Dear traders aaj hum aik rewiew Demand aur Supply per krian gay Demond and Supply trading mein do ahem tasawurat hain jo ke kharidaron ki security ya asasa (mutalba ) kharidne ki razamandi aur is security ya asasa (supply ) ko baichnay ke liye baichnay walay ki razamandi ka hawala dete hain. yeh tasawurat kisi asasay ki market qeemat ka taayun karne mein ahem kirdaar ada karte hain

How Supply and Demand Effects Market.

Dear traders jab kisi asasay ki maang ziyada hoti hai aur rasad kam hoti hai to asasay ki qeemat barh jati hai aur is ke bar aks jab talabb kam hoti hai aur supply ziyada hoti hai to qeemat neechay jati hai. is ki wajah yeh hai ke khredar asasa haasil karne ke liye ziyada qeemat ada karne ko tayyar hotay hain jab ziyada talabb aur rasad mehdood hoti hai, aur baichnay walay kam qeemat par farokht karne ke liye tayyar hotay hain jab kam talabb aur ziyada rasad ho .

demand aur supply mukhtalif awamil se mutasir ho sakti hai Bashmole iqtisadi isharay siyasi waqeat, aur company se mutaliq khabrain. misaal ke tor par, kisi company ki maali karkardagi ke baray mein misbet khabrain is ke stock ki maang mein izafah kar sakti hain, jabkay manfi khabrain talabb ko kam kar sakti hain aur rasad mein izafah kar sakti hain .

Demond and Supply Analysis.

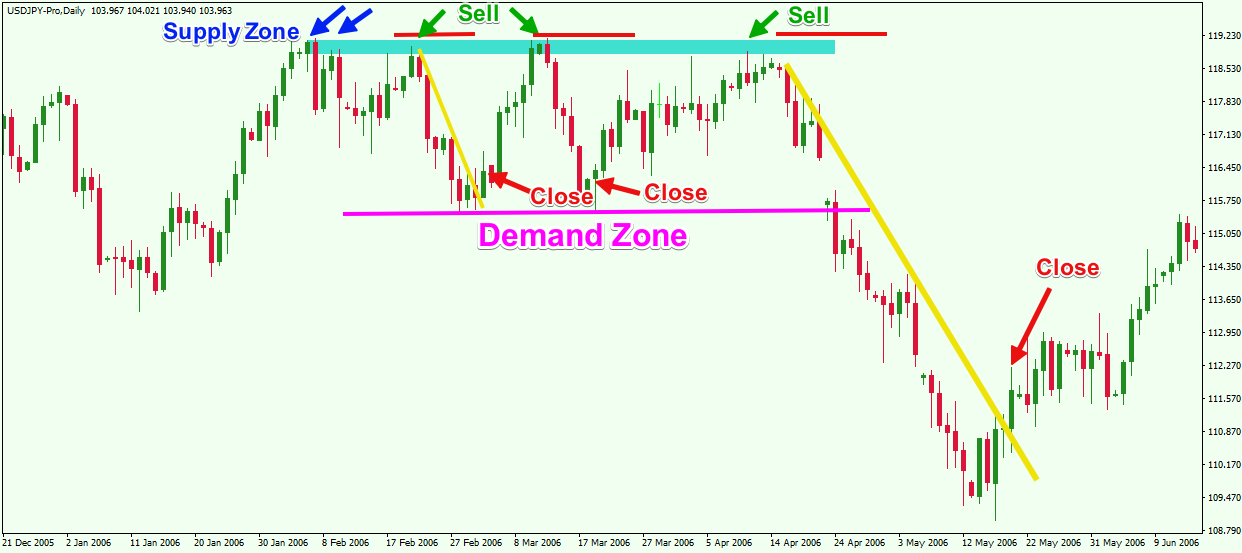

Dear rraders maahir tajir tijarti faislay karne ke liye Demond and Supply ke tajziye ka istemaal karte hain. woh aisay ishaaron ki talaash karte hain jo kisi khaas asasa ki talabb aur rasad mein tabdeelion ki nishandahi karte hain, aur is maloomat ko sahih waqt par is asasay ko kharidne ya baichnay ke liye istemaal karte hain. yeh tajzia takneeki isharay par mabni ho sakta hai jaisay qeemat ke chart, ya iqtisadi aur company ke makhsoos data ke bunyadi tajzia.

