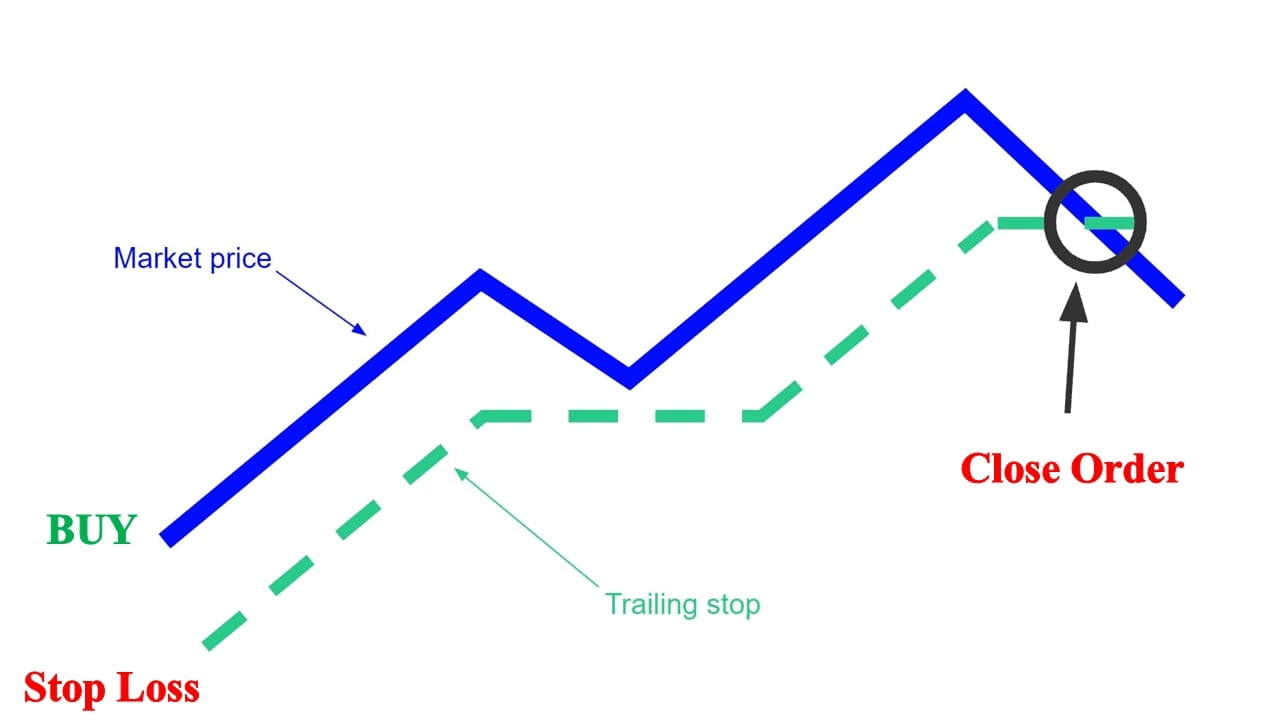

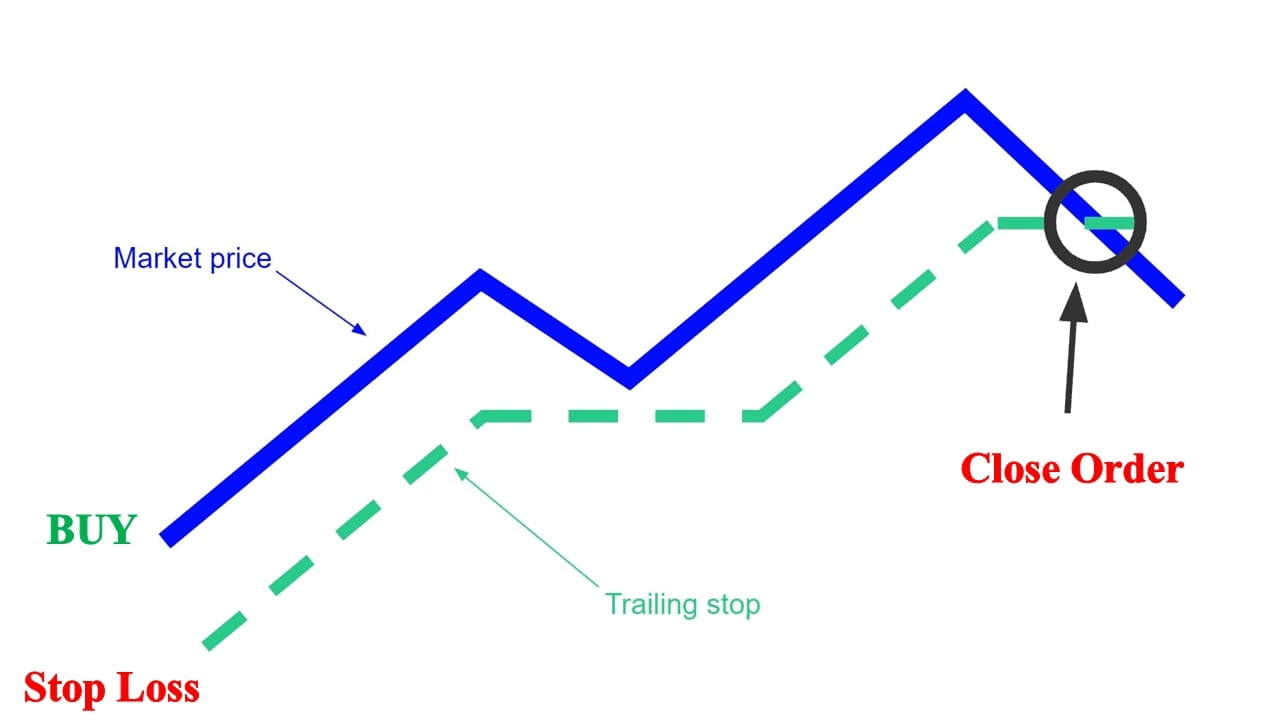

Trailing Stop, forex trading mein ek bahut important concept hai jo traders ke liye risk management ka ek important tool hai. Trailing stop ek aisa stop loss order hai jo aapke position ki profitability ke saath saath move karta hai. Matlab agar aapka position profitable ho raha hai to trailing stop bhi automatically adjust hokar is position ko lock kar leta hai, lekin agar market apke against move karta hai to trailing stop apne level ko maintain karta hai. Trailing stop order laga kar trader ko market ki volatality se bachne ka mauka milta hai. Trailing stop order ke through trader ko trade ke exit point ko adjust karna hota hai taki unko profit book karne aur loss se bachne mein madad mil sake.

Trailing Stop laga kar trader ko apne open position ke liye ek stop loss order set karna hota hai. Agar position profit mein move karta hai to trailing stop apne level ko maintain karta hai aur agar position loss mein move karta hai to trailing stop position ko close karne ke liye market order generate karta hai. Trailing Stop ko set karne ke liye trader ko pata hona chahiye ki wo kis level par apni position ko close karna chahte hain agar market unke against move karta hai. Agar trader ki position profitable ho jati hai to trailing stop order ka level bhi increase ho jata hai, taki wo apni position ko aur zyda profit mein close kar sake. Agar market aapke against move karta hai to trailing stop order position ko close karne ke liye market order generate karta hai.

Trailing Stop ke liye trader ko apne broker ke trading platform mein trailing stop order set karne ki advise milti hai. Trader ko ye bhi decide karna hota hai ki trailing stop order ko kis range mein adjust karna hai. Jitna bada range trader set karta hai utna hi zyda risk wo lena chah raha hai, isliye trader ko apne risk management strategy ko plan karne ke baad hi trailing stop order set karna chahiye.

