Counter attack candlestick pattern

Counter attack candlestick pattern

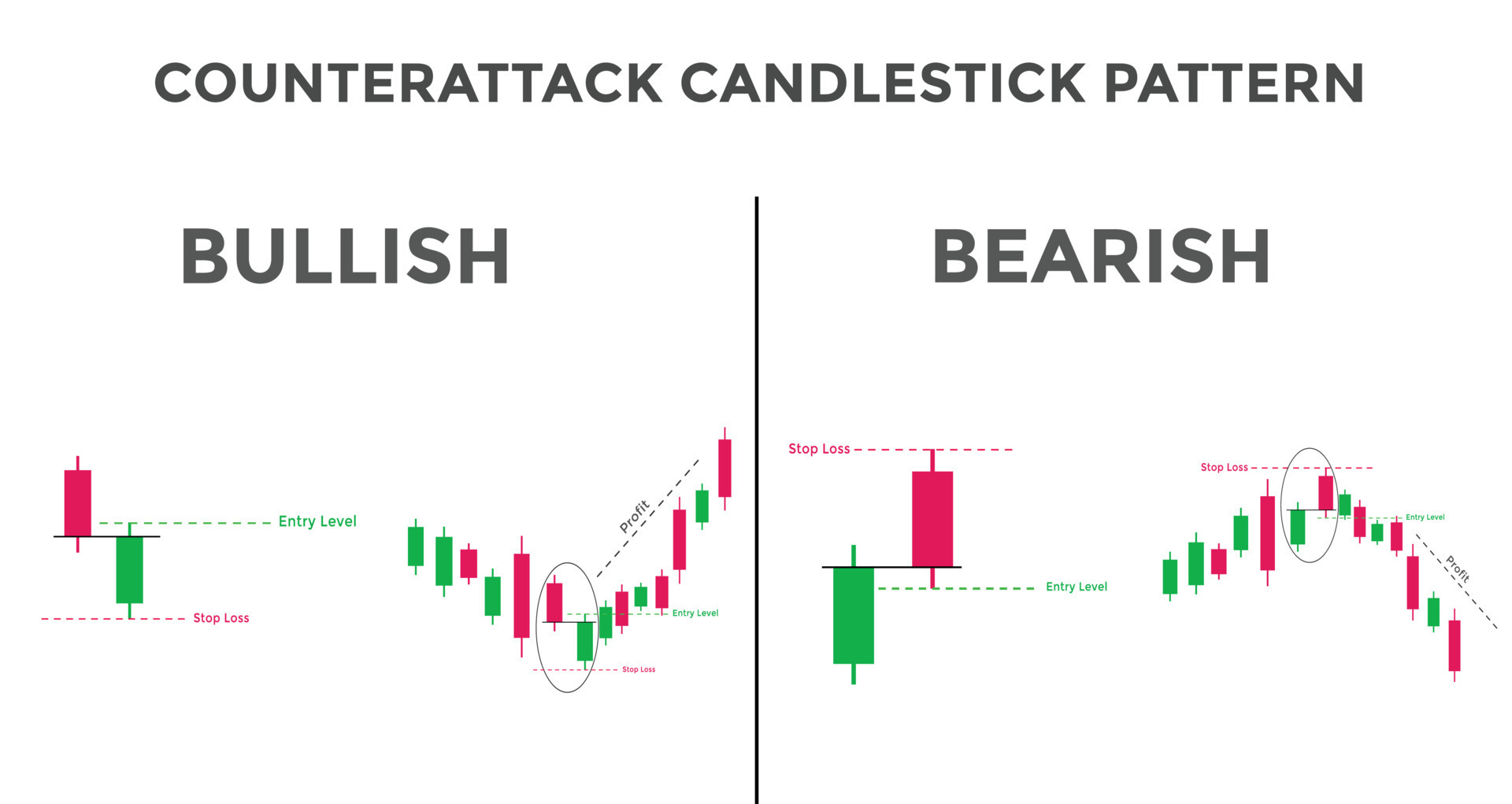

Dear friends, candle counter attack pattern hmain current trend to reversal ka signal daita ha, ye bullish aur bearish dono ho saktay hain jo je baat par dependent card ha k ye kis tarah k trend appear ho raha ha, ye do candles sa mil kar bnta ha yes color aur direction ma aik dusray k opposite hoti hain, is ma trend ki direction ko confirm karnay k liay hmain 3rd ya 4th par candle depends karna party ha, ye pattern show card ha k uptrend ma buyers check loose kar rahay hain aur downtrend ma sellers control loose kar rahay hain, ye aik specific pattern ha jo candles chart par ziana nhi milta, traders ko successful trade k liay is pattern ko dusray Technical Anaylisis k

sath uses karna chaiay.

