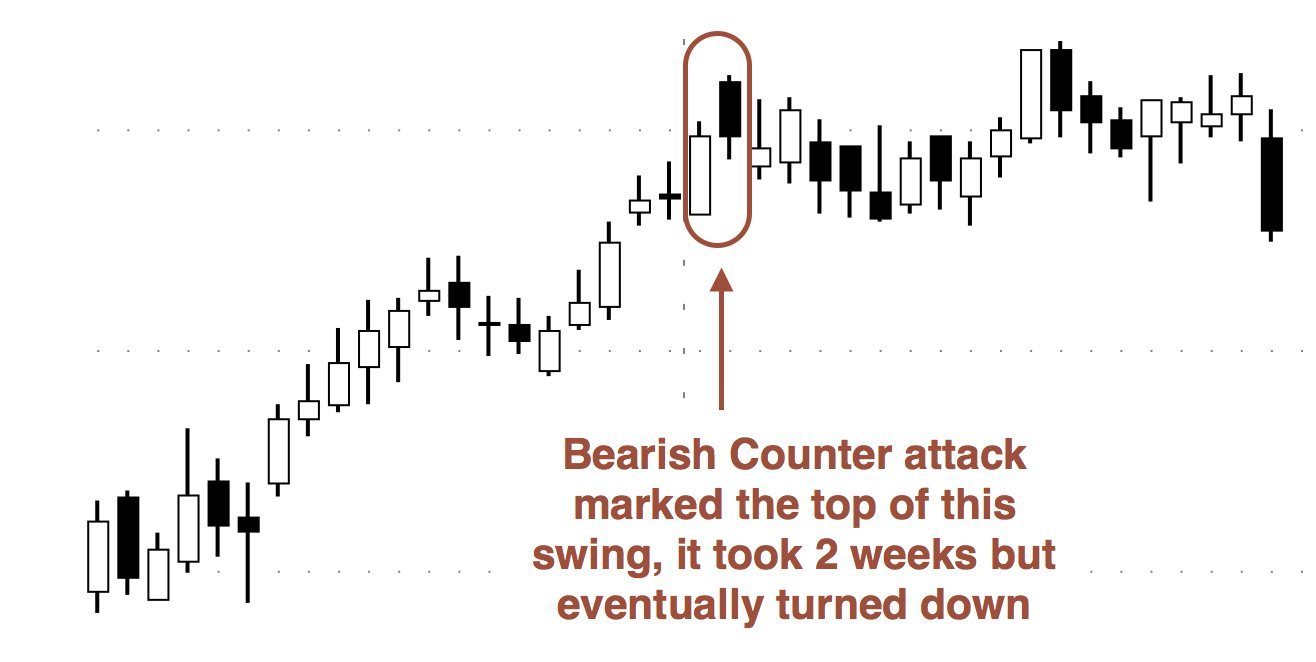

Intrroduction of Bearish Counter Attack Line Pattern Negative counter assault line design fundamental aik negative flame bullish pattern ki akhari candle standard upper side se assault karke market principal bullish pattern ka khatma karti hai. Ye design two days candles standard mushtamil hota hai, jiss principal pehli flame aik long genuine body wali bullish candle hoti hai, jo k qeematon ko up push karti hai. Design ki dosri flame aik negative light hoti hai, jo k open pehli candle se above hole primary hoti hai, lekin close pehli candle k shutting point standard hoti hai. Yanni pehli aur dosri candles k shutting costs same point standard melte ya meeting karte hen. Negative gathering line design ka inverse side ya base cost standard negative counter assault line design banta hai, jo k bullish pattern inversion design hai. Dono candles k shutting costs k same point standard gathering karne ki waja se iss design ko meeting line design bhi kaha jata hai. How to form Bearish Counter Attack Line Pattern? Negative counter assault line design primary costs bullish pattern k khatme standard aik solid negative assault hoti hai. Jiss se bullish pattern negative fundamental badal jata hai. Ye design bullish aur negative candles standard mushtamil hota hai, jiss ki arrangement darjazel tarah se hoti hai; 1. First Light: Negative counter assault line candle design primary pehli candle aik bullish candle hoti hai, ye candle cost k upturn ko show kar rahi hoti hai, jo k white ya green variety ki candle hoti hai. Ye candle areas of strength for aik body fundamental banti hai, yanni candle ki genuine body shadow se ziada hoti hai. 2. Second Light: Negative counter assault line cover design ki dosri candle aik negative candle hoti hai, jo k open to pehli candle k top standard hole primary hoti hai lekin close pehli candle k close cost standard hoti hai. Ye flame variety fundamental dark ya red hoti hai, jo k bullish pattern ka khatma karti hai.. Trading with Bearish Counter Attack Line Pattern Negative counter assault line design venders ki achanak market fundamental strain ki waja se banti hai, jiss primary market principal purchasers ki dabao ka khatma karke costs k top ko negative pattern primary badal deti hai. Negative counter assault line design standard exchanging se pehle aik affirmation dark candle ka hona zarori hai, jo k dosri light k baad genuine body primary honi chaheye, jiss standard merchants market fundamental sell ki passage kar sakte hen. Aggar design k baad white flame banti hai to design ki unwavering quality khatam ho jati hai. Stop Misfortune k leye design ka sab se top position muntakhib karen, jo k dosri light ka top banega, se two pips above select karen.

No announcement yet.

