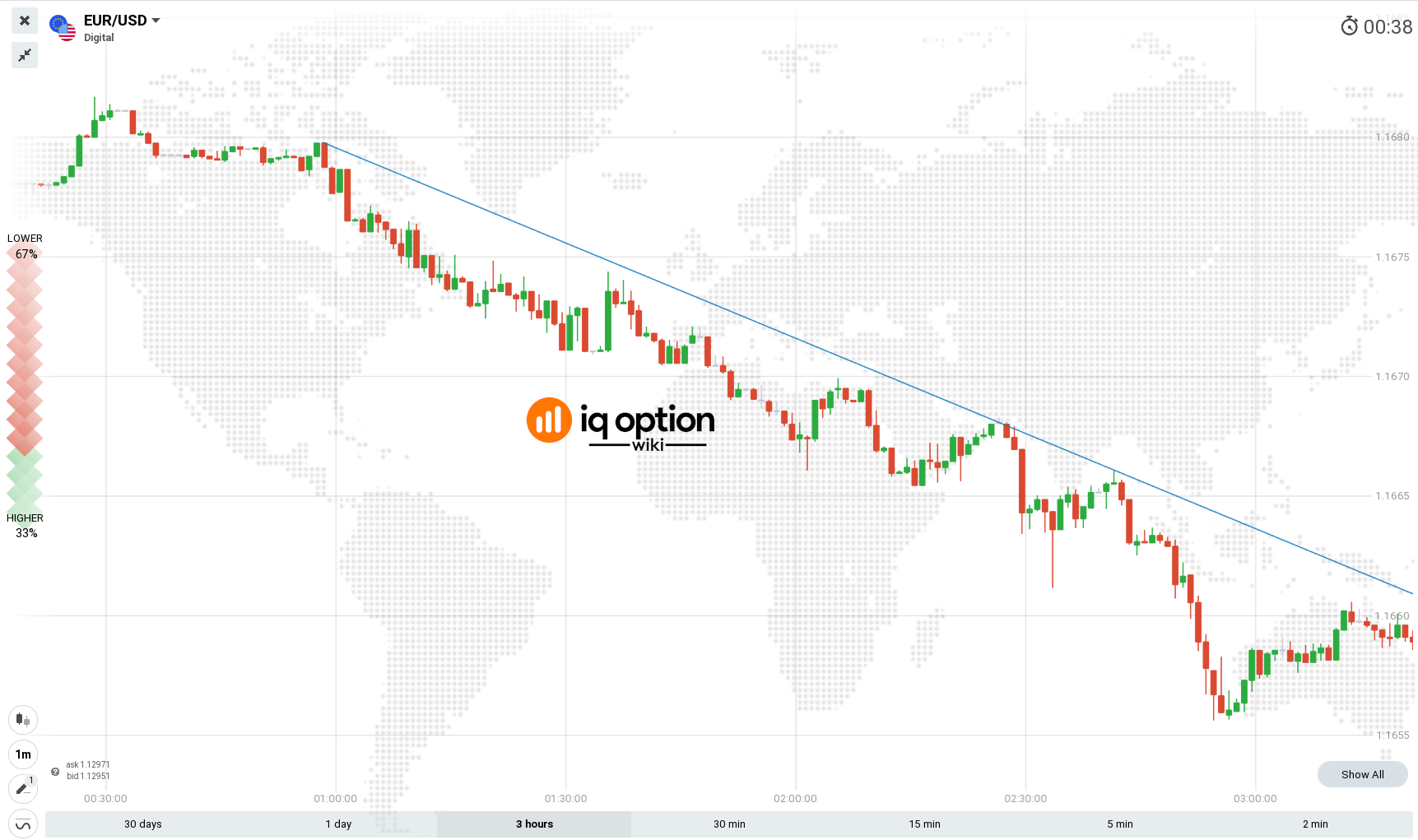

Forex trading Mein expert trader usko hi mana ja sakta hai jo kay tamam tarah trading principal per amal karte hue trading ko profit table banaa sakta hai aur acchi earning hasil kar sakta hai aaj ham aik Is tarah ka pattern discuss Karenge Jisko trader long term trading mein istemal karte hain aur us kay trading results quick aapko hasil nahin hote lekin long term trading ke liye bahut hi perfect hote hain aur friends is trading pattern ko three Stairs Steps Candlestick Pattern kehty hean is pattern ki working strategy kuch is tarha say hoti hea kay market downfall par pohanch ker bottom par pohanch jaye tou tou buy ki trade lagaty hain aur isi tarhan agar market high move ker k upward chali jaye tou sell ki trade ko open kerty hain aur ye aik aisi long term trade hai jo k humary liye bohat zeada profitable sabit hoti hai.

