Re: What is a Diamond Pattern in Forex Trading?

INTRODUCE""

Most often, diamond designs appear after a drawn-out pattern stage. Because of its negative effects, hona Chai, the examples are referred to as jewel tops or negative precious stone examples when they occur in the context of bullish markets. On the other hand, because of its bullish implications, when it occurs in a context of a bearish market, the example is referred to as a jewel base, or a bullish prior stone example. We ought to look at the depictions hidden under the design hona Chahi.

Diamond structure:

For the group of old-style graph designs, the gemstone arrangement is crucial. The precious stone outline design appears less frequently on the pricing graph than the more common banner, flag, head and shoulders, and square shape designs.

The head and shoulders diagram design is frequently confused with the diamond graph design. Although there are some similarities between these two arrangements, there are also some glaring differences.

It's important to understand that the jewel design is a more advanced outline design with inversion features before moving on to discuss the highlights of the precious stone example structure.

As a result, there aren't as many opportunities to trade the precious stone graph design as there are for some of the others mentioned. However, knowledgeable dealers should become familiar with this example as it offers a great trading opportunity when it is recognised early enough.

The diamond pattern typically appears after a drawn-out pattern stage. When it occurs in a bullish market environment, the example is referred to be a jewel top or a negative precious stone example due to its consequences. On the other hand, because of its optimistic implications, it is referred to as a jewel basis, or a bullish precious stone example, when it occurs in the context of a bearish market.

We should look into the representation underneath that softens the gem graph design.

We can see how the jewel top arrangement appears on the outline above.

Costs increase once more at that time, causing the top to become internal to the building. The cost motion then decreases but doesn't start from the previous swing's depressed location. Costs rise once more and level off just below where they were earlier. The price decreases once more and remains above the earlier swing depressed point.

We can create four genuinely equal measured trendlines that connect the swing highs at the highest point of the construction and the swing lows at the lower part of the design once this cost activity is complete. The name of the example comes from how this creates the look of a gem.

Sometimes, we might not witness every single cost leg mentioned previously in the purest sense of the gem structure. This won't necessarily contradict the design's designation as a jewel design. Most importantly, we can draw four trendlines around the building that are somewhat comparable in length.

Dimond chart pattern:

Dear Forex members Forex trading me Dimond chart pattern jo ziada tar market k top ya market k top k qareeb pe hi banta hai aur ye hamen indication de raha hota hai k yahan se market uptrend k mukhtalif (downtrend) move karna shoro karega Is ko Dimond trend pattern is waja se jaha jat hai k is me jo top lines candle sticks ki formation hoti hai wo breakout up side (jahan se market ne oper ko move karna shoro kia hota hai), aur market breakdown side pe candle sticks k sath jo pattern banta hai wo Dimond shape ka hota hai. Is me making head and shoulders out of candlesticks?Dimond shap pattern me analysis tajzeya karte hen k jab is me market breakout hoti hai to wo pattern k top candles aur down candles ki value ki calculation karte hen q k us k baad movement ziada tar reversal hi hoti hai.

Dimond chart pattern and reversal movement:

Mere aziz dosto Dimond chart pattern bohut hi kam bante hen whereas, if the pattern were to be confirmed, it would indicate that the trend was moving in one direction and then reversing itself. Technical analysis analysis ka ziada istemal karte hen dimond chart pattern. Ko lazmi define karne hote hen q k is me values. Ye chart pattern us waqat banana shoro ho jata hai when the market's uptrend movement is rukh kar seedhi chalna shoro hoti haia or the sideways ki trend me tabdeel ho jati hai to jo jo now uptrend movement hoti hai wo breakout hona shoro ho jati hai jo is kisam k chart pattern k banne ki waja.Technical analyst ko pata hota hai kjbi ye pattern banta hai to us k bad un ko confirm ho jata hai kjbi ab movement nechay ki taraf chalay gi to wo is moqay se sahi tarah se faida uthate hen Ye technical analyst long term trading me ziada istemal karte hen lekin pattern short term trading me to kam.

