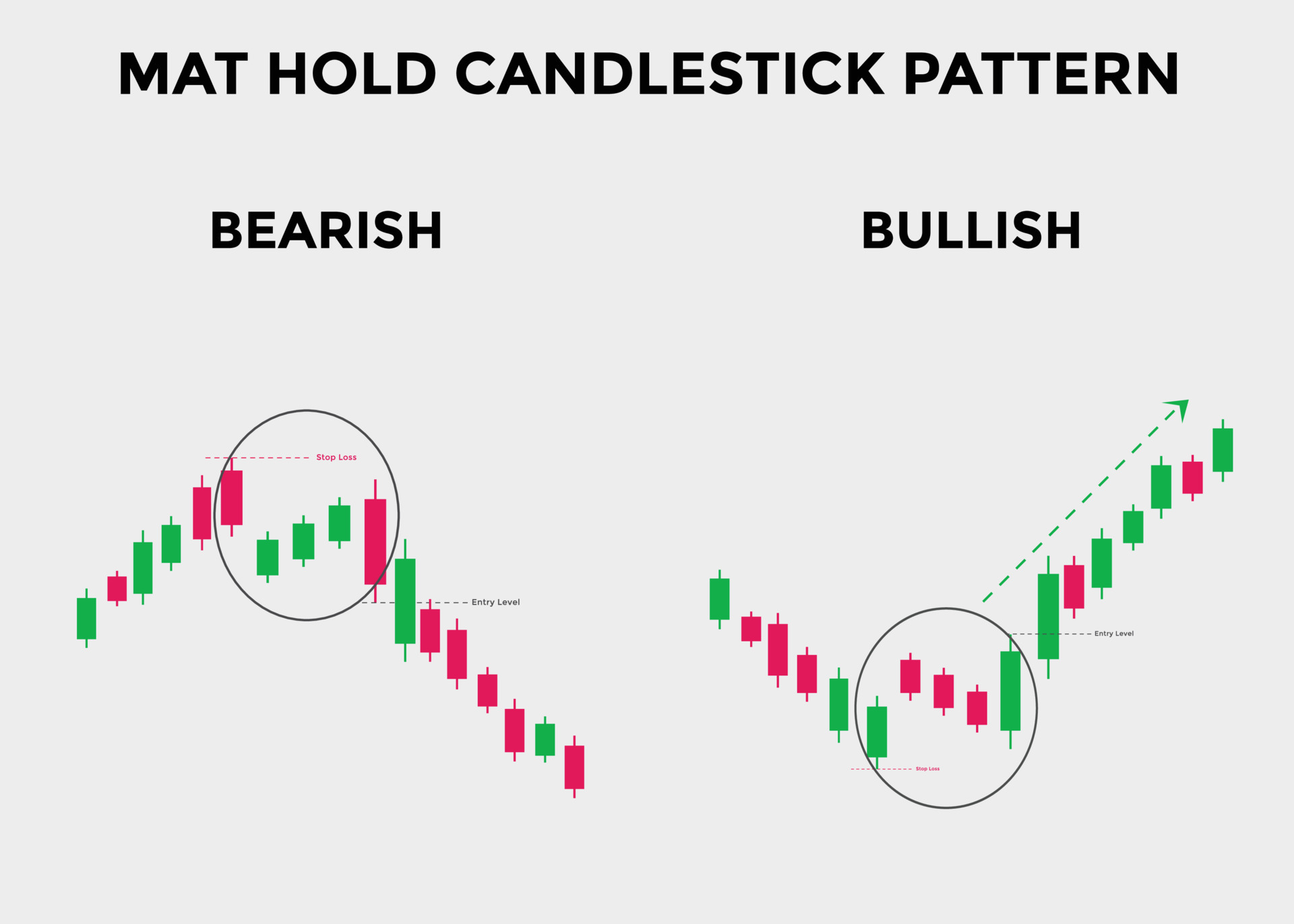

My dear Friends, Is mat hold sample kr marketplace ka chart ma do types hoti ha magar ya jab bhi banay ga yo marketplace ko maintains kara ga. Ya mat hols sample marketplace ka chart ma long term ma banay ga or ya strongly marketplace ka keep ka batay ga. Ya pattern huma zada tar market ma center ma dalhna ko mil jay ga or ya marketplace ko retain kara ga. Ya mat keep sample marketplace ka chart ma five candles sa mil kar banay ga is pattern ke ya 5 candles ak particular series ma ho ge or ya marketplace ko retain kara ge is mat maintain pattern ke jo first or final candle ho ge ya lengthy real frame candlr ho ge or jo is pattern ka center ma three candles ho ge ya small real body ho ge or ya market ko small reversal kara ge magar jasa he.Ya bullish mat preserve pattern ak kind hoti ha mat maintain sample ke ya bullish mat hold pattern huma market ka chart ma tab dakhna ko mil jay ga jab marketplace ma uptrend chal raha ho ga or ya mat maintain pattern marketplace ka uptrend ma ban kar market ko upward ke traf maintains karna ka kam karay ga. Ya mat keep pattern jab banay ga ya five candles sa mil kar banay ga is mat keep sample ke jo first candle ho ge ya ak long actual frame bullish ke candle ho ge jo ka marketplace ke rate ko high ke traf la kar jay ge or is sample ke is first candle ka bad jo subsequent 3 bearish ke candle banay ge jo ka length ma small jo ge is pattern ke first candle sa or ya is first candle ka high sa open ho kar ak collection ma market ke fee ko downward ke traf l. A. Kar jay ge..

