Assalamu Alaikum!

dear member Main ummid Karta hun, aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge. Jab aap ismein kam karte hain to aapko daily ka target complete karna hota hai aur hard work ke sath kam karna hota hai. agar aap ismein hard work Nahin Karenge to aap kabhi bhi successful trading nahin kar sakte, isliye aapko market Mein different important analysis per completely study Karni chahie aur Market ko acchi tarike se focus karna chahie jitne acchi analysis ke sath aap is market Mein trading Karenge aapko itna hi Achcha result milega. main aaj aapse bahut hi important information share karungi, jo aapki trading ko profit table banaa sakti hai to Mera topic hai cryptocurrency vs paper currency kya hai.

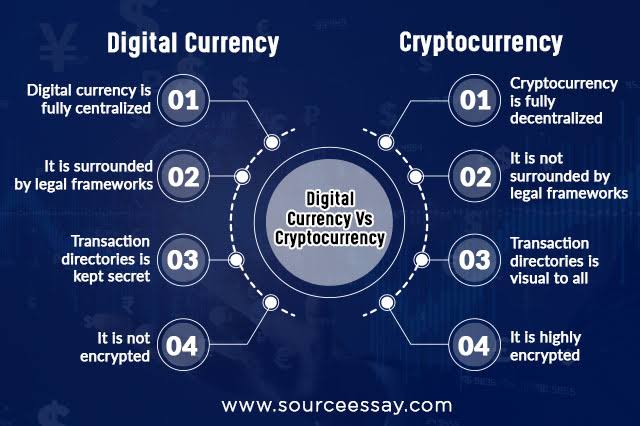

Cryptocurrency:

Dear member Forex trading Mein cryptocurrency Currency digital currency ko kaha Jata Hai Jisko computerised jaanch kar tarike se sev Kiya jata hai aur yah Ek khyali currency Hoti Hai Kyunki iska koi bhi shayari vajud Nahin hota hai cripto currency Mein Kyon Ke blockchain method use Kiya Jata Hai Is vajah Se is Mein Do numberi Aur Jali Palan takriban na Mumkin Hai cripto currency Kisi bhi country ki taraf se Saya Nahin Ki Jaati Hai aur na hi yah Kisi government ki market hoti hai jo isko control kar sake cripto currency government control se bahar hone ki vajah se ismein government ki do numberi ke chances Namumkin Hai cripto currency Ka Khyal 1985 Mein pesh Kiya gaya tha aur iska bakayda aagaaj Bitcoin ki currency se 2009 mein hua Bitcoin is time Puri world mein na sirf crop top currency mein se Bal ke Aam country currency mein bhi sabse powerful currency hai aajkal market Mein iski rate 11000 se upar Hai Bitcoin ki Lava krepto currency Mein light coin Bitcoin cash vagaira Shamil Hai digital currency bahut Sare contries mein kanuni hai aur Pakistan mein pahla Business mein filhal iski Karobar per pabandi hai Pakistan mein Mani laundering aur terrorism financial ka Bada problem chal raha hai is vajah se Iske business per filhal pabandi hai.

Paper Currency:

Hard currency ya paper currency ka aagaaj bahut purana aur purane time mein metal Sone aur Chandi ke Sikke hard currency ke Taur per use hote hain modern currency ka Aawas 1664 mein shivdan ke bank Ne pahle bakayda currency ke aagaaj kiya tha Uske bad yah different marhal se Gujarte Hue hamare pass is Shakal Mein Aaya Hai paper currency ko Aam Taur per gold ki jamanat ke Taur per Jari Kiya Ja chuka hai use Aur Is per mention hota hai ki yah government ki official Bank Ki Tarah Se Hamare liye ek jamanat Hai Puri Duniya Mein Har EK country ka Apna currency note hota hai aur isase vah Apne Mulk Mein maujud Karobar ke liye use karte hain is time paper ya bank note Mein sabse strong currency kuwaiti dinner hai aur sabse kamjor bhi currency Irani Rahil hai.

Forex Trading And Currency (Crypto And Paper Currency).