Supply Meanings.

tijarat mein, istilaah" supply" ke sayaq o Sabaq ke lehaaz se kuch mukhtalif maienay ho satke hain. yahan teen mumkina tshrihat hain aur supply se morad kisi khaas asasay ki kal raqam hai jo kisi bhi waqt khareed ya farokht ke liye dastyab hai. is mein nai supply ( jaisay stock ke naye jari kardah hasas ) ke sath sath mojooda supply ( jaisay woh hasas jo pehlay hi sarmaya karon ki malkiat hain aur farokht ke liye paish kiye ja rahay hain ) dono shaamil ho satke hain .

Meanings of Demond in Trading.

Dear traders mujhe yaqeen hai ke aap trading mein istilaah" demand" ka hawala day rahay hon ge, jis se morad kharidaron ki kisi makhsoos qeemat par kisi khaas security ya asasay ko kharidne ki khwahish hai. takneeki tajzia mein, maang ko aksar qeemat ke chart par support level ke tor par grafk tor par dekhaya jata hai, kyunkay yeh qeemat ke aik aisay nuqta ki nishandahi karta hai jahan khredar qadam rakhnay aur asasa kharidne ke liye tayyar hotay hain, jis se qeemat ke liye aik manzil banti hai aur friends mazeed bar-aan, maang mein tabdeelian market ke jazbaat mein tabdeeli ki nishandahi kar sakti hain aur market ke wasee tar rujhanaat ke baray mein baseerat faraham kar sakti hain.

How Supply and Demand Effects Market.

Dear traders jab kisi asasay ki maang ziyada hoti hai aur rasad kam hoti hai to asasay ki qeemat barh jati hai aur is ke bar aks jab talabb kam hoti hai aur supply ziyada hoti hai to qeemat neechay jati hai. is ki wajah yeh hai ke khredar asasa haasil karne ke liye ziyada qeemat ada karne ko tayyar hotay hain jab ziyada talabb aur rasad mehdood hoti hai, aur baichnay walay kam qeemat par farokht karne ke liye tayyar hotay hain jab kam talabb aur ziyada rasad ho .

demand aur supply mukhtalif awamil se mutasir ho sakti hai Bashmole iqtisadi isharay siyasi waqeat, aur company se mutaliq khabrain. misaal ke tor par, kisi company ki maali karkardagi ke baray mein misbet khabrain is ke stock ki maang mein izafah kar sakti hain, jabkay manfi khabrain talabb ko kam kar sakti hain aur rasad mein izafah kar sakti hain .

Demond and Supply Analysis.

Dear rraders maahir tajir tijarti faislay karne ke liye Demond and Supply ke tajziye ka istemaal karte hain. woh aisay ishaaron ki talaash karte hain jo kisi khaas asasa ki talabb aur rasad mein tabdeelion ki nishandahi karte hain, aur is maloomat ko sahih waqt par is asasay ko kharidne ya baichnay ke liye istemaal karte hain. yeh tajzia takneeki isharay par mabni ho sakta hai jaisay qeemat ke chart, ya iqtisadi aur company ke makhsoos data ke bunyadi tajzia.

Supply Meanings.

tijarat mein, istilaah" supply" ke sayaq o Sabaq ke lehaaz se kuch mukhtalif maienay ho satke hain. yahan teen mumkina tshrihat hain aur supply se morad kisi khaas asasay ki kal raqam hai jo kisi bhi waqt khareed ya farokht ke liye dastyab hai. is mein nai supply ( jaisay stock ke naye jari kardah hasas ) ke sath sath mojooda supply ( jaisay woh hasas jo pehlay hi sarmaya karon ki malkiat hain aur farokht ke liye paish kiye ja rahay hain ) dono shaamil ho satke hain .

Meanings of Demond in Trading.

Dear traders mujhe yaqeen hai ke aap trading mein istilaah" demand" ka hawala day rahay hon ge, jis se morad kharidaron ki kisi makhsoos qeemat par kisi khaas security ya asasay ko kharidne ki khwahish hai. takneeki tajzia mein, maang ko aksar qeemat ke chart par support level ke tor par grafk tor par dekhaya jata hai, kyunkay yeh qeemat ke aik aisay nuqta ki nishandahi karta hai jahan khredar qadam rakhnay aur asasa kharidne ke liye tayyar hotay hain, jis se qeemat ke liye aik manzil banti hai aur friends mazeed bar-aan, maang mein tabdeelian market ke jazbaat mein tabdeeli ki nishandahi kar sakti hain aur market ke wasee tar rujhanaat ke baray mein baseerat faraham kar sakti hain.

تبصرہ

Расширенный режим Обычный режим