Moving Average Convergence Divergence (MACD) Indicator

Moving average convergence divergence (MACD) indicator aik popular technical analysis tool hai jisay trader potential buy and sell ke signals ki identification ke liye istemaal karte hain. Indicator two moving averages ke darmiyan farq par mabni hota hai, aam tor par 12-day aur 26-day ki exponential moving averages. MACD indicator ko aksar trader signals ki additional confirmation faraham karne ke liye second technical indicator ke sath istemaal kya jata hai. Hum MACD indicator par detail se baat karty hain.

Calculation of the MACD Indicator

MACD indicator ka hisaab 12 din ke ema se 26-day ke exponential moving average (ema) ko substract kar ky kya jata hai. Result aik chart par aik line ke tor par banaya gaya hai, jisay MACD line kaha jata hai. Is ke ilawa, aik signal line, jo MACD line ki 9 din ki ema hai, ko bhi chart par plot kya gaya hai. Signal line ka istemaal trader signal peda karne ke liye kya jata hai jab yeh MACD line ko cross karti hai.

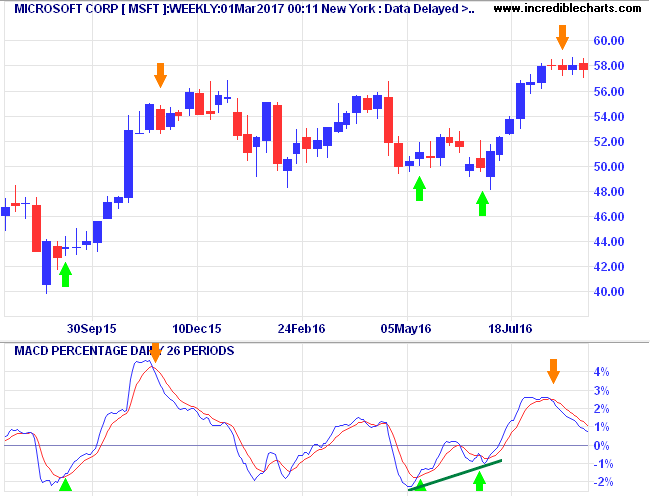

Interpretation of the MACD Indicator

MACD indicator ki tashreeh MACD line aur signal line ke darmiyan cross over ka analysis ki jati hai. Jab MACD line signal line se oopar cross karti hai, to usay taizi ka signal samjha jata hai, jo is baat ko indicate karta hai ke yeh security kharidne ka acha waqt ho sakta hai. Is ke bar aks, jab MACD line signal line ke neechay se guzarti hai, to usay aik bearish signal samjha jata hai, jo is baat ko indicate karta hai ke yeh security baichnay ka acha waqt ho sakta hai. Cross over ke ilawa, trader signal ki taaqat ka taayun karne ke liye MACD line aur signal line ke darmiyan faaslay ko bhi dekhte hain. Jab MACD line signal line se bohat oopar hoti hai, to yeh mazboot bullish signal ko indicate karti hai. Is ke bar aks, jab MACD line signal line se bohat neechay hoti hai, to yeh mazboot bearish signal ko indicate karti hai.

MACD Histogram

MACD histogram MACD line aur signal line ke darmiyan farq ki aik visual representation hai. Histogram am ae si d line se signal line ko ghata kar aur result ko histogram ke tor par tayyar kar ke banaya gaya hai. Histogram trend ki taaqat aur potential trader signal ke baray mein additional baseerat faraham karta hai. Jab histogram 0 ki line se oopar hota hai, to yeh bullish trend ko indicate karta hai, jis mein higher bars mazboot trend ko indicate karti hain. Is ke bar aks, jab histogram 0 ki line se neechay hota hai, to yeh mandi ke trend ko indicate karta hai, jis mein nichli bars mazboot trend ko indicate karti hain.

Divergence

Divergence aik taaqatwar signal hai jo MACD indicator ke zariye peda hota hai. Inhiraf is waqt hota hai jab security ki qeemat MACD indicator ke mukhalif simt mein barh rahi ho. Yeh aik intibahi alamat hai ke ho sakta hai mojooda trend apni raftaar kho raha hai, aur aik ulat jane ka imkaan hai. Inhiraf ki do kasmain hain Bullish and bearish. Bullish ka inhiraf is waqt hota hai jab security ki qeemat nichli satah par hoti hai, jab ke MACD indicator ziyada nichli satah par hota hai. Is se zahir hota hai ke ho sakta hai trend badal raha hai, aur yeh security kharidne ka acha waqt ho sakta hai. Bearish divergence is waqt hota hai jab security ki qeemat ziyada onche hoti hai, jab ke MACD indicator kam oonchai bana raha hota hai. Is se zahir hota hai ke ho sakta hai trend badal raha hai, aur yeh security baichnay ka acha waqt ho sakta hai.

