Assalam Walekum dear Forex member ummid Karti hun aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge Jab aap is market Mein kam karte hain to aapko daily ka target complete kar leta hai aur hard work ke sath kam karna hota hai agar aap is market Mein hard work karte hain aur Chhoti Si Chhoti mistake Ka Khyal rakhte Hain To aapko market mein bahut hi fayda Milta hai aur aap ismein planning Karke trading kar sakte hain aapko Hamesha Koshish Karna Hogi ki aap ismein acchi strategies ke sath kam Karen aur Market Mein To acchi tarike se Samajh Kar trading Karen Jab aap is market mein planning Karte Hain To aap market Mein fayda Hasil kar sakte hain agar aap ismein without lene ke trading Karenge aur is market Mein jaldbaji Karenge to aapko sirf aur sirf loss Hoga loss se bachne ke liye aapko hard work karna hoga aur Market ko acchi tarike se focus karna hoga aur tab hi aap is market Mein profitable trading kar sakte hain main aaj aapse ek Aise patterns ke related information share karungi jo aapki trading ko Achcha result dekh sakte hai to Mera topic hai separating line candlestick pattern kia hai hum es par kesy kaam kar k trading main kamyabi hasil kar sakhty hain.

Definition of Bullish separating Line Pattren:

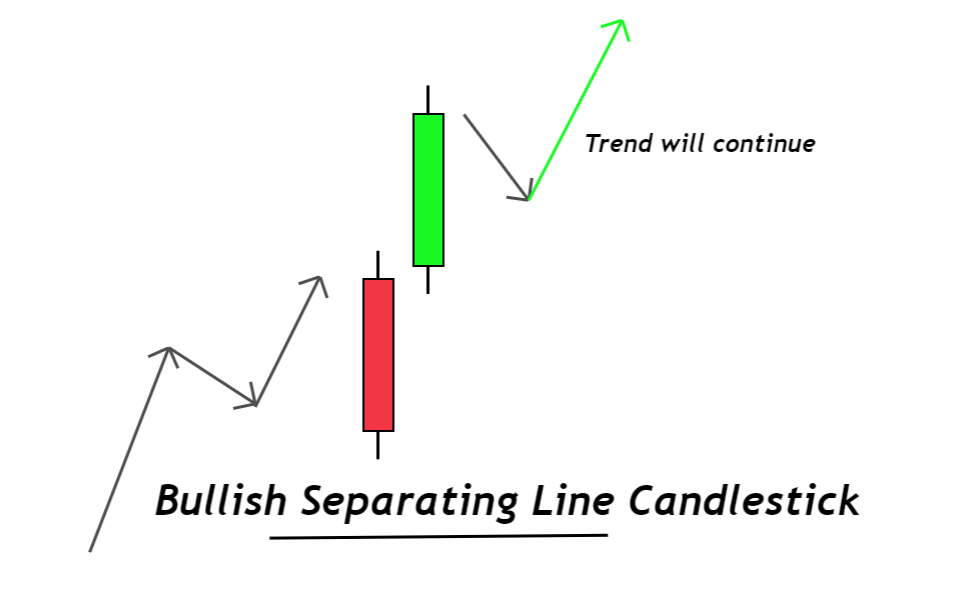

Dear forex friend Bullish separating candles take pattern se traders is saved by trade ki same Bullish direction mein moment ka Ishara lete hain yah pattern bahut hi kam bante hain aur isase ko Sahi Manav Mein samajhne ki bahut hi jyada jarurat Hoti Hai Bole separating line pattern Hamen strongli Ishara deti hai ki trend same up trend per hi Aage ko bahry ga aam taur per yah pattern 2 Dinon Ke Darmiyan Hisse mein jyada bante Hain Jab market ki movement normal up down ho rahi Hoti Hai pattern do candles per mustamel Hota Hai Jiski Pahli candle Ek bearish candle Hoti Hai candal ek normal real body wali black candle Hoti Hai bearish candal ke bad Ek bullish candle ke open point per open hokar upward side per higher Banakar close hoti hai.

Identification:

Dear forex friend Bullish separating line pattern pahle din ki candle ek bearish candal hoti hai lekin dusre Din Ki candle bullish candle ke close price per hone ki bajay sem bearish candle ke open price per open bullesh candle ke Trend ke mutabik up side per close Hoti Hai pattern Mein Shamil candles ki formation darja Zail tara Se Hoti Hai.

Explanation And Chart In Analysis:

Dear forex friend Bullish separating line candlestick pattern ki Pahli candle Ek Bearish candle hoti hai jo price ke bullish trend mein ban kar trend reversal ki nakam koshish Karti Hai yah candle Ek real body wali candle hoti hai jo ki black jar red color Mein banti hai.Bullish separating line candles take pattern ki dusri candle Lake real body wali bullish candle Hoti Hai yah candle Bearish candle ke close price per Nahin balki open price per khulati hai aur ab jakar close Hoti Hai yah candle Pahli candles k Bearish trend reversal ki koshish ko nakam Banakar price ko sem Bullish trend Mein continuation karvati hai.