Forex trading Mein aajkal Har broker takriban donon types currency Mein trade Karvate Hain hard currency ke trading ka aagaaj to 1973 mein Britain would agreement ke dissolved hone pay start ho gaya tha aur cripto currency ka aagaaj modern time Mein Hi Hua Hai kraptor currency abhi tarikh ke marhall se Gujar rahi hai farak trading Asal kam hi currency exchange ka karta hai aur ismein rojana ke lihaj se takriban 5 trillions dollar ki investment ya transaction Hoti Hai currency bhi ab is Daur Mein barabar Ka hissa Dar Ban chuki hai.

dear member Main ummid Karta hun, aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge. Jab aap ismein kam karte hain to aapko daily ka target complete karna hota hai aur hard work ke sath kam karna hota hai. agar aap ismein hard work Nahin Karenge to aap kabhi bhi successful trading nahin kar sakte, isliye aapko market Mein different important analysis per completely study Karni chahie aur Market ko acchi tarike se focus karna chahie jitne acchi analysis ke sath aap is market Mein trading Karenge aapko itna hi Achcha result milega. main aaj aapse bahut hi important information share karungi, jo aapki trading ko profit table banaa sakti hai to Mera topic hai cryptocurrency vs paper currency kya hai.

Cryptocurrency:

Dear member Forex trading Mein cryptocurrency Currency digital currency ko kaha Jata Hai Jisko computerised jaanch kar tarike se sev Kiya jata hai aur yah Ek khyali currency Hoti Hai Kyunki iska koi bhi shayari vajud Nahin hota hai cripto currency Mein Kyon Ke blockchain method use Kiya Jata Hai Is vajah Se is Mein Do numberi Aur Jali Palan takriban na Mumkin Hai cripto currency Kisi bhi country ki taraf se Saya Nahin Ki Jaati Hai aur na hi yah Kisi government ki market hoti hai jo isko control kar sake cripto currency government control se bahar hone ki vajah se ismein government ki do numberi ke chances Namumkin Hai cripto currency Ka Khyal 1985 Mein pesh Kiya gaya tha aur iska bakayda aagaaj Bitcoin ki currency se 2009 mein hua Bitcoin is time Puri world mein na sirf crop top currency mein se Bal ke Aam country currency mein bhi sabse powerful currency hai aajkal market Mein iski rate 11000 se upar Hai Bitcoin ki Lava krepto currency Mein light coin Bitcoin cash vagaira Shamil Hai digital currency bahut Sare contries mein kanuni hai aur Pakistan mein pahla Business mein filhal iski Karobar per pabandi hai Pakistan mein Mani laundering aur terrorism financial ka Bada problem chal raha hai is vajah se Iske business per filhal pabandi hai.

Paper Currency:

Hard currency ya paper currency ka aagaaj bahut purana aur purane time mein metal Sone aur Chandi ke Sikke hard currency ke Taur per use hote hain modern currency ka Aawas 1664 mein shivdan ke bank Ne pahle bakayda currency ke aagaaj kiya tha Uske bad yah different marhal se Gujarte Hue hamare pass is Shakal Mein Aaya Hai paper currency ko Aam Taur per gold ki jamanat ke Taur per Jari Kiya Ja chuka hai use Aur Is per mention hota hai ki yah government ki official Bank Ki Tarah Se Hamare liye ek jamanat Hai Puri Duniya Mein Har EK country ka Apna currency note hota hai aur isase vah Apne Mulk Mein maujud Karobar ke liye use karte hain is time paper ya bank note Mein sabse strong currency kuwaiti dinner hai aur sabse kamjor bhi currency Irani Rahil hai.

Forex Trading And Currency (Crypto And Paper Currency).

Forex trading Mein aajkal Har broker takriban donon types currency Mein trade Karvate Hain hard currency ke trading ka aagaaj to 1973 mein Britain would agreement ke dissolved hone pay start ho gaya tha aur cripto currency ka aagaaj modern time Mein Hi Hua Hai kraptor currency abhi tarikh ke marhall se Gujar rahi hai farak trading Asal kam hi currency exchange ka karta hai aur ismein rojana ke lihaj se takriban 5 trillions dollar ki investment ya transaction Hoti Hai currency bhi ab is Daur Mein barabar Ka hissa Dar Ban chuki hai.

تبصرہ

Расширенный режим Обычный режим