Trading strategy with Dimond chart pattern:

Dear friends, Diamond pattern main trading karny kay liye zaroori hay keh ham support and resistance points ko lazmi follow karain. Q keh market is major aik arzi support and resistance level banaye to rakhti hay laikin jab ye break ho jayain to market further movement karti hay Is liye zaroori hay keh jab price resistance aur support kay darmian ho to he trading order place karain. Iska best tariqa ye hay keh jab market support say wapas jaye to yahan say buy karain aur support say kuch pips nichy stop loss lagayain jab keh resistance level per take profit lagayain.When it comes to following trends, Isi tarah hamain yahan says that overall, the trend is moving forward. Isko follow kiye baghair diamond trading strategy main nuqsan bhi ho sakta hay? Q keh trend ko jany aur hay. Yahan traders chahiye keh woh swing traders ki bajaye trend kay mutabiq trade kary yani ager up trend chal raha ho to woh price down any per buy ki trade lagaye or jab price up jaye to waha say sell ki trade na lagaye balkeh iska again low any ka wait kary.

Negative jewel:

The negative gem plan collection, generally called, a valuable stone top was portrayed in the past fragment. Again the model ought to be noticeable as a movement of all over cost swings that seem to be the development of the head and shoulders improvement.

Even more expressly, the left shoulder and head will interact with structure a trendline, the head and the right shoulder will communicate with structure a second trendline. This completes the trendlines for the upper fragment of the negative valuable stone plan. Then, for the lower portion, we would interact the swing lows inside the crate which will approach a Rakish shape.

A couple of vendors like to hold on for just the breakout under this line without the need for a close by underneath it. This is a possible segment point as well, regardless, recall that it will incite every one of the more fake signs when diverged from keeping it together for the breakout and close condition.

The expense center for the development is resolved using an intentional move method. Even more expressly, we really want to measure the top to valley distance inside the development, and subsequently project that distance diving from the breakout point. This will give a level at which we can anticipate that the finish on the breakout should begin to subside or potentially chat. Likewise, it tends to an eminent take benefit level and trade exit.