Important factors:

Advantages of Trailing Stop:

Disadvantages of Trailing Stop:

Trailing Stop laga kar trader ko apne open position ke liye ek stop loss order set karna hota hai. Agar position profit mein move karta hai to trailing stop apne level ko maintain karta hai aur agar position loss mein move karta hai to trailing stop position ko close karne ke liye market order generate karta hai. Trailing Stop ko set karne ke liye trader ko pata hona chahiye ki wo kis level par apni position ko close karna chahte hain agar market unke against move karta hai. Agar trader ki position profitable ho jati hai to trailing stop order ka level bhi increase ho jata hai, taki wo apni position ko aur zyda profit mein close kar sake. Agar market aapke against move karta hai to trailing stop order position ko close karne ke liye market order generate karta hai.

Trailing Stop ke liye trader ko apne broker ke trading platform mein trailing stop order set karne ki advise milti hai. Trader ko ye bhi decide karna hota hai ki trailing stop order ko kis range mein adjust karna hai. Jitna bada range trader set karta hai utna hi zyda risk wo lena chah raha hai, isliye trader ko apne risk management strategy ko plan karne ke baad hi trailing stop order set karna chahiye.

Important factors:

- Volatility: High volatility wale markets mein trailing stop order ka use karne se bache. Aise markets mein price bahut jaldi up-down ho jata hai aur trailing stop order hit ho jata hai. Isliye trader ko apne trading position ki volatility ko consider karna chahiye.

- Timeframe: Trailing stop order ka use karne se pehle trader ko apne trading timeframe ko consider karna chahiye. Agar trader kisi short-term trade mein hai to wo trailing stop ka use nahi karna chahiye kyu ki short-term trading mein market ki movement bahut jaldi hoti hai, jis se trailing stop order hit ho jata hai.

- Support and Resistance: Support aur Resistance level ko consider karke trailing stop order set karna chahiye. Agar trader ko pata hai ki kis level par market mein support aur resistance hai to wo uss level ko apne trailing stop order ka reference point bana sakta hai.

- Market Trends: Trailing stop order ka use karne se pehle trader ko market trend ko consider karna chahiye. Agar market trend strong hai to trailing stop order ka use karne se bachna chahiye.

- News and Events: Trailing stop order ka use karne se pehle trader ko news aur events ko consider karna chahiye. Agar kisi important news ya event ki announcement hone wali hai to trader trailing stop order ka use nahi karna chahiye. Kyuki aise samay market bahut volatile ho jata hai, jis se trailing stop order hit ho jata hai.

- Market Analysis: Trailing stop order ka use karne se pehle trader ko market analysis karna chahiye. Market analysis karne se trader ko pata chalta hai ki kya market bullish ya bearish hai aur kis direction mein movement hone wala hai. Isse trader apne trailing stop order ko better plan kar sakta hai.

Advantages of Trailing Stop:

- Risk management: Trailing stop ka use kar ke trader apni trading position ko risk se bacha sakta hai. Trailing stop order lagane se trader ko market ki volatality se bachne ka mauka milta hai.

- Profit booking: Trailing stop order laga kar trader apni trading position ko profit mein lock kar sakta hai. Isse trader ko profit book karne aur apne trade ka maximum profit potential achieve karne mein madad milti hai.

- Flexibility: Trailing stop order bahut flexible hota hai. Trader ko apne position ko adjust karne ka flexibility milta hai. Isse trader apne risk management strategy ko better plan kar sakta hai.

Disadvantages of Trailing Stop:

- False signals: Kabhi kabhi market mein false signals bhi aate hain. Jab kisi false signal ke wajah se trailing stop order hit hota hai to trader ko nuksan uthana padta hai.

- High volatility: High volatility wale markets mein trailing stop order lagana risky ho sakta hai. Aise markets mein price bahut jaldi up-down ho jata hai aur trailing stop order hit ho jata hai.

- Overuse: Kabhi kabhi trader trailing stop order ka overuse kar leta hai, jis se unko loss hone ka khatra ho sakta hai Is liye trailing stop order ka use bhi limit mein hona chahiye. Agar trader apne trailing stop order ka distance bahut chota rakhna chahta hai to wo overtrading kar raha hai. Isse unko zyada se zyada profit kamane ki greed ho sakti hai, jis se unki trading position lock ho jati hai.

تبصرہ

Расширенный режим Обычный режим