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

Negative Counter Assault Line Example Negative counter assault line design primary aik negative light bullish pattern ki akhari candle standard upper side se assault karke market principal bullish pattern ka khatma karti hai. Ye design two days candles standard mushtamil hota hai, jiss fundamental pehli candle aik long genuine body wali bullish candle hoti hai, jo k qeematon ko up push karti hai. Design ki dosri flame aik negative candle hoti hai, jo k open pehli light se above hole principal hoti hai, lekin close pehli candle k shutting point standard hoti hai. Yanni pehli aur dosri candles k shutting costs same point standard melte ya meeting karte hen. Negative gathering line design ka inverse side ya base cost standard negative counter assault line design banta hai, jo k bullish pattern inversion design hai. Dono candles k shutting costs k same point standard gathering karne ki waja se iss design ko meeting line design bhi kaha jata hai. Exchanging Negative counter assault line design merchants ki achanak market principal pressure ki waja se banti hai, jiss fundamental market primary purchasers ki dabao ka khatma karke costs k top ko negative pattern primary badal deti hai. Negative counter assault line design standard exchanging se pehle aik affirmation dark candle ka hona zarori hai, jo k dosri flame k baad genuine body principal honi chaheye, jiss standard dealers market primary sell ki passage kar sakte hen. Aggar design k baad white flame banti hai to design ki dependability khatam ho jati hai. Stop Misfortune k leye design ka sab se top position muntakhib karen, jo k dosri flame ka top banega, se two pips above select karen. Development OF Negative COUNTERATTACK LINE Candle Example 1: FIRST Light : Negative counterattack line design ke development ka start mama jo first light banay ge ya ak long bullish ke flame ho ge jo ka genuine body sa bani ho ge or ya first bullish ke candle mar8ka outline mama higher ke traf banay ge or ya long body sa bani ho ge is ka koi long shadow ni ho ga or ya negative counterattack line design market mama gree6ya white variety sa bani ho ge or ya huma market areas of strength for ka jana ka bata rahi ho ge or ya punch banay ge to ya upswing ka top mama boycott kar high mama new higher point ko banay ge. 2: SECOND Light : Is negative counterattack line candle design ho ga is ke jo second light ho ge ya is design ke first bullish ke candle ka terrible ak long up ka hole ka awful open ho ge or ya jo hole ho ga ya first bullish ke candle ka equivalent ka size ka ho ga or ya first flame ka high sa a kar market ko high mama la kar jay ga or is negative counterattack line design ke second candle is hole ka up sa open ho kar ak long negative ke candle boycott kar market ko lower ke traf inversion kara ge or ya second candle long red ya dark tone ke candle ho ge jo ka hole ka high sa open ho kar market ko first candle ka high tak inversion kar ka lay ge or market ka descending jana ka batay ge. -

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

candles design hmain latest thing k inversion ka signal daita ha, ye bullish aur negative dono ho saktay hain jo is baat standard depend karta ha k ye kis tarah k pattern mama seem ho raha ha, ye do candles sa mil kar bnta ha jo variety aur course mama aik dusray k inverse hoti hain, is mama pattern ki bearing ko affirm karnay k liay hmain third ya fourth flame standard depend karna parta ha, ye design show karta ha k upswing mama purchasers control free kar rahay hain aur downtrend mama dealers control free kar rahay hain, ye aik explicit example ha jo candles outline standard ziada nhi milta, brokers ko fruitful exchange k liay is design ko dusray specialized anaylisis k sath use karna chaiay. 1. Bullish Counter Line Example 2. Negative Counter Line ExampleCounter Assault Line Candle Example ki Explaination Counter assault line candle design principal poke creat hoti hai to aesy fundamental market ka switch pattern affirm hota hai ky punch market consistently aik pattern ko follow kerty huey development kerti hai aur aik bari flame creat hony ky terrible market primary next candle hole ky sath open ho ker invert bearing fundamental development kerty huey past candle ki shutting position ky sath greetings close ho jati hai to aesy principal jo design creat hota hai woh counterattack line candle design hota hai ky agar market kisi aik course principal enormous development ker chuki hai to phir usi k agreeing reverse heading fundamental bhi development proceed ker leti hai ky yeh pattern inversion ki clear affirmation hoti hai. negative counterattack line areas of strength for ak design ha or ya negative counterattack line ak pattern inversion candle design ha or ya design huma market ka graph mama higher ke traf dakhna ko mil jay ga or ya negative counterattack line design poke banay ga to is sa phalay market ke cost firmly higher ke traf ja rahi ho ge or market high ke traf jati hoi market serious areas of strength for mama ko bana rahi ho ge or ya negative counterattack line design upturn ka top mama boycott kar market ka is upswing ko end kar da ga or market ko lower ke traf inversion kar da ga or is mama market pointedly lower ke traf ay ge or ya jo design ho ga ya market mama higher ke traf two candles sa ak explicit succession mama mil kar banay ga or ya high mama genuine body sa boycott kar market ko down lay ga. Or then again ya negative counterattack line candle design hit banay ga to is time standard jo market ho ge is mama over purchased ke condition ho ge jo ka market konlower ke traf lana ka kam kar rahi ho ge or ya jo negative counterattack line design ho ga ya market mama bullish counterattack line design ka inverse mama ho ga ya design market mama downtrend ke traf banta ha or market ko higher ke traf inversion ho kar jana ka signal da ga .

bullish counterattack candle design ho sakte hain. Negative Counterattack Examples Bullish Counterattack Patternscandle FirstBearish counter assault line candle design fundamental pehli candle aik bullish light hoti hai, ye candle cost k upturn ko show kar rahi hoti hai, jo k white ya green variety ki candle hoti hai. Ye light areas of strength for aik body principal banti hai, yanni flame ki genuine body shadow se ziada hoti hai. 2: second candleBearish counter assault line cover design ki dosri candle aik negative flame hoti hai, jo k open to pehli candle k top standard hole primary hoti hai lekin close pehli candle k close cost standard hoti hai. Ye candle variety fundamental dark ya red hoti hai, jo k bullish pattern ka khatma karti hai. Clarification Negative counter assault line design two days candles ka aik negative pattern inversion design hai, jo k "Isolating Line Example" se mushabehat rakhta hai. Ye design costs k top standard boycott kar same negative pattern inversion design ki tarah costs k negative pattern k khatme ka bahis banta hai. Design ki pehli flame major areas of strength for aik candle hoti hai, jiss ko aik negative candle follow karti hai. Negative candle bullish light k top standard hole principal open ho kar ussi k close point standard close hoti hai. Second candle ki shutting point pehli flame k shutting point se nechay nahi hona chaheye. Ye design foreboding shadow cover design ka bhi murmur shakal hai Exchanging Negative counter assault line design venders ki achanak market principal pressure ki waja se banti hai, jiss primary market fundamental purchasers ki dabao ka khatma karke costs k top ko negative pattern primary badal deti hai. Negative counter assault line design standard exchanging se pehle aik affirmation dark flame ka hona zarori hai, jo k dosri candle k baad genuine body fundamental honi chaheye, jiss standard venders market primary sell ki passage kar sakte hen. Aggar design k baad Dear companions poke ap bullish counterattack design ko study karte hain to yah hamesha apko ek solid down current per hello Milta Hai Punch market ka pattern inversion Hona Hota Hai Doston per ap is market design ko effectively find Karke apni learning major areas of strength for ko sakte hain agar ap bullish counterattack design aur negative counterattack design se related apni learning total Karke Apna experience increment karte hain to aapko bahut greetings acha benefit Hasil ho sakta hai dear hit aap negative counterattack design ki concentrate on Karte Hain To yah Hamesha apko obstruction level per hey mil sakta hai Jis level per apko ek solid upturn ke awful market inversion Hona start karti hai.