Conclusion

MACD indicator technical analysis ke liye aik taaqatwar tool hai, jo taajiron ko potential trader signals aur trend ki taaqat ke baray mein baseerat faraham karta hai. Cross over, MACD line aur signal line ke darmiyan faasla, MACD histogram, aur divergence ka analysis kar ke, trader is baray mein bakhabar faislay kar satke hain ke securties kab khareedain aur bechen. Yeh note karna zaroori hai ke MACD indicator ko tanhai mein istemaal nahi kya jana chahiye, balkay second technical indicator aur bunyadi analysis ke sath mil kar istemaal kya jana chahiye. Aisa karne se, trader marketon mein apni kamyabi ke imkanaat ko behtar bana satke hain.

Moving average convergence divergence (MACD) indicator aik popular technical analysis tool hai jisay trader potential buy and sell ke signals ki identification ke liye istemaal karte hain. Indicator two moving averages ke darmiyan farq par mabni hota hai, aam tor par 12-day aur 26-day ki exponential moving averages. MACD indicator ko aksar trader signals ki additional confirmation faraham karne ke liye second technical indicator ke sath istemaal kya jata hai. Hum MACD indicator par detail se baat karty hain.

Calculation of the MACD Indicator

MACD indicator ka hisaab 12 din ke ema se 26-day ke exponential moving average (ema) ko substract kar ky kya jata hai. Result aik chart par aik line ke tor par banaya gaya hai, jisay MACD line kaha jata hai. Is ke ilawa, aik signal line, jo MACD line ki 9 din ki ema hai, ko bhi chart par plot kya gaya hai. Signal line ka istemaal trader signal peda karne ke liye kya jata hai jab yeh MACD line ko cross karti hai.

Interpretation of the MACD Indicator

MACD indicator ki tashreeh MACD line aur signal line ke darmiyan cross over ka analysis ki jati hai. Jab MACD line signal line se oopar cross karti hai, to usay taizi ka signal samjha jata hai, jo is baat ko indicate karta hai ke yeh security kharidne ka acha waqt ho sakta hai. Is ke bar aks, jab MACD line signal line ke neechay se guzarti hai, to usay aik bearish signal samjha jata hai, jo is baat ko indicate karta hai ke yeh security baichnay ka acha waqt ho sakta hai. Cross over ke ilawa, trader signal ki taaqat ka taayun karne ke liye MACD line aur signal line ke darmiyan faaslay ko bhi dekhte hain. Jab MACD line signal line se bohat oopar hoti hai, to yeh mazboot bullish signal ko indicate karti hai. Is ke bar aks, jab MACD line signal line se bohat neechay hoti hai, to yeh mazboot bearish signal ko indicate karti hai.

MACD Histogram

MACD histogram MACD line aur signal line ke darmiyan farq ki aik visual representation hai. Histogram am ae si d line se signal line ko ghata kar aur result ko histogram ke tor par tayyar kar ke banaya gaya hai. Histogram trend ki taaqat aur potential trader signal ke baray mein additional baseerat faraham karta hai. Jab histogram 0 ki line se oopar hota hai, to yeh bullish trend ko indicate karta hai, jis mein higher bars mazboot trend ko indicate karti hain. Is ke bar aks, jab histogram 0 ki line se neechay hota hai, to yeh mandi ke trend ko indicate karta hai, jis mein nichli bars mazboot trend ko indicate karti hain.

Divergence

Divergence aik taaqatwar signal hai jo MACD indicator ke zariye peda hota hai. Inhiraf is waqt hota hai jab security ki qeemat MACD indicator ke mukhalif simt mein barh rahi ho. Yeh aik intibahi alamat hai ke ho sakta hai mojooda trend apni raftaar kho raha hai, aur aik ulat jane ka imkaan hai. Inhiraf ki do kasmain hain Bullish and bearish. Bullish ka inhiraf is waqt hota hai jab security ki qeemat nichli satah par hoti hai, jab ke MACD indicator ziyada nichli satah par hota hai. Is se zahir hota hai ke ho sakta hai trend badal raha hai, aur yeh security kharidne ka acha waqt ho sakta hai. Bearish divergence is waqt hota hai jab security ki qeemat ziyada onche hoti hai, jab ke MACD indicator kam oonchai bana raha hota hai. Is se zahir hota hai ke ho sakta hai trend badal raha hai, aur yeh security baichnay ka acha waqt ho sakta hai.

Conclusion

MACD indicator technical analysis ke liye aik taaqatwar tool hai, jo taajiron ko potential trader signals aur trend ki taaqat ke baray mein baseerat faraham karta hai. Cross over, MACD line aur signal line ke darmiyan faasla, MACD histogram, aur divergence ka analysis kar ke, trader is baray mein bakhabar faislay kar satke hain ke securties kab khareedain aur bechen. Yeh note karna zaroori hai ke MACD indicator ko tanhai mein istemaal nahi kya jana chahiye, balkay second technical indicator aur bunyadi analysis ke sath mil kar istemaal kya jana chahiye. Aisa karne se, trader marketon mein apni kamyabi ke imkanaat ko behtar bana satke hain.

تبصرہ

Расширенный режим Обычный режим