What Is Bearish Engulfing Candle Stick Pattern

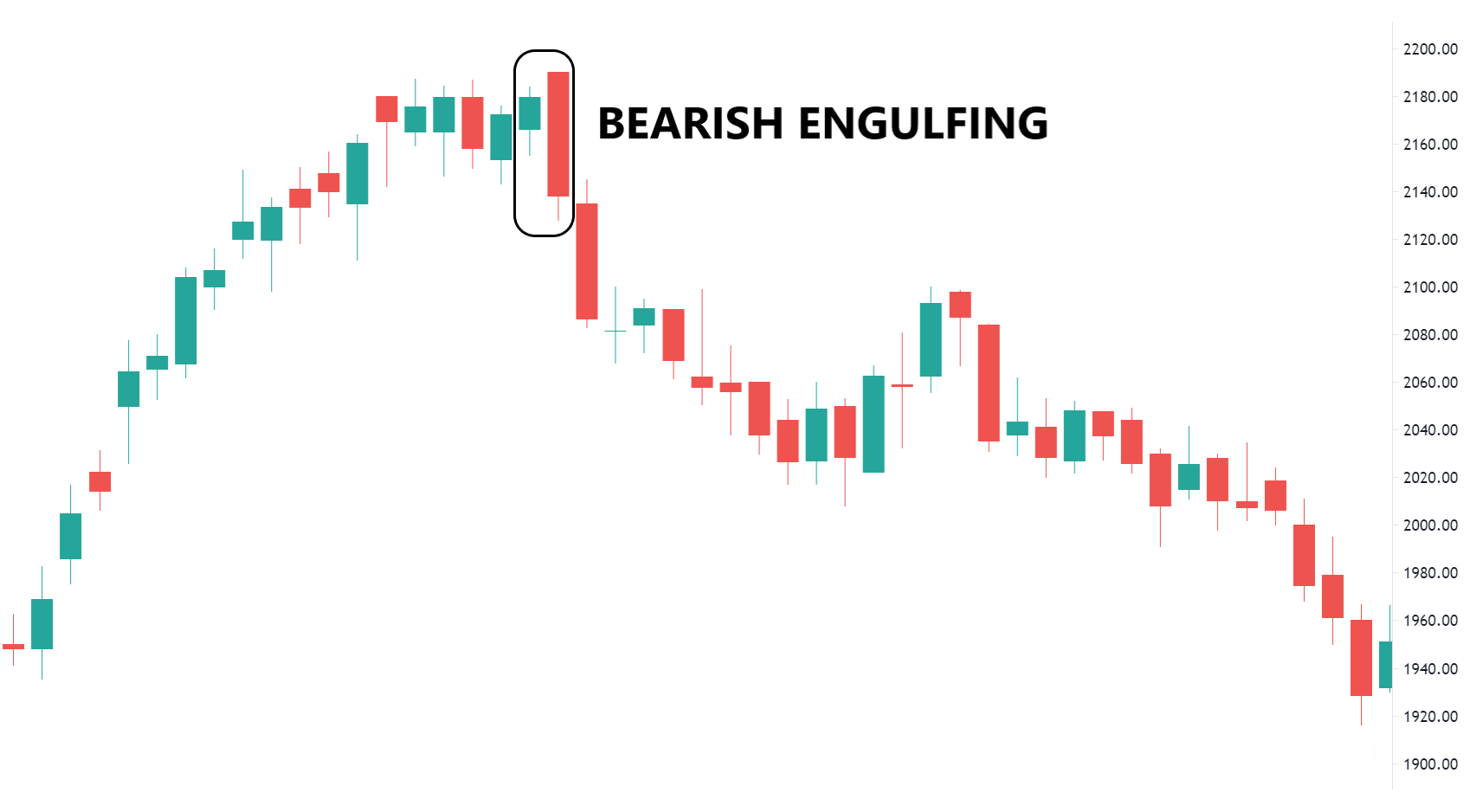

Bearish engulfing candle stick pattern strong signal provide karta he bearish engulfing candle stick pattern up trend kay end par endicate hota he or yeh bearish reversal signal frahm karta he es pattern par 2 candle stick hote hein aik bullish hote he or 2nd candle stick bearish hote he jo keh long candle stick hote he pehle candle stick kaim shodah strength kay end ko zahair karay ge or es baat ka bha khas kheyal rakhna chihay keh primary candle stick ka size different ho sakta he laken yeh bhe bohut zaroore he keh es candle stick ke body os kay bad anay wale candle stick ke wick say mkamal tor par engulfing hote he or chote candle stick market ke adam faislay ko indicate karte he pattern mein dosre candle stick reversal. Signal ko frahm karte hein yeh candle stick aik long red candle stick par moshtamell hote he jes mein price mein taza kame aa jate he bearish candle stick last candle stick say kay close kay opar open hote he or pechle candle stick kay nechay osay achay say close hona chihay nechay ke taraf say strong movement seller ke buying strength ko pechay chornay ke akace karte he r zyada tar price mein msalsal kame say pehlay hote he or bearish candle stick jetne zyada gerte jay ge trend otna he strong ho ga.