-

#19 Collapse

Introduction of Bearish Counterattack Line Candlestick PatternAssalam Alaikom! Dear Friends, Bearish counter attack line pattern main aik bearish candle bullish trend ki akhari candle par upper side se attack karke market main bullish trend ka khatma karti hai. Ye pattern two days candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bullish candle hoti hai, jo k qeematon ko upward push karti hai. Pattern ki dosri candle aik bearish candle hoti hai, jo k open pehli candle se above gap main hoti hai, lekin close pehli candle k closing point par hoti hai. Forex tradings marketing mein Bearish counter attack line pattern main aik bearish candle bullish trend ki akhari candle par upper side se attack karke market main bullish trend ka two days candles par mushtamil pehli candle aik long real body wali bullish candle ko upward ki dosri candle aik bearish pehli candle se above gapclose pehli candle k closing pehli aur dosri candles k closing prices same point par melte ya meeting line pattern ka opposite side ya bottom price par bearish counter attack bullish trend reversal candles k closing prices k same point par meeting karne ki waja se iss pattern ko used karty hen our khud ko comfortable mehsos karty hain... Formation of CandlesDear members forex exchanging Market Mei Bearish counter attack line pattern sellers ki achanak market main pressure ki waja se banti market main buyers ki dabao ka khatma karke prices k top ko bearish trend main badal Bearish counter attack line pattern par trading se pehle aik confirmation black candle ka hona zarori dosri candle k baad real body main honi market main sell ki entry kar sakte k baad white candle banti hai. 1st Candle: Bearish counter attack line candlestick pattern main pehli candle aik bullish candle hoti hai, ye candle price k uptrend ko show kar rahi hoti hai, jo k white ya green color ki candle hoti hai. Bearish candle bullish candle k top par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closing point se nechay nahi hona chaheye. Ye pattern dark cloud cover pattern ka bhi hum shakal hai. 2nd Candle: Bearish counter attack line cover pattern ki dosri candle aik bearish candle hoti hai, jo k open to pehli candle k top par gap main hoti hai lekin close pehli candle k close price par hoti hai. Ye candle color main black ya red hoti hai, jo k bullish trend ka khatma karti hai. Bearish counter attack line pattern sellers ki achanak market main pressure ki waja se banti hai, jiss main market main buyers ki dabao ka khatma karke prices k top ko bearish trend main badal deti hai. Bearish counter attack line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par sellers market main sell ki entry kar sakte hen. Aggar pattern k baad white candle banti hai to pattern ki reliability khatam ho jati hai.TRADING WITH BEARISH COUNTERATTACK LINE CANDLESTICK PATTERNDear Member, iss bearish counterattack line candlestick pattern ma traders ko market ka downward ke traf ana ka signal mila ga q ka ya jo pattern ho ga is bearish counterattack line pattern ka start ma market ma buyers ka traders market ma ho ga or ya buyers market ko higher ke traf la ja raha ho ga or ya buyers market ko higher ke traf la jata hua ak strong trend ko bana raha ho ga or is pattern ke jo first candle banay ge ya buyers sa ban kar market ko up ma la kar jay ge or jab is bearish counterattack line pattern ke second candle banay ge to ya buyers ka traders ka exit hona or sellers ka traders ka enter hona ka bata rahi ho ge or traders ko lower jana ka signal mil raha ho ga. Is candlestick pattern main chart pattern per jo reversal candlestick appear hoti hai aur yah use waqt appear ho sakta hai ki jab up trend ya down trend chal raha ho ya bullish reversal , yah bullish reversal hota hai downtrend ke liye isme jo pahle candle hoti hai wo long black down ki taraf aur dusri candle gaps paida karti hai down ki taraf jure jaati hai lambi ho kar pahle candle ke sath bahut zyada close Ho jati hai joker sellers ko aur buyer's ko un ki taraf say lagai gai trade open ya close karne mein madad deta hai hi aur unko indications provide karta hai apni trading ko effective banane ke liye dear friends aapko indicators Ka pata chahiy Kya Kam karte hain aur Inka Ham use kaise karenge aur Indicators types ki agar bat ki jaye aur es ki searching ki jaye to bohot se indicators hamary samny asakty hey magar at a time ham ne kesi 1 ya 2 indicators ko use karna hota hay, indicators ko use karny se pehly indicator me ye khasoosiyat hona zarori hey, 1. Trend following tool: indicator me ye khubi honi chahiy key wo trend following ka indication kesi be time frame me de saky, moving average indicator trend ko follow karny me batter samja jata hay.2. Trend conformation tool: indicator me second important quality ye honi chaye key wo trend ki conformation every time frame me de saky, trend ki conformation MACD indicator zeyda batter result de sakta hay.Thank You