Bull line counter attack

Bullish counterattack piercing line k similar ha, dono ma difference first candle k penetration level ka ha, you pattern downtrend ma appear hota ha, je ma 2 candles hoti hain jin ma sa first long aur black yani bearish hoti ha auf second candle white mtlb bullish hoti ha in doni candles ki real body aur length takreeban aik jaisi hoti ha, trend ko confirm karnay k liay confirmation candle ki zarurat hoti ha, jis k baad buy and sell ki trading set ki ja sakti ha.

Bearish counterattack line

Bear counterattack candlestick pattern dark cloud cover pattern k similar ha, you uptrend ma appear hota ha, jis ma pehli candle long aur white matlb bullish hoti ha aur second candle black mtlb bearish hoti ha, jska close first candle k same level par hota ha , is pattern ma b dono candle ki real body same hoti ha aur confirmation candle ki zarurat hoti ha.

Guidelines for traders

Is the pattern ma pehle bearish banti hai candlestick or the second bullish banti hai candlestick. Ye second candle market ma down gap sy open hoti hai or phr ye usi point k kareeb close hoti hai jaha par previous candles close hoe thi. Pattern ma jo bull candle banti hai wo pehle candle ki nisbat big body ki hoti hai. Ye long bull candle darsal market k reverse hony ko zahir karti hai k market pehle bear trend ma thi or ab bull ma ah chuki hai. Es pattern k bad agr trader ko bull ki trade open karni hain to unko chahe k wo stop loss second candle k bottom par set karyn. is ka benefit ye ho ga k wo great loss sy bach jayn gy. Ye bhot important hai k both candles big hon or dono ka closing point b about the same he ho. Agr second candle bullish ni ho gi or market k gap ko fill ni kary gi to ye pattern invalid samaja jae ga.

Counter attack candlestick pattern

Dear friends, candle counter attack pattern hmain current trend to reversal ka signal daita ha, ye bullish aur bearish dono ho saktay hain jo je baat par dependent card ha k ye kis tarah k trend appear ho raha ha, ye do candles sa mil kar bnta ha yes color aur direction ma aik dusray k opposite hoti hain, is ma trend ki direction ko confirm karnay k liay hmain 3rd ya 4th par candle depends karna party ha, ye pattern show card ha k uptrend ma buyers check loose kar rahay hain aur downtrend ma sellers control loose kar rahay hain, ye aik specific pattern ha jo candles chart par ziana nhi milta, traders ko successful trade k liay is pattern ko dusray Technical Anaylisis k

sath uses karna chaiay.

Bull line counter attack

Bullish counterattack piercing line k similar ha, dono ma difference first candle k penetration level ka ha, you pattern downtrend ma appear hota ha, je ma 2 candles hoti hain jin ma sa first long aur black yani bearish hoti ha auf second candle white mtlb bullish hoti ha in doni candles ki real body aur length takreeban aik jaisi hoti ha, trend ko confirm karnay k liay confirmation candle ki zarurat hoti ha, jis k baad buy and sell ki trading set ki ja sakti ha.

Bearish counterattack line

Bear counterattack candlestick pattern dark cloud cover pattern k similar ha, you uptrend ma appear hota ha, jis ma pehli candle long aur white matlb bullish hoti ha aur second candle black mtlb bearish hoti ha, jska close first candle k same level par hota ha , is pattern ma b dono candle ki real body same hoti ha aur confirmation candle ki zarurat hoti ha.

Guidelines for traders

Is the pattern ma pehle bearish banti hai candlestick or the second bullish banti hai candlestick. Ye second candle market ma down gap sy open hoti hai or phr ye usi point k kareeb close hoti hai jaha par previous candles close hoe thi. Pattern ma jo bull candle banti hai wo pehle candle ki nisbat big body ki hoti hai. Ye long bull candle darsal market k reverse hony ko zahir karti hai k market pehle bear trend ma thi or ab bull ma ah chuki hai. Es pattern k bad agr trader ko bull ki trade open karni hain to unko chahe k wo stop loss second candle k bottom par set karyn. is ka benefit ye ho ga k wo great loss sy bach jayn gy. Ye bhot important hai k both candles big hon or dono ka closing point b about the same he ho. Agr second candle bullish ni ho gi or market k gap ko fill ni kary gi to ye pattern invalid samaja jae ga.

:max_bytes(150000):strip_icc():format(webp)/CounterattackLines2-fef16518446649638410021deffe635d.png)

تبصرہ

Расширенный режим Обычный режим