Channel Formation and Median Line

My dear forum member, Forex trading aik risky business hai. Is me kamyabi k liy different method use hoty hain, ager ap in ko use krty hain to ap Kamyab trader Ban sakty hain. In me say aik technique channel formation aur median line ki understanding hai. Is technique ko use krny say pehly ap ko channel formation aur median Lin eki definition ka pata Hona chaiy.

What is median Line Introduction

Dear median line simply bisector of a given channel ya pher ek range hoti hia median line pitchfork ye ap ko ek point offer krti hai jis ky refrence se trigger inflections se ap is ki price ko adjustkr sakty haen is me median line ye line shifts ho kr upper paraleel ki traf move krti haen is ki price breaks hoti hain below the median line target shifts se ho kr lower paralell ki traf.

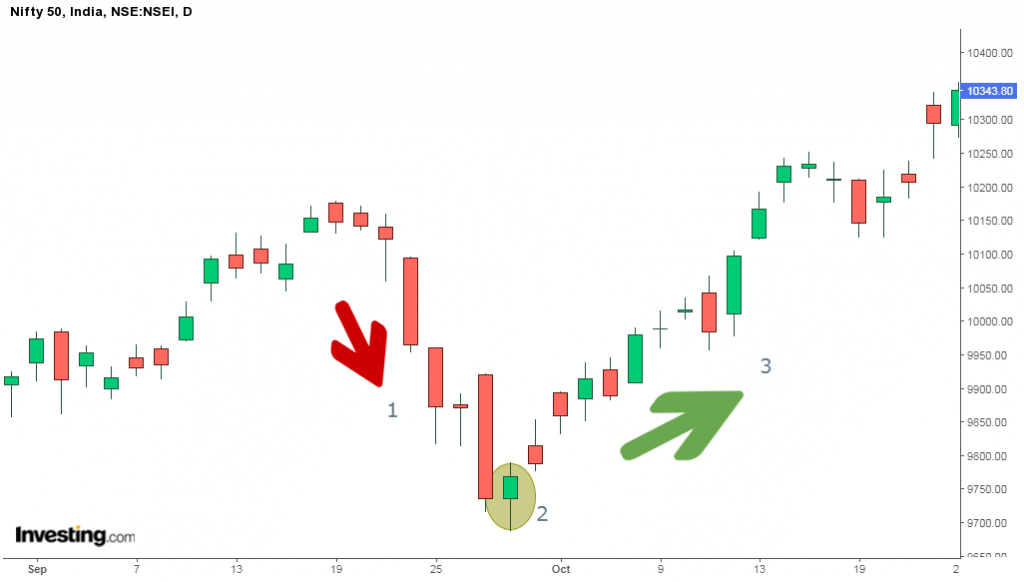

Shape of Channel Formation

Intra day trading main Channel Formation, os formation ko kehty hain, jo 2 different trendline say mil kr banta hai, in me say first trend line support level per hoti hai aur second trend line resistance level per draw ki jati hai. Jab market en 2 line kay andr apni movement continue rakhti hai tu usy aap channel khety hain. Qk market bar bar in trend lines ko respect krti hai is liy market movement in lines k darmiyan rahny k chances hoty hain...

Trading Strategies Using channel formation

Forex markrt main Channel Formation technique aik buht achi technique hai. Is main aap ko hamesha resistance level wali trend line or support level wali trend line per entry laty hain. Jab bhi market above mentioned Trend line per aapko bullish ya bearish signal deti hai aap entry la sakhty hain. Support level trend line per buying trade or resistance level trend line per aapko selling trade laini chaiy.

Trading Using Median Line

Dear, ager ap Median line techniques ko use chahte hain, tu is techniques main aap na center line per trade start krni hoti hai. Jab market support level ko touch kr k median line ki taraf ati hai tu aap selling entry la sakhty hain. Jab market resistance level say median line ki taraf ati hai tu aap mediian line ki touch krny per buying entry la sakhty hain. Ya Techniques bahut hi asan hoti hai aur is say ap buht achi trade lay sakty hain.

Pro and Cons

Forex market Mein kamyabi Hasil karne ke liye hamen channel formation aur median Ko samajhna Hoga jab tak Ham ine chijon Ko Nahin samjhoge Ham median Ko samajhna Hoga jab tak Ham ine chijon Ko Nahin samjhoge Ham forex market me kamyab Nahin ho sakte isliye hamen channel formation aur mehdin Ko samajhna Hoga....

My dear forum member, Forex trading aik risky business hai. Is me kamyabi k liy different method use hoty hain, ager ap in ko use krty hain to ap Kamyab trader Ban sakty hain. In me say aik technique channel formation aur median line ki understanding hai. Is technique ko use krny say pehly ap ko channel formation aur median Lin eki definition ka pata Hona chaiy.

What is median Line Introduction

Dear median line simply bisector of a given channel ya pher ek range hoti hia median line pitchfork ye ap ko ek point offer krti hai jis ky refrence se trigger inflections se ap is ki price ko adjustkr sakty haen is me median line ye line shifts ho kr upper paraleel ki traf move krti haen is ki price breaks hoti hain below the median line target shifts se ho kr lower paralell ki traf.

Shape of Channel Formation

Intra day trading main Channel Formation, os formation ko kehty hain, jo 2 different trendline say mil kr banta hai, in me say first trend line support level per hoti hai aur second trend line resistance level per draw ki jati hai. Jab market en 2 line kay andr apni movement continue rakhti hai tu usy aap channel khety hain. Qk market bar bar in trend lines ko respect krti hai is liy market movement in lines k darmiyan rahny k chances hoty hain...

Trading Strategies Using channel formation

Forex markrt main Channel Formation technique aik buht achi technique hai. Is main aap ko hamesha resistance level wali trend line or support level wali trend line per entry laty hain. Jab bhi market above mentioned Trend line per aapko bullish ya bearish signal deti hai aap entry la sakhty hain. Support level trend line per buying trade or resistance level trend line per aapko selling trade laini chaiy.

Trading Using Median Line

Dear, ager ap Median line techniques ko use chahte hain, tu is techniques main aap na center line per trade start krni hoti hai. Jab market support level ko touch kr k median line ki taraf ati hai tu aap selling entry la sakhty hain. Jab market resistance level say median line ki taraf ati hai tu aap mediian line ki touch krny per buying entry la sakhty hain. Ya Techniques bahut hi asan hoti hai aur is say ap buht achi trade lay sakty hain.

Pro and Cons

Forex market Mein kamyabi Hasil karne ke liye hamen channel formation aur median Ko samajhna Hoga jab tak Ham ine chijon Ko Nahin samjhoge Ham median Ko samajhna Hoga jab tak Ham ine chijon Ko Nahin samjhoge Ham forex market me kamyab Nahin ho sakte isliye hamen channel formation aur mehdin Ko samajhna Hoga....

تبصرہ

Расширенный режим Обычный режим