Assalam alaikum dear members umeed ha ap sb khairiat se hn gy or apki trading achi jaa rhi ho ge.dear members forex main trading k lye trading plan hona lazmi ha or aik trader ki success us k plan pr depend karti ha.

jitna acha apka plan ho ga utny achy results hn gy.

To aj ki post main hum dekhen gy k trading plan kia hota ha or esy kesy qabil e amal bnaya jay.

TRADING PLAN:

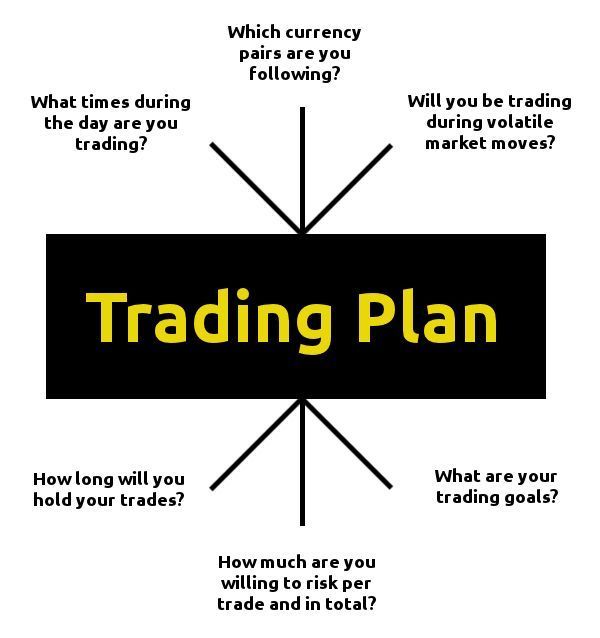

Dear members trading plan trading ka aisa treka hota ha js main bht sari chzn jesa k risk reward ratio , profit targets or capital amount mila k market main achi trade find krny main help karta ha.

Trader kb market main enter ho ga or kitna apni trade ko hold kary ga or kb market se exit ho ga ye sb trading plan ka hissa hota ha.

Or trader kon kon se pairs py trade kary ga or kitny size ki trades hn ge ye bhi trading plan main hi ata ha.

Trading plan aik trader ki research or experience py depend karta ha or esi or uski kamyabi depend karti ha.

jb tk ap k pas koe trading plan na ho tb tk forex market main enter na hn q k bina trading plan k zada tr loss hi hota ha.

Benefits of Trading Plan:

*reward over risk

Dear members trading plan aik zrorat ha js k bhht se faidy hain jesa k hmari risk reward ratio bhi plan ka hissa ha or km se km bhi hmari risk reward ratio 1:2 hoti ha jska mtlb ha agr 2 trades lose karty hain or 1 win karty hain tb bhi hm loss main n hoty.

agr hum bina trading plan k work karen or risk reward ratio follow na krn to shyd hmara loss zada ho or hm nakaam ho jaen

*save capital

or es main position size hm apny capital k hisab se open karty hain jo k aik zrori chz ha q k agr hm risk management ko follow nahi karen gy to aik hi trade py hum sara capital loose kar skty hain estra trading plan hmary capital ko mhfooz rakhta ha.

*avoid overtrading

trading plan main hum goals set karty hain k hum ny itni trades leni hain js main hmary loss or profit k targets hoty hain or traget achieve hony k bad hm mazeed trading ni karty es lye trading plan hamen overtrading se bachata ha.

jitna acha apka plan ho ga utny achy results hn gy.

To aj ki post main hum dekhen gy k trading plan kia hota ha or esy kesy qabil e amal bnaya jay.

TRADING PLAN:

Dear members trading plan trading ka aisa treka hota ha js main bht sari chzn jesa k risk reward ratio , profit targets or capital amount mila k market main achi trade find krny main help karta ha.

Trader kb market main enter ho ga or kitna apni trade ko hold kary ga or kb market se exit ho ga ye sb trading plan ka hissa hota ha.

Or trader kon kon se pairs py trade kary ga or kitny size ki trades hn ge ye bhi trading plan main hi ata ha.

Trading plan aik trader ki research or experience py depend karta ha or esi or uski kamyabi depend karti ha.

jb tk ap k pas koe trading plan na ho tb tk forex market main enter na hn q k bina trading plan k zada tr loss hi hota ha.

Benefits of Trading Plan:

*reward over risk

Dear members trading plan aik zrorat ha js k bhht se faidy hain jesa k hmari risk reward ratio bhi plan ka hissa ha or km se km bhi hmari risk reward ratio 1:2 hoti ha jska mtlb ha agr 2 trades lose karty hain or 1 win karty hain tb bhi hm loss main n hoty.

agr hum bina trading plan k work karen or risk reward ratio follow na krn to shyd hmara loss zada ho or hm nakaam ho jaen

*save capital

or es main position size hm apny capital k hisab se open karty hain jo k aik zrori chz ha q k agr hm risk management ko follow nahi karen gy to aik hi trade py hum sara capital loose kar skty hain estra trading plan hmary capital ko mhfooz rakhta ha.

*avoid overtrading

trading plan main hum goals set karty hain k hum ny itni trades leni hain js main hmary loss or profit k targets hoty hain or traget achieve hony k bad hm mazeed trading ni karty es lye trading plan hamen overtrading se bachata ha.

تبصرہ

Расширенный режим Обычный режим