Market Stategy of Mat Hold Candlestick Pattern?

Ve candles sa mil kar banay ga is design ke ya five candles ak actual succession mama ho ge or ya industrial center ko keep kara ge is mat shield take a look at ke jo first or shutting candle ho geTrading with Mat Hold Candlestick PattDosto, d candlestick pattern in step with buying and selling karne ke liye technical analysis karna bahot zayada zaroori hea without evaluation aap ko buying and selling karny ka threat nahin uthana chahye jub mat maintain candlestick sample create hojata hai jis pe promote ki trade input karna hota hai jab ki agar market constantly bullish trend mein motion karty hwey aek bari candle create karny ky baad 3 candle bearish mein create karny ky baad again bullish mein candle create karti haiMatt hold pattern ki upr di gayi data se sabit hota hai k yeh market psychology or technical factors okay nateejy me tashkeel paati hai, agr esko barwaqt become aware of krliya jaye tow aik profitable alternate ki jaskti hai ,kion k yeh sample apny andr marketplace ki kafi zyada facts smoy huy hota hai, taaham investors ko chahye k wo mat preserve pattern ok sath sath baki buying and selling se associated cheezon pr bhe nazr saani kryn taa ok danger of loss se bcha jaa sky.Raders ko market ka upward ke traf maintains hona ka signal da ge. Is sample ka entire hona ka bad jo final 5th candle ho ge is ka high sa investors is ma buy ke long time trade ko enter kara ga or is buy ke exchange ka jo prevent loss ho ga wo is fifth candle ka decrease ma place kara ga.

Limitations of mat preserve pattern

Mat keep sample talash krna mushkil hay . Yeh kabhi kabhar hota hay. Or keemat hmesha sample kay terrible tawaqa kau mutabik nahi barhti hay. Mat maintain sample kay lye munafa ka koi hadaf nahi hay. Agar keemat tawaqa kay mutabik harkat krti hay to sample is bat ke neshandahi karta hay kay keemat kitna dor tak ja skti hay .Is kay lye ksi or tareqy ki zrort hogi .Jasy jay rujhan ka tajziya ya taqniqi ishary bahir nikalnay ka tayun karnay kay lye ya mumkina tor pr ksi or candlestick sample ki zrort hgi. Mat keep pattern ko am tor pr tajziya ki dosrri shaklo kay sath mil kar istmal kia jata hay kiu ky yeh naqabl e aitbar ho sakta hay agar mukamal tor pr tejarat khud ke jaye to yeh mumkin ho sakta hay.

Market Stategy of Mat Hold Candlestick Pattern?

Ve candles sa mil kar banay ga is design ke ya five candles ak actual succession mama ho ge or ya industrial center ko keep kara ge is mat shield take a look at ke jo first or shutting candle ho geTrading with Mat Hold Candlestick PattDosto, d candlestick pattern in step with buying and selling karne ke liye technical analysis karna bahot zayada zaroori hea without evaluation aap ko buying and selling karny ka threat nahin uthana chahye jub mat maintain candlestick sample create hojata hai jis pe promote ki trade input karna hota hai jab ki agar market constantly bullish trend mein motion karty hwey aek bari candle create karny ky baad 3 candle bearish mein create karny ky baad again bullish mein candle create karti haiMatt hold pattern ki upr di gayi data se sabit hota hai k yeh market psychology or technical factors okay nateejy me tashkeel paati hai, agr esko barwaqt become aware of krliya jaye tow aik profitable alternate ki jaskti hai ,kion k yeh sample apny andr marketplace ki kafi zyada facts smoy huy hota hai, taaham investors ko chahye k wo mat preserve pattern ok sath sath baki buying and selling se associated cheezon pr bhe nazr saani kryn taa ok danger of loss se bcha jaa sky.Raders ko market ka upward ke traf maintains hona ka signal da ge. Is sample ka entire hona ka bad jo final 5th candle ho ge is ka high sa investors is ma buy ke long time trade ko enter kara ga or is buy ke exchange ka jo prevent loss ho ga wo is fifth candle ka decrease ma place kara ga.

Limitations of mat preserve pattern

Mat keep sample talash krna mushkil hay . Yeh kabhi kabhar hota hay. Or keemat hmesha sample kay terrible tawaqa kau mutabik nahi barhti hay. Mat maintain sample kay lye munafa ka koi hadaf nahi hay. Agar keemat tawaqa kay mutabik harkat krti hay to sample is bat ke neshandahi karta hay kay keemat kitna dor tak ja skti hay .Is kay lye ksi or tareqy ki zrort hogi .Jasy jay rujhan ka tajziya ya taqniqi ishary bahir nikalnay ka tayun karnay kay lye ya mumkina tor pr ksi or candlestick sample ki zrort hgi. Mat keep pattern ko am tor pr tajziya ki dosrri shaklo kay sath mil kar istmal kia jata hay kiu ky yeh naqabl e aitbar ho sakta hay agar mukamal tor pr tejarat khud ke jaye to yeh mumkin ho sakta hay.

تبصرہ

Расширенный режим Обычный режим