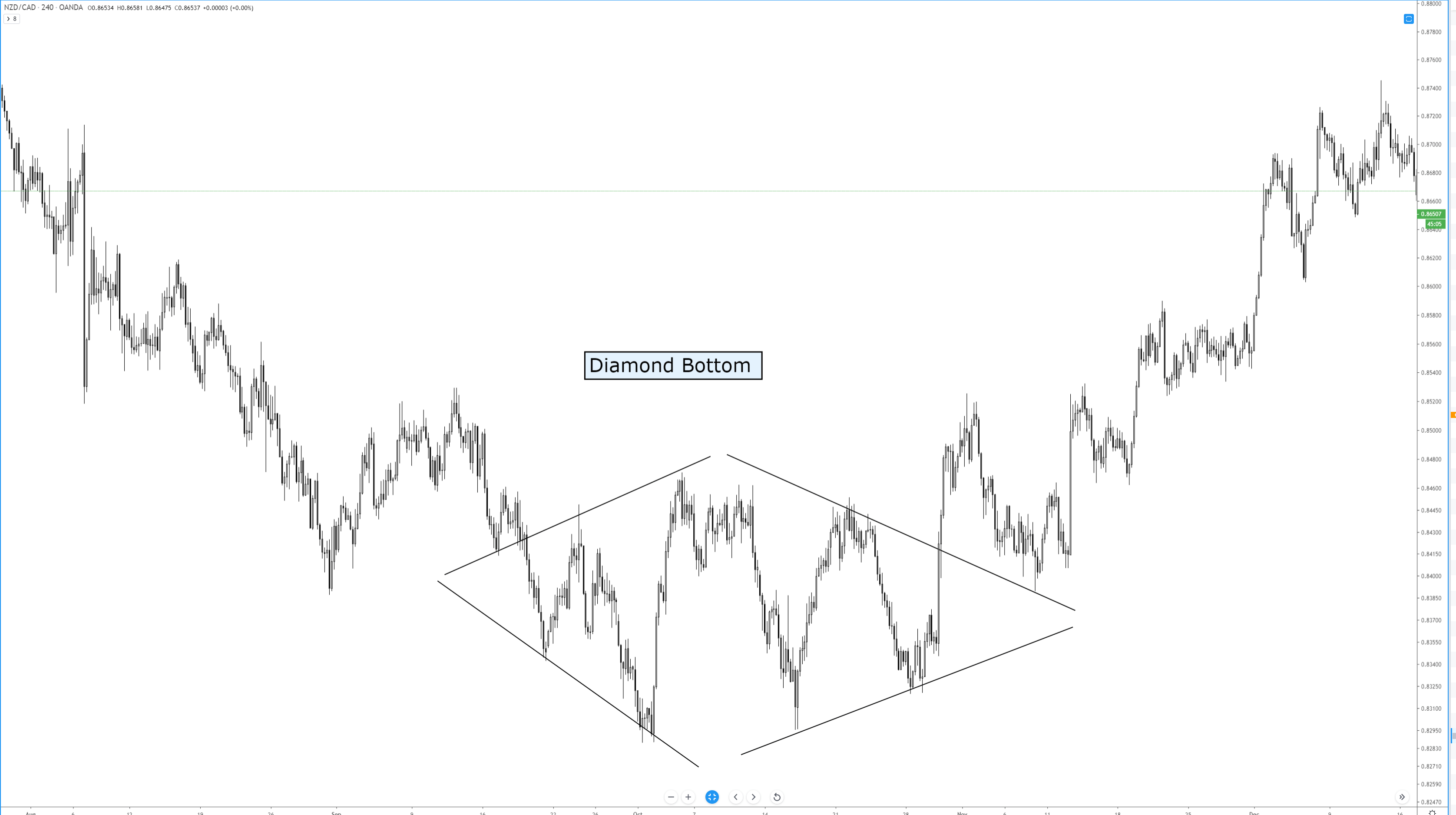

Could we right now look at the regressive of the negative valuable stone model, which is the bullish gem plan. A bullish valuable stone model variety, moreover implied as a gem base, occurs with respect to a downtrend. Ordinarily we will see solid areas for a move lower, and a short time later a mix stage that removes the all over swing points of the valuable stone base.

For this present circumstance, the appearance will resemble the changed head and shoulders improvement. We will relate the apexes and box inside the development similarly as portrayed previously. Whenever we have drawn the four trendlines around the development, and can confirm that the four lines are really indistinguishable in size, we will truly need to endorse the plan as bullish gem , we can see that the improvement is gone before by a slipping expense move. We can then see the up down gathering inside the gem structure which is outlined by the two upper trendlines pointing lower, and the two lower trendlines looking up.

The long section signal is set off at the break and close over the upper right-hand line inclining lower. Again, the inclined toward method is keep it together for a genuine breakout and close instead of just a breakout over this trendline to hinder the occasion of deluding signs and potential whipsawing cost movement around this area.

We would figure the upper expense center by assessing the high to low inside the encased plan. Whenever we have not entirely settled and plotted on the graph, we would expand that comparable partition from the breakout guide extended vertical toward appear at the leaned toward true level. At the point when cost shows up at this level we should

We ought to now move our focus to concocting a trading strategy that incorporates the gem plan. We have seen that the gem particular improvement happens both with respect to a rise and a downtrend. Right when a bullish expense move goes before the valuable stone model it is known as a gem top and which has a negative consequences. Exactly when a negative expense move goes before the valuable stone model is known as a gem base which has a bullish consequences.

In this particular valuable stone trading framework, we will attempt to keep it as clear as possible by utilizing a pure expense action based approach. We understand that the gem configuration is one that doesn't occur often watching out. As such we would prefer not to place an exorbitant number of elements into the methodology which would filter through a by and large fair set up.

Here are the norms for trading the gem top framework plan.

A sensible upswing ought to be set up going before the gem top turn of events.

The valuable stone top improvement should be clearly portrayed with four trendlines that partner with each other, and which are by and large close lengthy to one another.

Enter a sell demand at the market upon a break and close under the vertical inclining trendline near the fulfillment of the model.

⚡ Explaination:

The stoploss should be set at the most recent swing high going before the breakout point.