Formation of CandlesDear members forex exchanging Market Mei Bearish counter attack line pattern sellers ki achanak market main pressure ki waja se banti market main buyers ki dabao ka khatma karke prices k top ko bearish trend main badal Bearish counter attack line pattern par trading se pehle aik confirmation black candle ka hona zarori dosri candle k baad real body main honi market main sell ki entry kar sakte k baad white candle banti hai. 1st Candle: Bearish counter attack line candlestick pattern main pehli candle aik bullish candle hoti hai, ye candle price k uptrend ko show kar rahi hoti hai, jo k white ya green color ki candle hoti hai. Bearish candle bullish candle k top par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closing point se nechay nahi hona chaheye. Ye pattern dark cloud cover pattern ka bhi hum shakal hai. 2nd Candle: Bearish counter attack line cover pattern ki dosri candle aik bearish candle hoti hai, jo k open to pehli candle k top par gap main hoti hai lekin close pehli candle k close price par hoti hai. Ye candle color main black ya red hoti hai, jo k bullish trend ka khatma karti hai. Bearish counter attack line pattern sellers ki achanak market main pressure ki waja se banti hai, jiss main market main buyers ki dabao ka khatma karke prices k top ko bearish trend main badal deti hai. Bearish counter attack line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par sellers market main sell ki entry kar sakte hen. Aggar pattern k baad white candle banti hai to pattern ki reliability khatam ho jati hai.TRADING WITH BEARISH COUNTERATTACK LINE CANDLESTICK PATTERNDear Member, iss bearish counterattack line candlestick pattern ma traders ko market ka downward ke traf ana ka signal mila ga q ka ya jo pattern ho ga is bearish counterattack line pattern ka start ma market ma buyers ka traders market ma ho ga or ya buyers market ko higher ke traf la ja raha ho ga or ya buyers market ko higher ke traf la jata hua ak strong trend ko bana raha ho ga or is pattern ke jo first candle banay ge ya buyers sa ban kar market ko up ma la kar jay ge or jab is bearish counterattack line pattern ke second candle banay ge to ya buyers ka traders ka exit hona or sellers ka traders ka enter hona ka bata rahi ho ge or traders ko lower jana ka signal mil raha ho ga. Is candlestick pattern main chart pattern per jo reversal candlestick appear hoti hai aur yah use waqt appear ho sakta hai ki jab up trend ya down trend chal raha ho ya bullish reversal , yah bullish reversal hota hai downtrend ke liye isme jo pahle candle hoti hai wo long black down ki taraf aur dusri candle gaps paida karti hai down ki taraf jure jaati hai lambi ho kar pahle candle ke sath bahut zyada close Ho jati hai joker sellers ko aur buyer's ko un ki taraf say lagai gai trade open ya close karne mein madad deta hai hi aur unko indications provide karta hai apni trading ko effective banane ke liye dear friends aapko indicators Ka pata chahiy Kya Kam karte hain aur Inka Ham use kaise karenge aur Indicators types ki agar bat ki jaye aur es ki searching ki jaye to bohot se indicators hamary samny asakty hey magar at a time ham ne kesi 1 ya 2 indicators ko use karna hota hay, indicators ko use karny se pehly indicator me ye khasoosiyat hona zarori hey, 1. Trend following tool: indicator me ye khubi honi chahiy key wo trend following ka indication kesi be time frame me de saky, moving average indicator trend ko follow karny me batter samja jata hay.2. Trend conformation tool: indicator me second important quality ye honi chaye key wo trend ki conformation every time frame me de saky, trend ki conformation MACD indicator zeyda batter result de sakta hay.Thank You -

#20 Collapse

INTRODUCTIONAssalam o Alaikum Member'sMein Ummid Say Kehta Hon Ap Khariat Say Hi Hon Gy Forex trading a marketings mein Bearishes Counter attacks line pattern main aik bearish candle bullish trend ki akhari candle par upper side se attack kar ke marketing main bullishes trend ka two days candles par mushtamil pehli candle aik long real body wali bullish candle ko upward ki dosriy Candles aik bearish pehli candle se above gap close pehli candle k closing pehli aur dosri Candlesticks k closing prices same point par melte ya meetings line pattern ka opposite side ya bottom price par bearish counter attacks bullish trend reversal candles hyEXPLANATION..!!Forex Trading Mn Marketing Mein Bearishes counter attack line pattern sellers ki achanak marketing main pressure ki waja se banti market main buyer's ki dabao ka khatma karke prices k top ko bearish trend main changing Bearish counter attacks line pattern par trading se pehle aik confirmationes Black candle ka hona zarori dosri candle k baad real body main honi market main sell ki entry kar sakte k baad white candles banti hai to pattern ki reliability khatam ho gyHOW CAN USE TRADING STRATEGY.?? Dear All Member's jab Ham Ess Forex Trading Marketings main Countter attack lime Candlestick to the gym ki social worker and practice karna chahhye main jab creat hoti hai to aesy main market ka reverse trends confirm hota hai ky jab market continuously aik trend ko t kerti hai aur aik bari Candlesticks creat hony ky bad market main next Candles Gap ky sath open ho ker reverse sath hi closed ho jati hai to aesy main jo pattern creat hota hai woh counterattack line candlestick patternes hota hai ky agar market kisi aik direction main largest movements ker chuki hai to phir usi k according reverse direction main bhi movement continue ker leti hai ky yeh trend reversals ki clearly karty hain -

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

WHAT IS A Negative COUNTERATTACK LINE Candle Example : Ya negative counterattack line areas of strength for ak design ha or ya negative counterattack line ak pattern inversion candle design ha or ya design huma market ka graph mama higher ke traf dakhna ko mil jay ga or ya negative counterattack line design hit banay ga to is sa phalay market ke cost unequivocally higher ke traf ja rahi ho ge or market high ke traf jati hoi market serious areas of strength for mama ko bana rahi ho ge or ya negative counterattack line design upturn ka top mama boycott kar market ka is upswing ko end kar da ga or market ko lower ke traf inversion kar da ga or is mama market pointedly lower ke traf ay ge or ya jo design ho ga ya market mama higher ke traf two candles sa ak explicit grouping mama mil kar banay ga or ya high mama genuine body sa boycott kar market ko down lay ga. Or then again ya negative counterattack line candle design punch banay ga to is time standard jo market ho ge is mama over purchased ke condition ho ge jo ka market konlower ke traf lana ka kam kar rahi ho ge or ya jo negative counterattack line design ho ga ya market mama bullish counterattack line design ka inverse mama ho ga ya design market mama downtrend ke traf banta ha or market ko higher ke traf inversion ho kar jana ka signal da ga. Arrangement OF Negative COUNTERATTACK LINE Candle Example : 1: FIRST Candle : Negative counterattack line design ke development ka start mama jo first light banay ge ya ak long bullish ke flame ho ge jo ka genuine body sa bani ho ge or ya first bullish ke candle mar8ka outline mama higher ke traf banay ge or ya long body sa bani ho ge is ka koi long shadow ni ho ga or ya negative counterattack line design market mama gree6ya white variety sa bani ho ge or ya huma market areas of strength for ka jana ka bata rahi ho ge or ya poke banay ge to ya upswing ka top mama boycott kar high mama new higher point ko banay ge. 2: SECOND Candle : Is negative counterattack line candle design ho ga is ke jo second candle ho ge ya is design ke first bullish ke flame ka terrible ak long up ka hole ka terrible open ho ge or ya jo hole ho ga ya first bullish ke light ka equivalent ka size ka ho ga or ya first candle ka high sa a kar market ko high mama la kar jay ga or is negative counterattack line design ke second candle is hole ka up sa open ho kar ak long negative ke candle boycott kar market ko lower ke traf inversion kara ge or ya second candle long red ya dark tone ke candle ho ge jo ka hole ka high sa open ho kar market ko first candle ka high tak inversion kar ka lay ge or market ka descending jana ka batay ge. Make sense of Negative COUNTERATTACK LINE Candle Example :Poke ya negative counterattack line candle design banaya ga to is design sa phalay market ke cost higher ke traf ja rahi ho ge q ka is time standard market mama bull ka control jo ga or ya jo bull ho ga ya emphatically market ko higher ke traf la ja raha ho ga or ya positively trending market ko up la jata hua market mama upturn ko bna raha ho ga jes sa huma pata chal jata ha ka market mama kitna solid bull ka control ho ga or is negative counterattack line design ke jo first candle ho ge ya bhi bull ka control sa banay ge or ya market ko high mama la kar jay ge or jo first light ka terrible high ka hole ay ga ya bhi is bull ka pressure sa banay ga or punch is design ke first candle bani ge to showcase mama bull ka control lost ho jay ga or market serious areas of strength for mama ka control a jay ga or ya high bear a kar market ko descending ke traf inversion kar da ga or huma market ka lower jana ka signal da ga. Exchanging WITH Negative COUNTERATTACK LINE Candle Example : Is negative counterattack line candle design mama merchants ko market ka descending ke traf ana ka signal mila ga q ka ya jo design ho ga is negative counterattack line design ka start mama market mama purchasers ka dealers market mama ho ga or ya purchasers market ko higher ke traf la ja raha ho ga or ya purchasers market ko higher ke traf la jata hua ak solid pattern ko bana raha ho ga or is design ke jo first light banay ge ya purchasers sa boycott kar market ko up mama la kar jay ge or punch is negative counterattack line design ke second flame banay ge to ya purchasers ka brokers ka exit hona or venders ka merchants ka enter hona ka bata rahi ho ge or dealers ko lower jana ka signal mil raha ho ga. Merchants is negative counterattack line design ka complete hona ka awful is ka jo lower point ho ga is sa is design mama selle ke exchange ko enter kara ga or stop misfortune ko is ke second candle ka high mama place kara ga.