Dear Bullish separating line candlestick pattern price may mostly do Dinon Ke Darmiyan Mein banta hai jisse market ki same up trend jaane ka Ishara Milta Hai pattern ki Pahli candle ke bad dusri candle Usi ke closing price per open hone ki bajay open price per open hokar ab side per close hoti hain normal yah pattern bahut kam tadad Mein bante hain lekin Bullishe trend Mein banne per yah price ko bullish trend continuation ka work Karti Hai pattern ki Pahli candle Bearish aur dusri Bullishe candle Hoti Hai Jiske lazmi Mein real body honi chahie jabki donon candles Shadow Semat Ja Shadow ke bagair ho sakti hain pattern Mein donon candle same point per open hoti hain lekin close Ek dusre ke opposite direction Mein hoti hai.

Conclusion:

Dear forex friend Bullish separating line candlestick pattern prices main traders ke liye Bullish trend ki indication Deta Hai Jis per Bhai Ki entry ki Jaati Hai pattern ke bad Ek confirmation candle Ka Hona jaruri hai yah candle real body Mein Bullish honi chahie jo ki dusri candle ke top Mein Ban Jaati Hai pattern ke bad Bearish candle Banane se pattern trading invalid ho jaega jb k CCI RSI indicator oscillator per value about 50th zone Mein honi chahie pattern Jyada reliable na hone ki vajah se stop loss ka use jaruri hai pattern ka stop loss pahle candles ke bottom price Se Two pipes below set Karen.

Definition of Bullish separating Line Pattren:

Dear forex friend Bullish separating candles take pattern se traders is saved by trade ki same Bullish direction mein moment ka Ishara lete hain yah pattern bahut hi kam bante hain aur isase ko Sahi Manav Mein samajhne ki bahut hi jyada jarurat Hoti Hai Bole separating line pattern Hamen strongli Ishara deti hai ki trend same up trend per hi Aage ko bahry ga aam taur per yah pattern 2 Dinon Ke Darmiyan Hisse mein jyada bante Hain Jab market ki movement normal up down ho rahi Hoti Hai pattern do candles per mustamel Hota Hai Jiski Pahli candle Ek bearish candle Hoti Hai candal ek normal real body wali black candle Hoti Hai bearish candal ke bad Ek bullish candle ke open point per open hokar upward side per higher Banakar close hoti hai.

Identification:

Dear forex friend Bullish separating line pattern pahle din ki candle ek bearish candal hoti hai lekin dusre Din Ki candle bullish candle ke close price per hone ki bajay sem bearish candle ke open price per open bullesh candle ke Trend ke mutabik up side per close Hoti Hai pattern Mein Shamil candles ki formation darja Zail tara Se Hoti Hai.

Explanation And Chart In Analysis:

Dear forex friend Bullish separating line candlestick pattern ki Pahli candle Ek Bearish candle hoti hai jo price ke bullish trend mein ban kar trend reversal ki nakam koshish Karti Hai yah candle Ek real body wali candle hoti hai jo ki black jar red color Mein banti hai.Bullish separating line candles take pattern ki dusri candle Lake real body wali bullish candle Hoti Hai yah candle Bearish candle ke close price per Nahin balki open price per khulati hai aur ab jakar close Hoti Hai yah candle Pahli candles k Bearish trend reversal ki koshish ko nakam Banakar price ko sem Bullish trend Mein continuation karvati hai.

Dear Bullish separating line candlestick pattern price may mostly do Dinon Ke Darmiyan Mein banta hai jisse market ki same up trend jaane ka Ishara Milta Hai pattern ki Pahli candle ke bad dusri candle Usi ke closing price per open hone ki bajay open price per open hokar ab side per close hoti hain normal yah pattern bahut kam tadad Mein bante hain lekin Bullishe trend Mein banne per yah price ko bullish trend continuation ka work Karti Hai pattern ki Pahli candle Bearish aur dusri Bullishe candle Hoti Hai Jiske lazmi Mein real body honi chahie jabki donon candles Shadow Semat Ja Shadow ke bagair ho sakti hain pattern Mein donon candle same point per open hoti hain lekin close Ek dusre ke opposite direction Mein hoti hai.

Conclusion:

Dear forex friend Bullish separating line candlestick pattern prices main traders ke liye Bullish trend ki indication Deta Hai Jis per Bhai Ki entry ki Jaati Hai pattern ke bad Ek confirmation candle Ka Hona jaruri hai yah candle real body Mein Bullish honi chahie jo ki dusri candle ke top Mein Ban Jaati Hai pattern ke bad Bearish candle Banane se pattern trading invalid ho jaega jb k CCI RSI indicator oscillator per value about 50th zone Mein honi chahie pattern Jyada reliable na hone ki vajah se stop loss ka use jaruri hai pattern ka stop loss pahle candles ke bottom price Se Two pipes below set Karen.

تبصرہ

Расширенный режим Обычный режим