The goal level not entirely settled considering an intentional move assessment. We will evaluate the distance between most raised high and least low inside the plan, and adventure that plunging from the breakout point. This projected level will go probably as the advantage leave point.

There will be an additional time stop part on the trade. Specifically, accepting after the passing of 50 candles, the expense has not set off either our stoploss or target level, we will rapidly leave the trade at the market.

An unquestionable downtrend ought to be set up going before the valuable stone base turn of events.

The precious stone base game plan should be clearly described with four trendlines that partner with each other, and which are by and large close lengthy to one another.

Enter a buy demand at the market upon a break and close over the slipping inclining trendline near the fulfillment of the model.

The stoploss should be put at the most recent swing low going before the breakout point.

The goal level not entirely set in stone considering a purposeful move calculation. We will check the distance between most vital high and least low inside the development, and an endeavor that vertical from the breakout point. This projected level will go probably as the advantage leave point.

There will be an additional time stop part on the trade. Specifically, accepting after the passing of 50 candles, the expense isn't set off either or stoploss or target level, we will rapidly leave the trade at the market.

Valuable stone Trade Course of action EURCAD

We'll presently look at a delineation of the valuable stone model in the Forex market. This outline of the gem top trade set up relies upon our as of late outlined strategy and will be shown on EURCAD cross cash pair. Underneath you'll find the expense chart for the EURAD pair considering the eight hour trading period of time.

INTRODUCE""

Most often, diamond designs appear after a drawn-out pattern stage. Because of its negative effects, hona Chai, the examples are referred to as jewel tops or negative precious stone examples when they occur in the context of bullish markets. On the other hand, because of its bullish implications, when it occurs in a context of a bearish market, the example is referred to as a jewel base, or a bullish prior stone example. We ought to look at the depictions hidden under the design hona Chahi.

Diamond structure:

For the group of old-style graph designs, the gemstone arrangement is crucial. The precious stone outline design appears less frequently on the pricing graph than the more common banner, flag, head and shoulders, and square shape designs.

The head and shoulders diagram design is frequently confused with the diamond graph design. Although there are some similarities between these two arrangements, there are also some glaring differences.

It's important to understand that the jewel design is a more advanced outline design with inversion features before moving on to discuss the highlights of the precious stone example structure.

As a result, there aren't as many opportunities to trade the precious stone graph design as there are for some of the others mentioned. However, knowledgeable dealers should become familiar with this example as it offers a great trading opportunity when it is recognised early enough.

The diamond pattern typically appears after a drawn-out pattern stage. When it occurs in a bullish market environment, the example is referred to be a jewel top or a negative precious stone example due to its consequences. On the other hand, because of its optimistic implications, it is referred to as a jewel basis, or a bullish precious stone example, when it occurs in the context of a bearish market.

We should look into the representation underneath that softens the gem graph design.

We can see how the jewel top arrangement appears on the outline above.

Costs increase once more at that time, causing the top to become internal to the building. The cost motion then decreases but doesn't start from the previous swing's depressed location. Costs rise once more and level off just below where they were earlier. The price decreases once more and remains above the earlier swing depressed point.

We can create four genuinely equal measured trendlines that connect the swing highs at the highest point of the construction and the swing lows at the lower part of the design once this cost activity is complete. The name of the example comes from how this creates the look of a gem.

Sometimes, we might not witness every single cost leg mentioned previously in the purest sense of the gem structure. This won't necessarily contradict the design's designation as a jewel design. Most importantly, we can draw four trendlines around the building that are somewhat comparable in length.

Dimond chart pattern:

Dear Forex members Forex trading me Dimond chart pattern jo ziada tar market k top ya market k top k qareeb pe hi banta hai aur ye hamen indication de raha hota hai k yahan se market uptrend k mukhtalif (downtrend) move karna shoro karega Is ko Dimond trend pattern is waja se jaha jat hai k is me jo top lines candle sticks ki formation hoti hai wo breakout up side (jahan se market ne oper ko move karna shoro kia hota hai), aur market breakdown side pe candle sticks k sath jo pattern banta hai wo Dimond shape ka hota hai. Is me making head and shoulders out of candlesticks?Dimond shap pattern me analysis tajzeya karte hen k jab is me market breakout hoti hai to wo pattern k top candles aur down candles ki value ki calculation karte hen q k us k baad movement ziada tar reversal hi hoti hai.