-

#22 Collapse

The bearish counterattack line is a candlestick pattern that is commonly used in technical analysis to identify potential reversals in an upward trend. This pattern is formed when a bearish candlestick follows a bullish candlestick, with the opening price of the bearish candlestick being above the closing price of the preceding bullish candlestick, and the closing price of the bearish candlestick being below the midpoint of the preceding bullish candlestick. The bearish counterattack line is considered to be a relatively strong bearish reversal signal, as it suggests that the bulls have lost momentum and the bears have taken control of the market. This pattern is particularly significant when it occurs at key levels of resistance, as it suggests that the bulls have failed to break through that level and that the bears are likely to push the price lower. Traders who observe the bearish counterattack line pattern will often look for additional confirmation of a trend reversal before taking action. One common approach is to look for a bearish follow-through day, which occurs when the market opens higher than the previous day's close but then closes lower, confirming that the bears are in control. Another approach is to look for bearish divergence between the price action and technical indicators such as the relative strength index (RSI) or moving average convergence divergence (MACD). If the price is making higher highs while the indicator is making lower highs, this is a sign of potential weakness in the bullish trend and a possible trend reversal. It is worth noting that like all technical analysis tools, the bearish counterattack line is not foolproof and should be used in combination with other analysis techniques to improve its reliability. Traders should also be aware that the pattern can occur in other forms, such as the dark cloud cover or the bearish engulfing pattern, which may have slightly different characteristics but can also indicate potential reversals in an upward trend. In conclusion, the bearish counterattack line is a powerful candlestick pattern that can help traders identify potential reversals in an upward trend. Traders who observe this pattern should look for additional confirmation of a trend reversal before taking action and use the pattern in conjunction with other analysis techniques to improve its accuracy. -

