Re: What is a Double Bottom?

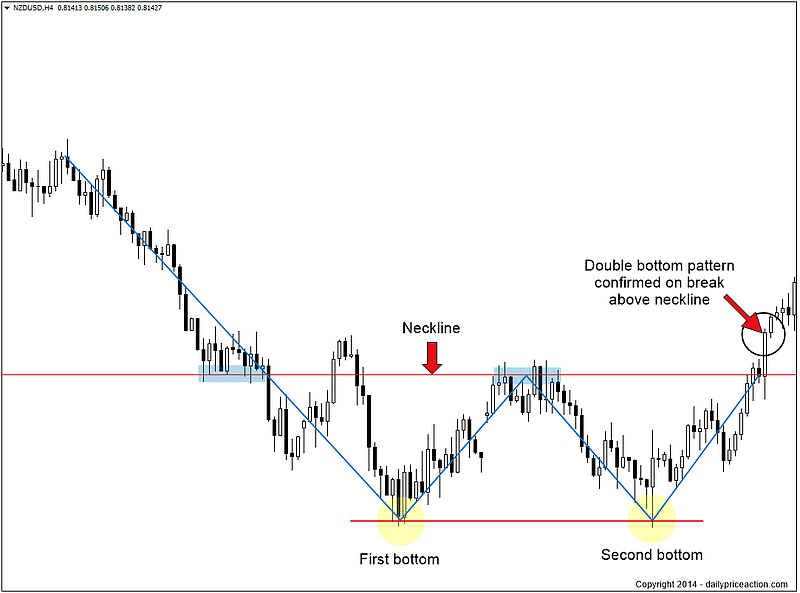

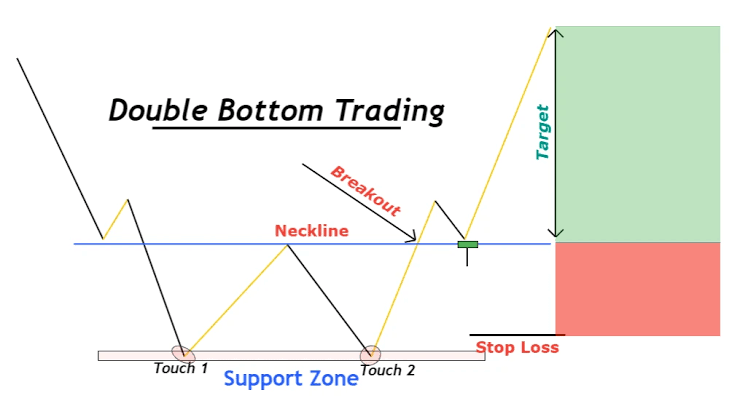

pattern ka jo second bottom ho ga ya same first bottom ke trha sa ho ga or ya jab market first bottom ko banay ka bad reversal ho kar opening point par ay ge to is sa start ho ga or is ka start ma market ke price lower ke traf strongly reversal hoti hoi ak bar phir sa jay ge or same first bottom ka equal ma support level ka near ma second bottom ko banay ga or is bottom ka bannay ka bad market ke price higher ke traf reversal ho ge or market ke price reversal hoti hoi phir sa neckline level par a jay ge or is double bottom pattern ke formation complete ho jay ge.

Regarding "What Is a Double Bottom?" pattern with two bottoms qeematon ki aik jaisi ufuqi satah par taraqqi pazeer do kam points par mushtamil hai jo mumkina taizi ke ulat jane walay isharay ki numindagi karta hai Don't do nichale points ke darmiyan aik pemaiesh shuda qeemat mein izafah hoga; instead, use the qeemat's kam tareen satah par kuch istehkaam ki nishandahi karta. Neechay ke rujhan ke ekhtataam ke qareeb zahir hota hai, jo khat w se mushabihat rakhta hai, double neechay chart pattern. Qeemat is a non-nichli satah par girty, and his non-nichli kam par girnay se pehlay thora sa barh jati

Regarding "What Is a Double Bottom?" pattern with two bottoms qeematon ki aik jaisi ufuqi satah par taraqqi pazeer do kam points par mushtamil hai jo mumkina taizi ke ulat jane walay isharay ki numindagi karta hai Don't do nichale points ke darmiyan aik pemaiesh shuda qeemat mein izafah hoga; instead, use the qeemat's kam tareen satah par kuch istehkaam ki nishandahi karta. Neechay ke rujhan ke ekhtataam ke qareeb zahir hota hai, jo khat w se mushabihat rakhta hai, double neechay chart pattern. Qeemat is a non-nichli satah par girty, and his non-nichli kam par girnay se pehlay thora sa barh jati patteren aik classic technical analysis charting formation hai jo trend mein aik barri tabdeeli aur market trading mein pehlay se neechay ki movement se momentum reversal ki indication karta hai. yeh security ya index ke girnay, aik rebound , asal drop ke tor par isi ya isi satah par aik aur drop, aur aakhir mein aik aur rebound " jo aik naya up trained ban sakta hai " ki wazahat karta hai. double neechay khat[ w] ki terhan lagta hai. do baar chone wali kam ko ab aik ahem support level samjha jata hai. jab ke woh do kmyan barqarar hain, oopar ki taraf nai salahiyat hai. munafe ke ahdaaf ke lehaaz se, patteren ka aik qadamat pasand studies batati hai ke kam az kam qeemat ka hadaf do kam aur darmiyani height ke faaslay ke barabar hai. ziyada agressive ahdaaf do nechy aur darmiyani height ke darmiyan faaslay se deep hotay hain.pattern sab patters may sab say zeyada important hay or yeh*tab hi banta hay keh jab price up say down ki taraf move karne ke mood main aati hay or is terha say aik double Bottom*neechay se bhi banta hey jis ko hum Reversal*Double*Bottom bhi*kehtey hain or reversal*double*bottom*us waqt banta hey keh jab price down se up ki taraf move kerti hey is liye hamy chahiye keh is ko always find kartay rahain kyun keh yeh jab bhi market main banta hay to market main hamay aik achi trade open kernay ko mil jati hay.