Dimond chart pattern and reversal movement:

Mere aziz dosto Dimond chart pattern bohut hi kam bante hen whereas, if the pattern were to be confirmed, it would indicate that the trend was moving in one direction and then reversing itself. Technical analysis analysis ka ziada istemal karte hen dimond chart pattern. Ko lazmi define karne hote hen q k is me values. Ye chart pattern us waqat banana shoro ho jata hai when the market's uptrend movement is rukh kar seedhi chalna shoro hoti haia or the sideways ki trend me tabdeel ho jati hai to jo jo now uptrend movement hoti hai wo breakout hona shoro ho jati hai jo is kisam k chart pattern k banne ki waja.Technical analyst ko pata hota hai kjbi ye pattern banta hai to us k bad un ko confirm ho jata hai kjbi ab movement nechay ki taraf chalay gi to wo is moqay se sahi tarah se faida uthate hen Ye technical analyst long term trading me ziada istemal karte hen lekin pattern short term trading me to kam.

Trading strategy with Dimond chart pattern:

Dear friends, Diamond pattern main trading karny kay liye zaroori hay keh ham support and resistance points ko lazmi follow karain. Q keh market is major aik arzi support and resistance level banaye to rakhti hay laikin jab ye break ho jayain to market further movement karti hay Is liye zaroori hay keh jab price resistance aur support kay darmian ho to he trading order place karain. Iska best tariqa ye hay keh jab market support say wapas jaye to yahan say buy karain aur support say kuch pips nichy stop loss lagayain jab keh resistance level per take profit lagayain.When it comes to following trends, Isi tarah hamain yahan says that overall, the trend is moving forward. Isko follow kiye baghair diamond trading strategy main nuqsan bhi ho sakta hay? Q keh trend ko jany aur hay. Yahan traders chahiye keh woh swing traders ki bajaye trend kay mutabiq trade kary yani ager up trend chal raha ho to woh price down any per buy ki trade lagaye or jab price up jaye to waha say sell ki trade na lagaye balkeh iska again low any ka wait kary.

Negative jewel:

The negative gem plan collection, generally called, a valuable stone top was portrayed in the past fragment. Again the model ought to be noticeable as a movement of all over cost swings that seem to be the development of the head and shoulders improvement.

Even more expressly, the left shoulder and head will interact with structure a trendline, the head and the right shoulder will communicate with structure a second trendline. This completes the trendlines for the upper fragment of the negative valuable stone plan. Then, for the lower portion, we would interact the swing lows inside the crate which will approach a Rakish shape.

A couple of vendors like to hold on for just the breakout under this line without the need for a close by underneath it. This is a possible segment point as well, regardless, recall that it will incite every one of the more fake signs when diverged from keeping it together for the breakout and close condition.

The expense center for the development is resolved using an intentional move method. Even more expressly, we really want to measure the top to valley distance inside the development, and subsequently project that distance diving from the breakout point. This will give a level at which we can anticipate that the finish on the breakout should begin to subside or potentially chat. Likewise, it tends to an eminent take benefit level and trade exit.

Could we right now look at the regressive of the negative valuable stone model, which is the bullish gem plan. A bullish valuable stone model variety, moreover implied as a gem base, occurs with respect to a downtrend. Ordinarily we will see solid areas for a move lower, and a short time later a mix stage that removes the all over swing points of the valuable stone base.

For this present circumstance, the appearance will resemble the changed head and shoulders improvement. We will relate the apexes and box inside the development similarly as portrayed previously. Whenever we have drawn the four trendlines around the development, and can confirm that the four lines are really indistinguishable in size, we will truly need to endorse the plan as bullish gem , we can see that the improvement is gone before by a slipping expense move. We can then see the up down gathering inside the gem structure which is outlined by the two upper trendlines pointing lower, and the two lower trendlines looking up.

The long section signal is set off at the break and close over the upper right-hand line inclining lower. Again, the inclined toward method is keep it together for a genuine breakout and close instead of just a breakout over this trendline to hinder the occasion of deluding signs and potential whipsawing cost movement around this area.