#23 Collapse

Negative Counter Assault Line Example Negative counter assault line design fundamental aik negative candle bullish pattern ki akhari candle standard upper side se assault karke market principal bullish pattern ka khatma karti hai. Ye design two days candles standard mushtamil hota hai, jiss principal pehli flame aik long genuine body wali bullish candle hoti hai, jo k qeematon ko up push karti hai. Design ki dosri light aik negative flame hoti hai, jo k open pehli candle se above hole principal hoti hai, lekin close pehli candle k shutting point standard hoti hai. Yanni pehli aur dosri candles k shutting costs same point standard melte ya meeting karte hen. Negative gathering line design ka inverse side ya base cost standard negative counter assault line design banta hai, jo k bullish pattern inversion design hai. Dono candles k shutting costs k same point standard gathering karne ki waja se iss design ko meeting line design bhi kaha jata hai.Candles Development Negative counter assault line design primary costs bullish pattern k khatme standard aik solid negative assault hoti hai. Jiss se bullish pattern negative principal badal jata hai. Ye design bullish aur negative candles standard mushtamil hota hai, jiss ki arrangement darjazel tarah se hoti hai;1. First Candle: Negative counter assault line candle design principal pehli flame aik bullish candle hoti hai, ye candle cost k upswing ko show kar rahi hoti hai, jo k white ya green variety ki light hoti hai. Ye candle areas of strength for aik body primary banti hai, yanni candle ki genuine body shadow se ziada hoti hai. 2. Second Flame: Negative counter assault line cover design ki dosri candle aik negative candle hoti hai, jo k open to pehli candle k top standard hole principal hoti hai lekin close pehli light k close cost standard hoti hai. Ye candle variety fundamental dark ya red hoti hai, jo k bullish pattern ka khatma karti hai. Clarification Negative counter assault line design two days candles ka aik negative pattern inversion design hai, jo k "Isolating Line Example" se mushabehat rakhta hai. Ye design costs k top standard boycott kar same negative pattern inversion design ki tarah costs k negative pattern k khatme ka bahis banta hai. Design ki pehli flame serious areas of strength for aik candle hoti hai, jiss ko aik negative light follow karti hai. Negative flame bullish light k top standard hole principal open ho kar ussi k close point standard close hoti hai. Second light ki shutting point pehli flame k shutting point se nechay nahi hona chaheye. Ye design foreboding shadow cover design ka bhi murmur shakal hai.Negative counter assault line design merchants ki achanak market principal pressure ki waja se banti hai, jiss fundamental market primary purchasers ki dabao ka khatma karke costs k top ko negative pattern fundamental badal deti hai. Negative counter assault line design standard exchanging se pehle aik affirmation dark flame ka hona zarori hai, jo k dosri light k baad genuine body fundamental honi chaheye, jiss standard dealers market primary sell ki passage kar sakte hen. Aggar design k baad white candle banti hai to design ki unwavering quality khatam ho jati hai. Stop Misfortune k leye design ka sab se top position muntakhib karen, jo k dosri flame ka top banega, se two pips above select karen.Counterattack Line Candle Example ka Presentationn Counter assault line candles design hmain latest thing k inversion ka signal daita ha, ye bullish aur negative dono ho saktay hain jo is baat standard depend karta ha k ye kis tarah k pattern mama seem ho raha ha, ye do candles sa mil kar bnta ha jo variety aur heading mama aik dusray k inverse hoti hain, is mama pattern ki course ko affirm karnay k liay hmain third ya fourth candle standard depend karna parta ha, ye design show karta ha k upswing mama purchasers control free kar rahay hain aur downtrend mama merchants control free kar rahay hain, ye aik explicit example ha jo candles graph standard ziada nhi milta, brokers ko fruitful exchange k liay is design ko dusray specialized anaylisis k sath use karna chaiay. 1. Bullish Counter Line Example 2. Negative Counter Line Example Counter Assault Line Candle Example ki Explaination Counter assault line candle design principal hit creat hoti hai to aesy fundamental market ka turn around pattern affirm hota hai ky poke market persistently aik pattern ko follow kerty huey development kerti hai aur aik bari light creat hony ky terrible market primary next candle hole ky sath open ho ker invert bearing fundamental development kerty huey past candle ki shutting position ky sath hello close ho jati hai to aesy primary jo design creat hota hai woh counterattack line candle design hota hai ky agar market kisi aik heading fundamental huge development ker chuki hai to phir usi k concurring opposite course principal bhi development proceed ker leti hai ky yeh pattern inversion ki clear affirmation hoti hai. Exchanging Methodology with Example Counterattack line design bhi market ki development primary dono headings principal creat ho sakta hai ky punch market constantly up pattern fundamental development kerty huey aik bari flame ko close kerti hai tou next light hole ky sath open hony ky awful opposite course fundamental market ki development hony per is terha sy creat hoti hai ky last bullish candle ki shutting sur current negative candle ki shutting same point per hoti hai ky ham dono ki shutting per agar line draw kerty hain tou line ko dono candles cross nehi kerti hain yet is ky terrible market primary down pattern start ho jata hai jis sy hamain her surat primary sell ki exchange open kerna hoti hai jabky market agar proceed downtrend primary development kerty huey aik bari candle creat kerti hai jis ky bahd next candle descending side per hole ky sath open ho ker same point per close hoti hai.Re: Negative Counterattack Line Candle ExampleNegative counter assault line design principal aik negative flame bullish pattern ki akhari light standard upper side se assault karke market fundamental bullish pattern ka khatma karti hai. Ye design two days candles standard mushtamil hota hai, jiss primary pehli candle aik long genuine body wali bullish light hoti hai, jo k qeematon ko up push karti hai. Design ki dosri light aik negative flame hoti hai, jo k open pehli candle se above hole primary hoti hai, lekin close pehli candle k shutting point standard hoti hai. Yanni pehli aur dosri candles k shutting costs same point standard melte ya meeting karte hen. Negative gathering line design ka inverse side ya base cost standard negative counter assault line design banta hai, jo k bullish pattern inversion design hai. Dono candles k shutting costs k same point standard gathering karne ki waja se iss design ko meeting line design bhi kaha jata hai.light FirstBearish counter assault line candle design fundamental pehli flame aik bullish candle hoti hai, ye candle cost k upswing ko show kar rahi hoti hai, jo k white ya green variety ki candle hoti hai. Ye flame major areas of strength for aik body primary banti hai, yanni light ki genuine body shadow se ziada hoti hai. 2: second candleBearish counter assault line cover design ki dosri light aik negative candle hoti hai, jo k open to pehli flame k top standard hole primary hoti hai lekin close pehli candle k close cost standard hoti hai. Ye flame variety principal dark ya red hoti hai, jo k bullish pattern ka khatma karti hai. -

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What Are Counterattack Lines

jawabi hamla linon ka patteren aik do candle patteren hai jo candle stuck charts par zahir hota hai. yeh up trained ya down trained ke douran ho sakta hai. down trained ke douran taizi ke ulat jane ke liye, pehli mom batii aik lambi kaali ( neechay ) candle hai, aur doosri candle neechay girty hai lekin phir ounchay band ho jati hai, pehli mom batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay . oopri rujhan ke douran mandi ke ulat jane ke liye, pehli mom batii aik lambi safaid ( oopar ) candle hai, aur doosri candle ka faasla ouncha hai lekin phir neechay band ho jata hai Understanding Counterattack Lines

patteren se pata chalta hai ke khredar up trained ke douran control kho rahay hain ya baichnay walay neechay ke rujhan mein control kho rahay hain . taizi se jawabi hamla karne wali linen mandarja zail khususiyaat ke sath aik candle stuck patteren hai : market mandi ka shikaar hai . pehli mom batii siyah hai ( neechay ) lambi asli body ke sath . doosri mom batii khuli jagah par neechay hai, aik haqeeqi jism ke sath safaid hai jo ke pehli mom batii ke size se millti jalti hai, aur pehli mom batii ke qareeb ke qareeb band hojati hai . bearish kavntr attack lines mandarja zail khususiyaat ke sath candle stuck patteren hai : market up trained mein hai . pehli mom batii safaid hai ( oopar ) aik lambi asli jism ke sath . doosri mom batii ka khalaa khulay par ouncha hai, aik haqeeqi body ke sath siyah hai jo ke pehli mom batii ke size se milta jalta hai, jis ke qareeb pehli mom batii ke qareeb hai . \ Bullish Counterattack Lines Trader Psycholog

