Indicator ki sab say asan qisam ka oscillator hai. jo takneeki tijarat mein istemaal hota hai. RSI, aik sarkardah isharay hai, jis ka matlab hai ke qeemat ke waqea se pehlay is ke isharay chart par zahir hotay hain. faida yeh hai ke hum apni tijarat ke liye ibtidayi signal haasil kar satke hain, lekin nuqsaan yeh hai ke un mein se bohat se signals ghalat ya qabal az waqt ho satke hain. nateejay ke tor par, tasdeeq ke liye, RSI ko hamesha forex trading ke kisi dosray alay ya nuqta nazar ke sath istemaal kya jana chahiye. hum is session mein RSI isharay ko daryaft karen ge aur is ke sath tijarat ke liye kuch behtareen tareeqon par tabadlah khayaal karen ge .

RSI oscillator se signals:

RSI, index takneeki isharay teen bunyadi signal faraham karta hai. kyunkay yeh aik sarkardah isharay hai, chart par qeemat mein tabdeeli se pehlay signals aa satke hain, is maloomat par munhasir hai jo aap tijarat mein daakhil honay ke liye istemaal karte hain .

RSI DiveRSIon:

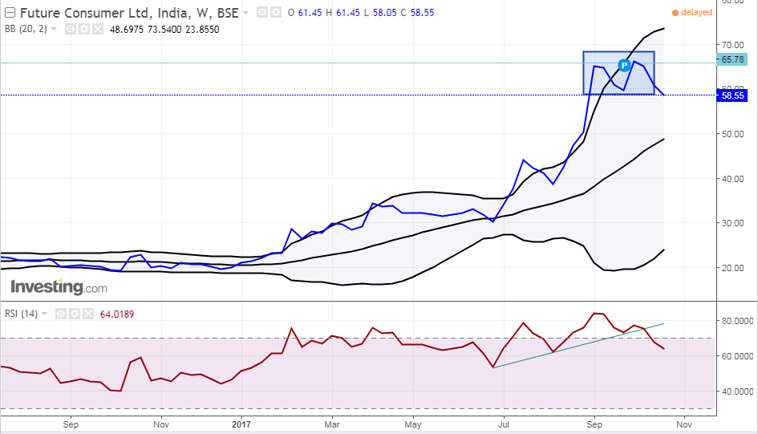

RSI, k aakhri signal jisay hum dekhen ge woh hai RSI divergence. RSI, MACD aur stochastics jaisay deegar asharion ki terhan, qeemat ke wasee tar amal se hatt sakta hai, jo market mein anay wali tabdeeli ke isharay faraham karta hai.

Bullsih RSI Divergence:

chart par qeemat ka amal kam ho raha hai jabkay RSI line barh rahi hai, jo ke aik mazboot taizi ka ishara hai. qeemat ka amal barh raha hai, lekin RSI line gir rahi hai, jo chart par mazboot bearish signal ki nishandahi karti hai .

RSI VS Stochastic oscillator:

RSI ko stochastic ke sath milana aasaan hai kyunkay un ke graph, objective aur uses same hain. D ono isharay aik muqarara muddat ke douran mojooda band honay wali qeematon ka pichli bulandiyon aur kmon se mawazna karte hain. mazeed bar-aan, dono isharay ziyada kharidi hui aur ziyada farokht honay wali sthon ki wazahat karte hain, jinhein tajir yeh taayun karne ke liye istemaal karte hain ke kab khareedna aur bechna hai. do isharay ka mawazna neechay diye gaye jadole mein dekhaya gaya hai. dono isharay ke darmiyan farq mamooli hai, aur un ko samajhney ka behtareen tareeqa un ki shaklon ko dekhna hai

Forex mein RSI trading ke advantages:

ghair mulki currency ke isharay ke tor par RSI ki appeal tehqeeq aur tashkhees ke alay ke tor par is ke munfarid fawaid se peda hoti hai. RSI ko apnane ke chand ahem fawaid darj zail hain

1) yah aik seedhay saaday Mathematical formulay par mabni hai. RSI ka farmolh itna aasaan hai ke tajir dosray takneeki isharay ke bar aks, agar zaroorat ho to usay haath se injaam day satke hain .

2) Yah saada chart ke tajzia ki ijazat deta hai. chunkay RSI ki ziyada kharidi hui aur ziyada farokht ki satah wazeh tor par bayan ki gayi hai, is liye isharay naye taajiron ke liye bhi istemaal karne ke liye aasaan hai - lekin tajurbah car taajiron ke liye is par inhisaar jari rakhnay ke liye kaafi durust aur baseerat hai .

3) Yaht tijarat ke mawaqay peda honay par bohat aasaan it-tila-aat bhejta hai. tijarat shuru karne ke liye sirf RSI par inhisaar karne ke bajaye, ziyada tar tajir is ka istemaal mumkina tijarti mawaqay ko ujagar karne ke liye karte hain. nateejay ke tor par, bohat se tajir currency ke jore ke liye notification muratab karen ge jo halaat ke ziyada khareed ya ziyada farokht honay par fa-aal ho jayen ge. is se taajiron ko currency ke bdalty hue rujhanaat mein sare fehrist rehne ke sath sath naye tijarti mawaqay se mahroom honay se bhi bacha jata hai .