We would figure the upper expense center by assessing the high to low inside the encased plan. Whenever we have not entirely settled and plotted on the graph, we would expand that comparable partition from the breakout guide extended vertical toward appear at the leaned toward true level. At the point when cost shows up at this level we should

We ought to now move our focus to concocting a trading strategy that incorporates the gem plan. We have seen that the gem particular improvement happens both with respect to a rise and a downtrend. Right when a bullish expense move goes before the valuable stone model it is known as a gem top and which has a negative consequences. Exactly when a negative expense move goes before the valuable stone model is known as a gem base which has a bullish consequences.

In this particular valuable stone trading framework, we will attempt to keep it as clear as possible by utilizing a pure expense action based approach. We understand that the gem configuration is one that doesn't occur often watching out. As such we would prefer not to place an exorbitant number of elements into the methodology which would filter through a by and large fair set up.

Here are the norms for trading the gem top framework plan.

A sensible upswing ought to be set up going before the gem top turn of events.

The valuable stone top improvement should be clearly portrayed with four trendlines that partner with each other, and which are by and large close lengthy to one another.

Enter a sell demand at the market upon a break and close under the vertical inclining trendline near the fulfillment of the model.

⚡ Explaination:

The stoploss should be set at the most recent swing high going before the breakout point.

The goal level not entirely settled considering an intentional move assessment. We will evaluate the distance between most raised high and least low inside the plan, and adventure that plunging from the breakout point. This projected level will go probably as the advantage leave point.

There will be an additional time stop part on the trade. Specifically, accepting after the passing of 50 candles, the expense has not set off either our stoploss or target level, we will rapidly leave the trade at the market.

An unquestionable downtrend ought to be set up going before the valuable stone base turn of events.

The precious stone base game plan should be clearly described with four trendlines that partner with each other, and which are by and large close lengthy to one another.

Enter a buy demand at the market upon a break and close over the slipping inclining trendline near the fulfillment of the model.

The stoploss should be put at the most recent swing low going before the breakout point.

The goal level not entirely set in stone considering a purposeful move calculation. We will check the distance between most vital high and least low inside the development, and an endeavor that vertical from the breakout point. This projected level will go probably as the advantage leave point.

There will be an additional time stop part on the trade. Specifically, accepting after the passing of 50 candles, the expense isn't set off either or stoploss or target level, we will rapidly leave the trade at the market.

Valuable stone Trade Course of action EURCAD

We'll presently look at a delineation of the valuable stone model in the Forex market. This outline of the gem top trade set up relies upon our as of late outlined strategy and will be shown on EURCAD cross cash pair. Underneath you'll find the expense chart for the EURAD pair considering the eight hour trading period of time.

Diamond pattern ka formation do tarah ke hote hain - symmetrical aur ascending/descending. Symmetrical diamond pattern mein, trendlines upper aur lower sides pe almost equal distance ke saath move karte hain, jabki ascending/descending diamond pattern mein, ek trendline steeper angle ke saath move karta hai aur doosra trendline almost flat rehta hai.Diamond pattern ka use karke traders trend reversal ka prediction kar sakte hain aur apne trades ko profitable bana sakte hain. Traders is pattern ko identify karne ke baad ek entry point aur stop loss level set kar sakte hain, jisse ki unka risk management effective ho sake. Diamond pattern ko identify karne ke liye traders ko trendline analysis ke saath hi doosre technical indicators ka bhi use karna chahiye. Iske saath hi, traders ko market conditions aur volatility levels ka bhi analysis karna chahiye, kyunki market conditions aur volatility levels diamond pattern ke accuracy pe impact daalte hain. Diamond pattern ke advantages ke saath hi, is pattern ke limitations bhi hote hain. False signals ka risk bhi diamond pattern mein hota hai, jisse ki traders ko doosre technical indicators ka bhi use karne ki zarurat hoti hai. Diamond pattern ke formation mein bhi mistakes ho sakte hain, jisse ki traders ko price action ko sahi tareeke se analyse karne ki zarurat hoti hai. Iske saath hi, market conditions aur volatility levels ko analyze karne ki zarurat hoti hai, kyunki diamond pattern ke accuracy pe in factors ka bhi impact hota hai.