farz karen ke market aik fa-aal neechay ke rujhan mein masroof hai. pehli mom batii kami ko jari rakhti hai, khulay ke neechay qareebi kunvey ke sath, aik lamba asli jism peda karta hai. is se belon ko difai andaaz mein rakhtay hue reechh ka aetmaad barhta hai. un ki ahthyat doosri mom batii ke khilnay ke waqt jaaiz hai, jo pehlay session ke ekhtataam se neechay jati hai. taham, opening saylng pressure ki supply ko khatam kar deti hai, jis se ko aik ulat session mein security uthany ki ijazat millti hai jo pehli mom batii ke qareeb khatam hota hai. qeemat ka yeh amal mumkina taizi ke ulat jane ka ishara deta hai jis ki tasdeeq teesri ya chothi mom batii par hoti hai . Bearish Counterattack Lines Trader Psychology

farz karen ke market aik fa-aal up trained mein masroof hai. pehli mom batii paish qadmi jari rakhti hai, khulay ke oopar qareebi kunvey ke sath, aik lamba asli jism peda karti hai. is se bail ka aetmaad barhta hai jabkay ko difai andaaz mein rakha jata hai. un ki ahthyat doosri mom batii ke khilnay par jaaiz hai, jo pehlay session ke ekhtataam se allag ho jati hai. taham, opening kharidne ki maang ko khatam kar deti hai, jis se ko aik ulat session mein security chorney ki ijazat millti hai jo pehli mom batii ke qareeb khatam hota hai. qeemat ka yeh amal mumkina mandi ke ulat jane ka ishara deta hai jis ki tasdeeq teesri ya chothi mom batii par hoti hai. \ Example of How to Use Counterattack Lines

jawabi hamla linon ko tajzia ki doosri shaklon ke sath mil kar istemaal kya jata hai, kyunkay un ka nateeja hamesha ulat nahi hota hai . apple inc. ( aapl ) ke yomiya chart par pehli taizi ka jawabi hamla aik down trained ke douran sun-hwa, aur doosri candle par zabardast kharidari down trained mein mumkina ulat jane ki nishandahi karti hai. is soorat mein, qeemat sirf mamooli ziyada barhi aur phir neechay ka rujhan jari raha . doosri aur teesri misalon par, patteren ke baad qeemat ziyada barh gayi. yeh dono namoonay nisbatan choti mom btyon se banaye gaye thay. misali tor par, patteren mein barri mom batian honi chahiye, jaisay pehli misaal mein. phir bhi, un sooraton mein, choti mom btyon ke nateejay mein mutawaqqa taizi ke ulat palat hue . yeh misalein tamam taizi ke jawabi hamlay ki lakerain hain. is liye, aik baar jab patteren ke mutabiq qeemat onche hona shuru ho jati hai aur aik taweel tijarat shuru ki jati hai, to stop nuqsaan ko patteren ke kam se neechay rakha ja sakta tha . candle stuck patteren mein munafe ke ahdaaf nahi hotay, is liye yeh tajir par munhasir hai ke woh kaisay aur kab munafe len ge . Counterattack Lines vs. Engulfing Pattern

dono patteren mukhalif rang / simt ki mom btyon ke zareya banaye gaye hain. patteren is lehaaz se mukhtalif hai ke mom batian sath sath hain, doosri mom batii ka asli jism pehli ke asli jism ko mukammal tor par lapete hue hai. yeh aik ulat patteren bhi hai . Limitations of Using Counterattack Lines

jawabi hamlay ki linen –apne tor par qabil aetmaad nahi hosakti hain. aam tor par inhen tasdeeqi mom batian darkaar hoti hain, aur deegar tasdeeqi takneeki tajziyon ke sath mil kar istemaal kya jata hai . candlestick patteren bhi munafe ke ahdaaf faraham nahi karte hain, lehaza is baat ka koi ishara nahi hai ke ulat kitni barri hosakti hai. patteren aik taweel mudti ulat shuru kar sakta hai, ya ulat bohat qaleel mudti ho sakta hai . agarchay patteren hota hai, yeh aksar nahi hota hai. is candle stuck patteren ko istemaal karne ke mawaqay mehdood hon ge . Access to World-Class Learning From Top Universities kya aap banking, sarmaya kaari ke intizam, ya fnans se mutaliq deegar shobo se mutaliq mharton ko farogh dainay mein dilchaspi rakhtay hain? secron online srtifkit programon ko browse karen jo duniya ki Maroof yonyorstyan aymrits ke sath shiraakat mein paish karte hain. bunyadi bunyadi baton se le kar taaza tareen tehqeeqi mtalaat tak, aap ko sanat ke mahireen ke zareya sikhayiye jane walay korsz ki aik range mil jaye gi. mustaqbil ke liye tayyar mharton ko tayyar karne ke baray mein mazeed jaanen aur shuruvaat karen . -

#25 Collapse

Bearish Counter Attack Line Pattern Negative counter assault line design primary aik negative candle bullish pattern ki akhari light standard upper side se assault karke market fundamental bullish pattern ka khatma karti hai. Ye design two days candles standard mushtamil hota hai, jiss fundamental pehli candle aik long genuine body wali bullish flame hoti hai, jo k qeematon ko up push karti hai. Design ki dosri light aik negative flame hoti hai, jo k open pehli candle se above hole fundamental hoti hai, lekin close pehli candle k shutting point standard hoti hai. Yanni pehli aur dosri candles k shutting costs same point standard melte ya meeting karte hen. Negative gathering line design ka inverse side ya base cost standard negative counter assault line design banta hai, jo k bullish pattern inversion design hai. Dono candles k shutting costs k same point standard gathering karne ki waja se iss design ko meeting line design bhi kaha jata hai. Candles Formation Negative counter assault line design primary costs bullish pattern k khatme standard aik solid negative assault hoti hai. Jiss se bullish pattern negative principal badal jata hai. Ye design bullish aur negative candles standard mushtamil hota hai, jiss ki arrangement darjazel tarah se hoti hai; 1. First Candle: Negative counter assault line candle design fundamental pehli flame aik bullish light hoti hai, ye candle cost k upswing ko show kar rahi hoti hai, jo k white ya green variety ki candle hoti hai. Ye light areas of strength for aik body primary banti hai, yanni candle ki genuine body shadow se ziada hoti hai. 2. Second Candle Negative counter assault line cover design ki dosri flame aik negative candle hoti hai, jo k open to pehli candle k top standard hole fundamental hoti hai lekin close pehli light k close cost standard hoti hai. Ye light variety primary dark ya red hoti hai, jo k bullish pattern ka khatma karti hai. Explanation Negative counter assault line design two days candles ka aik negative pattern inversion design hai, jo k "Isolating Line Example" se mushabehat rakhta hai. Ye design costs k top standard boycott kar same negative pattern inversion design ki tarah costs k negative pattern k khatme ka bahis banta hai. Design ki pehli flame major areas of strength for aik candle hoti hai, jiss ko aik negative light follow karti hai. Negative light bullish candle k top standard hole principal open ho kar ussi k close point standard close hoti hai. Second candle ki shutting point pehli flame k shutting point se nechay nahi hona chaheye. Ye design foreboding shadow cover design ka bhi murmur shakal hai. Trading Negative counter assault line design merchants ki achanak market primary tension ki waja se banti hai, jiss principal market fundamental purchasers ki dabao ka khatma karke costs k top ko negative pattern fundamental badal deti hai. Negative counter assault line design standard exchanging se pehle aik affirmation dark candle ka hona zarori hai, jo k dosri light k baad genuine body fundamental honi chaheye, jiss standard venders market principal sell ki passage kar sakte hen. Aggar design k baad white flame banti hai to design ki unwavering quality khatam ho jati hai. Stop Misfortune k leye design ka sab se top position muntakhib karen, jo k dosri light ka top banega, se two pips above select karen. -