Ppp0

RSI k disadvantages:

ghair mulki currency ke taajiron ko faraham karne walay tamam fawaid ke bawajood si nakaam nahi hai. agarchay aap ki tijarti hikmat e amli mein RSI isharay ka ziyada istemaal isharay ki bohat si khamion ko barha deta hai, lekin zehen mein rakhnay ke liye kayi pabandiyan hain, Bashmole :

1) ziyada tar ghair mulki currency ke taajiron ke liye, RSI aik ibtidayi isharay ke tor par tijarti imkanaat ki nishandahi karne aur mazeed tafteesh aur tashkhees ki targheeb dainay ke liye sab se ziyada mufeed hai. is ki wajah yeh hai ke jab ke RSI ziyada kharidi hui ya ziyada farokht shuda halaat ka pata laganay mein behtareen hai, is ke paas is baat ka jaiza lainay ke liye zaroori sayaq o Sabaq ki kami hai ke aaya yeh sharait tijarti mawaqay ki nishandahi kyun karti hain ya nahi .

2) qeemat ke ulat jane ka aik ghair mutawaqqa tor par taweel waqt hota hai. agarchay RSI ab bhi mazboot rujhanaat mein kaar amad ho sakta hai, lekin is se ahthyat ke sath rabita kya jana chahiye .

RSI oscillator se signals:

RSI, index takneeki isharay teen bunyadi signal faraham karta hai. kyunkay yeh aik sarkardah isharay hai, chart par qeemat mein tabdeeli se pehlay signals aa satke hain, is maloomat par munhasir hai jo aap tijarat mein daakhil honay ke liye istemaal karte hain .

RSI DiveRSIon:

RSI, k aakhri signal jisay hum dekhen ge woh hai RSI divergence. RSI, MACD aur stochastics jaisay deegar asharion ki terhan, qeemat ke wasee tar amal se hatt sakta hai, jo market mein anay wali tabdeeli ke isharay faraham karta hai.

Bullsih RSI Divergence:

chart par qeemat ka amal kam ho raha hai jabkay RSI line barh rahi hai, jo ke aik mazboot taizi ka ishara hai. qeemat ka amal barh raha hai, lekin RSI line gir rahi hai, jo chart par mazboot bearish signal ki nishandahi karti hai .

RSI VS Stochastic oscillator:

RSI ko stochastic ke sath milana aasaan hai kyunkay un ke graph, objective aur uses same hain. D ono isharay aik muqarara muddat ke douran mojooda band honay wali qeematon ka pichli bulandiyon aur kmon se mawazna karte hain. mazeed bar-aan, dono isharay ziyada kharidi hui aur ziyada farokht honay wali sthon ki wazahat karte hain, jinhein tajir yeh taayun karne ke liye istemaal karte hain ke kab khareedna aur bechna hai. do isharay ka mawazna neechay diye gaye jadole mein dekhaya gaya hai. dono isharay ke darmiyan farq mamooli hai, aur un ko samajhney ka behtareen tareeqa un ki shaklon ko dekhna hai

Forex mein RSI trading ke advantages:

ghair mulki currency ke isharay ke tor par RSI ki appeal tehqeeq aur tashkhees ke alay ke tor par is ke munfarid fawaid se peda hoti hai. RSI ko apnane ke chand ahem fawaid darj zail hain

1) yah aik seedhay saaday Mathematical formulay par mabni hai. RSI ka farmolh itna aasaan hai ke tajir dosray takneeki isharay ke bar aks, agar zaroorat ho to usay haath se injaam day satke hain .

2) Yah saada chart ke tajzia ki ijazat deta hai. chunkay RSI ki ziyada kharidi hui aur ziyada farokht ki satah wazeh tor par bayan ki gayi hai, is liye isharay naye taajiron ke liye bhi istemaal karne ke liye aasaan hai - lekin tajurbah car taajiron ke liye is par inhisaar jari rakhnay ke liye kaafi durust aur baseerat hai .

3) Yaht tijarat ke mawaqay peda honay par bohat aasaan it-tila-aat bhejta hai. tijarat shuru karne ke liye sirf RSI par inhisaar karne ke bajaye, ziyada tar tajir is ka istemaal mumkina tijarti mawaqay ko ujagar karne ke liye karte hain. nateejay ke tor par, bohat se tajir currency ke jore ke liye notification muratab karen ge jo halaat ke ziyada khareed ya ziyada farokht honay par fa-aal ho jayen ge. is se taajiron ko currency ke bdalty hue rujhanaat mein sare fehrist rehne ke sath sath naye tijarti mawaqay se mahroom honay se bhi bacha jata hai .

Ppp0

RSI k disadvantages:

ghair mulki currency ke taajiron ko faraham karne walay tamam fawaid ke bawajood si nakaam nahi hai. agarchay aap ki tijarti hikmat e amli mein RSI isharay ka ziyada istemaal isharay ki bohat si khamion ko barha deta hai, lekin zehen mein rakhnay ke liye kayi pabandiyan hain, Bashmole :

1) ziyada tar ghair mulki currency ke taajiron ke liye, RSI aik ibtidayi isharay ke tor par tijarti imkanaat ki nishandahi karne aur mazeed tafteesh aur tashkhees ki targheeb dainay ke liye sab se ziyada mufeed hai. is ki wajah yeh hai ke jab ke RSI ziyada kharidi hui ya ziyada farokht shuda halaat ka pata laganay mein behtareen hai, is ke paas is baat ka jaiza lainay ke liye zaroori sayaq o Sabaq ki kami hai ke aaya yeh sharait tijarti mawaqay ki nishandahi kyun karti hain ya nahi .

2) qeemat ke ulat jane ka aik ghair mutawaqqa tor par taweel waqt hota hai. agarchay RSI ab bhi mazboot rujhanaat mein kaar amad ho sakta hai, lekin is se ahthyat ke sath rabita kya jana chahiye .

Pattern Breakout

Pattern Breakout Role of 50

Role of 50 Failure swing

Failure swing Bottomline

Bottomline

تبصرہ

Расширенный режим Обычный режим