Diamond pattern ka formation do tarah ke hote hain - symmetrical aur ascending/descending. Symmetrical diamond pattern mein, trendlines upper aur lower sides pe almost equal distance ke saath move karte hain, jabki ascending/descending diamond pattern mein, ek trendline steeper angle ke saath move karta hai aur doosra trendline almost flat rehta hai.Diamond pattern ka use karke traders trend reversal ka prediction kar sakte hain aur apne trades ko profitable bana sakte hain. Traders is pattern ko identify karne ke baad ek entry point aur stop loss level set kar sakte hain, jisse ki unka risk management effective ho sake. Diamond pattern ko identify karne ke liye traders ko trendline analysis ke saath hi doosre technical indicators ka bhi use karna chahiye. Iske saath hi, traders ko market conditions aur volatility levels ka bhi analysis karna chahiye, kyunki market conditions aur volatility levels diamond pattern ke accuracy pe impact daalte hain. Diamond pattern ke advantages ke saath hi, is pattern ke limitations bhi hote hain. False signals ka risk bhi diamond pattern mein hota hai, jisse ki traders ko doosre technical indicators ka bhi use karne ki zarurat hoti hai. Diamond pattern ke formation mein bhi mistakes ho sakte hain, jisse ki traders ko price action ko sahi tareeke se analyse karne ki zarurat hoti hai. Iske saath hi, market conditions aur volatility levels ko analyze karne ki zarurat hoti hai, kyunki diamond pattern ke accuracy pe in factors ka bhi impact hota hai.  Diamond pattern forex trading mein identify karne ke liye traders ko price action analysis ke saath hi doosre technical indicators ka bhi use karna chahiye. Diamond pattern ki identification mein traders ko trendline analysis ka bhi use karna hota hai. Diamond pattern ka formation ek diamond shape ki tarah hota hai, jismein price range gradually narrow hota hai aur phir ek point pe range increase hone lagta hai. Is pattern mein, price action ek triangle shape create karta hai, jismein price range gradually narrow hota hai aur phir ek point pe range increase hone lagta hai. Diamond pattern ko identify karne ke liye traders ko price action ko closely monitor karna hota hai. Iske saath hi, traders ko doosre technical indicators ka bhi use karna chahiye, jaise ki trendline analysis, moving averages, aur momentum indicators jaise ki RSI aur MACD. Diamond pattern ki identification mein traders ko trendline analysis ka bhi use karna chahiye. Trendlines ko draw karne ke liye traders ko price levels ko connect karna hota hai, jisse ki ek diamond shape create ho jaata hai. Trendlines ki direction ko identify karne ke liye traders ko market trend ko analyze karna hota hai, jisse ki upper trendline aur lower trendline ko identify kiya ja sake.

Diamond pattern forex trading mein identify karne ke liye traders ko price action analysis ke saath hi doosre technical indicators ka bhi use karna chahiye. Diamond pattern ki identification mein traders ko trendline analysis ka bhi use karna hota hai. Diamond pattern ka formation ek diamond shape ki tarah hota hai, jismein price range gradually narrow hota hai aur phir ek point pe range increase hone lagta hai. Is pattern mein, price action ek triangle shape create karta hai, jismein price range gradually narrow hota hai aur phir ek point pe range increase hone lagta hai. Diamond pattern ko identify karne ke liye traders ko price action ko closely monitor karna hota hai. Iske saath hi, traders ko doosre technical indicators ka bhi use karna chahiye, jaise ki trendline analysis, moving averages, aur momentum indicators jaise ki RSI aur MACD. Diamond pattern ki identification mein traders ko trendline analysis ka bhi use karna chahiye. Trendlines ko draw karne ke liye traders ko price levels ko connect karna hota hai, jisse ki ek diamond shape create ho jaata hai. Trendlines ki direction ko identify karne ke liye traders ko market trend ko analyze karna hota hai, jisse ki upper trendline aur lower trendline ko identify kiya ja sake.

تبصرہ

Расширенный режим Обычный режим