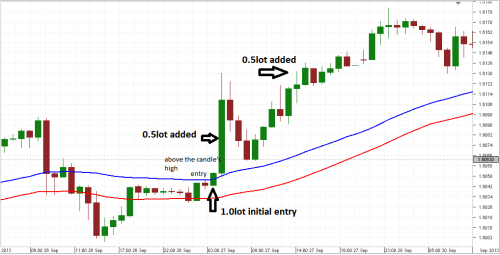

Turtle trading aik boht he famous or zyada tr use ki jany wali strategy hai,es strategy k zriye hum trading k doran km waqt me zyada or favourable profit earn kr skty hain aur friends trading strategy ka main purpose trend ko follow krty huy breakout k nateejy me hony wali quick tabdeeli ko study krna hai or retrace hony ki soorat me apna profit gain krna hai aur is strategy ko follow karne se loss kya risk kafi had tk avoid krty huy aik safe trading k zariye behtar profit earn kiya ja sakta hai. humain aksar trades main loss hi hota rehta

hai lekin agar hum forex market main turtle trading use kartay hain to same trading main risk factor bahut kam hota hai k humain market main trade entry ki aur acha profit kam time main hasil karne ki koi jaldi nahi hoti hum apni*trading*ko buht slow motion main continue karty hain is trading main traders makhsoos time span primary enter hoty hn or benefit lay kea leave ho jaty hn companions agar market kisi aik course fundamental development kerty hovey agar breakout kerry gi to market ki same bearing principal enormous development ho sakti hai to aest time per ham market principal exchange enter kerny ky liay forthcoming orders ka use karte hain

Brief Note on Turtle Trading.

Turtle trading trader ko bahut achi opportunity muhaya kiarti hea trading ko apne fayde ke liye istemal karne kay liye aur aap ko btata chaloon kay turtle movement kee surat mai market retracement karti hai ya downwards movement show karti hai to is retracement ky time aap market mein selling ki trades open kar dete hain aur is tarah is system mein aap market se good profit gain kar sakte hain. Yeh system bhut se pairs ky liye acha hai.Jo kay high volatile hoty hain turtle trading system indicator high price par sell or low price par buy karny k bilkul opposite work karta hai. Kiu k kahi bar aisa hota hai k market low jati hai ham sell kk trade open karty hain to market mazeed low chali jati hai. Es trader system indicator ko use kar k har trader profit hasil karne k kabil ho sakta hai basically turtle trading strategy breakout point standard, verifiable high or depressed spots standard enhesar karta hy. Ye exchanging framework pointer exorbitant cost standard sell or low cost standard purchase karny k bilkul inverse work karta hai.

Trading with turtle trading strategy.

Turtle trading karty huy trader ko chahie kya market ka acchi Tarah Se delicate Sanskar Le aur jitne acche specialized investigation Honge utane hey acchi exchanging karne ke chances badh Jaate Hain aur exchanging mein fruitful sharpen ke chances badh jate hain kyun kay market low jati hai ham sell kk exchange open karty hain friends koi bhi trading strategy use karne say pehly trading ky leay trading indicated primary use of facts ko use Karen marketplace makeup ke liye hamare skip sary problems ko remedy karne ke liye technical candlestick chart pattern maujud hai hamen aiay ma marketplace ko dekh ke kaam chalana chye qor expertise ful technique rakhne chahiye aur aap ko yea bhi dekhna hota hai kay market main trade open kerny per profit ky chances bahut kam hote hain jabky loss ky chances kafi zyada hoty hain.

hai lekin agar hum forex market main turtle trading use kartay hain to same trading main risk factor bahut kam hota hai k humain market main trade entry ki aur acha profit kam time main hasil karne ki koi jaldi nahi hoti hum apni*trading*ko buht slow motion main continue karty hain is trading main traders makhsoos time span primary enter hoty hn or benefit lay kea leave ho jaty hn companions agar market kisi aik course fundamental development kerty hovey agar breakout kerry gi to market ki same bearing principal enormous development ho sakti hai to aest time per ham market principal exchange enter kerny ky liay forthcoming orders ka use karte hain

Brief Note on Turtle Trading.

Turtle trading trader ko bahut achi opportunity muhaya kiarti hea trading ko apne fayde ke liye istemal karne kay liye aur aap ko btata chaloon kay turtle movement kee surat mai market retracement karti hai ya downwards movement show karti hai to is retracement ky time aap market mein selling ki trades open kar dete hain aur is tarah is system mein aap market se good profit gain kar sakte hain. Yeh system bhut se pairs ky liye acha hai.Jo kay high volatile hoty hain turtle trading system indicator high price par sell or low price par buy karny k bilkul opposite work karta hai. Kiu k kahi bar aisa hota hai k market low jati hai ham sell kk trade open karty hain to market mazeed low chali jati hai. Es trader system indicator ko use kar k har trader profit hasil karne k kabil ho sakta hai basically turtle trading strategy breakout point standard, verifiable high or depressed spots standard enhesar karta hy. Ye exchanging framework pointer exorbitant cost standard sell or low cost standard purchase karny k bilkul inverse work karta hai.

Trading with turtle trading strategy.

Turtle trading karty huy trader ko chahie kya market ka acchi Tarah Se delicate Sanskar Le aur jitne acche specialized investigation Honge utane hey acchi exchanging karne ke chances badh Jaate Hain aur exchanging mein fruitful sharpen ke chances badh jate hain kyun kay market low jati hai ham sell kk exchange open karty hain friends koi bhi trading strategy use karne say pehly trading ky leay trading indicated primary use of facts ko use Karen marketplace makeup ke liye hamare skip sary problems ko remedy karne ke liye technical candlestick chart pattern maujud hai hamen aiay ma marketplace ko dekh ke kaam chalana chye qor expertise ful technique rakhne chahiye aur aap ko yea bhi dekhna hota hai kay market main trade open kerny per profit ky chances bahut kam hote hain jabky loss ky chances kafi zyada hoty hain.

تبصرہ

Расширенный режим Обычный режим