patteren aik classic technical analysis charting formation hai jo trend mein aik barri tabdeeli aur market trading mein pehlay se neechay ki movement se momentum reversal ki indication karta hai. yeh security ya index ke girnay, aik rebound , asal drop ke tor par isi ya isi satah par aik aur drop, aur aakhir mein aik aur rebound " jo aik naya up trained ban sakta hai " ki wazahat karta hai. double neechay khat[ w] ki terhan lagta hai. do baar chone wali kam ko ab aik ahem support level samjha jata hai. jab ke woh do kmyan barqarar hain, oopar ki taraf nai salahiyat hai. munafe ke ahdaaf ke lehaaz se, patteren ka aik qadamat pasand studies batati hai ke kam az kam qeemat ka hadaf do kam aur darmiyani height ke faaslay ke barabar hai. ziyada agressive ahdaaf do nechy aur darmiyani height ke darmiyan faaslay se deep hotay hain.pattern sab patters may sab say zeyada important hay or yeh*tab hi banta hay keh jab price up say down ki taraf move karne ke mood main aati hay or is terha say aik double Bottom*neechay se bhi banta hey jis ko hum Reversal*Double*Bottom bhi*kehtey hain or reversal*double*bottom*us waqt banta hey keh jab price down se up ki taraf move kerti hey is liye hamy chahiye keh is ko always find kartay rahain kyun keh yeh jab bhi market main banta hay to market main hamay aik achi trade open kernay ko mil jati hay.

pattern ka jo second bottom ho ga ya same first bottom ke trha sa ho ga or ya jab market first bottom ko banay ka bad reversal ho kar opening point par ay ge to is sa start ho ga or is ka start ma market ke price lower ke traf strongly reversal hoti hoi ak bar phir sa jay ge or same first bottom ka equal ma support level ka near ma second bottom ko banay ga or is bottom ka bannay ka bad market ke price higher ke traf reversal ho ge or market ke price reversal hoti hoi phir sa neckline level par a jay ge or is double bottom pattern ke formation complete ho jay ge.

patteren aik classic technical analysis charting formation hai jo trend mein aik barri tabdeeli aur market trading mein pehlay se neechay ki movement se momentum reversal ki indication karta hai. yeh security ya index ke girnay, aik rebound , asal drop ke tor par isi ya isi satah par aik aur drop, aur aakhir mein aik aur rebound " jo aik naya up trained ban sakta hai " ki wazahat karta hai. double neechay khat[ w] ki terhan lagta hai. do baar chone wali kam ko ab aik ahem support level samjha jata hai. jab ke woh do kmyan barqarar hain, oopar ki taraf nai salahiyat hai. munafe ke ahdaaf ke lehaaz se, patteren ka aik qadamat pasand studies batati hai ke kam az kam qeemat ka hadaf do kam aur darmiyani height ke faaslay ke barabar hai. ziyada agressive ahdaaf do nechy aur darmiyani height ke darmiyan faaslay se deep hotay hain.pattern sab patters may sab say zeyada important hay or yeh*tab hi banta hay keh jab price up say down ki taraf move karne ke mood main aati hay or is terha say aik double Bottom*neechay se bhi banta hey jis ko hum Reversal*Double*Bottom bhi*kehtey hain or reversal*double*bottom*us waqt banta hey keh jab price down se up ki taraf move kerti hey is liye hamy chahiye keh is ko always find kartay rahain kyun keh yeh jab bhi market main banta hay to market main hamay aik achi trade open kernay ko mil jati hay.

patteren aik classic technical analysis charting formation hai jo trend mein aik barri tabdeeli aur market trading mein pehlay se neechay ki movement se momentum reversal ki indication karta hai. yeh security ya index ke girnay, aik rebound , asal drop ke tor par isi ya isi satah par aik aur drop, aur aakhir mein aik aur rebound " jo aik naya up trained ban sakta hai " ki wazahat karta hai. double neechay khat[ w] ki terhan lagta hai. do baar chone wali kam ko ab aik ahem support level samjha jata hai. jab ke woh do kmyan barqarar hain, oopar ki taraf nai salahiyat hai. munafe ke ahdaaf ke lehaaz se, patteren ka aik qadamat pasand studies batati hai ke kam az kam qeemat ka hadaf do kam aur darmiyani height ke faaslay ke barabar hai. ziyada agressive ahdaaf do nechy aur darmiyani height ke darmiyan faaslay se deep hotay hain.pattern sab patters may sab say zeyada important hay or yeh*tab hi banta hay keh jab price up say down ki taraf move karne ke mood main aati hay or is terha say aik double Bottom*neechay se bhi banta hey jis ko hum Reversal*Double*Bottom bhi*kehtey hain or reversal*double*bottom*us waqt banta hey keh jab price down se up ki taraf move kerti hey is liye hamy chahiye keh is ko always find kartay rahain kyun keh yeh jab bhi market main banta hay to market main hamay aik achi trade open kernay ko mil jati hay.

:max_bytes(150000):strip_icc():format(webp)/doublebottomchart-872b126f77e443fdb3b36836f33487eb.jpg)

تبصرہ

Расширенный режим Обычный режим