Three Stairs Steps Candlestick Pattern, Explanation.

Agar hum three stairs steps candlestick pattern ki takniky saakhat kay bary main discussion karian to kuch is tarha say kaha ja sakta hea kay three stair pattern mein humen sab se pehly tou small lot ko use kerna chahiye wo is liye kay bhi lot bohat he zeada risky hoti hai aur friends is pattern kay hisaab say step by step market ki prices mrin kami asti rehti hai jisky bad market mein resistance level ka breakout hojata hai aur market dobra se upwards trend main jaty huey aap ko bullish movement dikhati hai aur Is trha ek dafa nechy ja kar dobara retracement karty huey market resistance level ko touch krti hai aur phr us resistance se nechy aa jati hai aur is trha steps banty jaty hain is pattern per trade breakout ko bhi notice karty huy shot trading bhi kar sakty hean kyn kay breakout par aap buying ki trade laga skty hain is pattern kay mutabik mein market main entry leny ky liye aap resistance level ko use kar skty hain jab market us resistance level ko cross kar jaye to aap market mein breakout ki surat dekh skty hain .

Trading at Three Stairs Steps Candlestick Pattern.

Three Stairs Steps Candlestick Pattern per trading bahot he zyada profitable sabit ho sakti hea kyn kay yea pattern expert traders use karty hean trading karny kay liye kyn kay expert traders hain wh is pattern ki madad se apni long term trade lagaty hain aur profit book karty hain aur is type ke pattern me upward tren dbi ban raha hota hy aur downward bi trend ban raha hota hai.

Additional Information.

Aap trading Mein Koi Bhi pattern istemal Karen lekin uske liye technical analysis ko kabhi bhi forget na Karen Kyunki Is tarah karne se trade trend Ke against bhi ja sakti hai aur 3 stairs step candle stick pattern to hai he aik long term trading pattern lihaza is pattern per trading karne ke liye to market kay technical analysis karna bahut hi jyada Jaruri hain.

Three Stairs Steps Candlestick Pattern, Explanation.

Agar hum three stairs steps candlestick pattern ki takniky saakhat kay bary main discussion karian to kuch is tarha say kaha ja sakta hea kay three stair pattern mein humen sab se pehly tou small lot ko use kerna chahiye wo is liye kay bhi lot bohat he zeada risky hoti hai aur friends is pattern kay hisaab say step by step market ki prices mrin kami asti rehti hai jisky bad market mein resistance level ka breakout hojata hai aur market dobra se upwards trend main jaty huey aap ko bullish movement dikhati hai aur Is trha ek dafa nechy ja kar dobara retracement karty huey market resistance level ko touch krti hai aur phr us resistance se nechy aa jati hai aur is trha steps banty jaty hain is pattern per trade breakout ko bhi notice karty huy shot trading bhi kar sakty hean kyn kay breakout par aap buying ki trade laga skty hain is pattern kay mutabik mein market main entry leny ky liye aap resistance level ko use kar skty hain jab market us resistance level ko cross kar jaye to aap market mein breakout ki surat dekh skty hain .

Trading at Three Stairs Steps Candlestick Pattern.

Three Stairs Steps Candlestick Pattern per trading bahot he zyada profitable sabit ho sakti hea kyn kay yea pattern expert traders use karty hean trading karny kay liye kyn kay expert traders hain wh is pattern ki madad se apni long term trade lagaty hain aur profit book karty hain aur is type ke pattern me upward tren dbi ban raha hota hy aur downward bi trend ban raha hota hai.

Additional Information.

Aap trading Mein Koi Bhi pattern istemal Karen lekin uske liye technical analysis ko kabhi bhi forget na Karen Kyunki Is tarah karne se trade trend Ke against bhi ja sakti hai aur 3 stairs step candle stick pattern to hai he aik long term trading pattern lihaza is pattern per trading karne ke liye to market kay technical analysis karna bahut hi jyada Jaruri hain.

THREE STAR*STEP*PATTERN Candles Example : Jaisa ke naam se greetings pata chal raha hai ki yah ek aisa pata hona chahie jismein high schooler mukt point Ho poke bhi aapki market specialty ki taraf gire aur retracement ke terrible aapki market stomach muscle pattern mein jaaye aur apna pahla hai banay

THREE STAR*STEP*PATTERN Candles Example : Jaisa ke naam se greetings pata chal raha hai ki yah ek aisa pata hona chahie jismein high schooler mukt point Ho poke bhi aapki market specialty ki taraf gire aur retracement ke terrible aapki market stomach muscle pattern mein jaaye aur apna pahla hai banay

تبصرہ

Расширенный режим Обычный режим