Re: What is long term and short term trad ....

exchanging and transient exchanging 2 bahut hello aiham aur buniyadi factor hain exchanging kay aur in donon per exchanging karne ke liye dealer ko bahut hey master hona chahie aur exchanging ki rudiments ke uncovered mein bhi bahut acchi tarah say hona bhi bahut jaruri hai abhi ham long haul exchanging aur momentary exchanging ko one bye one kar kay talk about karte hain aur yah janne ki koshish karte hain kay long haul exchanging kay kya benefit hain aur momentary exchanging ke kya benefit hasil kiya ja sakte hain aur in donon ko compelling tariqy say kesy amal principal laya ja sakta hea.

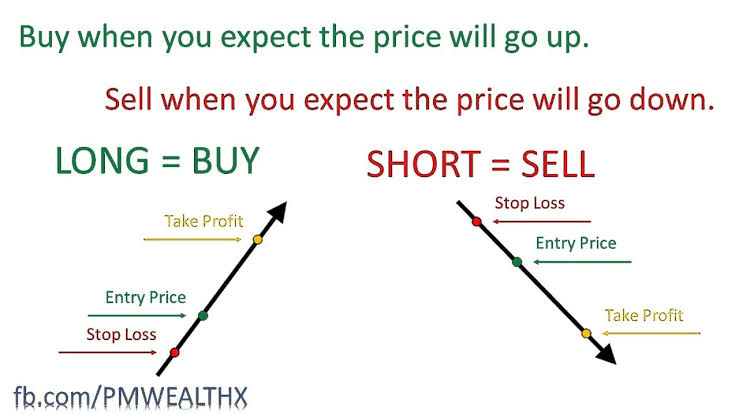

exchanging mein merchant little parcel kay zarie long haul exchanging karte shade bahut zyada benefit, yani ke long haul benefit lene ki koshish karta hai aur exchanging ko productive banane ke liye market ke investigation karta hai long haul exchanging mein position exchanging ko bahut ahmiyat hasil hai kyon kay Position exchanging methodology principal jo sab say essential variable hota hai vah aapke central examination hote hain crucial examination jitne aapke solid hote hain itna hello aap acche se market ko judgment kar sakte hain ki market nay long haul mein kis tarah Se development karni hai aur news update Lekar bhi aap is bat ka andaza Laga sakte hain aur companions aap ko btata chaloon kay position exchanging procedure ke liye broker ko enormous time span ko use karna chahie jiske liye best everyday time period ya week by week time period sabse best hai. exchanging Ko Murmur note kare to iske sath Hamen different break down karne ka mauka comprehend karte hain ismein risk Jo bahut jyada Hota Hai Chahe Ham long haul exchanging Karen ya present moment ismein Ham hazardous long haul exchange ko Restricted Karte Hain jismein Ham bye Bhi Karte Hain stock aur Sel bhi Karti Hain ISI cost ke point off view se Ham securities exchange ko ek acche examine point mein Lekar Aate Hain Hamen exchanging karne ke liye Apne market investigation ko Kafi acche se karna hai

Hamari exchanging jitni acchi Hogi jitni acche se Ham market ko dissect Karenge itna howdy jyada acche se Ham Ek acche broker banty exchanges wo hoti hain jo kay lamby arsy kay ly open rakhi jaati hain aur jin ka objective 200, 500 ya 1,000 pips hota roughage ya poke bhe munasib wakt hota tab shut ke jaati hain. Long time span dealers H4, D1 kay fime body us kar kay trading karty hain aur ye trading zayda behtar samjhi jaati feed. extended time span substitute woh hoti hai Jo keh murmur bary time body ko use karty shade karty hain poke keh short time frame trade woh hoti hai Jo keh choty time body ko use kar ke ki jati hai log apni pasand ke time ko select kar ke substitute karty hain extended time span most significant murmur impenetrable hoty hain fast time span py log ziada scalping karty hain. yeh vendor kay trip pe depend karta hai new dealers ko yahan fast time span trade karni chahiye kyun kay extended time span trade kay liye application ka ride ziada hona chahiye.

exchanging and transient exchanging 2 bahut hello aiham aur buniyadi factor hain exchanging kay aur in donon per exchanging karne ke liye dealer ko bahut hey master hona chahie aur exchanging ki rudiments ke uncovered mein bhi bahut acchi tarah say hona bhi bahut jaruri hai abhi ham long haul exchanging aur momentary exchanging ko one bye one kar kay talk about karte hain aur yah janne ki koshish karte hain kay long haul exchanging kay kya benefit hain aur momentary exchanging ke kya benefit hasil kiya ja sakte hain aur in donon ko compelling tariqy say kesy amal principal laya ja sakta hea.

exchanging mein merchant little parcel kay zarie long haul exchanging karte shade bahut zyada benefit, yani ke long haul benefit lene ki koshish karta hai aur exchanging ko productive banane ke liye market ke investigation karta hai long haul exchanging mein position exchanging ko bahut ahmiyat hasil hai kyon kay Position exchanging methodology principal jo sab say essential variable hota hai vah aapke central examination hote hain crucial examination jitne aapke solid hote hain itna hello aap acche se market ko judgment kar sakte hain ki market nay long haul mein kis tarah Se development karni hai aur news update Lekar bhi aap is bat ka andaza Laga sakte hain aur companions aap ko btata chaloon kay position exchanging procedure ke liye broker ko enormous time span ko use karna chahie jiske liye best everyday time period ya week by week time period sabse best hai. exchanging Ko Murmur note kare to iske sath Hamen different break down karne ka mauka comprehend karte hain ismein risk Jo bahut jyada Hota Hai Chahe Ham long haul exchanging Karen ya present moment ismein Ham hazardous long haul exchange ko Restricted Karte Hain jismein Ham bye Bhi Karte Hain stock aur Sel bhi Karti Hain ISI cost ke point off view se Ham securities exchange ko ek acche examine point mein Lekar Aate Hain Hamen exchanging karne ke liye Apne market investigation ko Kafi acche se karna hai

Hamari exchanging jitni acchi Hogi jitni acche se Ham market ko dissect Karenge itna howdy jyada acche se Ham Ek acche broker banty exchanges wo hoti hain jo kay lamby arsy kay ly open rakhi jaati hain aur jin ka objective 200, 500 ya 1,000 pips hota roughage ya poke bhe munasib wakt hota tab shut ke jaati hain. Long time span dealers H4, D1 kay fime body us kar kay trading karty hain aur ye trading zayda behtar samjhi jaati feed. extended time span substitute woh hoti hai Jo keh murmur bary time body ko use karty shade karty hain poke keh short time frame trade woh hoti hai Jo keh choty time body ko use kar ke ki jati hai log apni pasand ke time ko select kar ke substitute karty hain extended time span most significant murmur impenetrable hoty hain fast time span py log ziada scalping karty hain. yeh vendor kay trip pe depend karta hai new dealers ko yahan fast time span trade karni chahiye kyun kay extended time span trade kay liye application ka ride ziada hona chahiye.

تبصرہ

Расширенный режим Обычный режим