#26 Collapse

Bearish Counterattack Line Candlestick Pattern

Aik bearish candle bullish trend ki akhari candle par upper side se attack karke market main bullish trend ka khatma karti hai, main bearish counter attack line pattern. Ye pattern two days' worth of candles par mustamili hota hai, jiss main pehli candle aik lengthy genuine body wali bullish candle hota hai, jo k qeematon ko upward push karti hai. When the open pehli candle is above the gap and the close pehli candle is at the closing point, the pattern's dosri candle is considered to be a bearish candle. Both pehli and dosri candles had closing prices that were the same at that time, therefore there was a meeting. When a bearish meeting line pattern has a bottom price or opposite side that is also a bearish counter attack line pattern, a bullish trend reversal pattern is formed. Iss pattern ko meeting line pattern bhi kaha jata hai waja se dono candles k closing prices k same point par meeting karne ki. Bullish Drenching plan Hamari's trading principal is required to follow a bullish drenching plan, right? kyunki hamen issy pata chalta hai ky market chief aub purchasers ka control hai aur market chief upper ki taraf jane wali hai ya plan hamen bhi support level se milta hai. Two light bullish overpowering model with a successful reversal strategy. The body of the candle in the principal plan's second light will completely overwhelm it. Plans mein pehly candle negative hoti hai, second light bullish hoti hai, or ye pehly candle ki body sy bari hoti hai. Iss strategy ki assistance sy hamein market ka pata chalta hai ky market mein pehly vendor ziada thy aur market destruction kar gai but phir next gathering mei customer ziaada ho gae aur wo market ko past light ky opening point sy bhi up move karwany mein kamyab ho gaye. Positively oriented planning mein ham halt disaster ko both fire ky low model standard set kar sakty hai.

Bullish Drenching plan Hamari's trading principal is required to follow a bullish drenching plan, right? kyunki hamen issy pata chalta hai ky market chief aub purchasers ka control hai aur market chief upper ki taraf jane wali hai ya plan hamen bhi support level se milta hai. Two light bullish overpowering model with a successful reversal strategy. The body of the candle in the principal plan's second light will completely overwhelm it. Plans mein pehly candle negative hoti hai, second light bullish hoti hai, or ye pehly candle ki body sy bari hoti hai. Iss strategy ki assistance sy hamein market ka pata chalta hai ky market mein pehly vendor ziada thy aur market destruction kar gai but phir next gathering mei customer ziaada ho gae aur wo market ko past light ky opening point sy bhi up move karwany mein kamyab ho gaye. Positively oriented planning mein ham halt disaster ko both fire ky low model standard set kar sakty hai.  Trading with Drenching plan Representatives of the bullish drenching configuration have three signs given to them. Most significantly, us waqat jub dominating model entire ho jae wo market ko jub buy kar sakty hain. To put it another way, wo second flame k low sy bhe market ko purchase kar sakty hain, or thirdly vendor overpowering model k terrible market ki impediment ky break hony ka stand by karty hain, or buy stop ki help sy resistance level ky uper sy market ko buy kar lety hain. Aik strong reversal plan hota hai bullish say bear our negative say purchaser market ka design change ho jata hai humey baki candle plan ko Dakh kar us per trade karni chahey. Forex trading central mumble bullish inundating deal with buy ki area bill lay hit market ager ordinary candles hai to pher half retracement lay chuki ho.

Trading with Drenching plan Representatives of the bullish drenching configuration have three signs given to them. Most significantly, us waqat jub dominating model entire ho jae wo market ko jub buy kar sakty hain. To put it another way, wo second flame k low sy bhe market ko purchase kar sakty hain, or thirdly vendor overpowering model k terrible market ki impediment ky break hony ka stand by karty hain, or buy stop ki help sy resistance level ky uper sy market ko buy kar lety hain. Aik strong reversal plan hota hai bullish say bear our negative say purchaser market ka design change ho jata hai humey baki candle plan ko Dakh kar us per trade karni chahey. Forex trading central mumble bullish inundating deal with buy ki area bill lay hit market ager ordinary candles hai to pher half retracement lay chuki ho.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#27 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Counterattack Lines Trader Psychology Bullish Counterattack Lines, ek popular technical indicator hai jo trend reversal signal provide karta hai. Jab bearish trend ke baad Bullish Counterattack Lines form hota hai, toh traders ko stocks ko buy karne ka signal milta hai. Bullish Counterattack Lines ka formation ek single candle pattern hota hai. BCL pattern may, pehle bearish candlestick form hoti hai followed by ek bullish candlestick, jo pehli candle ko cover karta hai. Iske saath saath, ye pattern, trend ke lower support level ke baad form hota hai, jiske baad prices rebound karte hain. Bullish Counterattack Lines ke formation se, traders ko bulls ke dominance ka signal milta hai. Traders bullish momentum ko assess karte hain aur ek uptrend enter karne ke liye ready to hote hain. Bullish Counterattack Lines ka formation, traders ki psychology par bhi impact dalta hai, kyunki ye indicator positive sentiment ko highlight karta hai. Is indicator ke saath traders ki psychology, bullish market ke saath aligned hoti hai. Bullish Counterattack Lines ka formation, trend reversal ko signify karta hai aur traders ko buy signals dete hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим