Forex mein Hammer pattern ek candlestick chart pattern hai, jo kisi stock ya currency pair ke price action ko samajhne ke liye istemaal kiya jata hai, Hammer Candlestick Pattern ek technical analysis tool hai jo traders aur investors use karte hain to identify potential trend reversals in a financial market Iski shape hammer jaisi hoti hai jismein ek lamba tail neechay ki taraf hota hai aur ek chota body top mein hota hai, hammer candlestick pattern bull aur bear markets dono mein paya jata hai aur iski sahi tashkeel ko identify karne ke liye aapko candlestick chart ki samajh hona zaroori hai,hammer candlestick pattern ki tashkeel bullish trend reversal ko indicate karti hai yeh pattern jab market ke bottom par form hoti hai toh traders ko yeh signal deti hai ki bearish trend khatam ho chuka hai aur price reversal hone wala hai Iske alawa hammer pattern ko yeh bhi indicate karta hai ki buyers market mein strong hain aur ab market mein buyers ka dominance badhne wala hai.

Hammer pattern ek bullish reversal pattern hai, jo bearish trend ke baad price ke reversal ko signify karta hai Is pattern mein ek small body wali aur long lower shadow wali candlestick hoti hai jo ek hammer ki tarah dikhti hai jab market downtrend mein hota hai, to hammer pattern ko dekh kar traders ko yeh idea milta hai ke price bottom out hone ke baad ab upmove shuru karne wala hai Hammer pattern ki validity tab tak rehti hai jab tak ki price level hammer ki bottom wali shadow se neeche nahi jata, hammer pattern ka istemaal karna asan nahi hai, kyu ki kisi bhi single indicator ki tarah ye bhi kabhi kabhi galat bhi ho sakta hai Isliye, traders ko hammer pattern ko confirm karte hue aur kisi aur indicator ke sath combine kar ke hi trading decision lena chahiye.

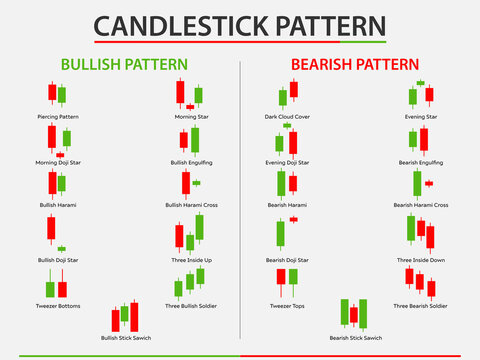

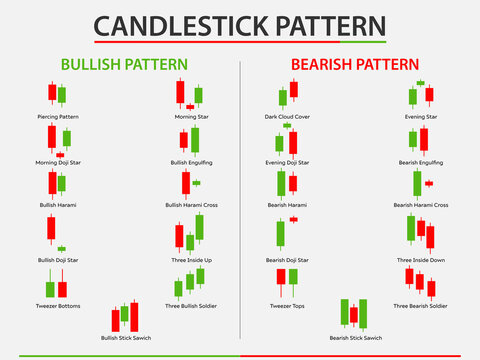

Hammer pattern ki sahi tashkeel ko identify karne ke baad traders is pattern ke alawa kuch aur technical analysis tools ka use bhi karte hain jaise ki trend lines, support and resistance levels, moving averages, RSI, MACD, aur Bollinger Bands, hammer candlestick pattern ke ilawa do aur candlestick patterns hote hain jo traders aur investors use karte hain: inverted hammer aur hanging man.

Inverted hammer bhi hammer pattern ki tarah dikhti hai lekin ismein body tail ke upar hota hai, Inverted hammer pattern bearish trend ke reversal ko indicate karta hai aur bullish trend ki shuruaat hone ki indication deta hai.Hanging man bhi hammer pattern ki tarah dikhti hai lekin iska tail body ke upar hota hai, hanging man pattern bullish trend ke reversal ko indicate karta hai.

Hammer Candlestick Pattern ki formation kai factors par depend karti hai Iske formation ke liye kuch important factors hain:

Hammer pattern ek bullish reversal pattern hai, jo bearish trend ke baad price ke reversal ko signify karta hai Is pattern mein ek small body wali aur long lower shadow wali candlestick hoti hai jo ek hammer ki tarah dikhti hai jab market downtrend mein hota hai, to hammer pattern ko dekh kar traders ko yeh idea milta hai ke price bottom out hone ke baad ab upmove shuru karne wala hai Hammer pattern ki validity tab tak rehti hai jab tak ki price level hammer ki bottom wali shadow se neeche nahi jata, hammer pattern ka istemaal karna asan nahi hai, kyu ki kisi bhi single indicator ki tarah ye bhi kabhi kabhi galat bhi ho sakta hai Isliye, traders ko hammer pattern ko confirm karte hue aur kisi aur indicator ke sath combine kar ke hi trading decision lena chahiye.

Hammer pattern ki sahi tashkeel ko identify karne ke baad traders is pattern ke alawa kuch aur technical analysis tools ka use bhi karte hain jaise ki trend lines, support and resistance levels, moving averages, RSI, MACD, aur Bollinger Bands, hammer candlestick pattern ke ilawa do aur candlestick patterns hote hain jo traders aur investors use karte hain: inverted hammer aur hanging man.

Inverted hammer bhi hammer pattern ki tarah dikhti hai lekin ismein body tail ke upar hota hai, Inverted hammer pattern bearish trend ke reversal ko indicate karta hai aur bullish trend ki shuruaat hone ki indication deta hai.Hanging man bhi hammer pattern ki tarah dikhti hai lekin iska tail body ke upar hota hai, hanging man pattern bullish trend ke reversal ko indicate karta hai.

Hammer Candlestick Pattern ki formation kai factors par depend karti hai Iske formation ke liye kuch important factors hain:

- Tail size: Hammer pattern mein tail chota aur body lamba hota hai tail ki length body ke 2-3 times tak hoti hai.

- Body size: Hammer pattern ke body ki size tail ke comparison mein choti hoti hai yeh body green (bullish) ya red (bearish) bhi ho sakti hai.

- Upar wali shadow: Agar hammer pattern ki upar wali shadow bhi tail ki tarah lambi hai toh yeh hammer pattern ko aur bhi powerful banati hai.

تبصرہ

Расширенный режим Обычный режим