Introduction

Assalamu alaikum bhai jaan main ummid karta hun aap sab khairiyat se hun aur Forex Mein acchi kar rahe Honge. Aaj ka Mera Sawal bahut hi jyada

important hai aur informative Hoga agar aap expecting Mein acchi arning Hasil karna chahte hain to aapko chahie ki matlab candle stick pattern ke

bare mein maloomat honi chahie agar aap ine patterns ko Sahi tarike se istemal Karenge tab aap Forex Mein acchi arning Hasil kar Sakenge aaj ka

Mera Sawal hai ki bearish kicker kiya hy aur ap isy used kasy kr sakhty hain

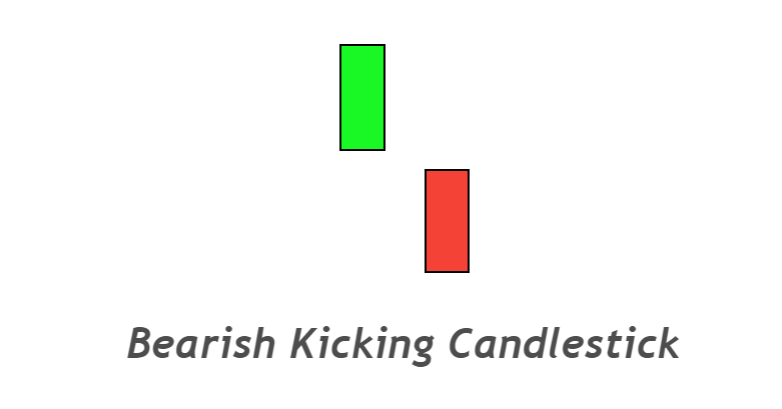

What is bearish kicker

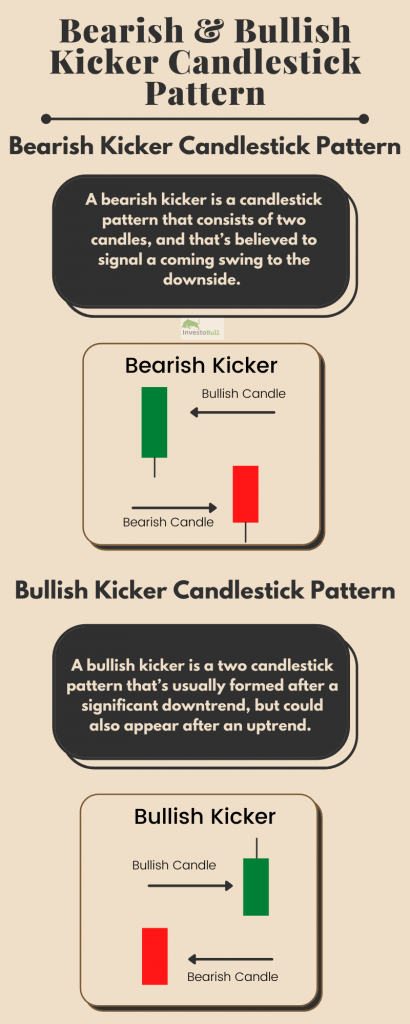

kukkar patteren aik do baar wala candle stuck patteren hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is ka istemaal is baat ka taayun karne ke liye karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai. simt mein tabdeeli aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hoti hai.

Significance of bearish kicker

kukkar patteren candle stick patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai .

What does bearish kicker tell you in trade

kukkar patteren aik do baar wala candle stuck patteren hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is ka istemaal is baat ka taayun karne ke liye karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai. simt mein tabdeeli aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hoti hai. kukkar patteren candle stick patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai .

Assalamu alaikum bhai jaan main ummid karta hun aap sab khairiyat se hun aur Forex Mein acchi kar rahe Honge. Aaj ka Mera Sawal bahut hi jyada

important hai aur informative Hoga agar aap expecting Mein acchi arning Hasil karna chahte hain to aapko chahie ki matlab candle stick pattern ke

bare mein maloomat honi chahie agar aap ine patterns ko Sahi tarike se istemal Karenge tab aap Forex Mein acchi arning Hasil kar Sakenge aaj ka

Mera Sawal hai ki bearish kicker kiya hy aur ap isy used kasy kr sakhty hain

What is bearish kicker

kukkar patteren aik do baar wala candle stuck patteren hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is ka istemaal is baat ka taayun karne ke liye karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai. simt mein tabdeeli aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hoti hai.

Significance of bearish kicker

kukkar patteren candle stick patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai .

What does bearish kicker tell you in trade

kukkar patteren aik do baar wala candle stuck patteren hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is ka istemaal is baat ka taayun karne ke liye karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai. simt mein tabdeeli aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hoti hai. kukkar patteren candle stick patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai .

تبصرہ

Расширенный режим Обычный режим