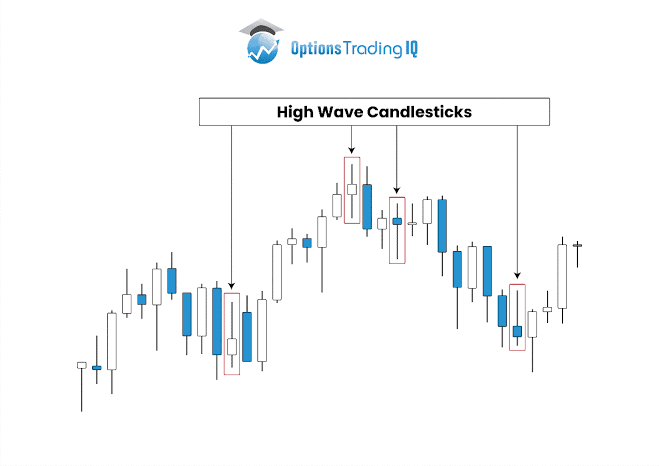

High wave Candlestick's Patterned ki Formation Ek little genuine body flame hoti hai aur body Mein iska variety dark aur white hota hai aur yah log SShadowsaur long Shadows dish instruction design se related hoti hai.high wave Candlestick's a short genuine body's natural with a long upper shadow and long lower shadow light hoti hai yeh darkness or white variety ki Hoti Hai Iske more than High wave or after one and other in this year market Mein Dena padta hai agar aapko during a companion yah aapko futures sign give kry tu aapko Ek acchi costs for starting passages Le sakte hain.Flame k upper aur lower sides ka shadow size practically High wave same hota hai. Ess Candlesticks ki genuine body the two sides k shadow k entirely focus me hoti hai. Yeh flame bullish aur negative , ya supply aur request ki barbari ki waja se banti hai.High wave candle costs k top standard akele howdy pattern inversion ka kaam karti hai . Yeh flame little genuine body bhi aik solid position rakhti hai , jiss ki specialized investigation primary bohut ziada ahmeyat hai.yah single candle costs ke top ya base Mein Pai Jaati Hain...

High wave Candlestick's Patterned say Trading,,

Ess Patterned Mn High wave Candlestick's to utilize Waqt yah train inversion ka kam Karti Hai single Candlestick's Patterned Mein duji Candles aur little genuine body wali candles Akeli ya dusri light ke sath costs Mein proactive factor ka kam Karti Hai first High way candle costs ke top ya base Mein Patterned inversion designed ka kam Karti Hai Punch Yahi candle sideways market Mein regular Candlesticks Say trading ki Jaati Hay...

Ess Patterned Mn High wave Candlestick's to utilize Waqt yah train inversion ka kam Karti Hai single Candlestick's Patterned Mein duji Candles aur little genuine body wali candles Akeli ya dusri light ke sath costs Mein proactive factor ka kam Karti Hai first High way candle costs ke top ya base Mein Patterned inversion designed ka kam Karti Hai Punch Yahi candle sideways market Mein regular Candlesticks Say trading ki Jaati Hay...

dear forex community, market mein mein bhot sary traders asy hain jo different analysis or indicator ko use kar trade open karty hain. Trader analysis k leye complex mathematical equations ko ya phir bhot sary pattern ko b use karty hain. Trade open karny k leye har trader ki apni seperate technique hoti hai or es tarha kuch indicator bhot commonly use hoty hain. Elliot wave calculations par depend ni kart ye financial market k history ko use karti hai. Hamy pata hai k investor jb market ma invest karty hain to market apni direction ko change karti hai or high swing ya low swing banati en swings ko wave kaha jata hai.High wave candlestick prices k top par ya bottom main ziada behtar tawar par kaam karti hai . Normal ye candle neutral samji jati hai.Bearish market main bullish trend reversal k leye buy ki entry ki ja sakti hai , jab k bullish trend main bearish trend reversal k leye sell ki entry k trades open keye ja sakte hen . Candle par trading se pehle long timeframe ka hona zarori hota hai , jab k trend reversal k leye confirmation candle ki bhi zarorat hoti hai . CCI indicator aur stochastic oscillator par trading k waqat support aur resistance levels and overbought aur over sold zone hona chaheye . Stop Loss candle k low ya high prices se two pips below ya above set kia ja sakta hai.good luck and thanks

High wave Candlestick's Patterned say Trading,,

dear forex community, market mein mein bhot sary traders asy hain jo different analysis or indicator ko use kar trade open karty hain. Trader analysis k leye complex mathematical equations ko ya phir bhot sary pattern ko b use karty hain. Trade open karny k leye har trader ki apni seperate technique hoti hai or es tarha kuch indicator bhot commonly use hoty hain. Elliot wave calculations par depend ni kart ye financial market k history ko use karti hai. Hamy pata hai k investor jb market ma invest karty hain to market apni direction ko change karti hai or high swing ya low swing banati en swings ko wave kaha jata hai.High wave candlestick prices k top par ya bottom main ziada behtar tawar par kaam karti hai . Normal ye candle neutral samji jati hai.Bearish market main bullish trend reversal k leye buy ki entry ki ja sakti hai , jab k bullish trend main bearish trend reversal k leye sell ki entry k trades open keye ja sakte hen . Candle par trading se pehle long timeframe ka hona zarori hota hai , jab k trend reversal k leye confirmation candle ki bhi zarorat hoti hai . CCI indicator aur stochastic oscillator par trading k waqat support aur resistance levels and overbought aur over sold zone hona chaheye . Stop Loss candle k low ya high prices se two pips below ya above set kia ja sakta hai.good luck and thanks

تبصرہ

Расширенный режим Обычный режим