeh batata hai ke kharidaron ne market par dobarah control haasil kar liya hai, aur taizi ka rujhan jari reh sakta hai . Taajiron ko upside tasuki gap pattern ki bunyaad par tijarti faisla karne se pehlay deegar awamil, jaisay hajam aur majmoi market ke rujhanaat par ghhor karna chahiye .

Up side tasuki gape pattern ke liye tijarti hikmat e amli

Tajir up side tasuki gape pattern ko signal ke tor par istemaal kar satke hain taakay woh stock khareed saken jis ke baray mein un ka khayaal hai ke is ki qader kam hai aur woh taizi ke ulat jane ke liye tayyar hai. Taham, inhen tijarti faisla karne se pehlay deegar awamil, jaisay hajam aur market ke majmoi rujhanaat par bhi ghhor karna chahiye . Aik mumkina tijarti hikmat e amli taizi ke rujhan ki tasdeeq karte hue doosri candle stuck ke khulay hue oopar teesri candle stuck ke band honay ka intzaar karna hai. Is ke baad tajir aik lambi position mein daakhil ho satke hain aur agar rujhan jari nahi rehta hai to mumkina nuqsanaat ko mehdood karne ke liye stap las order set kar satke hain . Doosri hikmat e amli yeh hai ke teesri candle stuck doosri candle stuck ke khilnay ke oopar band honay ke baad wapsi ka intzaar karen. Tajir pal back ke baad lambi position mein daakhil ho satke hain aur mumkina nuqsanaat ko mehdood karne ke liye stap las order set kar satke hain . Taajiron ko up side tasuki gape pattern par mabni tijarti faisla karne se pehlay market ke majmoi rujhan par bhi ghhor karna chahiye. Agar majmoi tor par market ka rujhan mandi ka shikaar hai, to taweel position mein daakhil honay se pehlay aik tasdeeq shuda taizi ke rujhan ka intzaar karna behtar hoga .

تبصرہ

Расширенный режим Обычный режим