Trading With Bearish Engulfing Candle Stick Pattern.

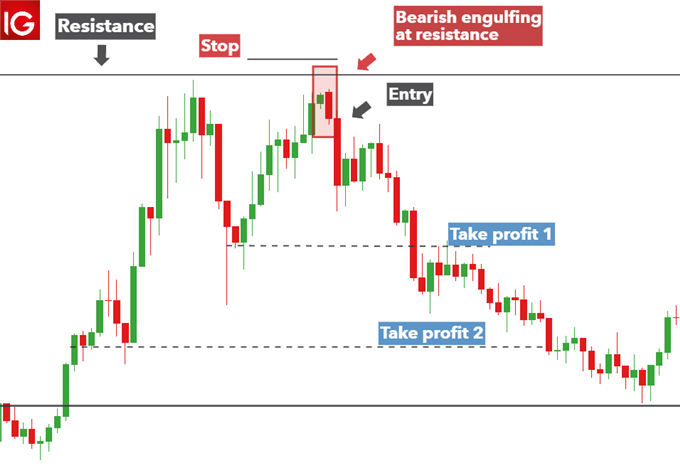

Trader ko hamesha esharay support or resistance level kay tor par samjhna chihayya kese dosray technical ko estamal kartay hovay trading ke tasdeeq ke talash mein rehna chihay jo keh trade ko sahara day or esay batell kar day zail mein doo tareekay paish key gay jenhen trader bearish engulfing pattern mein tasdeeq kardah tasub ko strong kay ley estamal kar sakta hey

Indicator Ka Estamal Bearish Engulfing Candle Stick Pattern.

Zail mein de gai mesal EUR/USD kay daily kay chart ko indicate karte he upper trend kay opare hesay mein zahair honay wallay bearish engulfing candle stick ko nomain karte he agerchay trend kay against trade karna monasab nahe hota he reality mein reversal hotay hein yeh he wajah he tamam trader ko es baat ka pata lagana chihay keh es kay zahair honay ka emkan kab ho ga

Bearish engulfing candle stick pattern strong signal provide karta he bearish engulfing candle stick pattern up trend kay end par endicate hota he or yeh bearish reversal signal frahm karta he es pattern par 2 candle stick hote hein aik bullish hote he or 2nd candle stick bearish hote he jo keh long candle stick hote he pehle candle stick kaim shodah strength kay end ko zahair karay ge or es baat ka bha khas kheyal rakhna chihay keh primary candle stick ka size different ho sakta he laken yeh bhe bohut zaroore he keh es candle stick ke body os kay bad anay wale candle stick ke wick say mkamal tor par engulfing hote he or chote candle stick market ke adam faislay ko indicate karte he pattern mein dosre candle stick reversal. Signal ko frahm karte hein yeh candle stick aik long red candle stick par moshtamell hote he jes mein price mein taza kame aa jate he bearish candle stick last candle stick say kay close kay opar open hote he or pechle candle stick kay nechay osay achay say close hona chihay nechay ke taraf say strong movement seller ke buying strength ko pechay chornay ke akace karte he r zyada tar price mein msalsal kame say pehlay hote he or bearish candle stick jetne zyada gerte jay ge trend otna he strong ho ga.

Trading With Bearish Engulfing Candle Stick Pattern.

Trader ko hamesha esharay support or resistance level kay tor par samjhna chihayya kese dosray technical ko estamal kartay hovay trading ke tasdeeq ke talash mein rehna chihay jo keh trade ko sahara day or esay batell kar day zail mein doo tareekay paish key gay jenhen trader bearish engulfing pattern mein tasdeeq kardah tasub ko strong kay ley estamal kar sakta hey

Indicator Ka Estamal Bearish Engulfing Candle Stick Pattern.

Zail mein de gai mesal EUR/USD kay daily kay chart ko indicate karte he upper trend kay opare hesay mein zahair honay wallay bearish engulfing candle stick ko nomain karte he agerchay trend kay against trade karna monasab nahe hota he reality mein reversal hotay hein yeh he wajah he tamam trader ko es baat ka pata lagana chihay keh es kay zahair honay ka emkan kab ho ga

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Bearish_Engulfing_Pattern_Definition_and_Tactics_Nov_2020-01-e5c7ca848ee14466bc981e29e8e63087.jpg)

تبصرہ

Расширенный режим Обычный режим